Bitcoin

As Bitcoin nears $60K, are miners preparing to cash in?

Credit : ambcrypto.com

- Bitcoin miners have bought off a big chunk of BTC after a light surge, cashing in on earnings.

- If the market high slips, miners’ capitulation may enhance.

Bitcoin [BTC] Miners have lately bought off a good portion of their holdings simply as mining issues reached document ranges.

It is a essential second: if miners don’t present confidence in a restoration, it may sign an impending bearish run.

Bitcoin miners are at an important juncture

The mining group owns about 9% of Bitcoin’s complete provide and is increasing capability amid document excessive mining woes.

Traditionally, miner capitulation – when Bitcoin miners give up attributable to low earnings – usually indicators native value bottoms throughout bull markets.

The final time this occurred was on July 5, when BTC fell to $56K after testing the $71K ceiling. Miners exited attributable to tight revenue margins, contributing to the value ground.

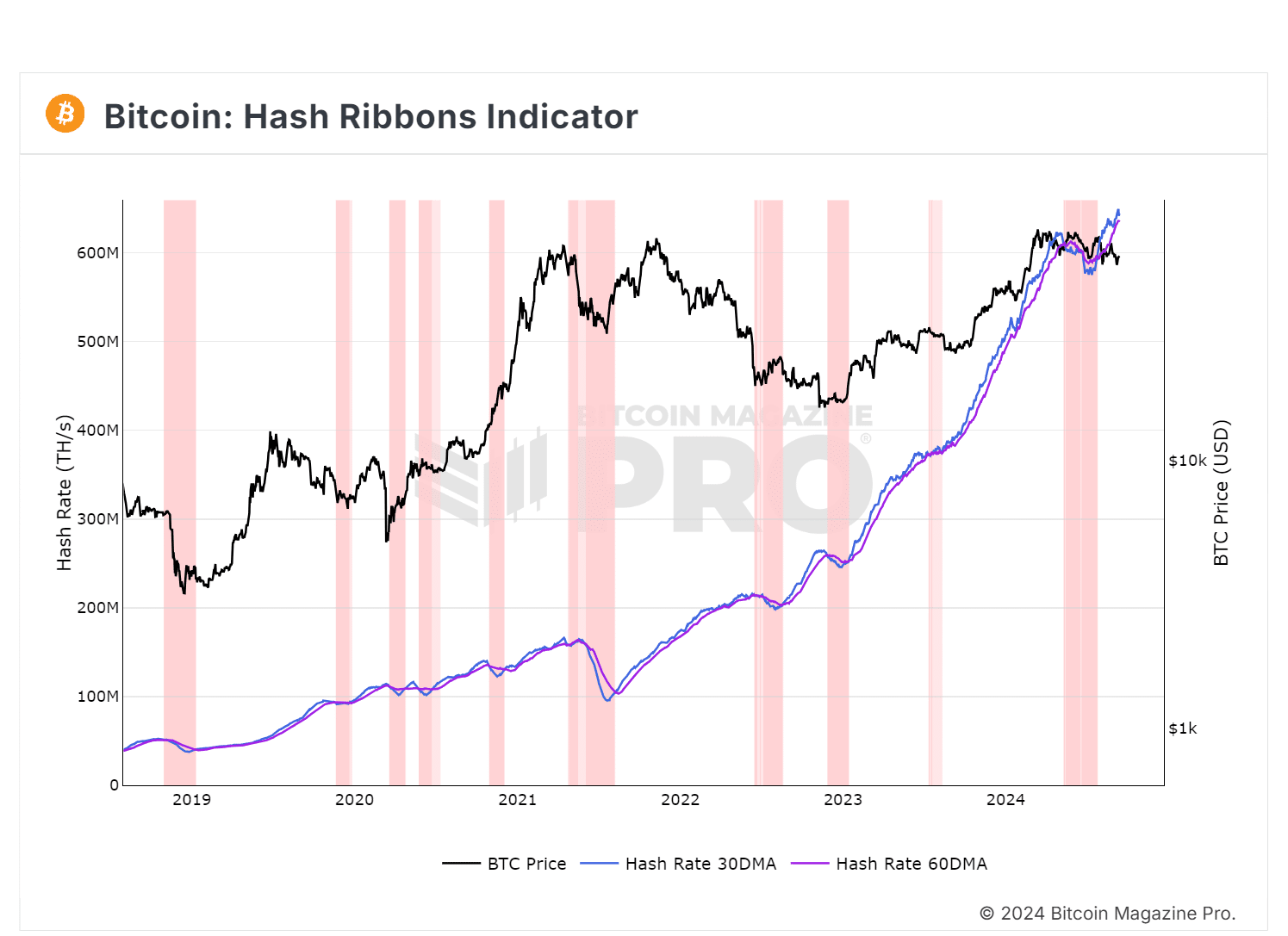

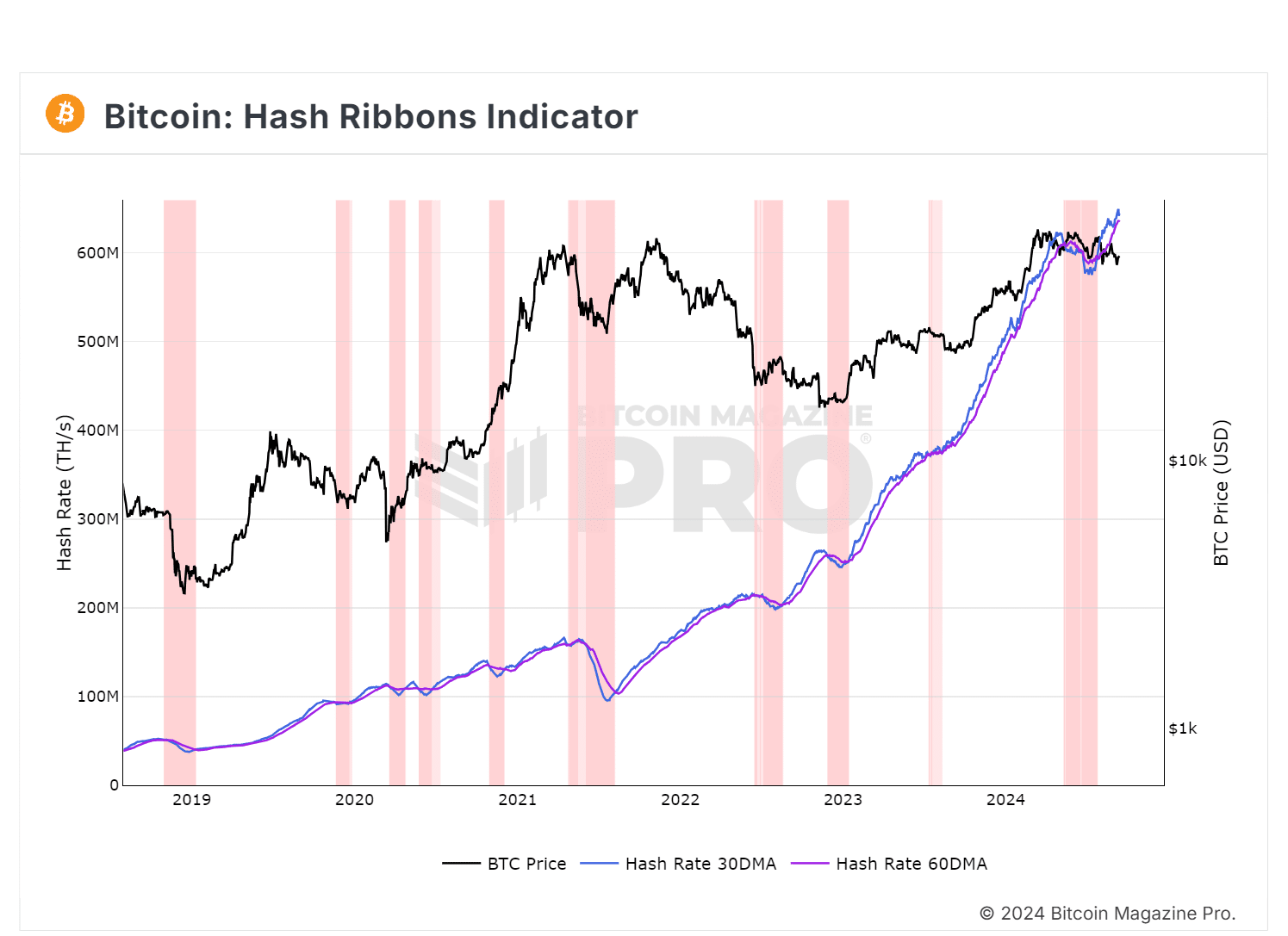

Supply: Bitcoin Journal Professional

The chart confirmed the 30-day MA above the 60-day MA, indicating a purchase sign for hash ribbons. This proposed mass capitulation of miners might have ended, suggesting miners are staying in regardless of the volatility.

