Policy & Regulation

As the SEC Continues Its Crypto Litigation Retreat, Here’s What’s Still Outstanding

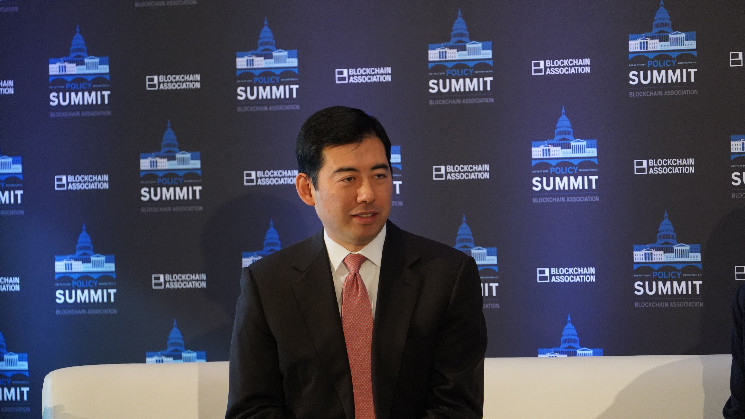

Credit : cryptonews.net

The US Securities and Alternate Fee (SEC) performs a whole retreat of a giant a part of the big crypto disputes that began underneath former chairman Gary Genler, however not everyone seems to be off the hook.

Not less than 4 lawsuits in opposition to Crypto corporations – Ripple, Kraken, Cumberland DRW and PulseChain – stay underway and probes in one other three corporations – Unicoin, crypto.com and unchangeable – aren’t but closed.

SEC Commissioner Hester Peirce, the chief of the newly created crypto-task pressure of the company, has fulfilled all its promise earlier this month to “shame” the SEC of assorted crypto-related lawsuits. The company has agreed to drop his affairs in opposition to Coinbase and Consensys, pending approval from the commissioner, and has positioned his affairs in opposition to Binance and Tron on a break, because the events think about a ‘potential decision’.

The unprecedented stage of exercise on the SEC whereas it withdraws from crypto actions illustrates “the additional within the final 4 years within the final 4 years”, Coinbase Chief Authorized Officer Paul Grewal in an interview with Coindesk. “It’s positively one thing that now we have by no means seen earlier than, however I believe it’s good.”

Prior to now two weeks, a lot of corporations which have beforehand acquired Putten messages acquired a heads-up of the regulator that plans to submit enforcement prices to the SEC phrase that the investigations have been concluded and enforcement taxes wouldn’t be submitted in opposition to them. That checklist incorporates Robinhood Crypto, Decentralized Protocol Uniswap, Non-Gungible token (NFT) Market OpenSea and Crypto Alternate Gemini.

Open

Though the SEC has withdrawn from his allegations that Coinbase operated as a non -registered inventory agent and trade, his comparable prices in opposition to Kraken haven’t but withdrawn. The SEC complained Kraken in November 2023 and accused the corporate of speaking buyer and enterprise funds whereas working as a non -registered inventory agent, clearing company and supplier. A consultant for Kraken didn’t reply to Coindesk’s request for feedback.

Likewise, the SEC Cumberland has sued DRW-the crypto-trading arm of the Chicago-based buying and selling firm DRW-Vorig years for alleged operation as a non-registered securities dealer. Don Wilson, the founding father of DRW, promised to combat the go well with on the time. A consultant for DRW refused to remark and instructed Coindesk that the corporate at present has no updates to share.

Learn extra: Who’s afraid of Gary Gensler? Not Don Wilson, the dealer who has beforehand defeated the regulator

The SEC complained Ripple in 2020 and largely misplaced in 2023, when a decide in New York dominated that XRP, then bought to retail buyers, was not safety. The SEC then appealed in opposition to that call. Though each Ripple leaders and exterior consultants have speculated that the company will drop the enchantment, the company has not but made a public assertion in regards to the case. A consultant for Ripple instructed Coindesk that the corporate at present has no updates to share.

Rebecca Fike, a partner-based accomplice at regulation agency Vinson & Elkins and a former SEC enforcement lawyer, Coindeesk instructed that she expects the SEC to drop one of many present circumstances based mostly on the usage of the Howey check to hassle a basting, the place there are not any bastings.

“As for the explanation why some individuals have fallen for others, they are often inner or judicial timelines that set priorities,” Fike mentioned. “There may be additionally an opportunity that some crypto-related circumstances that appear to suit the Howey window work and that determines the SEC, fourty based mostly on fraud-that means a promoter or CEO who says one however the different with investor funds may proceed underneath a standard fraud framework.”

In July 2023, the SEC introduced fraud and registration accusations in opposition to Richard Schueler, higher often known as Richard Coronary heart, PulSechain, PulSex and Hex.

The open probes

A number of of the probes of the SEC – research that haven’t but led to submitted prices – to crypto corporations additionally stay open.

Crypto.com sued the sec final October after it had acquired a Wells information. The corporate voluntarily dropped its lawsuit two months later, shortly after CEO Kris Marzalek met the then president of the chairman Donald Trump. Crypto.com didn’t reply to Coindesk’s request for feedback.

Australian Blockchain Gaming and NFT Firm Immantabable additionally acquired a Wells notification final 12 months that was linked to the sale of his IMX -Token in 2021, and promised to fight the next enforcement prices. Neither the corporate nor the SEC has made public statements in regards to the standing of the probe.

Unicoin additionally acquired a Wells information final 12 months during which he knowledgeable the corporate that the SEC was planning to set accusations with regard to fraud, deceptive practices and the availability and sale of non -registered results. Unicoin didn’t reply to Coindesk’s request for feedback.

Look out

The retreat of the SEC, in addition to the turns of his crypto enforcement group, in response to Fike, is a sign that the company leaves the so-called “Regulation by Enforcement” method to the crypto trade carried out by former chairman Genler.

“I believe the SEC indicators by personnel that it means what it now says: that crypto regulation will come by statements and potential future laws, not with enforcement actions,” Fike mentioned. “Their hope, and mine, is {that a} help of all crypto results to name and to evaluate the crypto trade as a complete underneath the brand new Process Drive of Commissioner Peirce, will create some readability round crypto regulation.”

Though the SEC adjustments quickly, not everyone seems to be completely satisfied. Gemini president and co-founder Cameron Winkelvoss went to X earlier this week to demand retribution for the money and time that the crypto trade dedicated to defending in opposition to the SEC probe. He instructed that the Sec Gemini has repaid its authorized prices and publicly dismissed all workers concerned within the probe.

In keeping with Fike, that is most likely a non-starter.

“I am unable to think about that the SEC would ever try this. It appears that evidently it might be a tough precedent to set it up and different companies attempting to control in new and rising markets, “Fike mentioned. “You will need to notice that new monetary merchandise can usually be a supply of fraud and that individuals/buyers may be harmed by them. I believe the SEC tried to be current and lively in a marketplace for billion {dollars} stuffed with buyers who could also be afraid to ‘miss’ however don’t essentially have the monetary or technological Savvy to dissect the actual crypto alternatives from potential fraud. “

Fike continued and added: “Many can’t agree with the trail they took, and commissioners Peirce and Uyeda are clear, however additionally they profit from some maturation within the crypto universe. I believe it’s good that the SEC takes a step again and is searching for a greater regulatory construction for crypto and digital property, however I don’t assume which means their earlier efforts have been poorly meant or deserve punishment. “

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024