Altcoin

Aptos: Spot, derivatives traders in battle – What’s next for APT?

Credit : ambcrypto.com

- Spot merchants seem like getting ready for a doable rally, lowering the accessible provide of APT on the exchanges.

- Derivatives merchants are taking a bearish stance; many promote or place quick positions.

Aptus [APT] has proven spectacular efficiency in latest weeks, regardless of present market sentiment. Over the previous month, the asset has risen 24.34%, whereas its weekly achieve has been a outstanding 12.76%.

On the time of writing, spot merchants had the higher hand, permitting APT to submit a modest every day achieve of 1.08%.

Nonetheless, the sustainability of this rally stays unsure. The important thing query is whether or not the bullish momentum can stand up to the bearish stress from the derivatives market.

Spot merchants seize management of the bullish momentum

APT’s latest good points can largely be attributed to the actions of spot merchants who’ve taken a bullish stance.

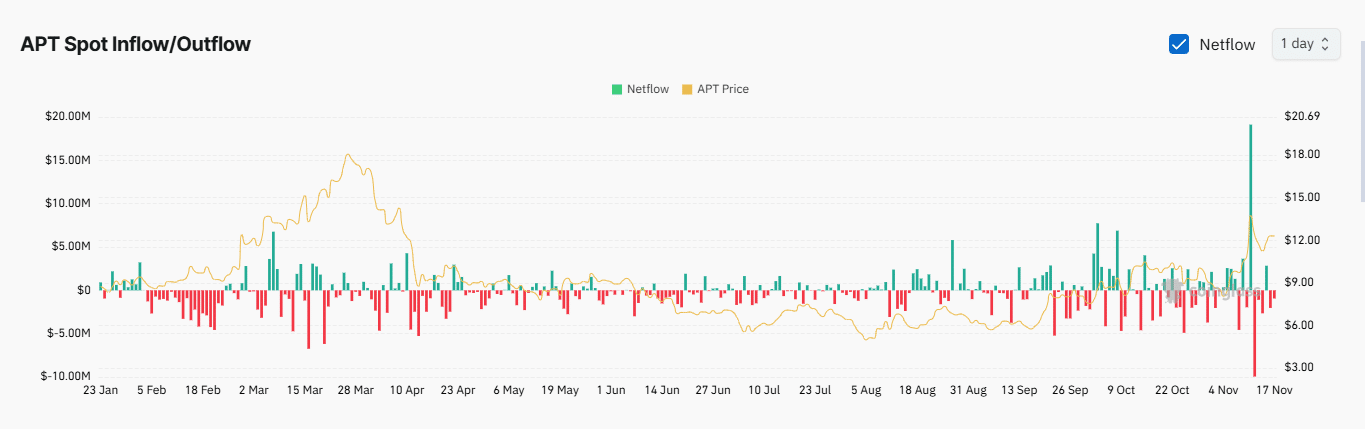

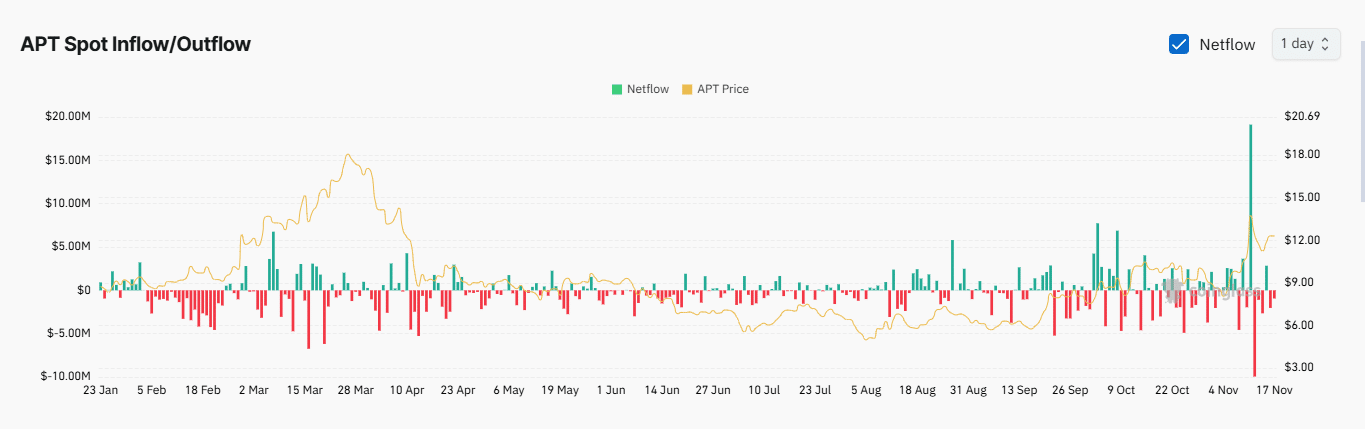

Knowledge from the Change Netflow – a metric that tracks APT inflows and outflows by means of crypto exchanges – confirmed damaging values for 2 consecutive days.

On November 16 and 17, $2.03 million and $938.67K price of APT had been withdrawn from the exchanges, respectively. This pattern confirmed a shift in sentiment amongst merchants.

Supply: Coinglass

Unfavorable Change Netflow sometimes signifies extra property shifting from change portfolios to non-public portfolios, indicating accumulation for long-term investments.

This discount in circulating provide on the exchanges prompted a provide squeeze, usually contributing to upward worth stress.

