Bitcoin

Analyzing Bitcoin’s surge: The impact of whales, institutional investments

Credit : ambcrypto.com

- Institutional curiosity in Bitcoin, mixed with sturdy demand for whales, is behind BTC’s latest uptrend.

- The latest new ATH of Bitcoin hashrate indicators the state of exercise surrounding the cryptocurrency.

Bitcoin [BTC] exhibits indicators of elevated exercise, particularly within the whaling and institutional lessons. These two classes most likely have the largest influence on BTC worth actions.

Bitcoin has maintained a powerful rise over the previous six weeks after beforehand struggling to remain above $60,000. This newest rally was smoother than normal and that was most likely as a result of sturdy institutional involvement.

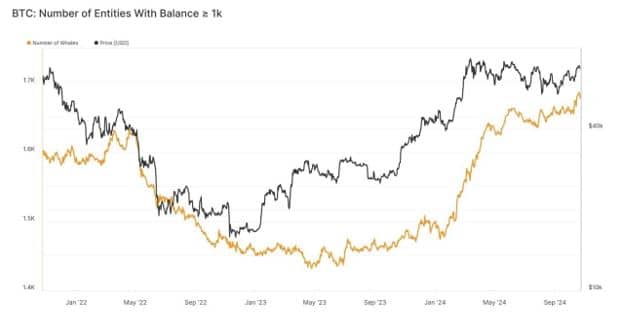

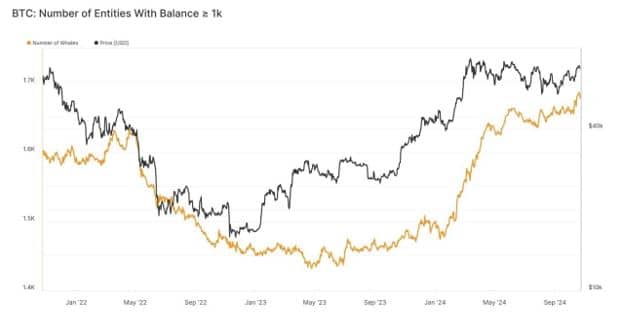

The altering sentiment round BTC made it extra engaging, as evidenced by the rise within the variety of establishments holding the cryptocurrency. Glassnode information lately confirmed that entities holding greater than 1,000 BTC lately rose above the Might 2022 degree.

Supply: Glassnode

The identical class of Bitcoin holders beforehand skilled a major decline, which leveled off in Might final yr. Which means they’ve been accumulating aggressively, however the momentum seems to have slowed between Might and August.

Bitcoin whales are surging to new highs

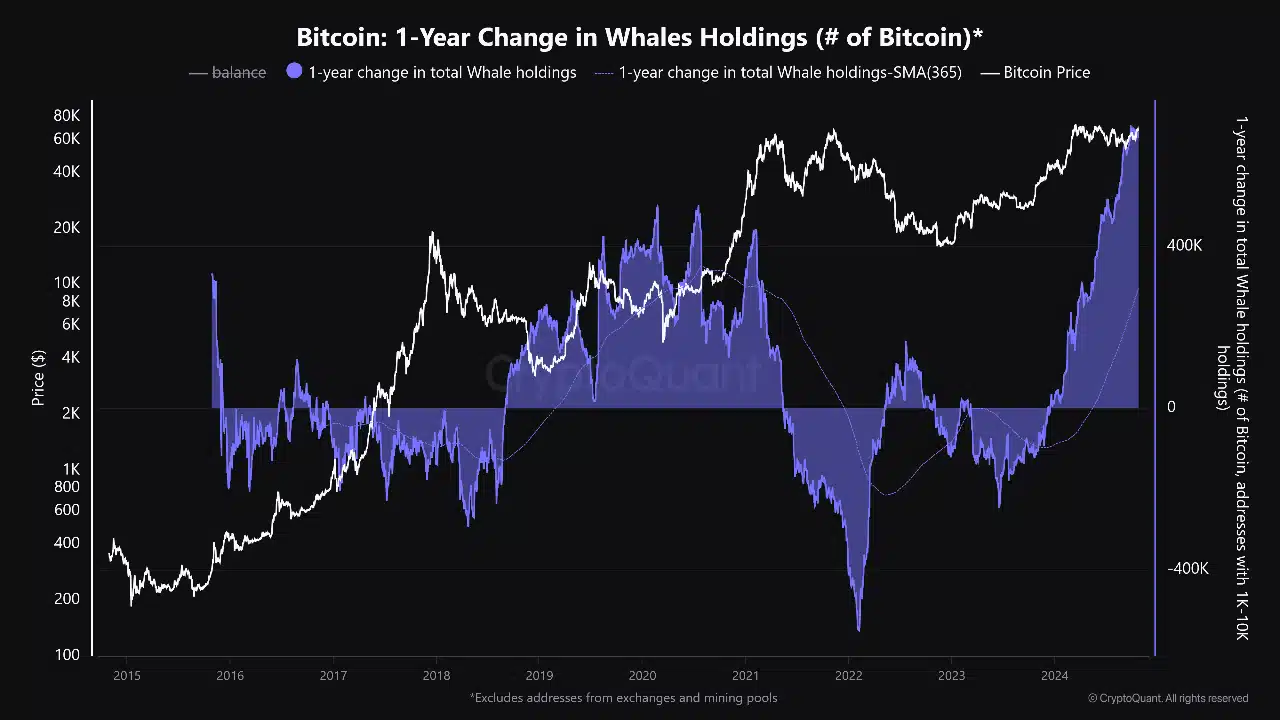

The upward tempo seems to be on an upward pattern once more since September. This additionally traces up with information on whale exercise, which has additionally elevated dramatically.

