Bitcoin

Are Bitcoin Treasury Companies Still A Smart Investment In 2025?

Credit : bitcoinmagazine.com

Bitcoin has lately established new highlights of all time, however a lot of the main Bitcoin Treasury firms have been significantly underperformed. Although Bitcoin itself lately pushes effectively above $ 120,000, the inventory costs of firms equivalent to (micro) technique stay removed from their peaks. Are these firms in all probability seen a sustainable restoration, or has their outperformance interval been assumed?

Bitcoin Treasury Firms: Huge BTC Holdings in 2025

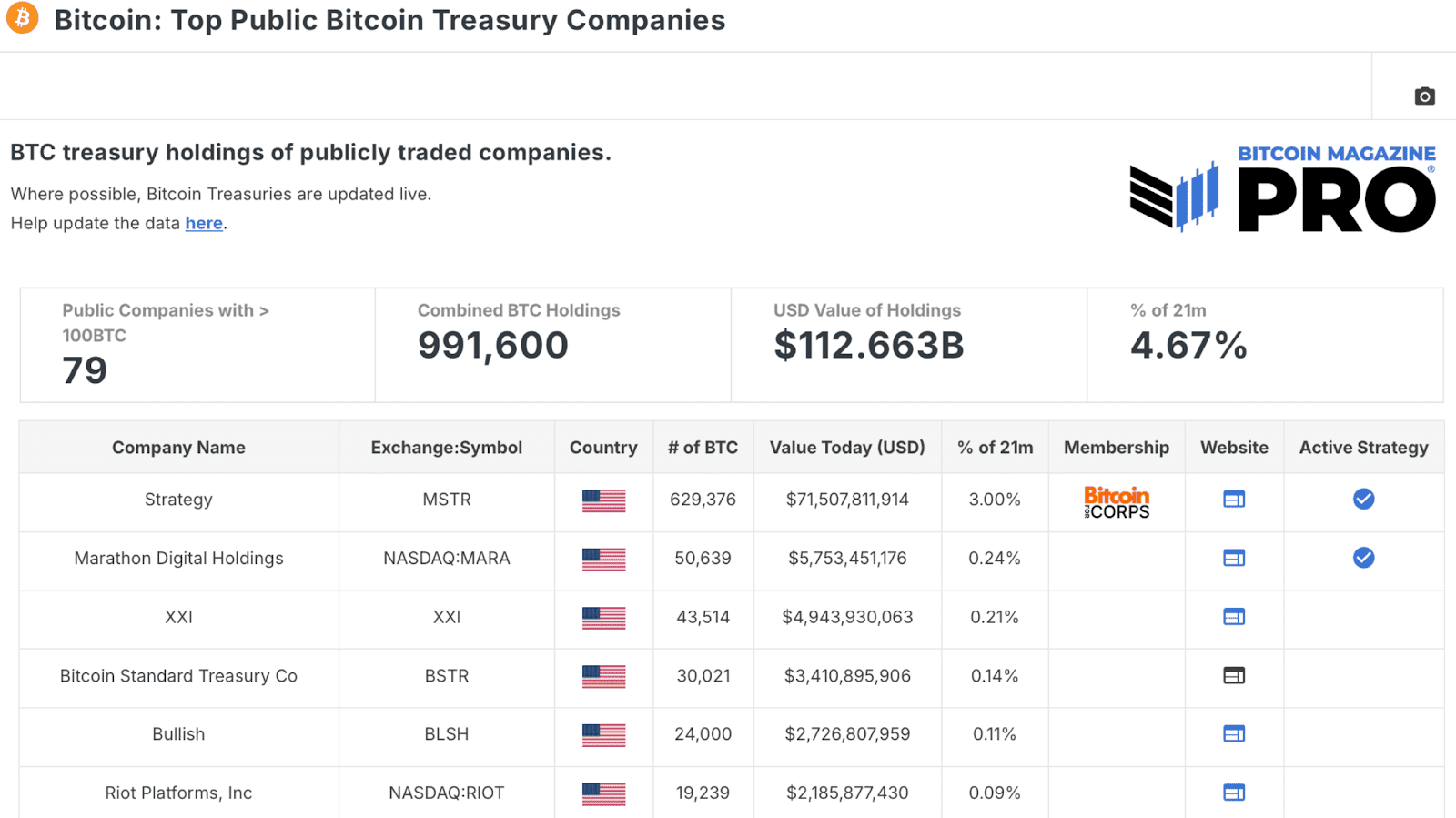

Analyzing the desk of Top Public Bitcoin Treasury companies It seems that a complete of 79 public firms have a minimum of 100 BTC, which quantities to virtually 1,000,000 bitcoin, with a worth of greater than $ 110 billion. A monumental quantity, since a majority of those firms solely began accumulating in recent times in recent times!

