Ethereum

Analysts divided: Will Ethereum break the $3,400 barrier soon?

Credit : ambcrypto.com

- A outstanding crypto analyst prompt that ETH might get away of a bullish sample, probably inflicting a big value improve.

- On-chain statistics inform a unique story, with rising investor warning and elevated promoting exercise casting doubt on a rally.

Over the previous month, Ethereum [ETH] delivered a notable 18.66% achieve, however the upward trajectory has since slowed. Weekly efficiency confirmed a marginal improve of 0.02%, whereas day by day positive aspects remained modest at 0.20%.

AMBCrypto’s evaluation prompt that ETH is extra more likely to face a downturn than obtain the bullish breakout many have hoped for, as market alerts stay largely bearish.

Is Ethereum Bullish Sufficient to Attain $3,400?

In accordance with Carl Runefelt graph analysisETH trades below a falling resistance sample – a formation that always alerts an impending value improve.

Primarily based on this sample, ETH might probably rise to $3,420, the formation excessive, representing an 8.55% achieve from its present place.

Supply:

Runefelt commented:

“Ethereum wants to interrupt above this falling resistance to regain bullish momentum.”

Nevertheless, additional evaluation reveals that market sentiment stays divided in favor of the bears, with no clear consensus but supporting a breakout above the resistance stage.

