Ethereum

All about Ethereum’s latest market shift and what it means for the price

Credit : ambcrypto.com

- Ethereum’s Change Netflows on derived exchanges fell underneath -400,000 ETH

- CME ETH Futures Open Intericht Noticed stays a lower from $ 3,216.66 million to $ 3,251.98 million previous 16 hours

Ethereum’s alternate community flows on derived exchanges not too long ago fell underneath -400,000 ETH, coinciding with Bitcoin -my -worker underpayment -a signal of market stress. These developments hinted collectively on a big ETH restoration from festivals. Such a improvement is traditionally linked to a fall in gross sales strain and a stroll in Bullish Sentiment available on the market.

A potential restoration within the charts?

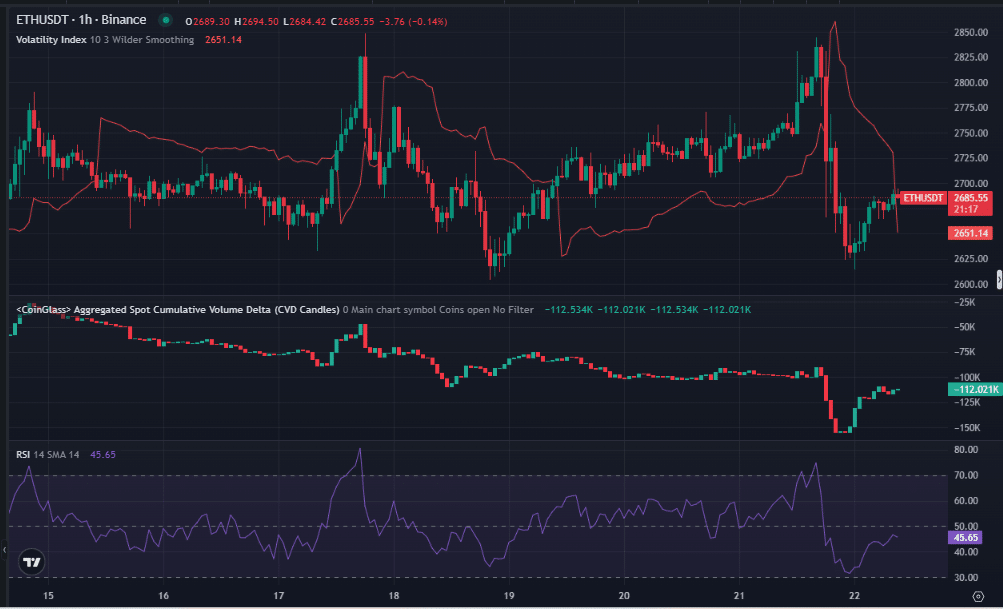

An evaluation of the ETH/USD graph of 1 hour on Binance noticed ETH commerce with round $ 2,685.55, after a good restoration within the final 72 hours. It’s value mentioning, nevertheless, that the Bybit -Hack might nonetheless have some affect on the worth of the Altcoin.

Supply: Coinglass

The place of the relative energy index (RSI) was referred to impartial to over -sold circumstances throughout the market – an indication of potential buying strain. Traditionally, comparable RSI ranges preceded worth rebounds, to assist decreased gross sales strain after massive outsource.

The aggregated cumulative quantity -delta (CVD) additionally mirrored on -112.02k a robust sale of dominance. Nonetheless, as the worth of the worth accumulation was seen by strategic merchants. These alerts have been tailor-made to a bullish shift and strengthened a potential motion above $ 2,800 whereas merchants modify their positions.

A bullish accumulation sign

The three -month alternate of Ethereum emphasised the unfavourable outflows of -191.96k ETH, with peak outings that have been seen very not too long ago.

Supply: Intotheblock

Normally, such massive outflow suggest a lower in gross sales strain, as a result of traders are switching property to chilly storage. The worth response close to $ 2,730, adopted by a lower to $ 2,529, mirrored an anticipated market consolidation section.

Stress for the miner’s underpayment additionally indicated that reductions on the availability facet indicated on the availability facet, which laid the inspiration for a rebound as a weakened exercise.

Market positioning for the following step

As well as, an evaluation of the open curiosity of the CME ETH Futures confirmed a lower from $ 3,216.66 million to $ 3,251.98 million for 16 hours.

Supply: Coinglass

The traded $ 2,736.79 on the time of the press, with the lower in open rate of interest signaling decreased speculative exercise. In mid -2024, an identical sample preceded worth restore, in accordance with the thought of market positioning earlier than a potential motion.

Decrease open curiosity is usually an indication of taking revenue or leverage reductions. This may increasingly additionally point out market stabilization earlier than a rebound is powered by bettering sentiment and decreased gross sales strain.

A prelude to a worth improve?

The 1-hour ETH/USD volatility index, flattened over 10 intervals, was 26.61. Over the past 16 hours the volatility through the sale was as much as $ 2,618.17, which then stabilizes.

This sample meant market uncertainty, however the decreased volatility appeared to be in step with historic post-outflow consolidations.

The holder’s confidence stays robust within the midst of market stress

Lastly, the worldwide in/out of cash confirmed 107.13 million ETH within the cash (75.06%), 24.24 million ETH from the cash (16.98%) and 11.35 million ETH for the cash (7 , 95%), with ETH commerce at $ 2,686.24.

Supply: Intotheblock

A dominant in-the-money ethereum provide is an indication of the holder’s confidence, which reduces the sale dangers. The out-of-the-money demographic demography hinted in resistance zones, however on the whole the construction pointed to potential upward electrical energy because the miner’s underpayment strain was relaxed.

These distributions appeared like Past Bullish restoration, to assist the proposition of the buildup after massive outskirts.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September