Bitcoin

All about Bitcoin ETFs’ 10-day inflow streak and what it means for you

Credit : ambcrypto.com

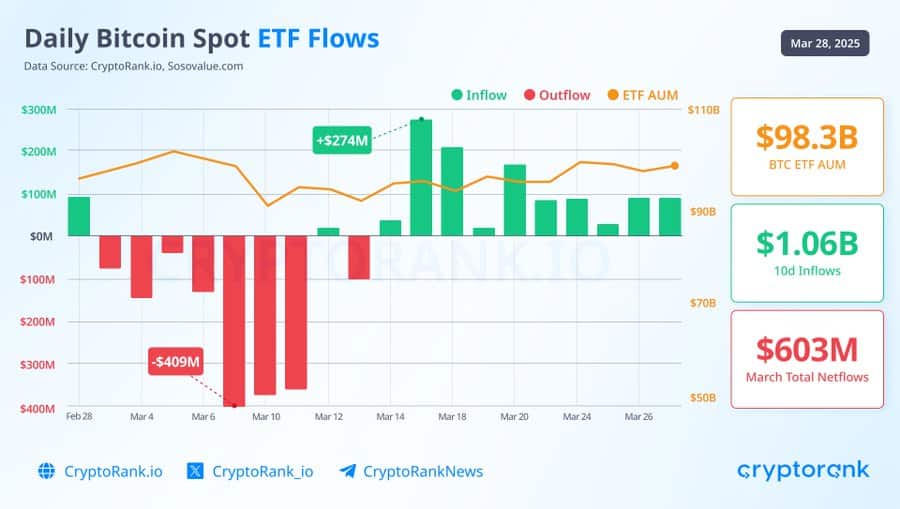

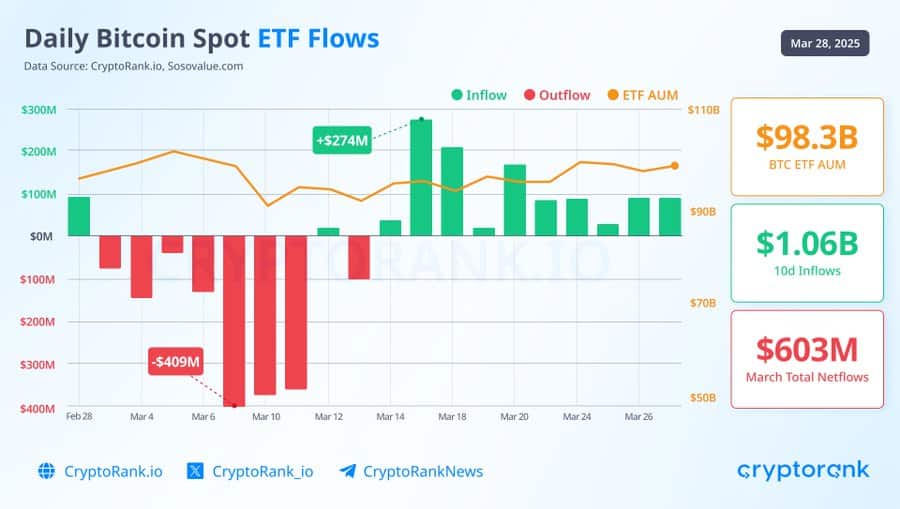

- Bitcoin ETF influx has been $ 1.06 billion within the final 10 days, and returned the outflow of the early March

- Belongings in administration [AUM] Climbed from $ 88 billion to $ 98.3 billion when the query stabilized in crypto ETFs

Bitcoin ETFs are once more within the highlight at present after a robust line of the influx reversed the sentiment that was seen earlier in March. Institutional buyers lean again in BTC with rising AUM and protracted demand.

Here’s a breakdown of the most recent ETF traits and what they’ll imply for the market.