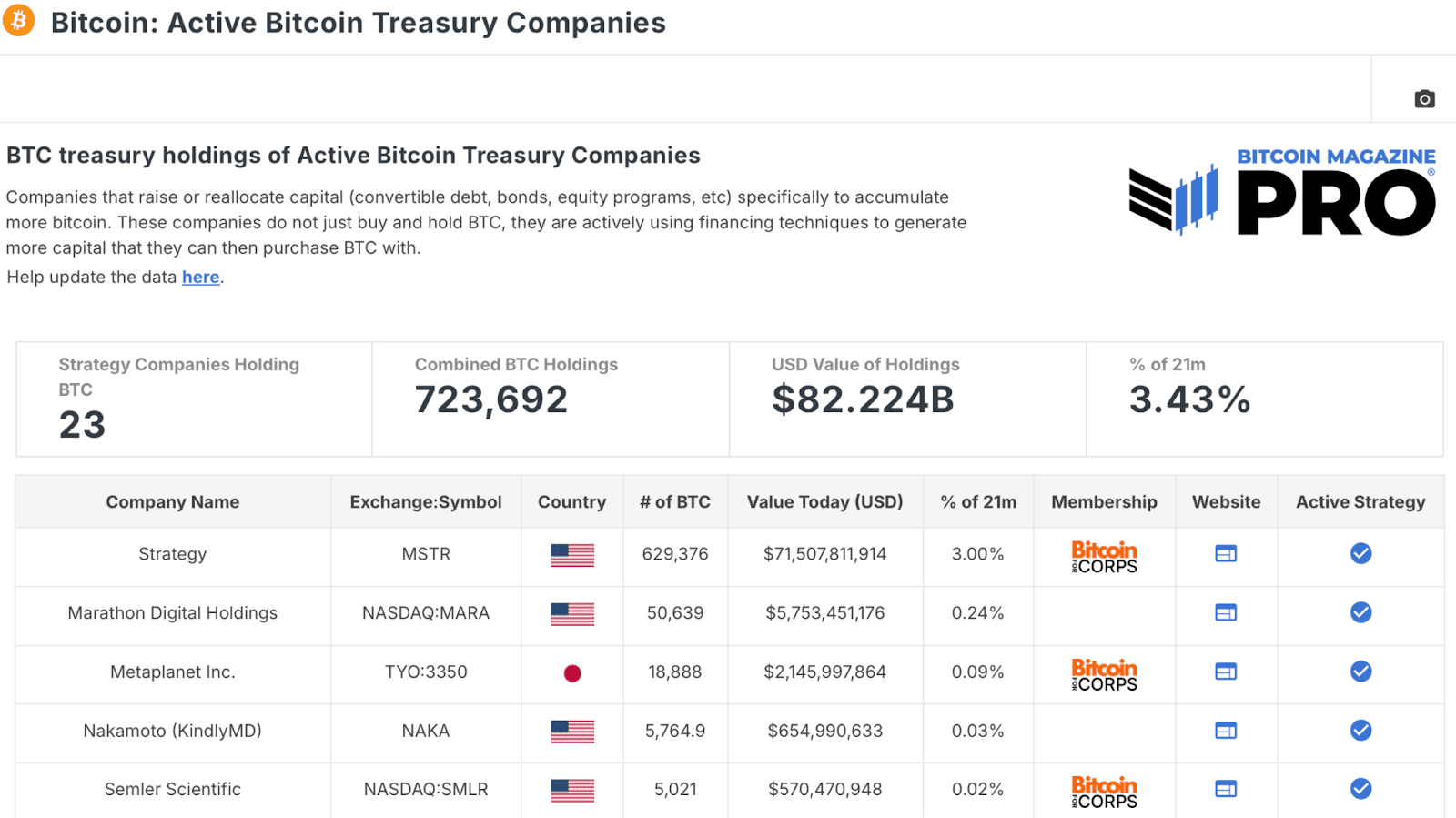

Of those, twenty -three firms are that Active Bitcoin Treasury companiesThose that actively use financing methods to generate extra capital for BTC accumulation, with a mixed 723,000 BTC and develop quick. It isn’t shocking that (micro) technique this group dominates with the best allocation of just about 630,000 BTC.

This huge stage of institutional accumulation emphasizes the rising significance of Bitcoin within the subject of firm steadiness. Nonetheless, traders began to wonder if the as soon as explosive inventory efficiency of those firms can proceed.

