Ethereum

All the reasons why Ethereum is struggling to catch up with Bitcoin

Credit : ambcrypto.com

- ETH’s underperformance in opposition to BTC reached an annual low

- Coinbase analysts linked weak efficiency to investor pursuits and different components

After peaking in March, the world’s largest altcoin, Ethereum [ETH]has continued to comply with Bitcoin [BTC].

ETH reached $4,000 in March and tried to retest the extent after partial approval of US ETH ETFs later that yr. And butETH continues to underperform BTC.

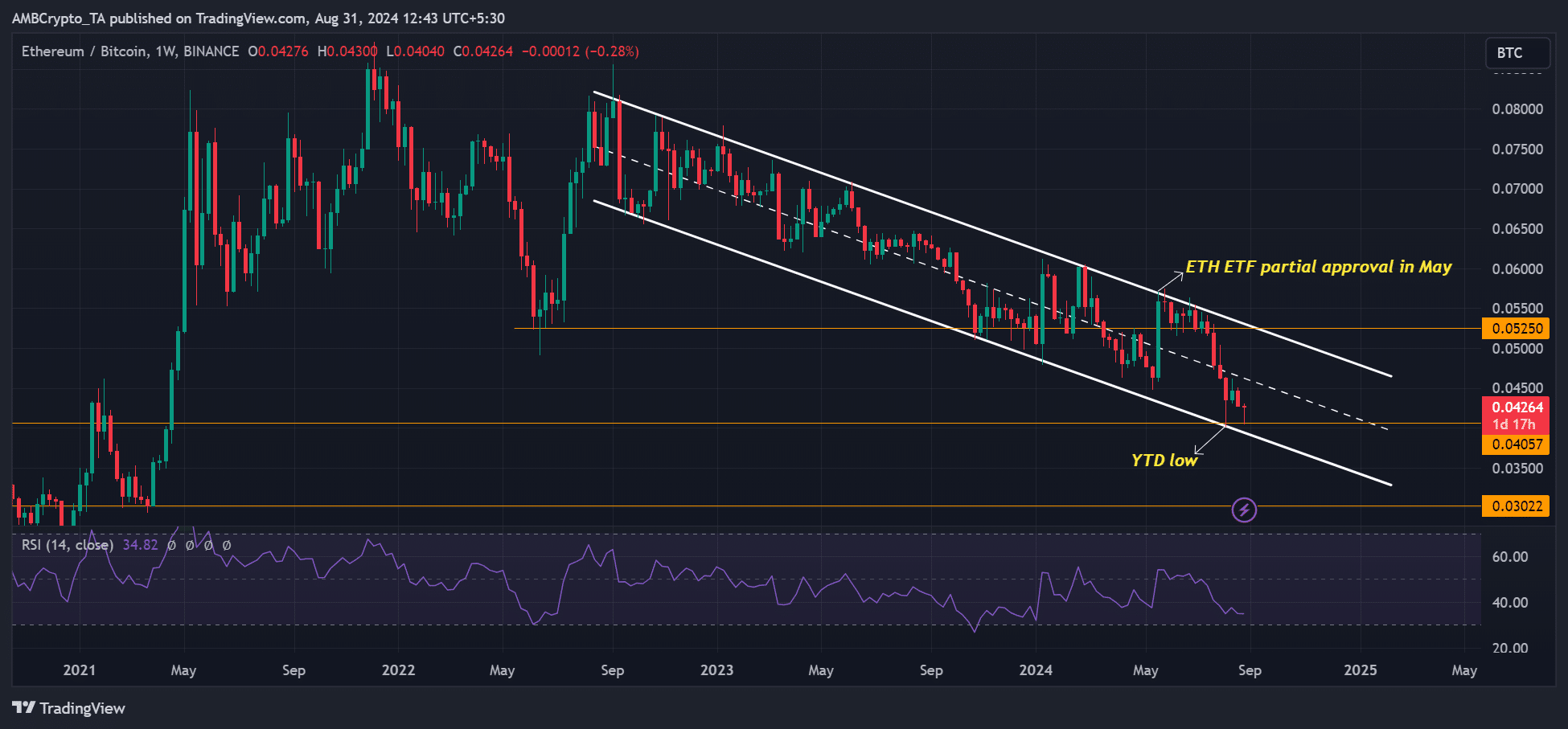

Even the ultimate ETH ETF approval in July did not assist the altcoin’s underperformance. In truth, it lately hit a yearly low of 0.040 on the ETHBTC ratio, which tracks the worth of ETH to BTC.