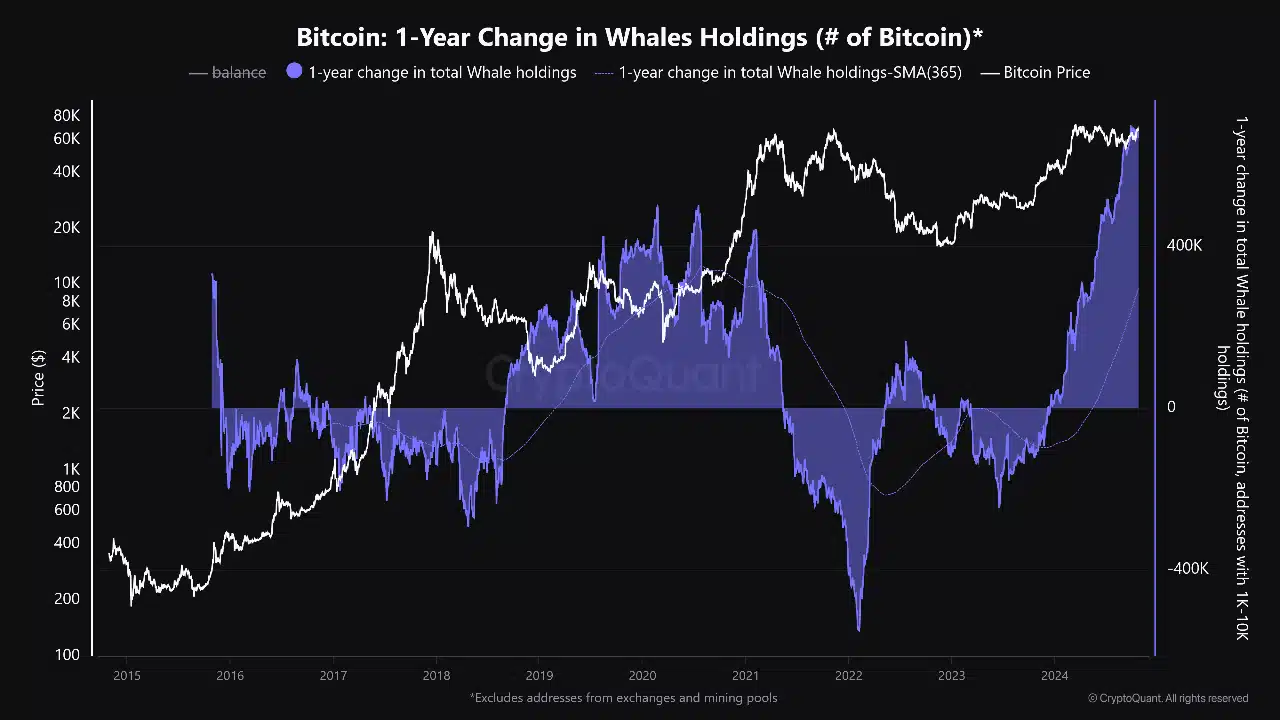

In response to the newest information, Bitcoin whales reportedly owned greater than 670,000 BTC, which is probably the most the whale class has ever owned. CryptoQuant analyst BaroVirtual described the commentary as an indication of accumulation forward of a giant transfer.

Supply: CryptoQuant

Bitcoin whale shares turned in 2023 and continued accumulation lately reached 2021 highs.

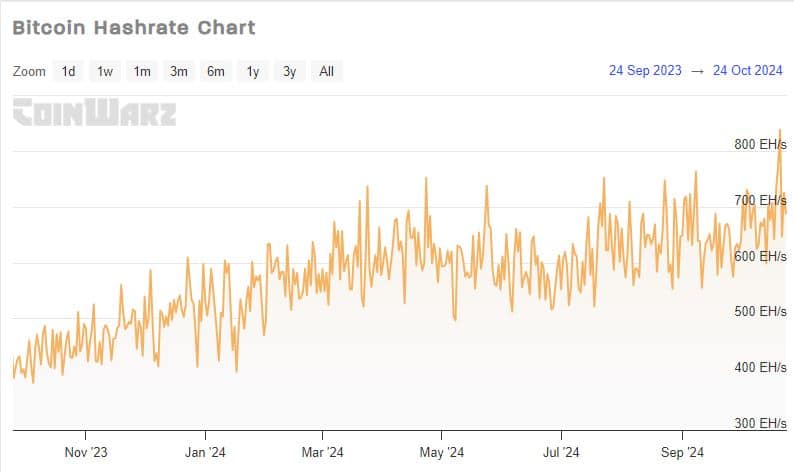

One of the vital frequent observations about each institutional and whale exercise is that it has grown quickly over the previous two months. Bitcoin-related transactions have thus been greater, requiring extra community capability.