Traders are offloading ETH, placing downward strain on the value

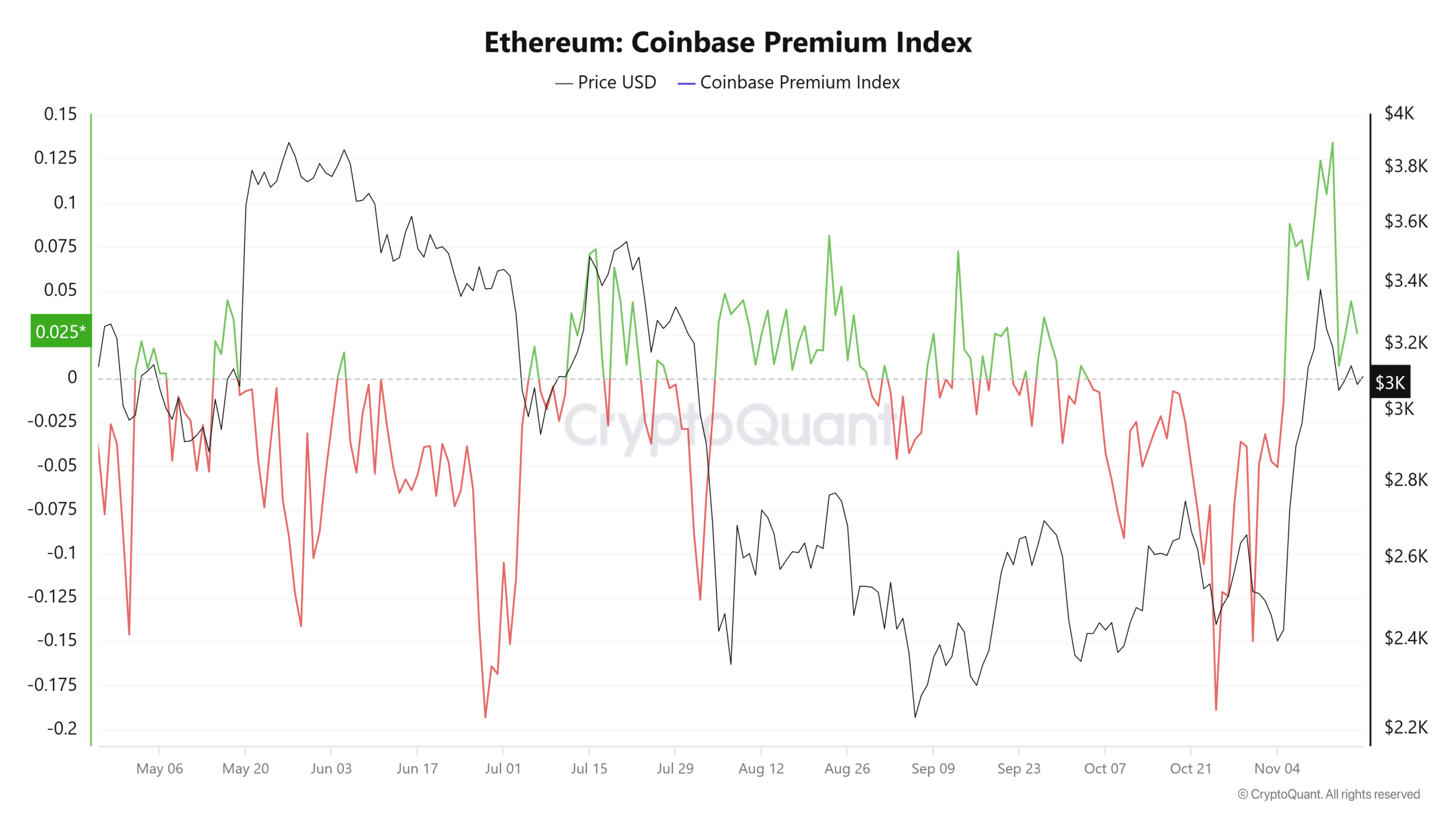

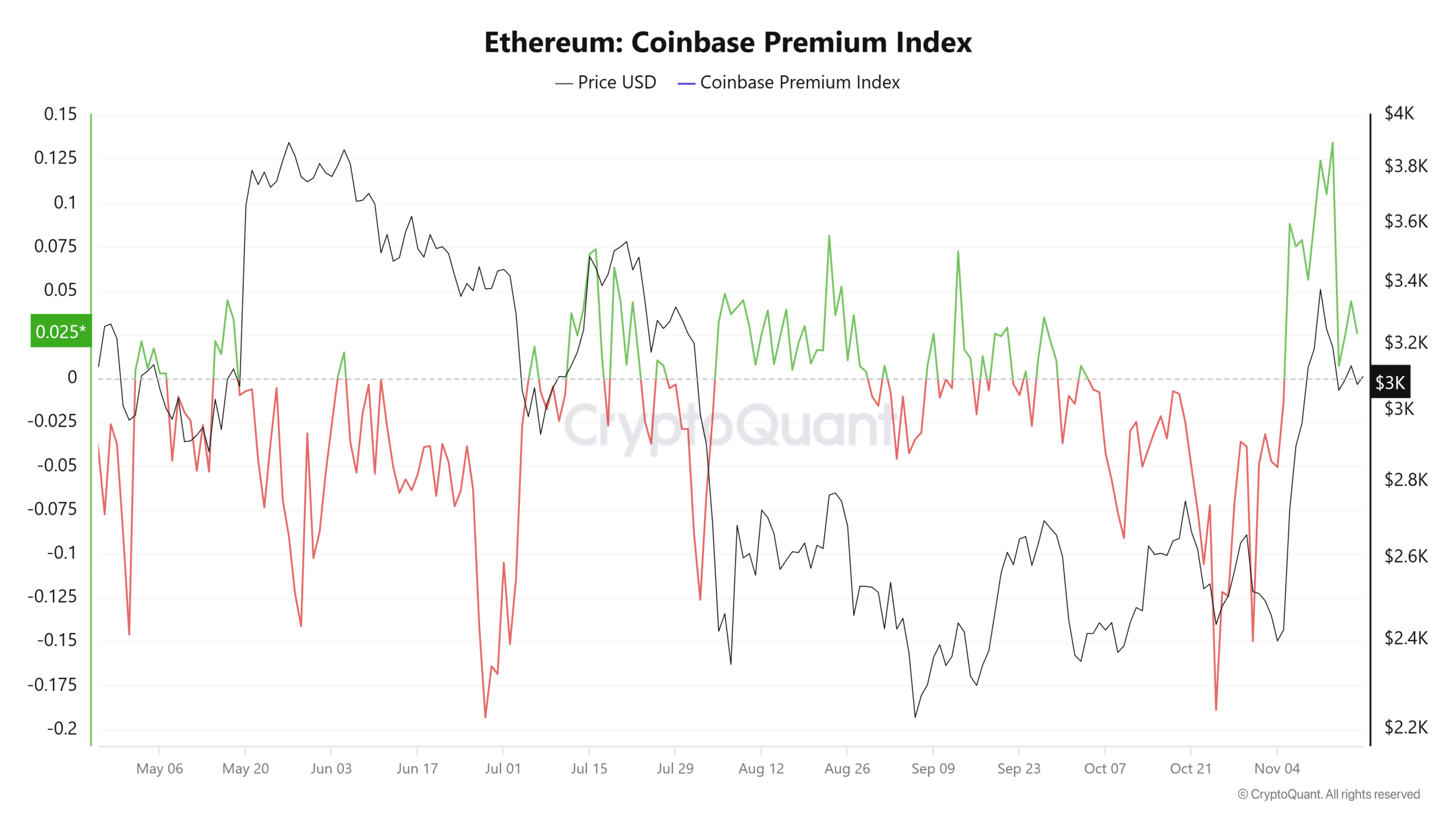

Information from CryptoQuant reveals that US traders are promoting their ETH holdings, indicating declining curiosity within the asset and diminishing expectations for a rally.