Supply: ETHBTC ratio, TradingView

Causes for ETH’s dismal efficiency

Of their newest weekly commentary, Coinbase analysts linked ETH’s weak efficiency to “web purchaser curiosity divergence” primarily based on ETF flows and different components. A part of the report read,

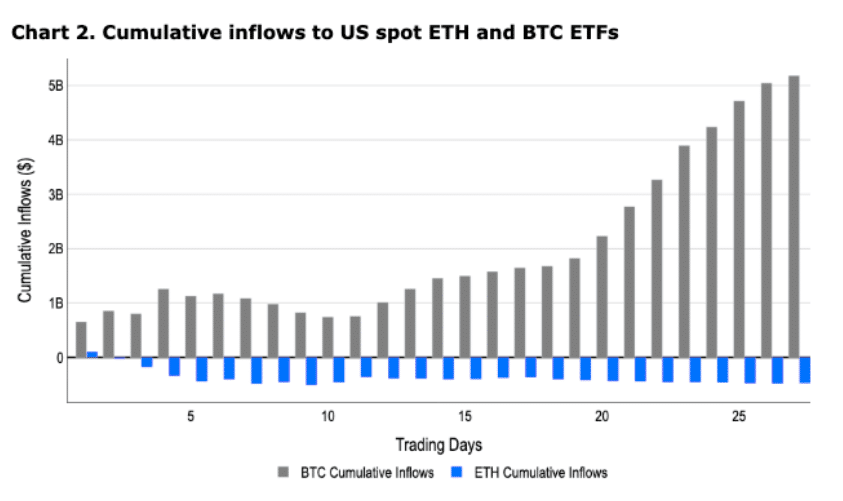

“We imagine this distinction in web purchaser curiosity is being embodied in US spot ETF flows. ETH ETFs had 9 consecutive days of outflows totaling $115 million between August 15 and 27, whereas BTC ETFs had inflows totaling $427 million for eight of these 9 days.”

Coinbase analysts David Duong and David Han added that ETH ETFs recorded cumulative web outflows of $477 million since inception. Quite the opposite, BTC ETFs have netted $17.8 billion in inflows since their debut.

The identical divergent development performed out when adjusting to the primary month of buying and selling. Briefly, there was an enormous demand for BTC ETFs, in distinction to the weak curiosity in ETH ETFs.

Supply: Coinbase

Nonetheless, the analysts famous that various debut durations might also have affected the circulate differential.

BTC ETFs had been launched in January when liquidity was prevalent. Then again, ETH ETFs had been launched in July in the course of the summer season liquidity disaster when most gamers had been on trip.

Analysts Han and Duong additionally imagine that the dearth of a staking characteristic on US spot ETH ETFs and competitors from different good contract chains corresponding to Solana [SOL] ETH may have gone off the rails.

Moreover, the dearth of a coherent imaginative and prescient for the story and path of the ETH ecosystem might restrict investor curiosity within the altcoin. Lastly, the report cited current robust criticism of Ethereum founder Vitalik Buterin, who has performed simply that skeptical of “pure DeFi” as a driving pressure behind crypto development.

In response to the analysts, divergent views and a disjointed view could make it tough for buyers to grasp ETH and its worth proposition.

“This divide between thought leaders within the Ethereum group could make it difficult to grasp the story and path of ETH, particularly for these unfamiliar with the sector.”

On the time of writing, BTC was buying and selling at $58.9k, up about 20% from its March excessive of $73k. Quite the opposite, ETH was valued at $2.5k, down 38% from the March excessive of $4k.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024