Bitcoin miners have responded to the rise in community exercise by boosting their operations. Consequently, the Bitcoin hash charge lately rose to an all-time excessive of 918.72 TH/s.

Supply: Coinwarz.com

The community achieved this feat on Monday, October 21 this week. The hash charge ATH means that miner profitability has been fairly excessive.

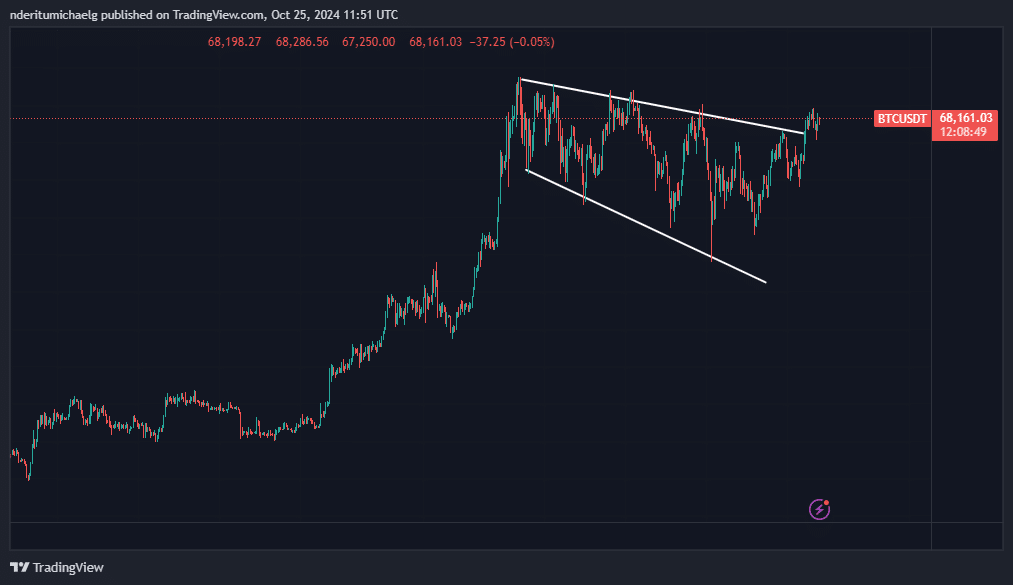

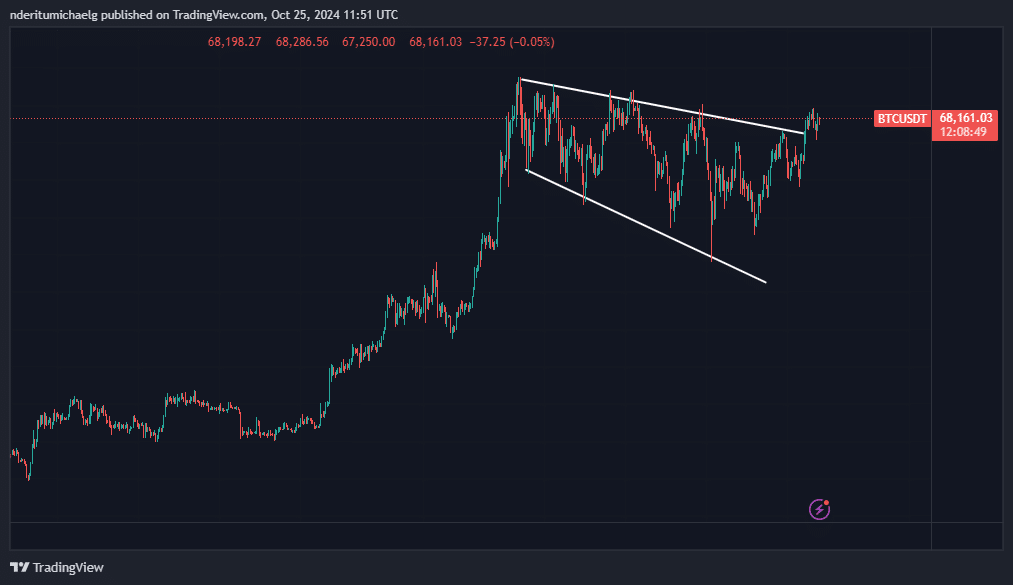

In the meantime, the influence of the newest surge in BTC demand was clearly seen within the worth motion. Bitcoin has been shifting inside a bullish flag sample since March.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

The newest bullish momentum appeared to have pushed the value above the resistance vary, suggesting extra potential upside may emerge within the coming months.

Supply: TradingView

Whale and institutional accumulation might point out main steps alongside the way in which. Nonetheless, these observations additionally implied the likelihood that Bitcoin may expertise extraordinarily unstable strikes within the quick to medium time period.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now