Nonetheless, a distinguished one analyst famous that Bitcoin miners bought round 30,000 BTC after BTC briefly surpassed $58,000, possible delivering robust features.

Maybe capitulation now indicators each the tops and bottoms of the market. The secret’s to see who capitulates first.

Falling reserves might be an indication of a market high

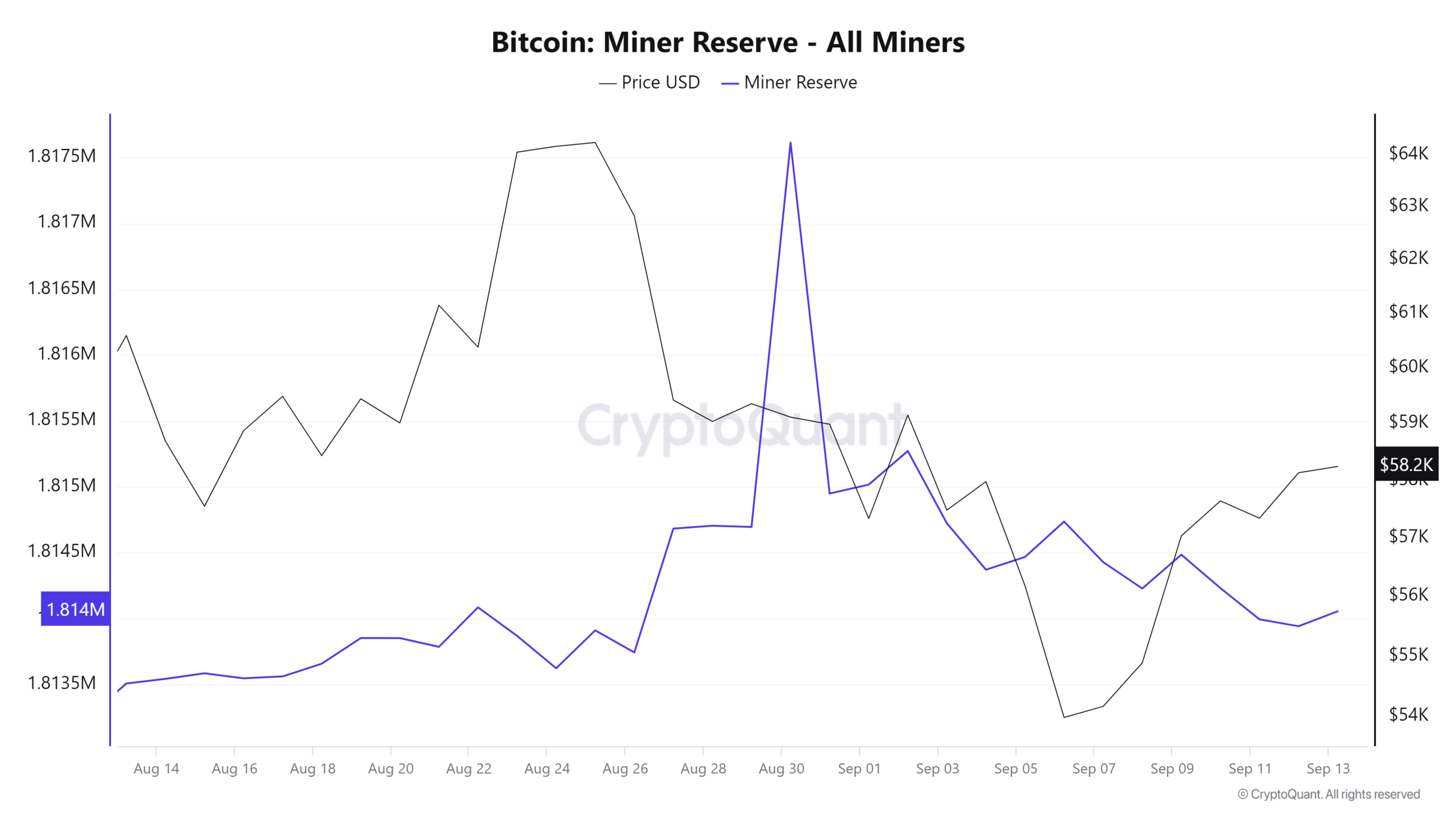

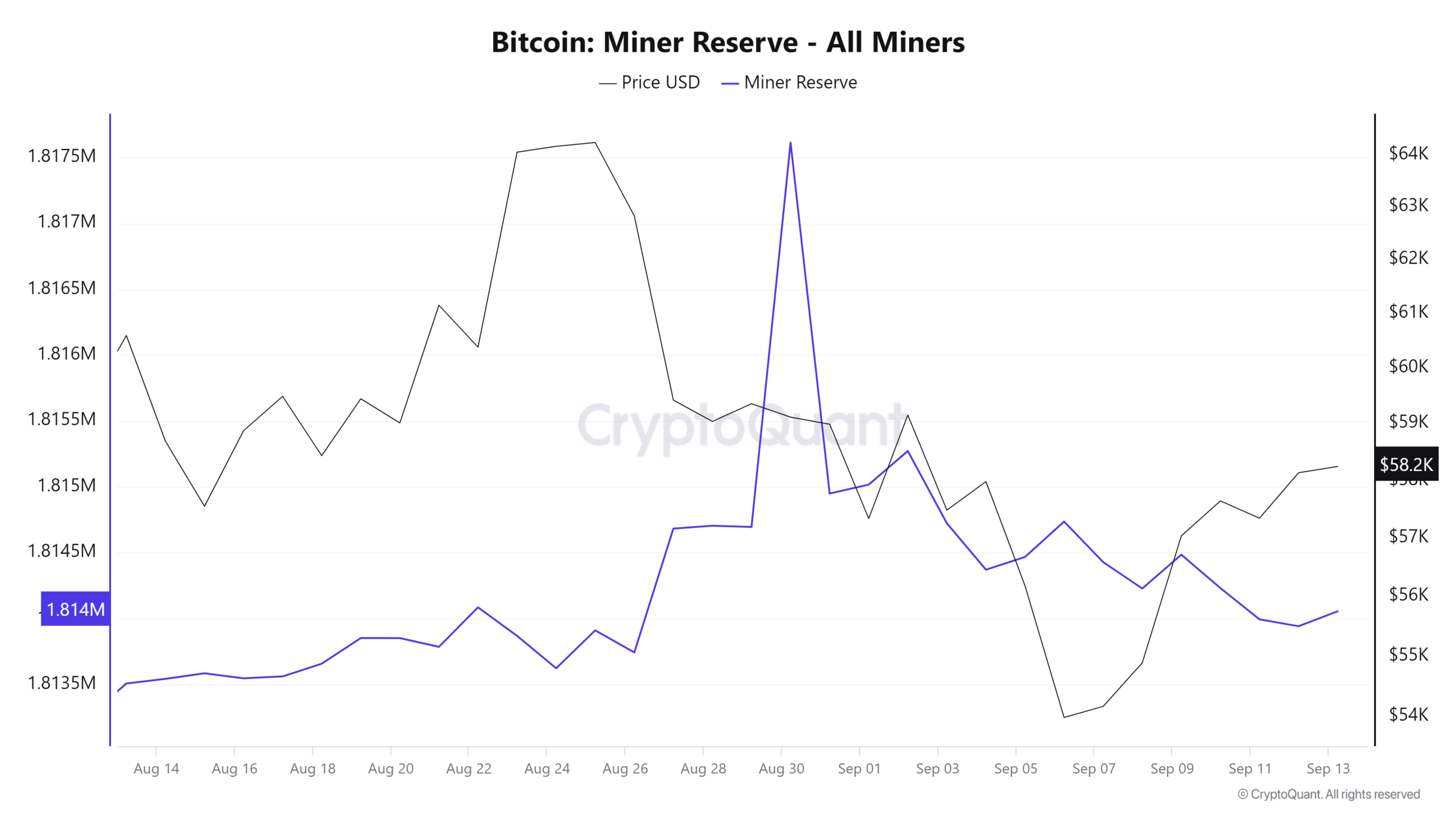

Whereas the chart above steered that miners usually discover exits on the backside of the market, AMBCrypto explored whether or not approaching a value high may result in miners exiting.

Apparently, as BTC approaches $60,000, Bitcoin miners are lowering their reserves, presumably to safeguard earnings, reinforcing this speculation.

Supply: CryptoQuant

With mining issues at an all-time excessive, many miners are cashing in on earnings to cowl their bills. This might create promoting strain as BTC approaches its subsequent market high.

Nonetheless, those that can climate the volatility can proceed to carry their Bitcoin as indicated by the purchase sign.

Learn Bitcoin’s [BTC] Value forecast 2024–2025

The true concern is that if BTC hits a market backside and fails to carry the $57,000 vary; Miners’ capitulation may enhance.

On this situation, Bitcoin miners may offload massive quantities of BTC not due to low earnings, however to restrict bigger losses.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024