This pattern is mirrored within the Coinbase Premium Index, which measures the value distinction between ETH/USD on Coinbase Professional (a US-focused change) and ETH/USDT on Binance (a globally centered change).

The index has fallen sharply to 0.0256 from 0.1346 in April, indicating weaker demand for ETH amongst US traders in comparison with world markets.

Supply: Cryptoquant

The sell-off coincides with an increase in Trade Netflow, which measures the motion of ETH between exchanges.

A optimistic Netflow signifies elevated inflows into exchanges, largely for gross sales, whereas a adverse Netflow signifies traders are transferring belongings into non-public portfolios for long-term investments.

ETH’s Trade Netflow has remained optimistic for 3 consecutive days, with an enormous influx of 28,726.8 ETH previously 24 hours. This promoting strain has negatively impacted ETH’s value trajectory and would proceed on that path with a extra optimistic Netflow.

Sellers are taking management as ETH struggles

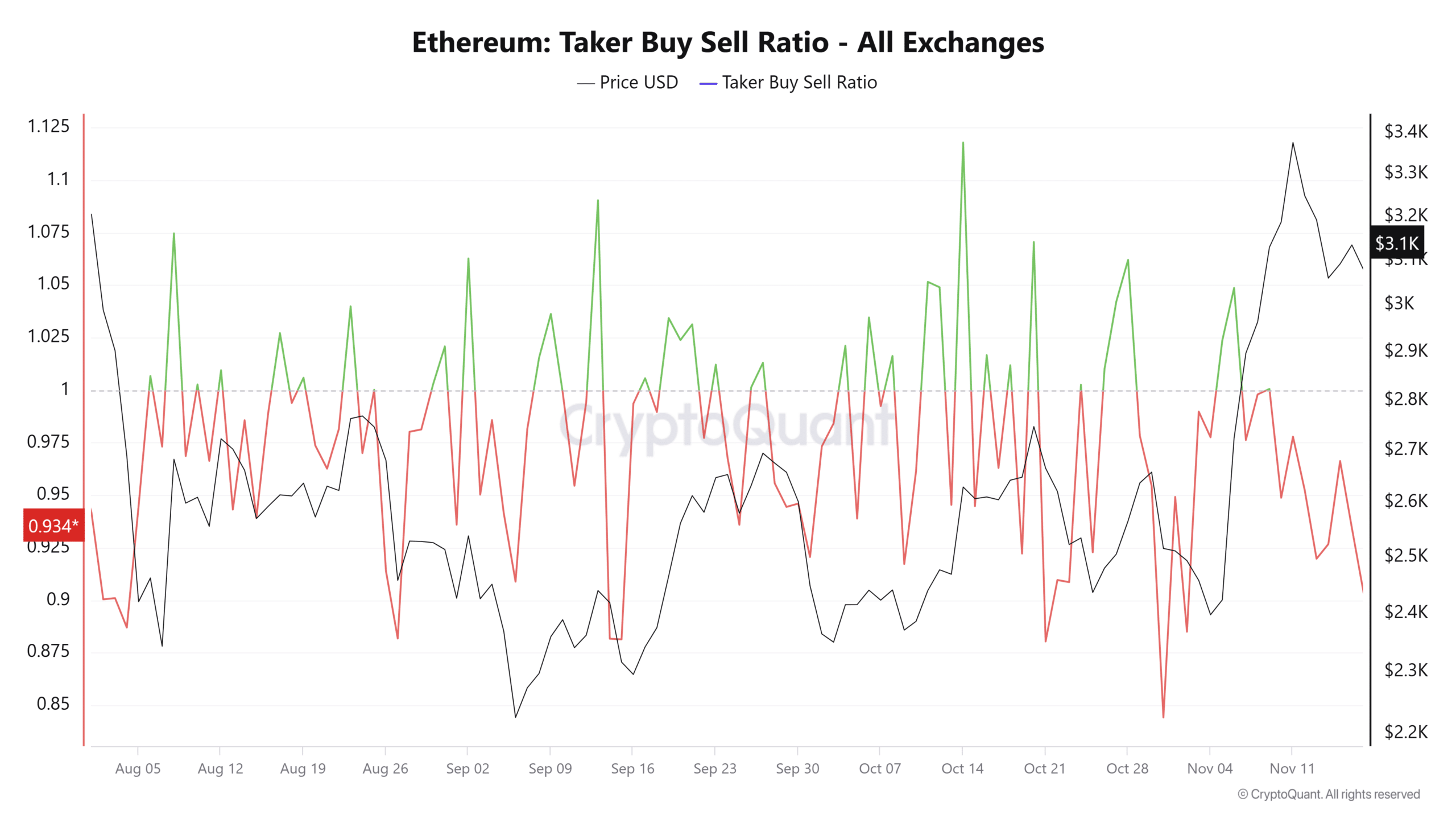

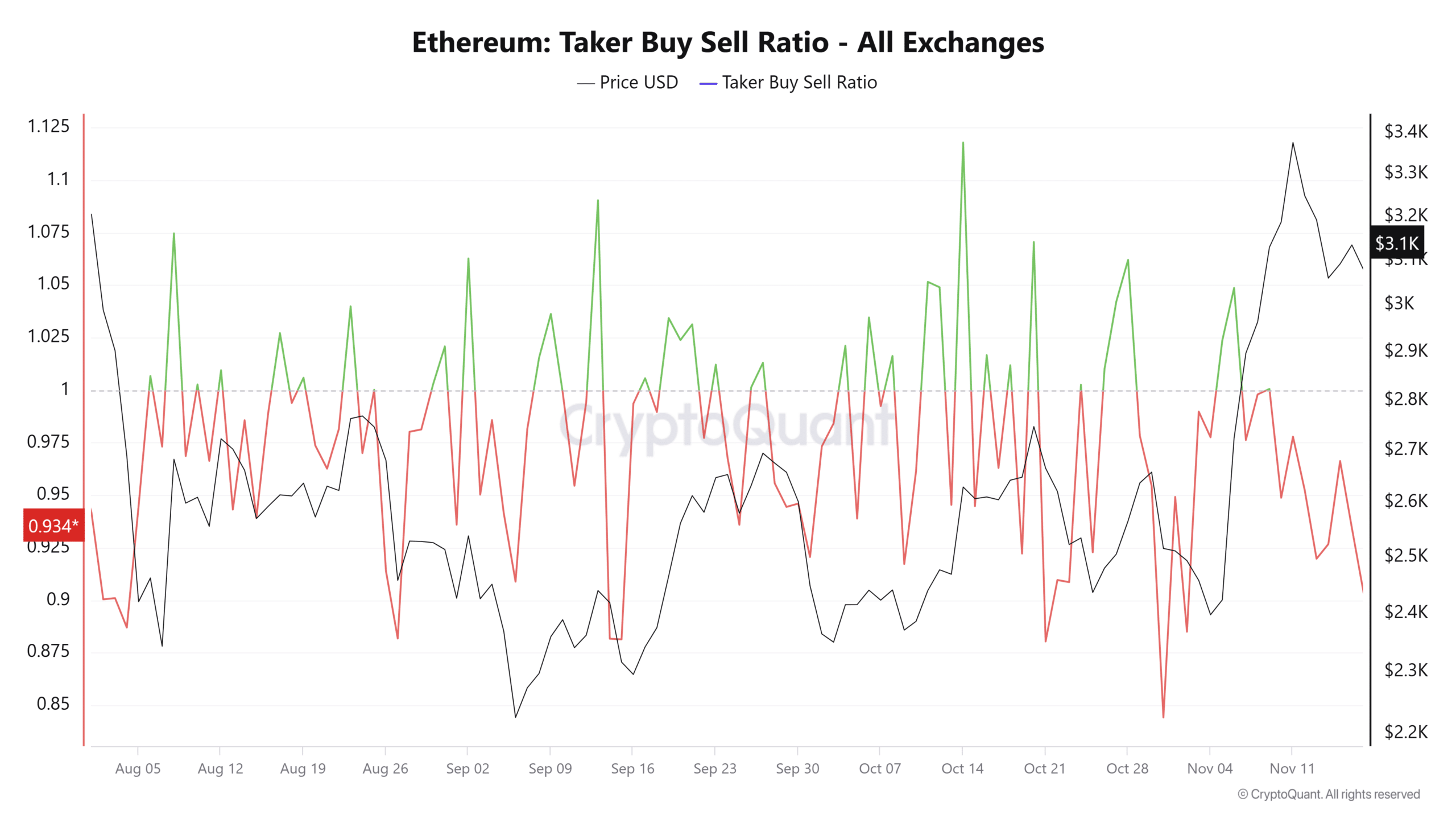

An evaluation of the Taker Purchase/Promote Ratio, a metric used to measure whether or not patrons (bulls) or sellers (bears) dominate the market, reveals that sellers at present have the higher hand.

Learn Ethereum’s [ETH] Value forecast 2024–2025

On the time of writing, the ratio is at 0.9033, beneath the essential threshold of 1. This worth signifies that promoting strain is exceeding shopping for exercise as extra traders lose their ETH holdings.

Supply: buying and selling view

If these bearish developments in a number of metrics proceed, ETH is unlikely to interrupt above its resistance line. As an alternative, this resistance stage might act as a value ceiling, probably resulting in additional declines in ETH’s worth.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now