Derivatives merchants stay aggressive

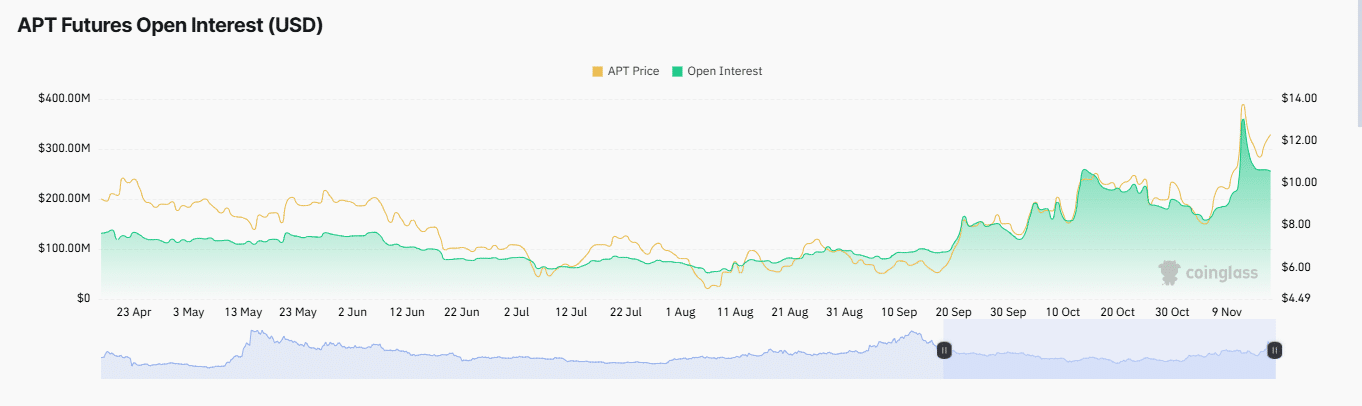

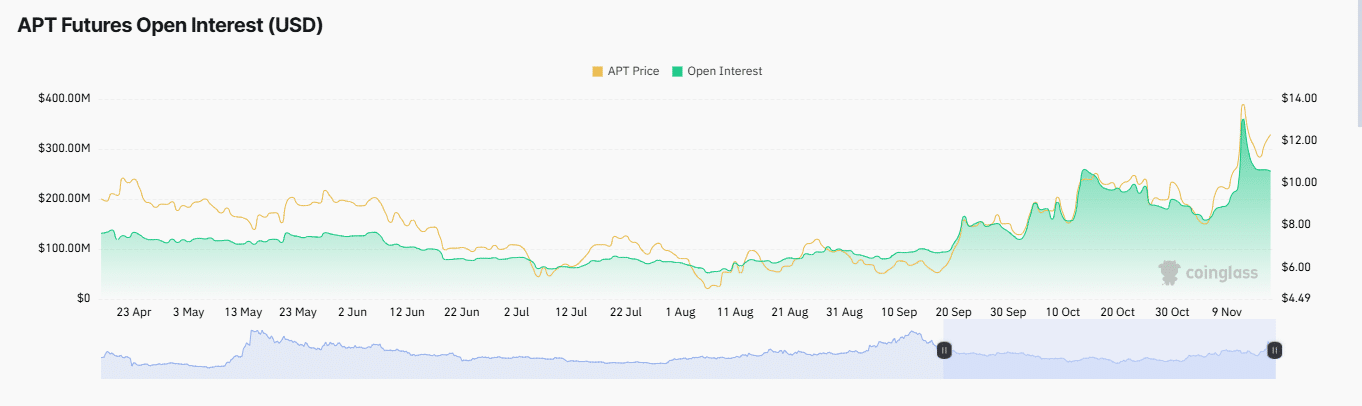

Derivatives merchants continued to dominate the market with a bearish stance as key on-chain indicators together with Open Curiosity, Liquidations and the Lengthy-to-Brief ratio confirmed declining confidence in a worth rally.

Knowledge from Mint glass revealed a big decline in Open Curiosity, which fell 8.03% to $255.58 million.

This indicated that almost all unsure contracts had been now pushed by quick merchants, who’ve taken management of the market momentum.

Supply: Coinglass

On the similar time, lengthy liquidations have elevated dramatically, wiping out $589.38K price of positions. This mirrored the market’s motion towards merchants who had wager on a worth rise, additional reinforcing bearish sentiment.

Moreover, the Lengthy-to-Brief ratio has dropped to 0.8822, indicating that there have been extra quick merchants than lengthy merchants on the time of writing.

This imbalance places extra stress on any potential bullish momentum, making a sustained rally much less possible within the close to time period.

