Altcoin

ApeCoin bulls regain key levels and that means…

Credit : ambcrypto.com

- APE’s latest turnaround has paved the way in which for bulls to re-enter and alter the short-term narrative.

- Merchants ought to hold a detailed eye on lengthy/quick ratios on main exchanges to evaluate any shifts in sentiment.

ApeCoin [APE] has proven indicators of restoration and just lately broke the descending channel sample on the every day chart, elevating hopes of a bullish reversal.

After beforehand experiencing vital promoting strain, APE noticed a promising 52% rally this previous week, briefly hitting the $0.87 resistance stage. Nonetheless, the query remained: can the bulls keep this momentum, or will we see a interval of consolidation?

Present value motion and key ranges to look at

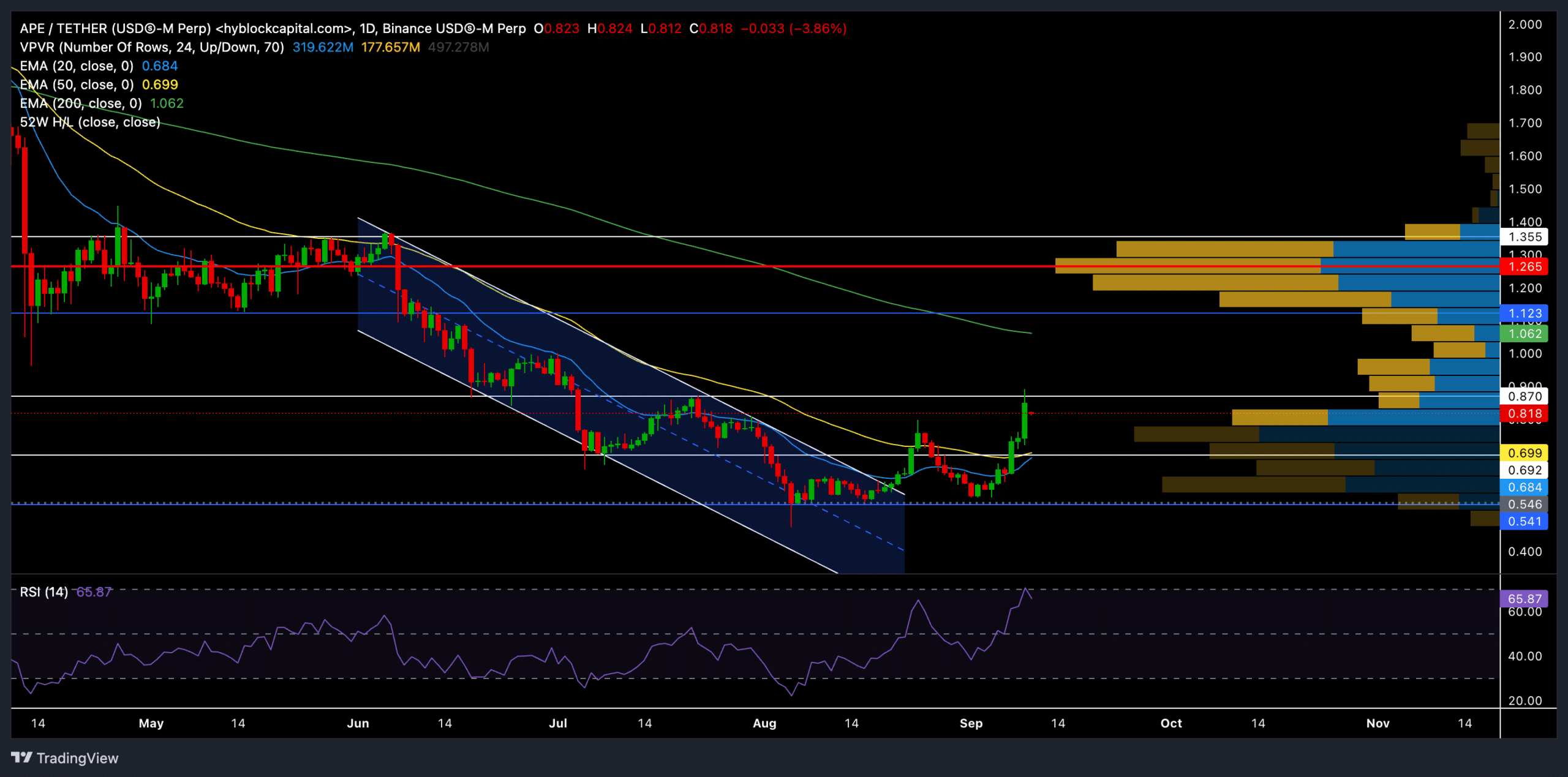

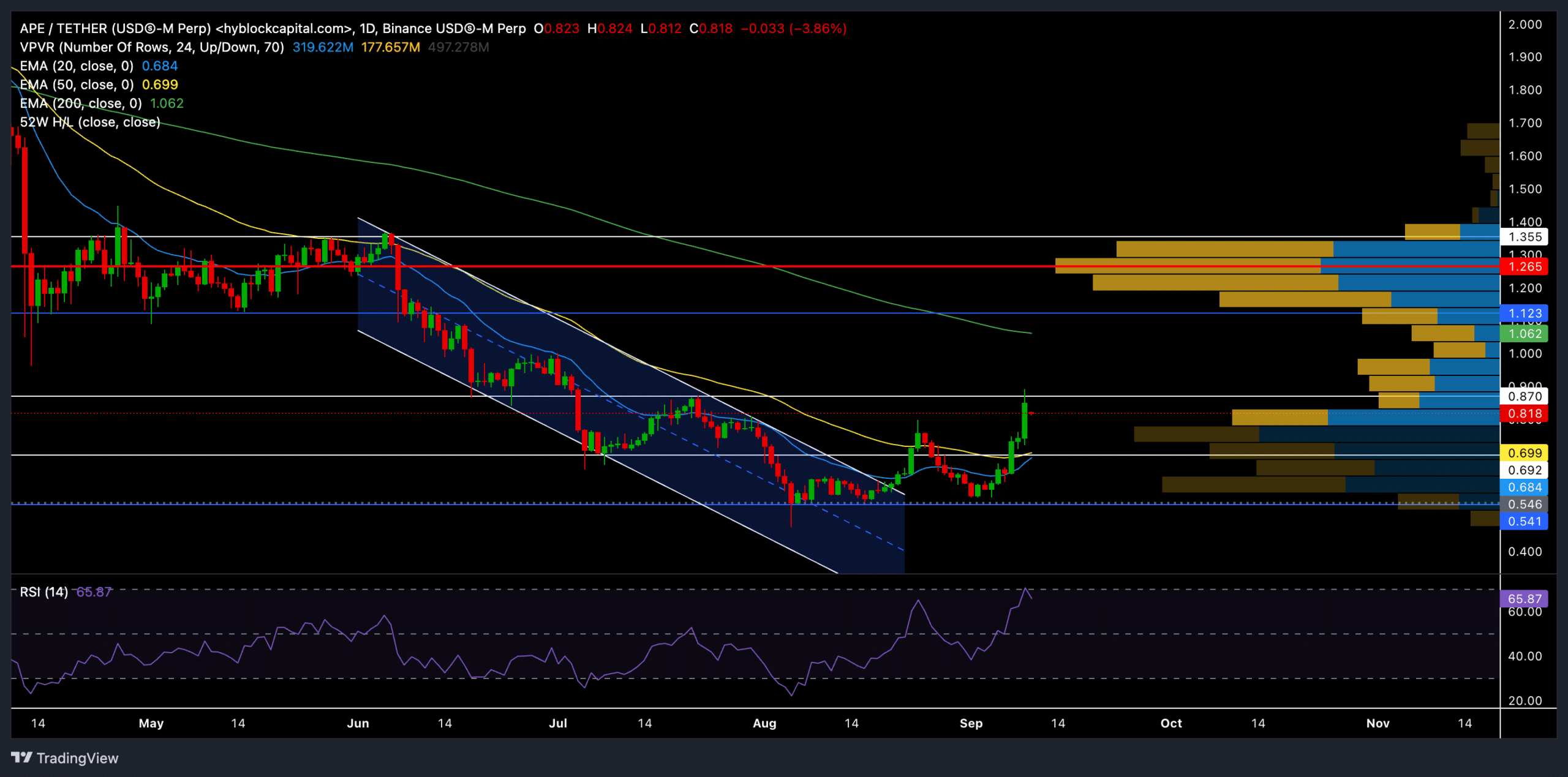

Supply: TradingView, APE/USDT

ApeCoin’s latest breakout from the descending channel sample marked an important shift in sentiment. APE was buying and selling round $0.818 on the time of writing, up about 11% within the final 24 hours.

In line with the VPVR (Quantity Profile Seen Vary) metric, the value was floating inside a excessive liquidity zone. This recommended that consolidation round $0.7 to $0.87 may be very possible within the close to time period.

For APE to keep up bullish momentum, patrons might want to break the fast resistance at $0.87. A transparent break above this stage may pave the way in which for a retest of the 200-day EMA, which stood at $1,062.

It’s price noting that it is a essential stage that would set off a stronger uptrend if regained.

On the draw back, fast assist was at $0.699, much like the 20-day and 50-day EMAs. Bulls want these ranges to keep up their short-term edge.

A breakdown under these EMAs may result in a take a look at of the earlier assist at $0.541, the place patrons may try to intervene once more.

The Relative Energy Index (RSI) stood at 65.87 on the time of writing. Whereas not but utterly overbought, it indicators the potential of a near-term correction or consolidation as shopping for momentum cools.

A sustained dip in the direction of the 50-58 vary may point out a probable consolidation within the coming days.

Indicators of a slowdown?

