Altcoin

American crypto users miss $ 5b in AirDrops – Is SECs Klemdown the guilty?

Credit : ambcrypto.com

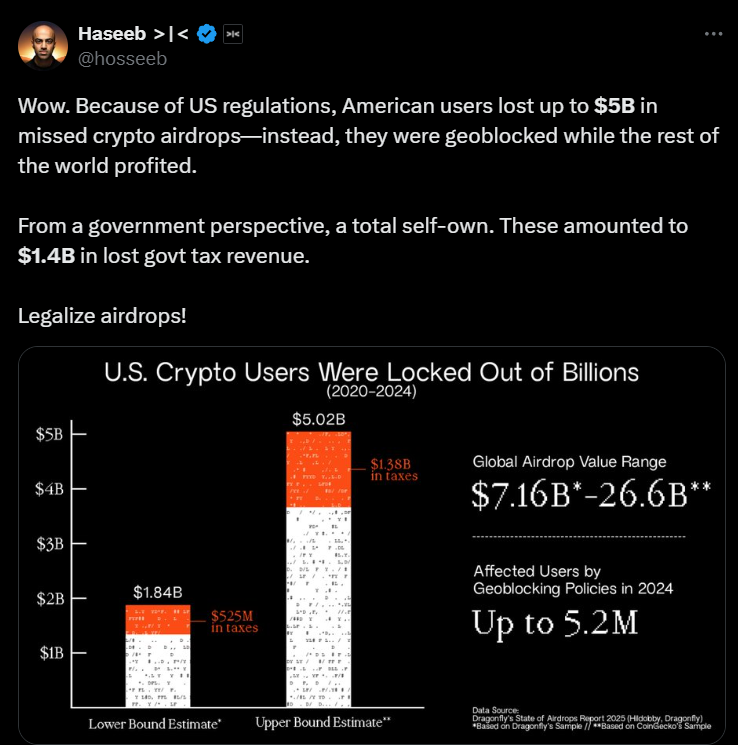

- American crypto customers missed as much as $ 5 billion in airdrops between 2020 and 2024 on account of sec pushed geofencing

- Legislators urge the SEC to make clear his Airdrops place

Up to now 4 years, thousands and thousands of American crypto holders haven’t been capable of take part in giant airdrops, which misses an estimated $ 5 billion in potential earnings.

A latest study From enterprise capital firm Dragonfly, the geoblocking coverage, applied by crypto initiatives to forestall the US analysis, had been answerable for these losses. These limitations stem from fixed authorized uncertainty about whether or not airdroped tokens are eligible as results or not.

With the SEC that additionally performs enforcement actions in opposition to crypto firms, many initiatives have chosen a cautious strategy by blocking American customers downright. The Dragonfly report even estimated that in 2024 between 1.84 million and 5.2 million lively American customers had been affected by these limitations alone.

Nonetheless, the monetary impression of those limitations went past particular person traders.

$ 1.4 billion in misplaced tax revenues

The report additionally confirmed that by stopping US customers from claiming AirDrops, the federal government misplaced an estimated $ 1.4 billion in tax revenues between 2020 and 2024.

The misplaced tax revenues stem from two major sources – private earnings tax on airdroped tokens and company tax that might have been generated by crypto initiatives which might be lively within the US as a substitute of going offshore.

Haseb Qureshi, managing companion at Dragonfly, assessed“

“Airdrops had been as soon as probably the most democratic solution to distribute tokens. These days they’ve develop into a recreation to keep away from the wrath of the sec. “

Supply: X

A putting instance is Tether, which in 2024 reported $ 6.2 billion in revenue, however didn’t pay an American company tax as a result of offshore design.

Dragonfly’s “State of AirDrops Report 2025”, claimed,

“Tether, who reported $ 6.2 billion in revenue in 2024, however Offshore was included, may have contributed round $ 1.3 billion in federal company tax and $ 316 million in state tax if it was totally topic to the US tax.”

Regulatory uncertainty has led to an exodus of blockchain startups from the USA.

Startups are in search of extra pleasant coasts

In 2024 alone, the SEC 33 enforcement actions in opposition to Crypto firms began, with 73% fraud allegations and 58% linked to non -registered provide of securities. These actions have created a hair -raising impact on crypto innovation, during which many initiatives favor to keep away from the American market.

Jessica Furr, counsel at Dragonfly, emphasized The unintended penalties of this strategy.

