Ethereum

Analyst Explains What Could Trigger Crash To $1,800

Credit : www.newsbtc.com

This text is accessible in Spanish.

An analyst has defined how the lack of this on-chain demand zone may end in Ethereum witnessing a crash to a low of $1,800.

Ethereum is presently retesting a key help zone on the chain

In a brand new after at

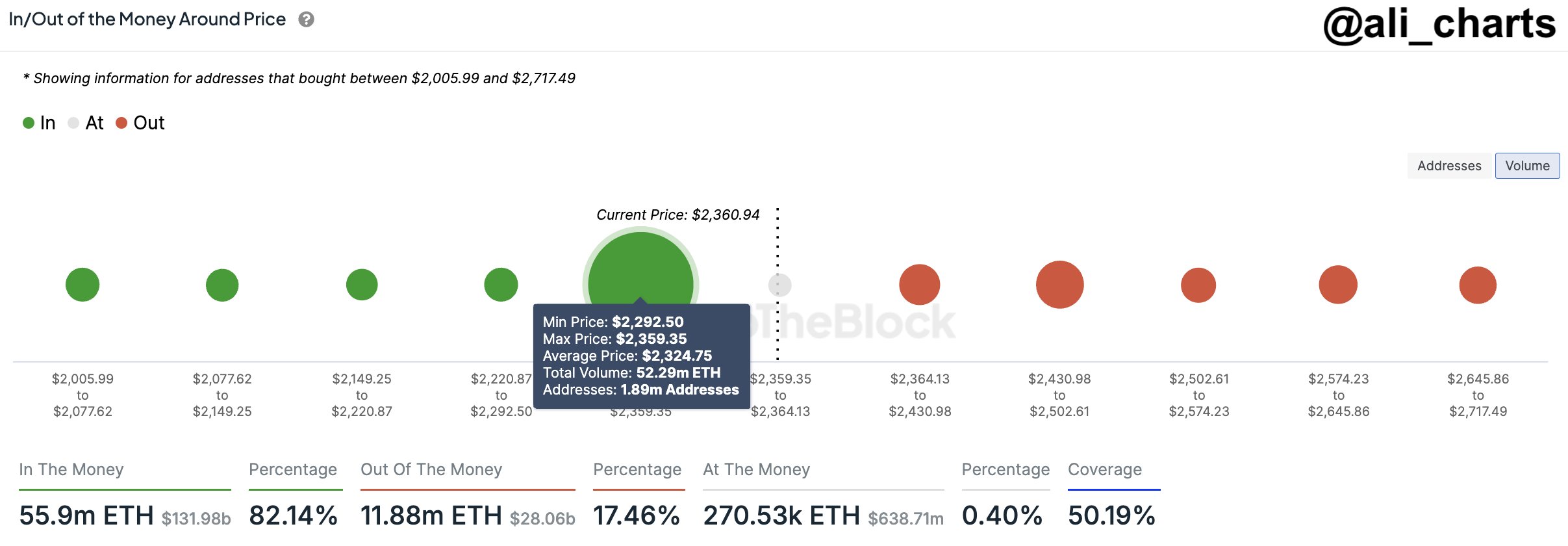

Within the chart above, the dots characterize the quantity of ETH final bought by traders or addresses throughout the corresponding worth vary. As will be seen, the vary from $2,292 to $2,359 is notable for the scale of the dot, indicating heavy shopping for has occurred between these ranges.

Associated studying

Extra particularly, nearly 52.3 million ETH was acquired by 1.9 million addresses inside this vary. Since Ethereum is presently retesting the vary, all of those traders would simply break even on their funding.

For any investor, their value foundation is after all an necessary degree and due to this fact they might be extra inclined to make some sort of transfer if retesting happens. Nevertheless, for ranges that accommodate the acquisition degree of solely a small variety of holders, any response ensuing from a retest is probably not as related to the broader market.

Nevertheless, within the case of worth ranges with giant demand zones, a retest might trigger seen fluctuations within the worth of the asset. The aforementioned Ethereum vary clearly belongs to this class.

As for the way precisely a retest of a excessive demand zone would influence the cryptocurrency, the reply lies in investor psychology. Retests which can be top-down, that’s, from traders who made income simply earlier than the retest, typically create a shopping for response available in the market.

It’s because these holders might imagine that the asset will rise once more sooner or later, so shopping for extra at their value might seem to be a worthwhile alternative. Since Ethereum is presently retesting the vary of $2,292 to $2,359, it’s doable that it senses help and finds a restoration.

Nevertheless, within the state of affairs the place a breakthrough happens, the cryptocurrency’s worth might be in danger. The chart reveals that margins beneath this demand zone solely help the fee base of a small variety of traders, which can stop them from stopping additional asset declines.

Associated studying

“If this demand zone breaks, we may see a sell-off that pushes ETH to $1,800,” the analyst notes. A drop within the present worth to this degree would imply a crash of over 21% for the coin.

It now stays to be seen how the Ethereum worth will develop within the coming days and whether or not the on-chain help zone will maintain.

ETH worth

After following the restoration in latest days, Ethereum is again at $2,300, which is throughout the aforementioned worth vary.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024