Altcoin

Amid Plans to Start a ‘Bitcoin Bank’, MSTR Stock Soars to ATH

Credit : ambcrypto.com

- Saylor plans to show MicroStrategy right into a Bitcoin financial institution.

- MSTR rallied and hit an ATH after the reveal.

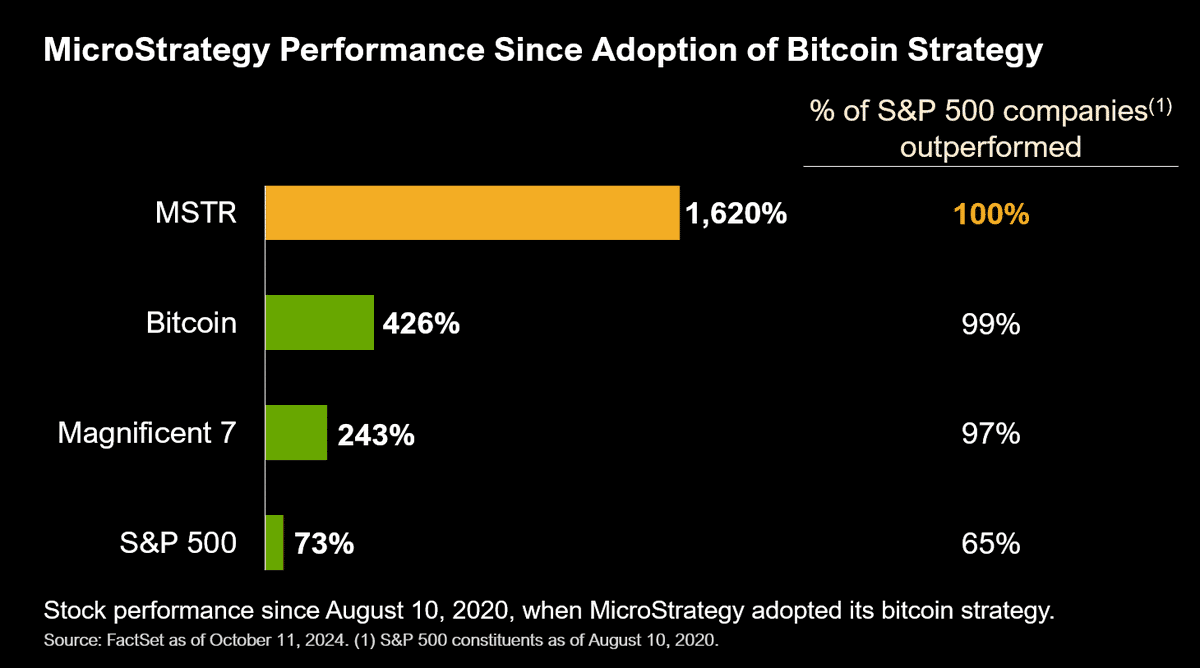

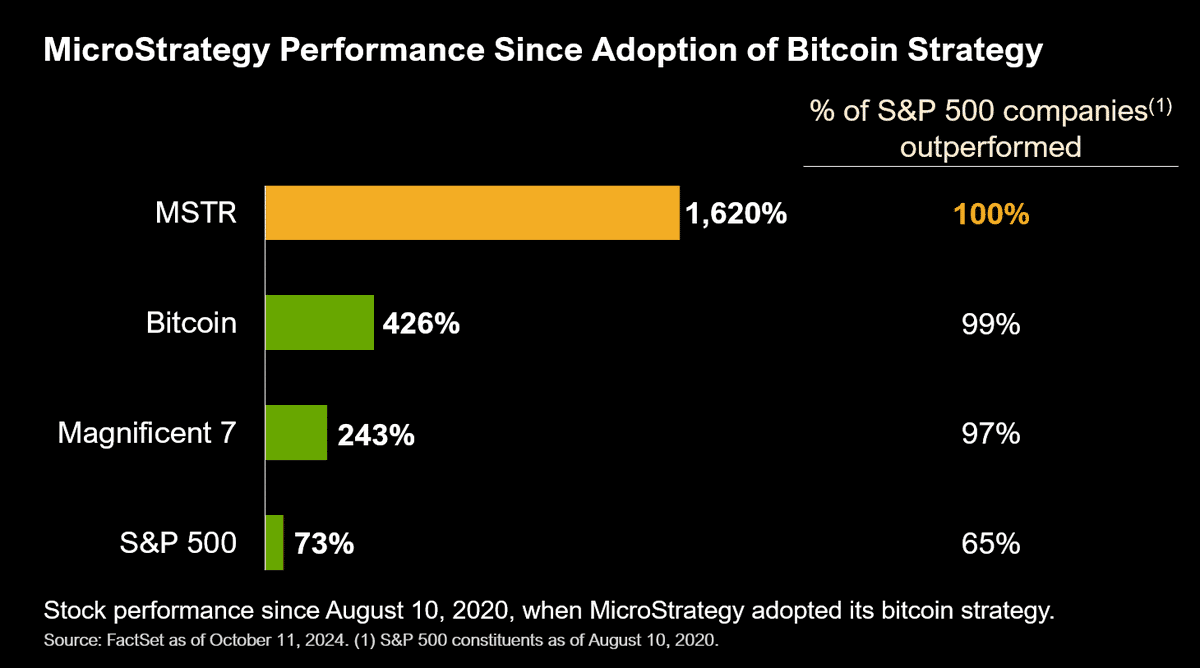

MicroStrategy’s MSTR inventory hit ATH (all-time excessive) after unveiling its finish purpose to turn out to be a trillion greenback Bitcoin [BTC] financial institution.

MicroStrategy founder Michael Saylor advised Bernstein analysts that his firm anticipated a $1 trillion valuation as the biggest BTC financial institution.

This may be helped partly by the aggressive accumulation of the world’s largest belongings, as analysts had forecast a $290 worth goal for the inventory.