“The enforcement-driven regulatory place of the SEC has compelled crypto initiatives to exclude American customers from airdrops, in order that they’re disadvantaged of billions of attainable revenue. Clearer pointers are wanted to forestall additional financial loss. “

Furr’s feedback replicate broader industrial frustrations in regards to the lack of clear authorized frameworks for crypto property -a drawback that has inspired many blockchain builders to maneuver overseas.

The regulatory challenges round air drops have additionally attracted the eye of legislators.

Congress to the SEC – “Make clear or justify”

In September 2024, Patrick Mchenry and Tom Emmer despatched a letter to SEC chairman Gary Gensler, demanding Readability about whether or not Airdrops ought to be categorized as results. The letter raised necessary questions in regards to the inconsistent strategy to the SEC, particularly as compared with conventional remuneration applications reminiscent of airways and bank card factors.

“Given the unwillingness of the SEC to arrange a regulatory framework in the USA, builders are compelled to dam Individuals to assert the possession of a digitally lively in an airdrop”. “

Geofencing-de Follow to dam customers for particular areas of legislation that grew to become the usual danger avoidance technique for crypto initiatives that function underneath authorized uncertainty. By one report Variant is usually poorly applied and leads to pointless exclusion of customers of legally conformed markets.

Jake Chervinsky, a authorized professional in Crypto-Regulation, believes that Geofencing is a stop-gap measure as a substitute of a long-term resolution,

“Many firms Geofence for concern as a substitute of necessity, which results in misplaced alternatives for each customers and the federal government.”

The variant report additionally urged {that a} extra structured compliance framework would allow crypto initiatives to serve American customers and on the similar time meet the authorized necessities.

What crypto leaders stated in opposition to regulators

A16Z Crypto, a serious danger capital firm, printed a coverage advice for the SEC. The corporate insisted on the company to challenge formal pointers for AirDrops. It additionally known as for clear exemptions for token distributions. These exemptions would apply to distributions that don’t function fundraising mechanisms.

Scott Walker and Invoice Hinman have suggested Reforms to additionally make clear the AirDrop directions.

They urged making suitability standards, in order that AirDrops usually are not categorized as results. Coordinating AirDrop guidelines with remuneration applications for shoppers would supply consistency and scale back the confusion of the laws.

They’ve additionally advisable secure port provisions to guard blockchain initiatives that distribute tokens to their communities.

Will the SEC modify or maintain the road?

Legislers, market leaders and traders enhance the strain on adjustments within the laws.

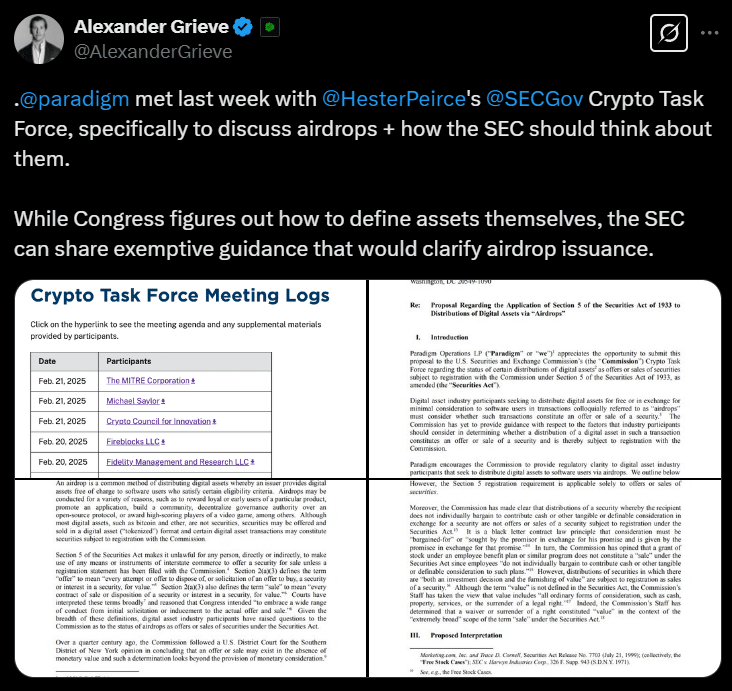

For instance – Alexander Grieve, VP of Public Affairs in Paradigm, shared That the corporate Hester Peirce and SEC officers met to debate the airdrop directions.

Supply: X

The SEC may introduce clearer pointers to sort out fixed uncertainties. Clear guidelines would allow our traders to take part in Airdrops with out authorized dangers.

This might profit each people and the broader economic system.

For now, Crypto initiatives stay cautious about recording American customers in Airdrops. That’s the reason American traders proceed to overlook alternatives which might be obtainable to worldwide members.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024