Why Bitcoin Treasury firms are left behind in 2025

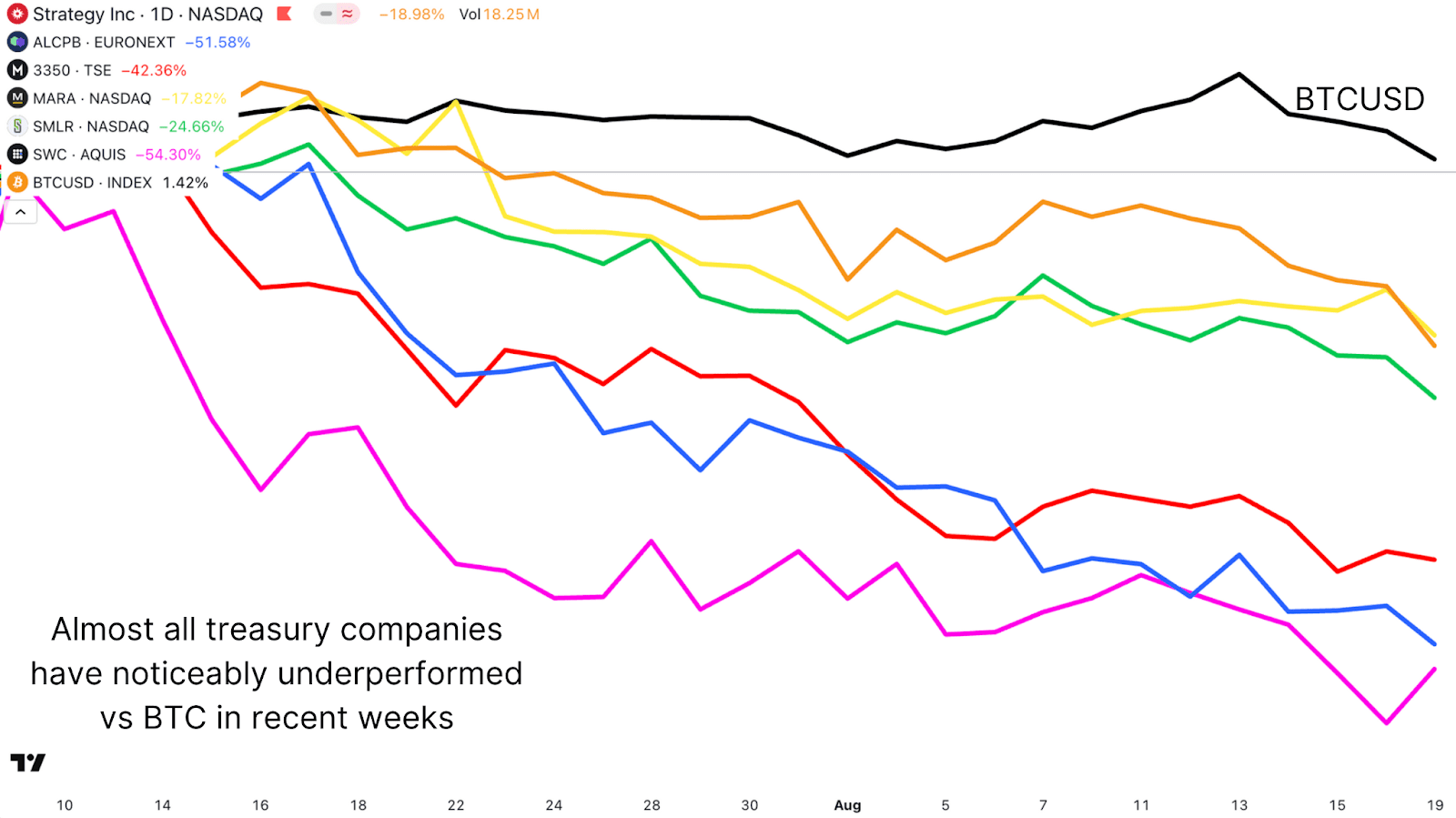

(Micro) Technique has been the flagship Bitcoin Treasury Firm, however the share worth has not mirrored the ability of Bitcoin in current months. Whereas BTC elevated by $ 124,000 earlier than the current Retracement, the share worth of MSTR was lately voted $ 330, effectively under the highlights of $ 543. In current weeks, most of these treasury firms have remained significantly in comparison with Bitcoin.

