Bitcoin

As Bitcoin miners dump $10 billion BTC, should you hold or sell?

Credit : ambcrypto.com

- Miners offered greater than 110,000 BTC in every week; Will it gradual value progress?

- There was little room for progress earlier than the euphoria hit the BTC markets by cycle.

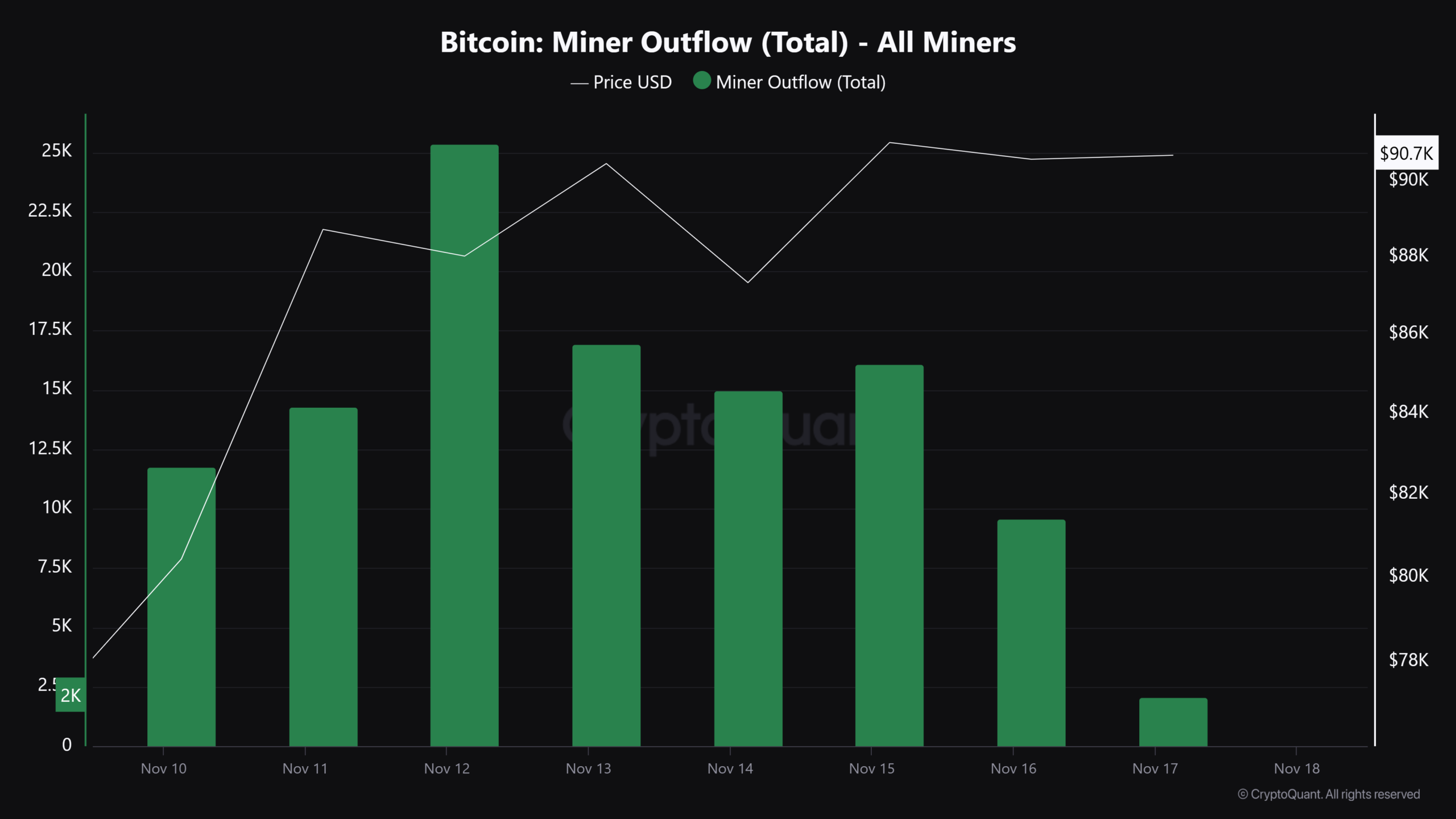

Bitcoin [BTC] Promoting stress from miners has elevated as the value of BTC has surpassed $90,000. Between November 10 and 17, miners offered greater than 110,000 BTC in every week, price virtually $10 billion.

The very best day by day sell-off, 25,367 BTC (price $2.2 billion), occurred on November 12, when the miners’ dump intensified.

Supply: CryptoQuant

Mining sell-offs have elevated since October, in opposition to the backdrop of an general broader market restoration.

This week, nonetheless, has intensified gross sales stress has raised doubts about whether or not this might cease BTC from breaching its psychological goal of $100,000.