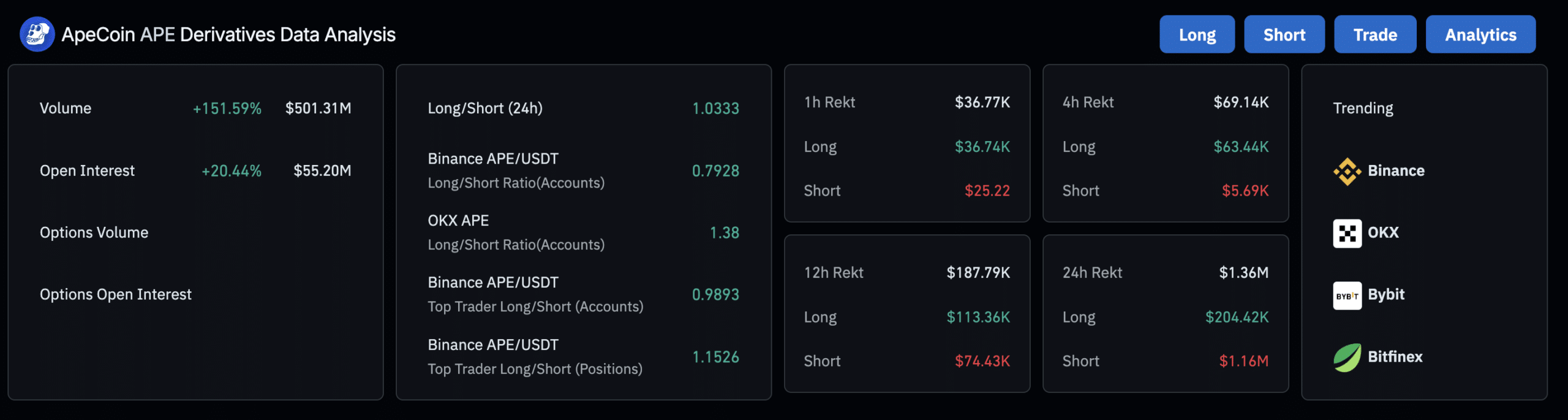

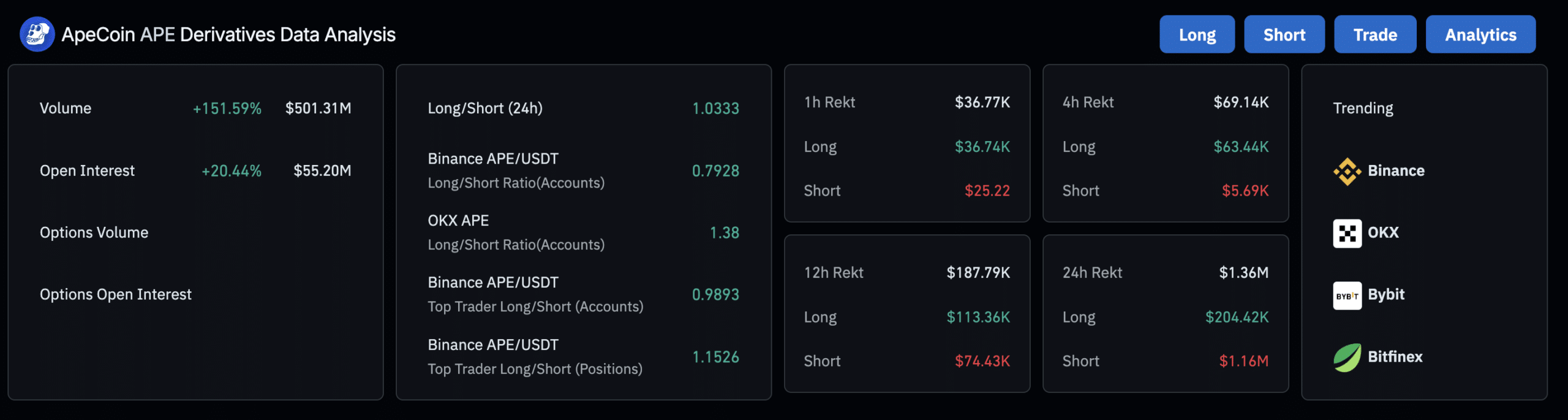

Supply: Coinglass

In line with the newest derivatives knowledge, APE’s quantity rose greater than 151% to $501.31 million. Then again, open curiosity noticed a rise of 20.44% to $55.20 million. However, the lengthy/quick ratio reveals combined sentiment.

The Binance APE/USDT lengthy/quick ratio was 0.7928, displaying that the quick positions have been barely bigger than the lengthy positions.

Nonetheless, the highest merchants on Binance are displaying extra bullish sentiment, with a ratio of 1.1526 for positions. Furthermore, the ratio on OKX was 1.38, which reveals a extra optimistic image.

This indicated a impartial to barely bullish sentiment on the derivatives market, with no robust bias but.

Is your portfolio inexperienced? Verify the ApeCoin revenue calculator

The worth motion within the coming days will largely rely on whether or not the bulls can push the value above $0.87 and, in the end, the 200-day EMA.

Failure to take action may result in sideways motion or a small pullback, giving patrons an opportunity to get again into the $0.7-$0.87 vary.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now