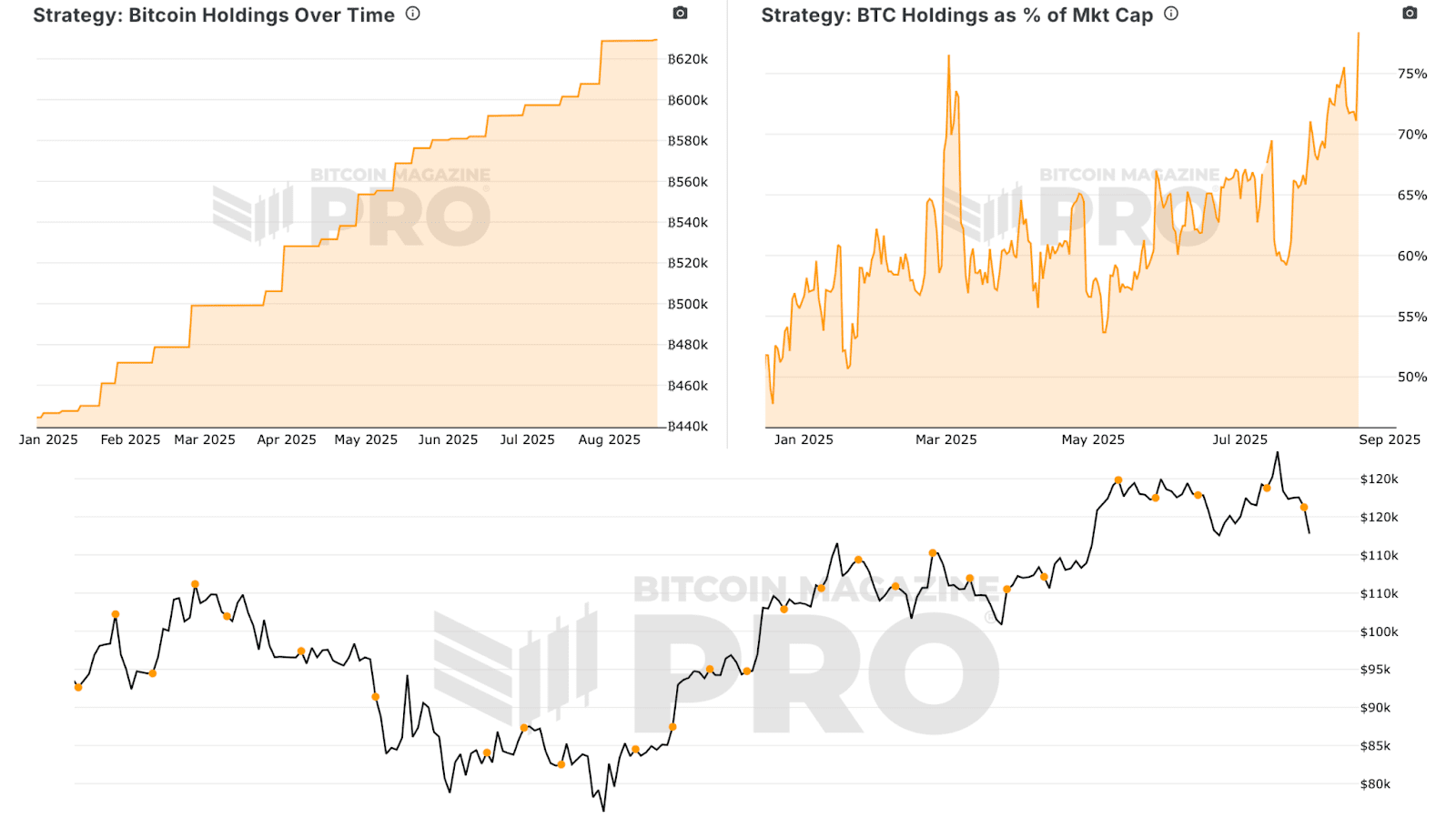

An vital purpose is the delaying accumulation. Whereas (micro) technique made a giant buy in July 2025, we are able to see from them Bitcoin Holdings over time That the tempo is noticeably coordinated in comparison with its aggressive purchase in earlier years. With out steady and appreciable accumulation, traders could also be much less keen to pay a premium for shares.

The affect of share dilution on the inventory costs of Bitcoin Treasury Firms

(Micro) Technique typically points new shares to draw capital for Bitcoin purchases. Though this will increase the full pursuits, the prevailing shareholders tolerate and weighs on the inventory worth. From 2020 to 2025, (micro) technique’s diluted inventory rely elevated from roughly 97 million to greater than 300 million, which displays the dimensions of capital improve for Bitcoin purchases. Though this technique has succeeded in gathering big BTC reserves, the appreciation of the share worth has additionally closed.