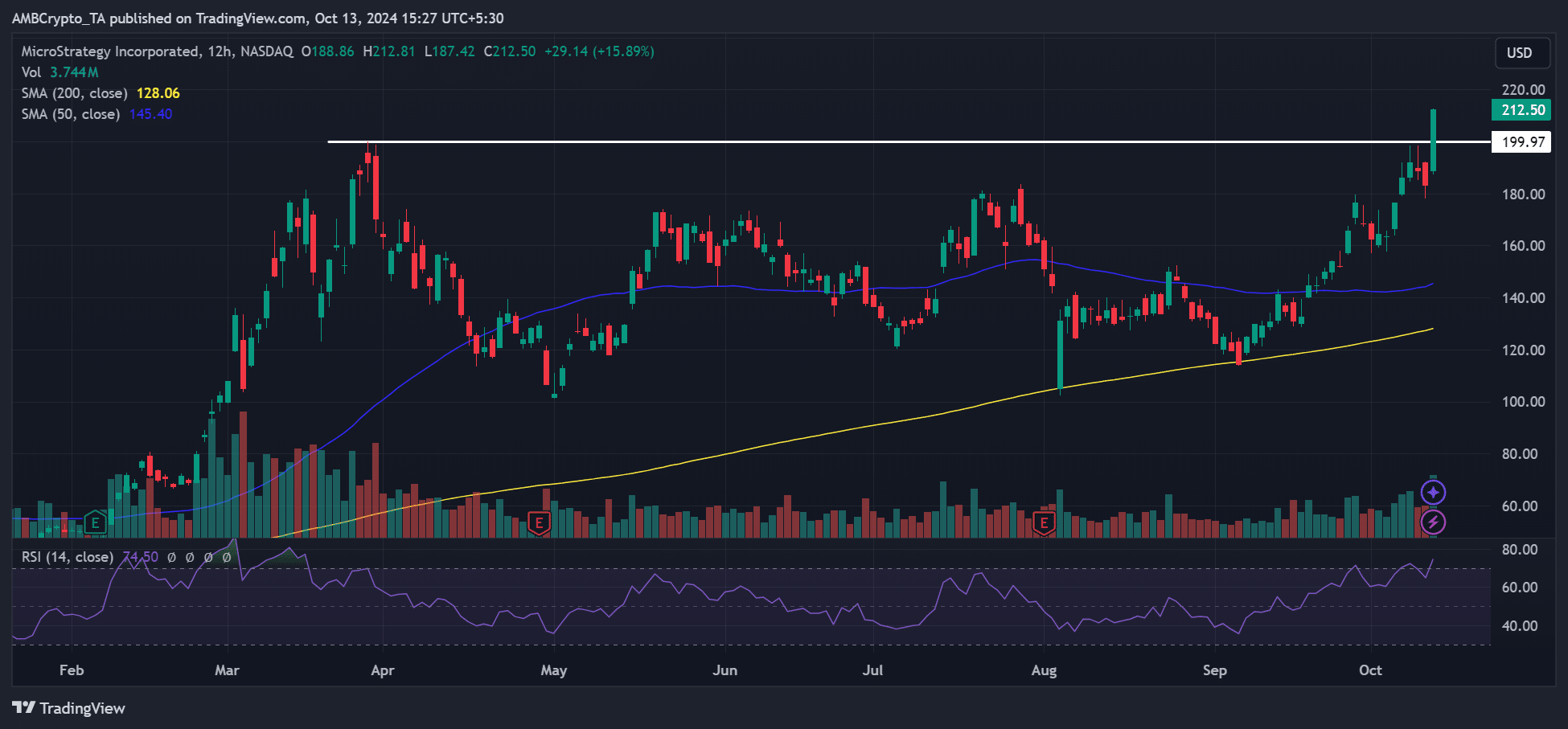

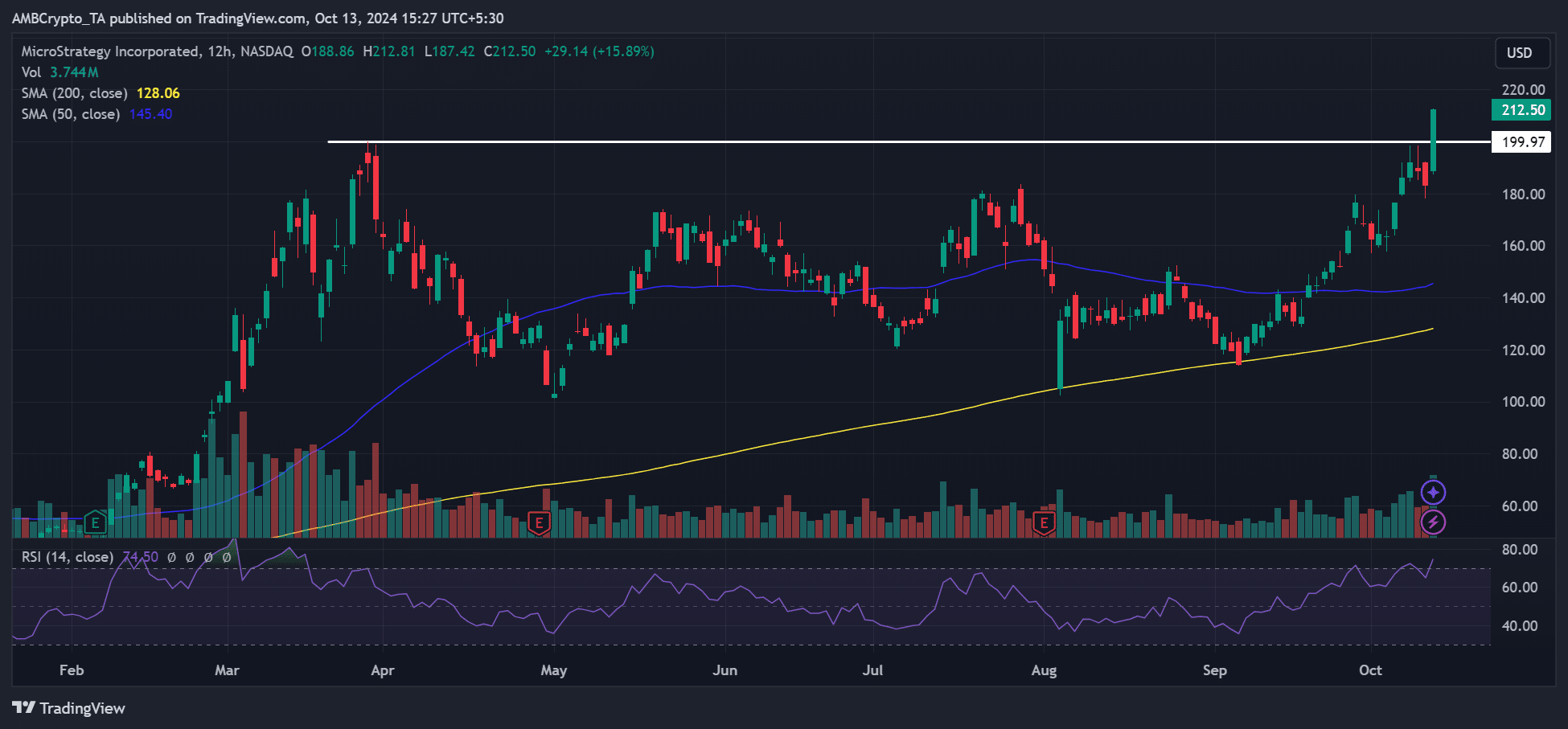

Supply: MSTR, TradingView

After the replace, MSTR rose to an all-time excessive of $212.50, up 15% through the intra-day buying and selling session on October 11. It even broke the $200 resistance.

Bitcoin Financial institution Endgame

In response to the MSTR assembly, Saylor noted that the one factor that outperformed BTC was extra BTC.

“The one factor higher than #Bitcoin is extra Bitcoin.”