Persistent influx gives brief -term lighting for Bitcoin ETFs

Bitcoin ETFs have had a Unbroken 10-day streak From influx of a complete of $ 1.06 billion. This, after a substantial restoration after a tough begin of the month. In reality, on March 6, they solely took up $ 409 million on 6 March.

The Turnaround in Sentiment has pushed the overall managed energy [AUM] From $ 88 billion on March 10 to $ 98.3 billion earlier than March 28.

Supply: Cryptorank

This sequence of inexperienced days comes at a vital second as a result of institutional buyers regain confidence within the midst of enhancing the macro circumstances and a therapeutic cryptomarkt.

If the pattern persists, it may function a robust wind wind for Bitcoin’s worth course of.

March remains to be on schedule for big internet outflows

Regardless of the latest consumption streak, March will stay on its option to turning into the second worst month for Bitcoin ETF Netflows. With the overall variety of internet outflows which were affected $ 603 million up to now, it surpasses $ 345 million from April 2024, though it nonetheless follows the report month of February.

The combined efficiency exhibits how investor conduct stays divided, with brief -term optimism in stability towards warning in the long run.

Though the latest restoration in currents on the momentum hinted, it has not been sufficient to compensate for earlier losses within the month.

Examine BTC and ETH ETF streams

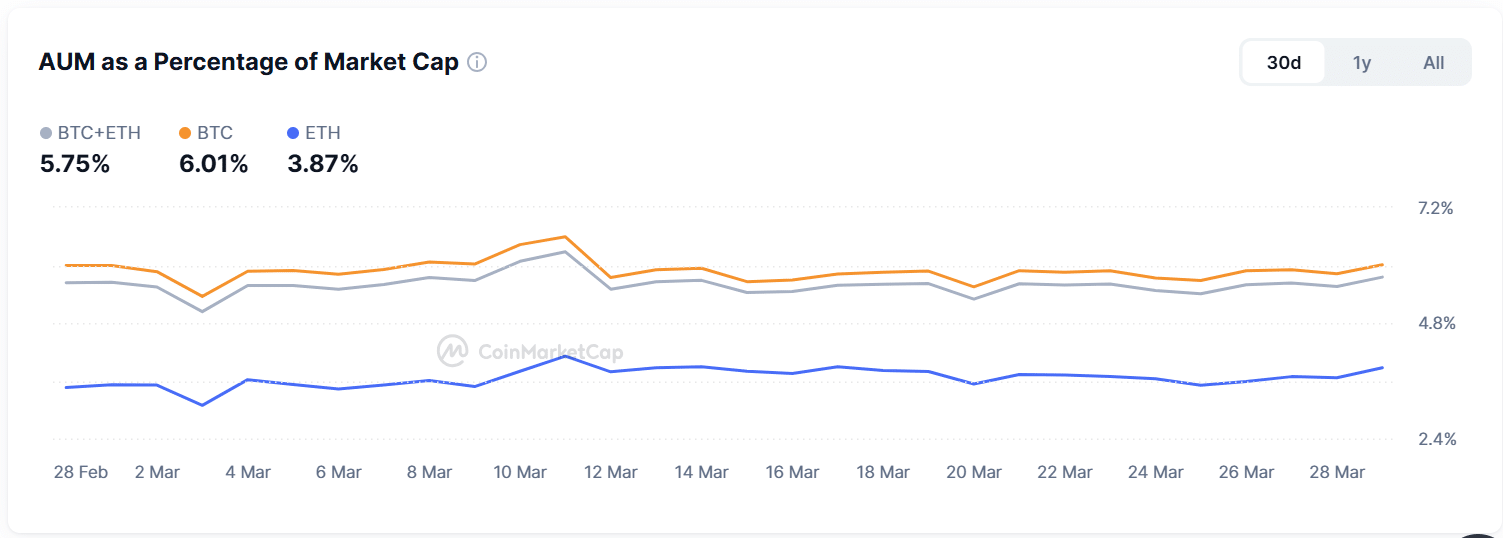

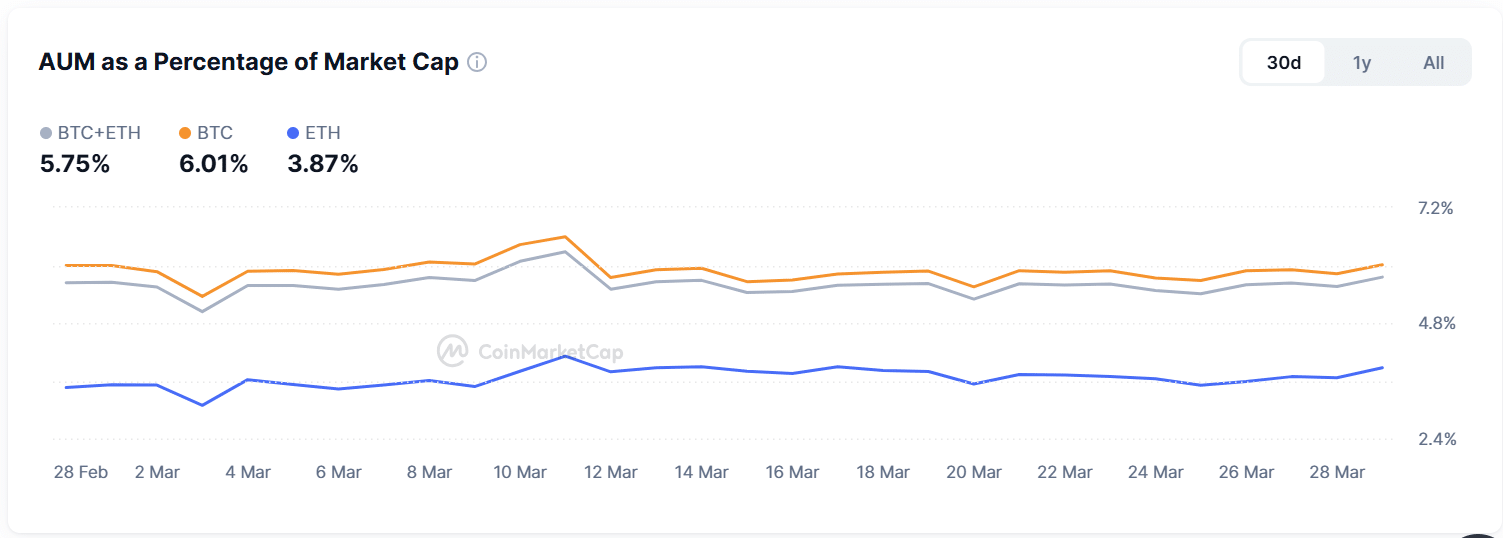

Knowledge of Mint market cap Though Bitcoin ETFs have seen the web outflows of $ 93 million within the final 30 days, Ethereum ETFs have positioned a modest $ 5 million in influx. The steady however small devices of ETH may point out a rising base of lengthy -term holders, though the quantity remains to be fading in comparison with BTCs.

Furthermore, Ethereum is much behind by way of ETF traction, the place the overall AUM solely contributes 3.87% to the market capitalization of ETH, in comparison with Bitcoin ETFs with 6.01% of the CAP of BTC.

Mixed, BTC and ETFs are at present 5.75% of the overall crypto market capitalization.

Supply: Coinmarketcap

Continuation or reversal in Bitcoin ETF present?

If BTC ETF influx continues till April, this will mark a broader institutional rotation in Crypto -exposure. Nevertheless, buyers should stay cautious, as a result of the outflow of the month thus far nonetheless mirror the continuing volatility in sentiment.

A persistent enhance in AUM and a discount in day by day outsource would most likely assist the bullish worth motion. Till that point, ETF influx can supply assist within the brief time period, however not a whole reversal of broader risk-off traits.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now