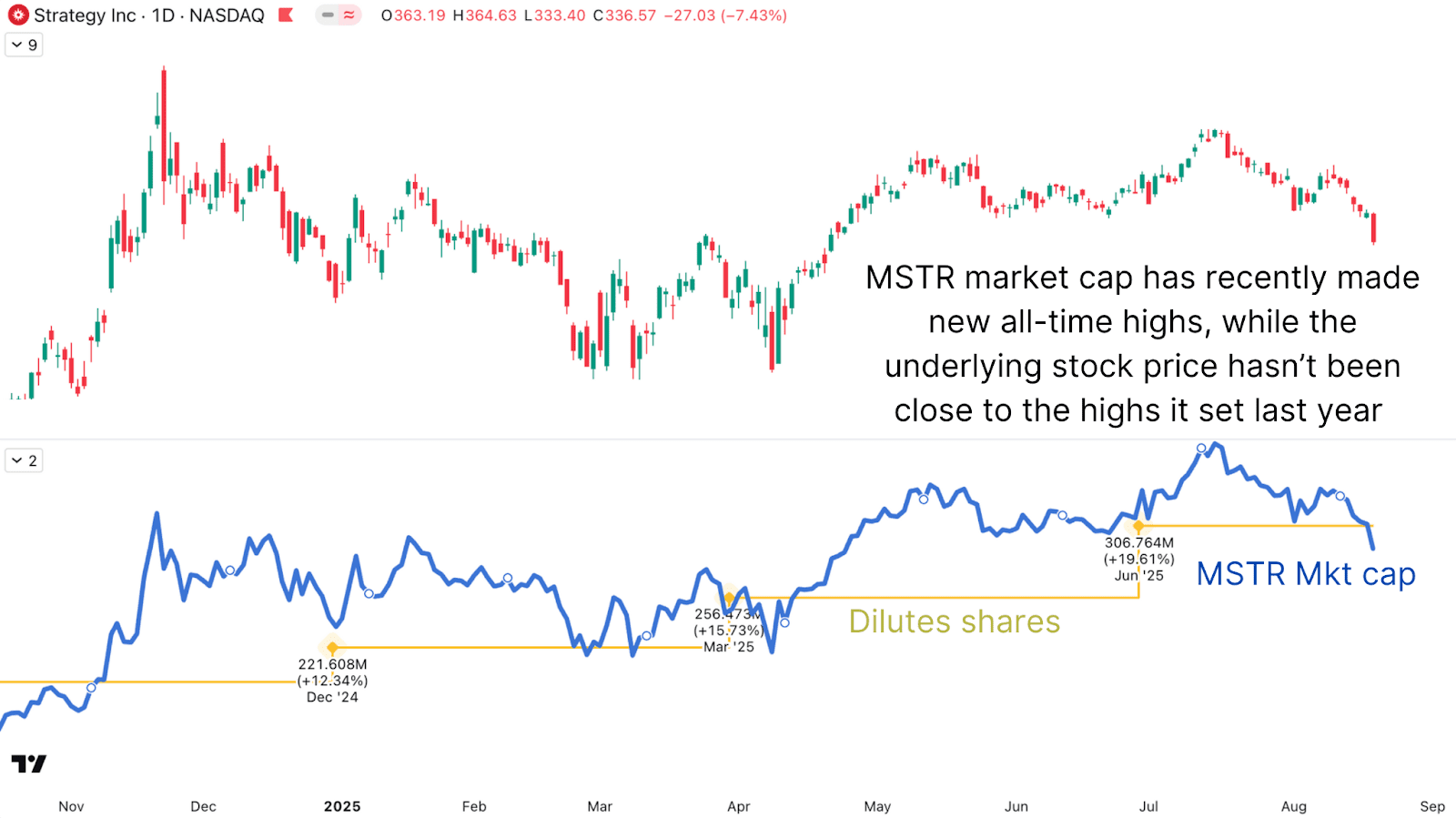

Wanting on the market capitalization of the corporate as an alternative of the inventory worth paints a special image. Market capitalization, which is excellent shares, truly reached new highlights in July 2025 and adopted the rise of Bitcoin precisely. The inventory worth alone tells a extra destructive story due to this heavy dilution.

Bitcoin Treasury Firms: NAV premiums and rankings in 2025

The web asset worth (NAV) premium, the premium traders pay for shares in comparison with their bitcoin per share, has fallen significantly. Traditionally, (micro) technique ordered an vital NAV premium as one of many few methods for traders to get Bitcoin publicity to Bitcoin. Now that dozens of Treasury firms and ETFs can be found, that benefit of the “first mover” has been decreased. As extra firms take Bitcoin as reserve resistant, the NAV premium within the sector will in all probability make a development to at least one.