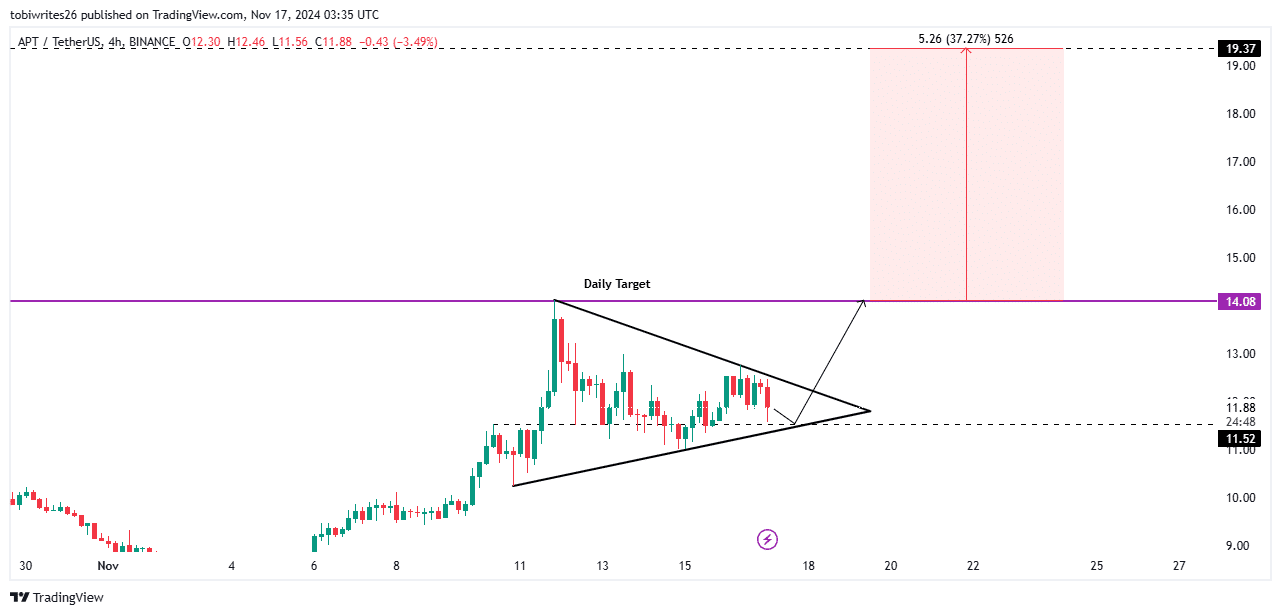

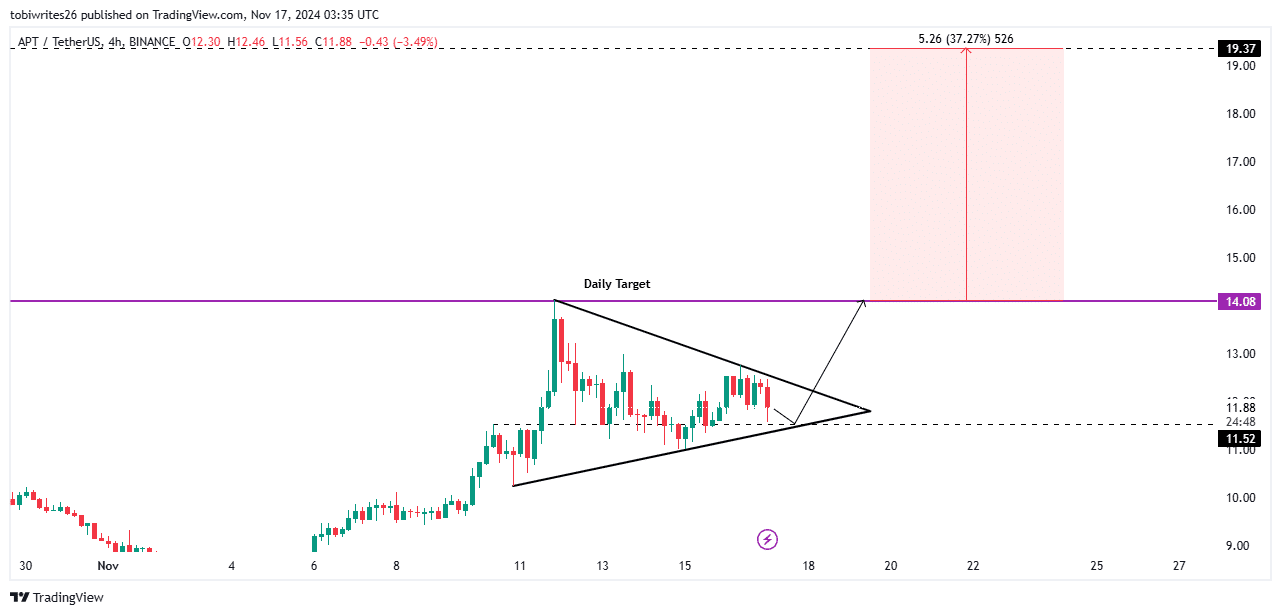

APT’s subsequent transfer on the map

Based on the chart, on the time of writing, APT was in a consolidation section and buying and selling inside a symmetrical triangle sample after bouncing off the $14.08 resistance.

This sample usually precedes a big market rally, indicating that APT is heading for a possible breakout.

For a sustained transfer to the upside, APT may first drop barely to retest the $11.52 assist degree earlier than recovering, or it may transfer straight up from its present place in direction of the $14.08 resistance zone.

Nonetheless, the resistance at $14.08 may trigger important promoting stress, doubtlessly triggering a small pullback.

Learn Aptos’ [APT] Value forecast 2024–2025

If bullish momentum stays sturdy, APT may break this degree, resulting in a projected achieve of 37.27% and a brand new month-to-month excessive of $19.37.

Supply: TradingView

Given this dynamic, spot merchants appeared to have the higher hand, and this benefit may enhance if the present bearish on-chain metrics begin to shift positively.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International