Bitcoin

After Gold and the S&P 500 Moves, Could Bitcoin (BTC) Hit a New ATH?

Credit : coinpedia.org

Bitcoin Value just lately regained the momentum, with the full market rate of interest that exceeds $ 116,000, indicating a potential shift in market dynamics. After underperforming conventional property equivalent to Gold and the S&P 500, BTC turned the tables, fed by the rising institutional acceptance, the aid of macro -economic strain and renewed curiosity for retail buyers. This revival raises the query: Can the Bullish Momentum of Bitcoin proceed the continuation of a brand new all-time excessive (ATH), making it an necessary asset to have a look at the Cryptomarkt?

Buyers stay cautious

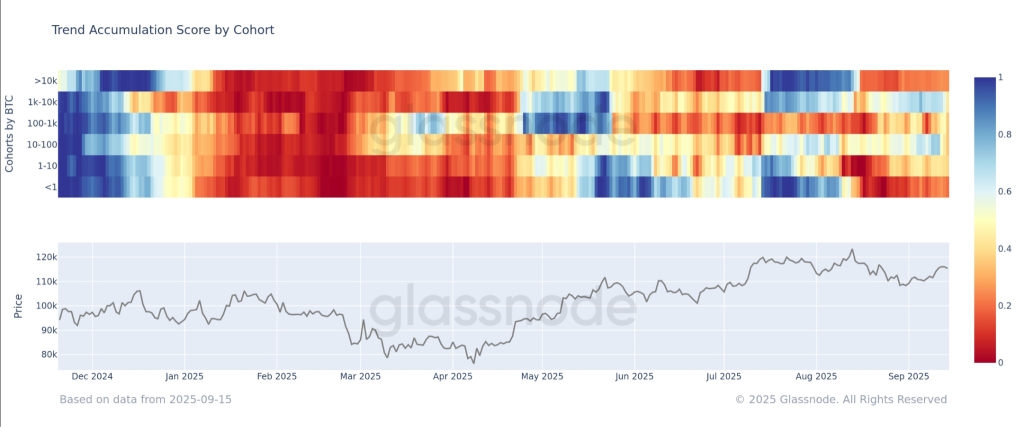

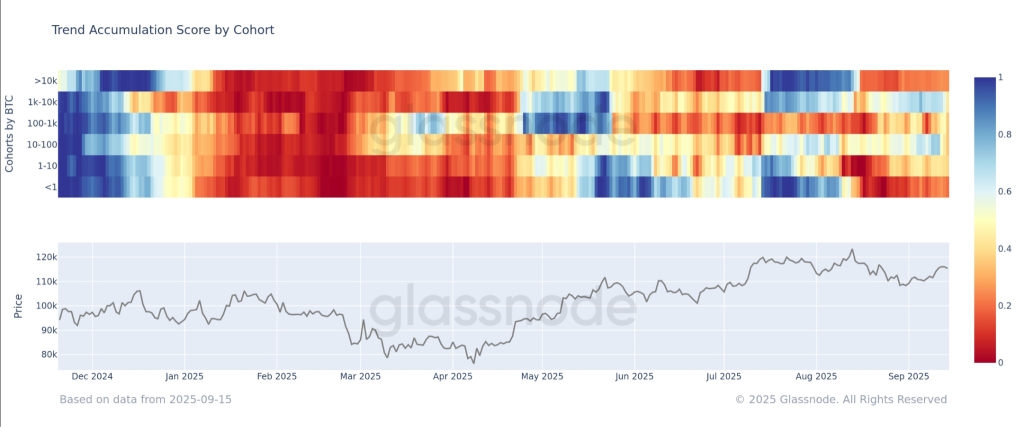

Since our replace of 25 August, the market dynamics of Bitcoin has proven delicate modifications, however the common pattern stays cautious. Distribution – when holders promote their cash – is considerably softened, indicating {that a} gross sales strain is relaxed, however it isn’t the alternative in a robust buy. Most BTC cohorts, segmented by the point they acquired their cash, are nonetheless under 0.5 threshold, indicating that holders don’t accumulate aggressively.

Information of Glass node means that no group has reached the extent of 0.8, which might imply a robust buy curiosity.

In easy phrases, whereas the market stabilizes, the vast majority of buyers nonetheless assume a impartial or considerably cautious angle as a substitute of betting closely on upward worth motion. Consequently, Bitcoin stays in a broad impartial distribution regime, with a gentle gross sales strain that persists. Merchants and buyers should observe this steadiness carefully, as a result of a transparent shift to accumulation can point out a possible bullish breakout.

What’s the following? Will BTC prize a brand new ATH in 2025 a brand new ATH?

The Bitcoin worth fluctuates between two giant collection, with one as a substantial resistance degree between $ 116,200 and $ 116,700, and the opposite serves as a help vary between $ 111,600 and $ 110,800. The prize has not breaking the resistance for the second time since August, which validates a robust presence of the bears. Furthermore, the technicals don’t flash sturdy bullish sign that will increase the potential of a bearish continuation.

As might be seen within the graph above, the BTC worth stays inside a consolidated zone whereas performing within the Ichimoku cloud. Though the cloud has undergone a bullish crossover, a turnout above the cloud is required to validate a bullish continuation. However, MacD Bearish can grow to be as a result of the shopping for strain appears to have pale with the degrees on the way in which to a Bearish crossover, which is inside the unfavourable attain.

That’s the reason the present market sentiments are impartial whereas buyers are ready for bullish or bearish affirmation. Nevertheless, so long as the Bitcoin (BTC) worth acts above the essential help vary, the potential of pattern elimination stays increased. If the value requires that new highlights are marked, the market sentiments should flip round whereas the markets must grow to be euphoric.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now