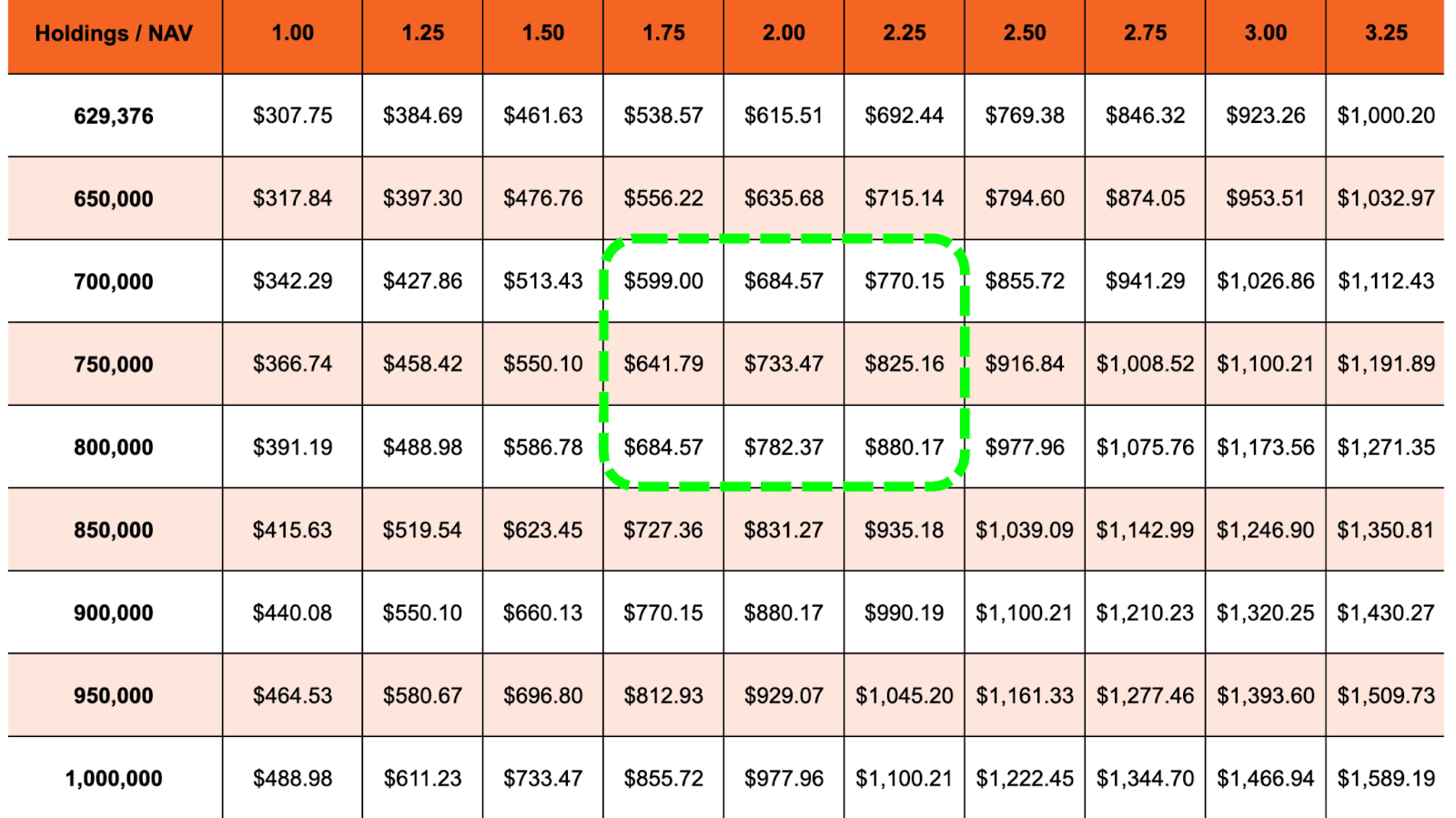

Treasury firms and their MNAV can have a tree/bust -cycles, like all markets all the time have. If Bitcoin reaches $ 150,000, (micro) technique’s personal finish -of -year prediction, completely based mostly on its present pursuits and doesn’t settle for extra accumulation or share difficulty, the true worth, with a NAV of 1.00x, could be round $ 308 per share. With steady accumulation (presumably between 700,000 – 800,000 BTC) and a modest NAV premium of 1.75-2.25x, inventory costs can attain the vary of $ 600 – $ 880. This nonetheless appears to be a sensible alternative, particularly if we see an S&P 500 recording within the coming months along with a extra sustainable BTC -Opwaartse motion.

The way forward for Bitcoin Treasury Firms: Funding prospects for 2025

Bitcoin Treasury firms equivalent to (micro) technique have needed to take care of a tough underperformance interval regardless of the rise in Bitcoin to new highlights. Dilunning, delay in accumulation and elevated competitors have weighed closely on inventory costs. Nonetheless, their basic position makes them strategically vital in locking up big quantities of bitcoin, and in sure market phases they will nonetheless provide one the wrong way up in comparison with BTC.

The asymmetrical alternative stays, however traders should mood expectations: the “straightforward outperformance” of the early (micro) technique days has in all probability handed, changed by a extra mature and aggressive panorama.

Did it like this deep dive in Bitcoin worth dynamics? Subscribe to Bitcoin Magazine Pro on YouTube For extra knowledgeable market insights and evaluation!

Go to for extra in -depth analysis, technical indicators, actual -time market warnings and entry to knowledgeable evaluation Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought-about as monetary recommendation. All the time do your personal analysis earlier than you make funding selections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024