Analysis

Are Bitcoin Whales Buying the Dip? On-Chain Data Reveals Their Next Move

Credit : coinpedia.org

The most recent Bitcoin worth drop has stunned merchants as they anticipated an increase above $95,000 after a short consolidation. The token broke beneath the psychological barrier at $86,800 and fashioned an intraday low at $84,756. The latest decline has additionally created a giant query available in the market: are whales shopping for this dip or taking a step again?

New information on the chain exhibits that whereas whales do not panic, they’re very selective about the place they accumulate. Let’s break it down.

Whales have not panicked; they watch for higher costs

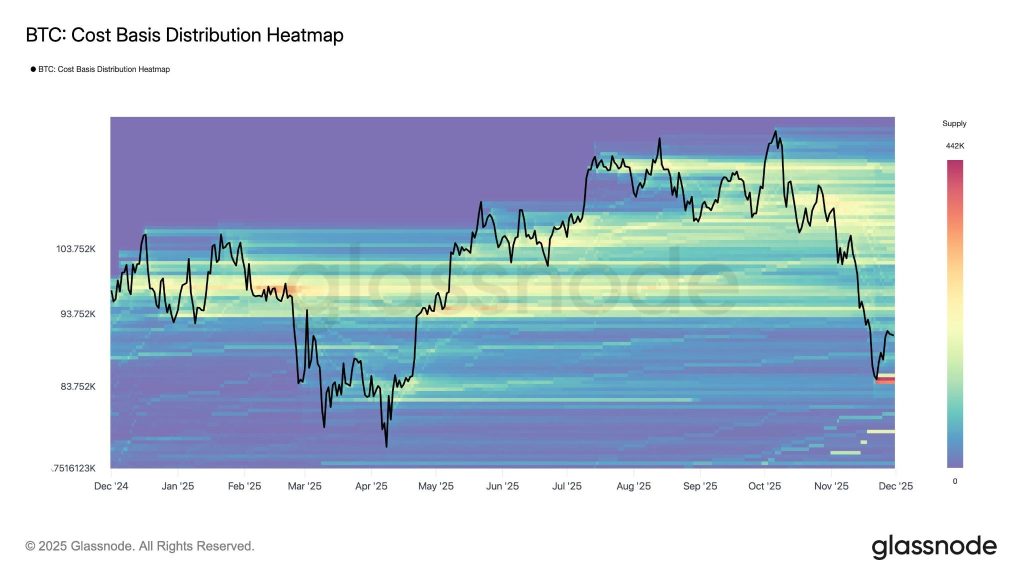

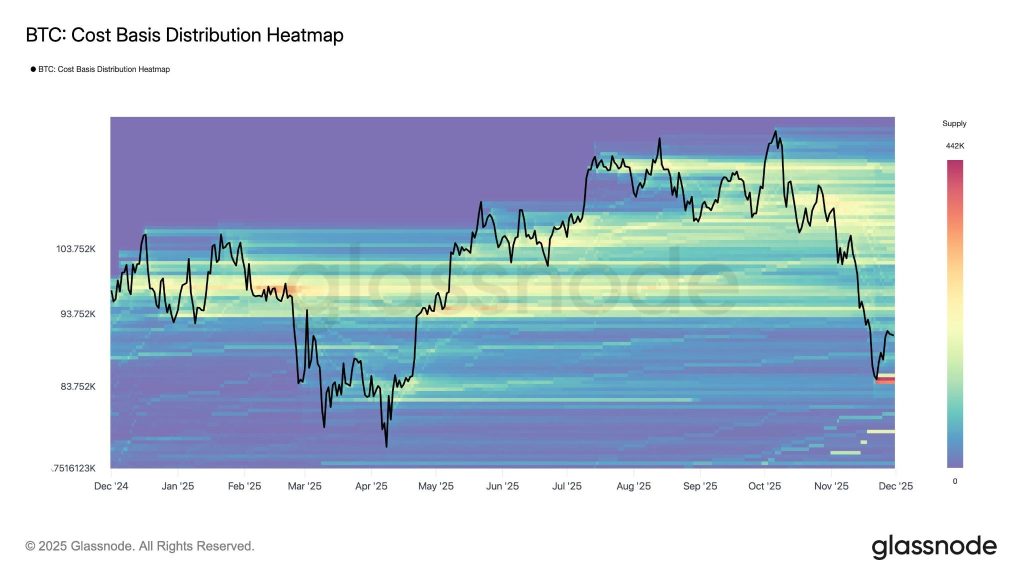

One of many strongest indicators of whale conduct through the corrections is the place their value base clusters are situated. The information beneath exhibits that the main BTC holders didn’t dump their cash over the past correction, however waited for the value to drop of their favourite shopping for zones. The Bitcoin Price Foundation Distribution Heatmap exhibits that the star token has fallen into a serious whale accumulation zone.

The Glassnode data highlights the place a considerable amount of provide was final moved. In response to the chart, the clusters primarily based on the price of heavy whales are between $83,000 and $88,000, that means whales are possible getting ready to build up once more if the value stays on this area. Probably the most compelling sign shouldn’t be the place whales used to purchase, however what they’re doing now. The final a part of the warmth map exhibits a brand new cluster forming close to the latest lows, indicating the whales could also be beginning to construct up once more.

This conduct is in keeping with earlier accumulation cycles, wherein whales steadily feed into weak point whereas retail holds again.

Are Whales Gathering Bitcoin?

The above graph means that the whales could also be beginning to collect once more, however the whale deal with signifies that the motion has but to start. The addresses holding greater than 1000 Bitcoin confronted a major decline simply earlier than the present pullback. Presently, ranges have stabilized, however a rise within the complete BTC held by main wallets might set off a powerful restoration within the Bitcoin worth.

If accumulation continues on this zone, Bitcoin might type a structural backside. Traditionally, whale value layers act as a springboard as soon as the market stabilizes and liquidity returns. A resumption of buying this tire often precedes:

- a discount in gross sales strain,

- a gradual restoration of resistance ranges, and

- a pattern reversal within the medium time period.

If this chart goes again up, it means whales are actively shopping for the dip – traditionally a powerful bullish sign.

Here is what the following BTC worth motion may very well be

The present pullback has validated the bearish strain on the token because the BTC worth has confirmed its third decrease excessive and low after a rejection on the ATH. Regardless of a number of makes an attempt, the bulls have been unable to spark a restoration above $87,000. This means that the BTC worth is liable to deeper corrections within the coming days, which might break the $80,000 help vary.

As seen within the chart above, the RSI rose out of the overbought zone however is getting ready to maneuver again into the identical vary. Nonetheless, the Chaikin Cash Circulate (CMF) confirmed a bullish divergence regardless of being throughout the destructive vary, indicating vital liquidity inflows. Furthermore, the Bollinger bands have additionally began squeezing, indicating that the token is getting ready for a giant transfer.

Due to this fact, within the coming days, one can anticipate the Bitcoin (BTC) worth to achieve the help at $82,918, which might provoke a restoration. Nonetheless, robust whale accumulation and bullish exercise can solely restore the Bitcoin bull run, and till then, the token could proceed to type decrease highs and lows.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We attempt to offer well timed updates on the whole lot crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market situations. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability to your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks could seem on our web site. Advertisements are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International