Up to now, elevated miner sell-offs and turnover have marked native and cycle tops. If the present development and studying had been to lean in direction of the latter (cycle prime), that might additionally push different holders to promote.

So, what’s the present cycle standing as BTC flirts with $90,000 and targets $100,000?

Decoding the cycle prime of BTC

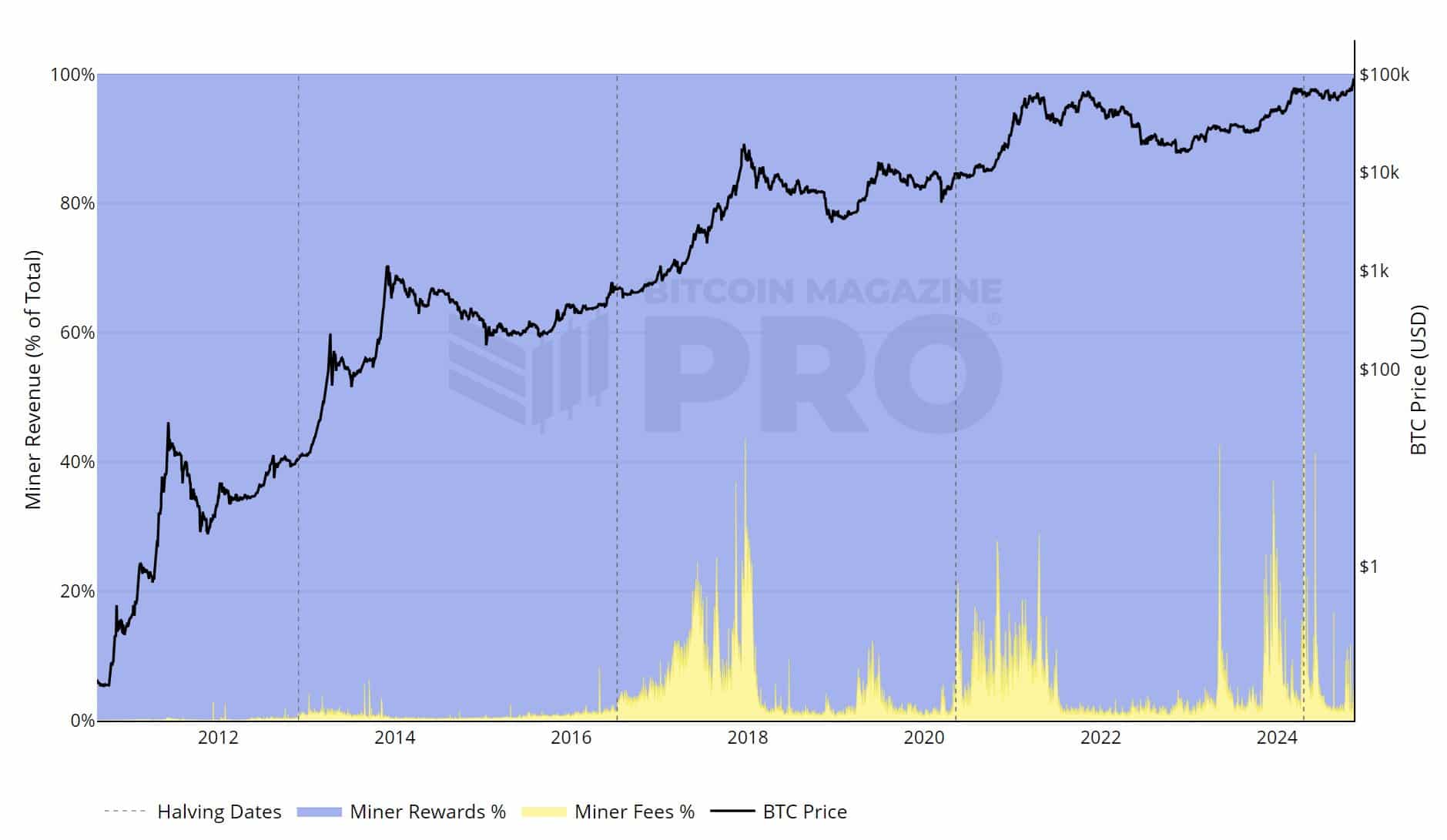

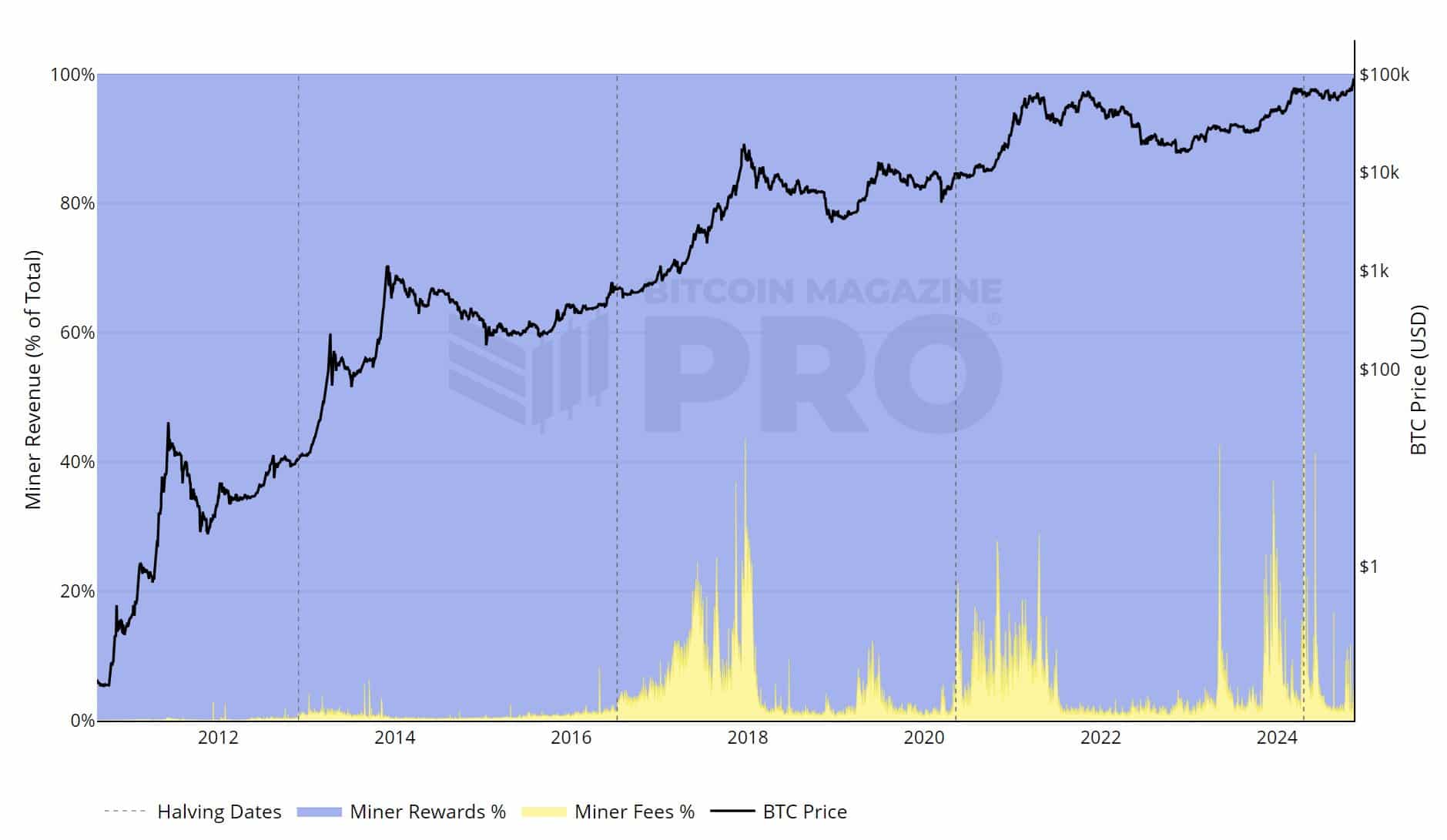

Supply: BMPro

From a miner’s perspective, a spike in miner charges (yellow) above 30% of whole income is usually correlated with earlier BTC cycle tops.

A excessive worth means elevated euphoria within the BTC markets, driving transaction prices to file highs relative to the rewards. That is an overheated market sign.

In November, miner charges hovered round 10% of whole income, which means the market was nonetheless not overheated.

One other indicator, the Pi Cycle High, confirmed little room for a rally for BTC earlier than the market overheated.

In earlier traits, BTC’s transfer above the shifting common (350DMA x2, inexperienced line) marked the cycle prime and a sign for holders to unload.

The inexperienced line indicated $120K, so BTC’s rise previous the extent might be thought of a promote sign.

Supply: BM Professional

Learn Bitcoin [BTC] Value forecast 2024-2025

Apparently, the $100,000-$120,000 targets had been wildly anticipated by main gamers within the choices market, as famous by QCP Capital, one of many world’s largest crypto choices buying and selling companies. The corporate lately famous:

“Given Bitcoin’s spectacular rally because the US elections, we imagine that $100,000 – $120,000 is just not far off.”

In that case, a robust transfer above $120,000 may set off the Pi Cycle High and, by extension, enhance revenue reserving for all cohorts of BTC holders. That may suggest a 30% transfer from the $90K stage on the time of writing.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September