Altcoin

ApeCoin: A break above THIS level could result in a breakout rally

Credit : ambcrypto.com

- ApeCoin’s latest breakout above the important thing EMAs urged the potential for extra near-term upside.

- The $0.87 resistance stage was essential for the bulls to regain a long-term lead.

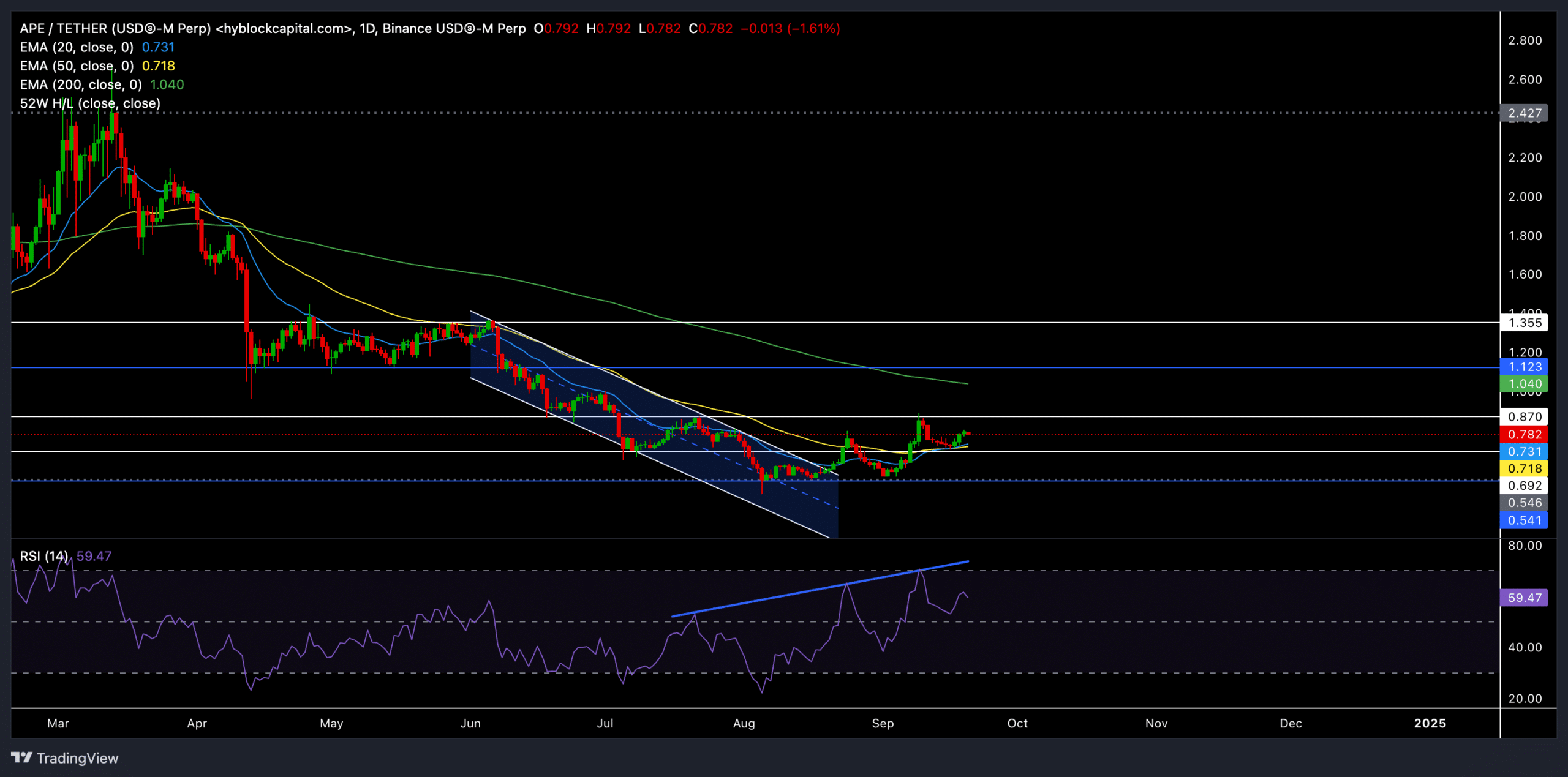

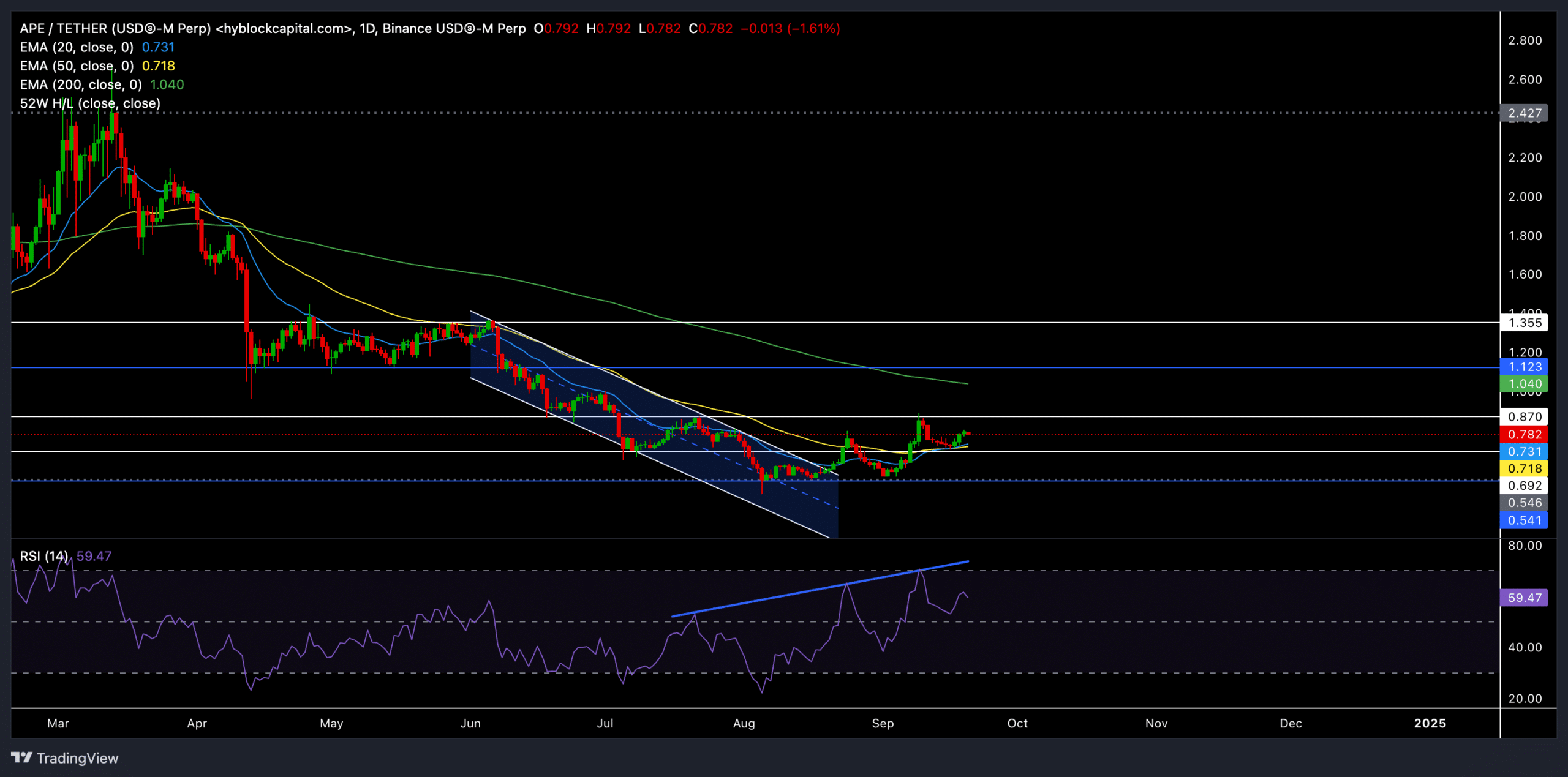

ApeCoin [APE] not too long ago confirmed indicators of restoration after a bullish breakout from a down-channel sample. After consolidating across the $0.54 help, APE noticed much-needed momentum above the 20-day and 50-day EMAs.

The day by day chart of APE/USDT confirmed a transparent breakout from the descending channel that has been placing strain on the worth since mid-July.

Quick-term restoration and EMA crossover

Supply: TradingView, APE/USDT

After the down-channel breakout, the APE fluctuated between $0.5 and $0.7.

Nevertheless, the breakout pushed the worth above each the 20-day EMA ($0.732) and the 50-day EMA ($0.718), indicating renewed shopping for curiosity. This crossover of the 20 EMA above the 50 EMA additional confirmed the bullish pattern.

On the time of writing, ApeCoin was buying and selling round $0.78. Regardless of this optimistic momentum, resistance at $0.87 may gradual the rally.

It’s value noting that the relative energy index (RSI) has reached increased highs over the previous two months, whereas the worth motion highs have remained flat.

This confirmed a light bearish divergence. If this distinction happens, APE might expertise a short lived downtrend. The altcoin may witness a pullback to retest the EMAs round $0.73.

Merchants ought to search for a rejection close to USD 0.87 as failure to interrupt this might end in a near-term correction.

The crucial resistance zone round $0.87 posed some challenges for bulls. A decisive break above this zone may open a path to the 200-day EMA, which was close to $1.04 on the time of writing.

This might be the subsequent massive goal for patrons. After the 200 EMA, the $1.12 and $1.35 ranges may come into play, however this could require a robust, sustained improve in quantity.