Supply:

On the time of writing, MicroStrategy owned 252,220 BTC, price roughly $15.8 billion per 12 months. facts of Bitcoin Treasuries. In most interviews, Saylor has by no means said whether or not the corporate will promote its BTC inventory or its finish purpose.

However the endgame was made clear final week.

So, what’s a Bitcoin financial institution?

In line with Saylor it’s BTC bank would behave like different asset lessons and construct monetary entities round them. A part of the Bernstein Report said:

“Michael believes that MSTR is engaged within the core enterprise of making Bitcoin capital market devices for equities, convertible bonds, fastened revenue and most popular shares and so on.”

Saylor had achieved that earlier than projected that BTC might attain $3 million to $49 million by 2045 as its belongings broaden as a part of international capital.

Thus, the chief predicted that getting cash by creating BTC-based monetary devices equivalent to bonds or shares can be simpler than lending out cash owned by MicroStrategy.

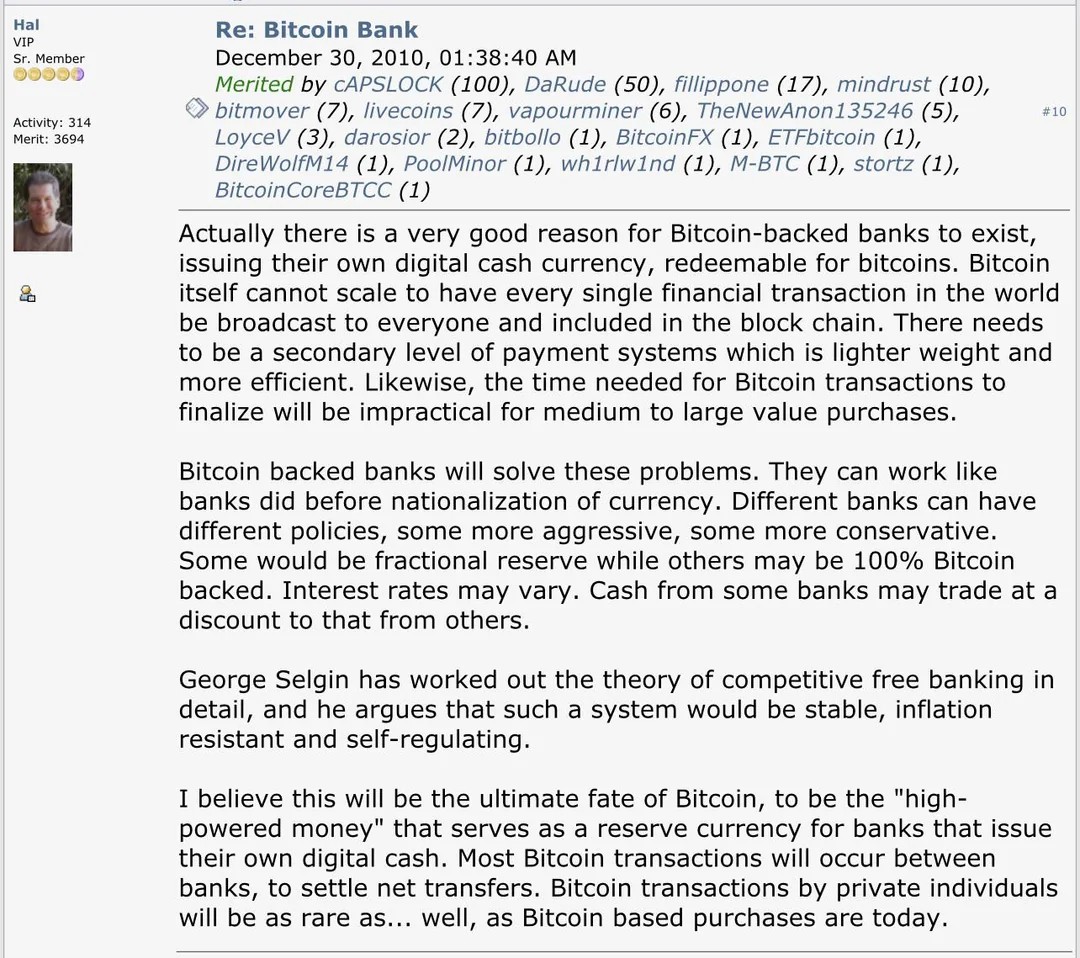

Apparently, Hal Finney, one of many early contributors to the BTC community, floated the same concept in 2010.

Supply:

However some known as for superior self-policing know-how to make sure such a system stays honest.

That mentioned, some market specialists anticipated a robust BTC rally as a constructive catalyst for MSTR’s worth.

In line with monetary advisor Ben FranklinPrimarily based on MicroStrategy’s monetary well being and BTC’s valuation, MSTR’s worth might develop 6x to 10x.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September