Inferred information reveals THIS

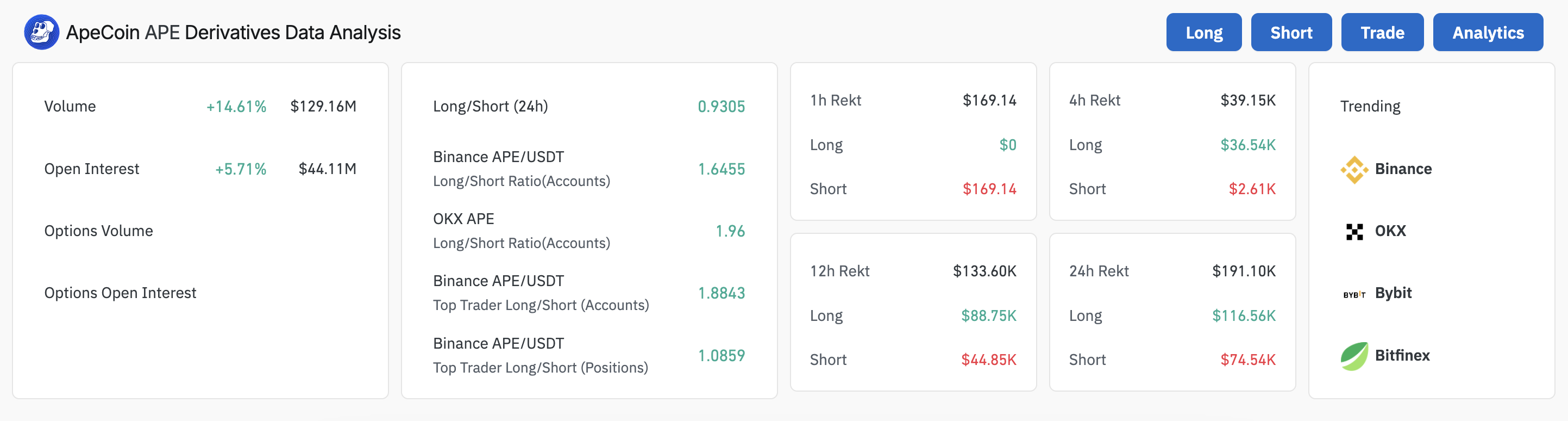

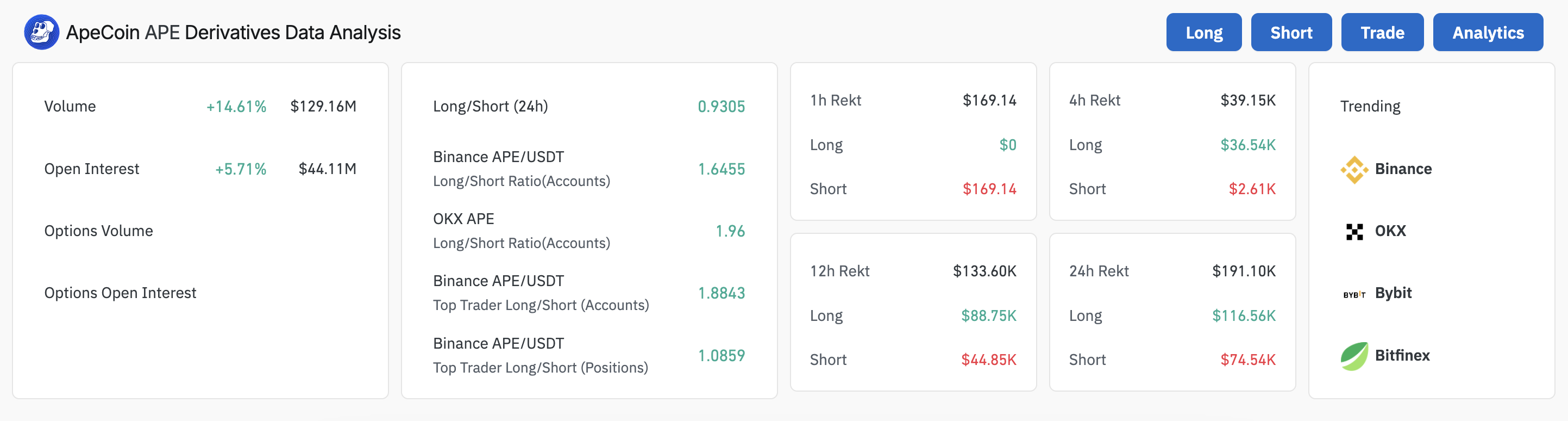

Supply: Coinglass

A take a look at the derivatives information confirmed a wholesome improve in each quantity (+14.61%) and Open Curiosity (+5.71%), with $129.16 million in buying and selling quantity and $44.11 million in Open Curiosity.

This bounce indicated that merchants had been positioning themselves for potential volatility and sure anticipated additional worth motion in direction of or away from the $0.87 mark.

Apparently, the Binance APE/USDT long-short ratio for accounts on the time of writing was 1.6455, reflecting a extra bullish sentiment. Equally, the OKX APE long-short ratio stood at 1.96.

Learn ApeCoins [APE] Value forecast 2024–2025

Nevertheless, merchants ought to carefully monitor derivatives market sentiment and the RSI for indicators of weak spot.

As all the time, broader market sentiment and on-chain developments can even play a key position in shaping ApeCoin’s worth trajectory within the coming days.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024