Altcoin

Assessing Arbitrum’s Mixed Signals: DeFi Growth vs. Bearish Price Action

Credit : ambcrypto.com

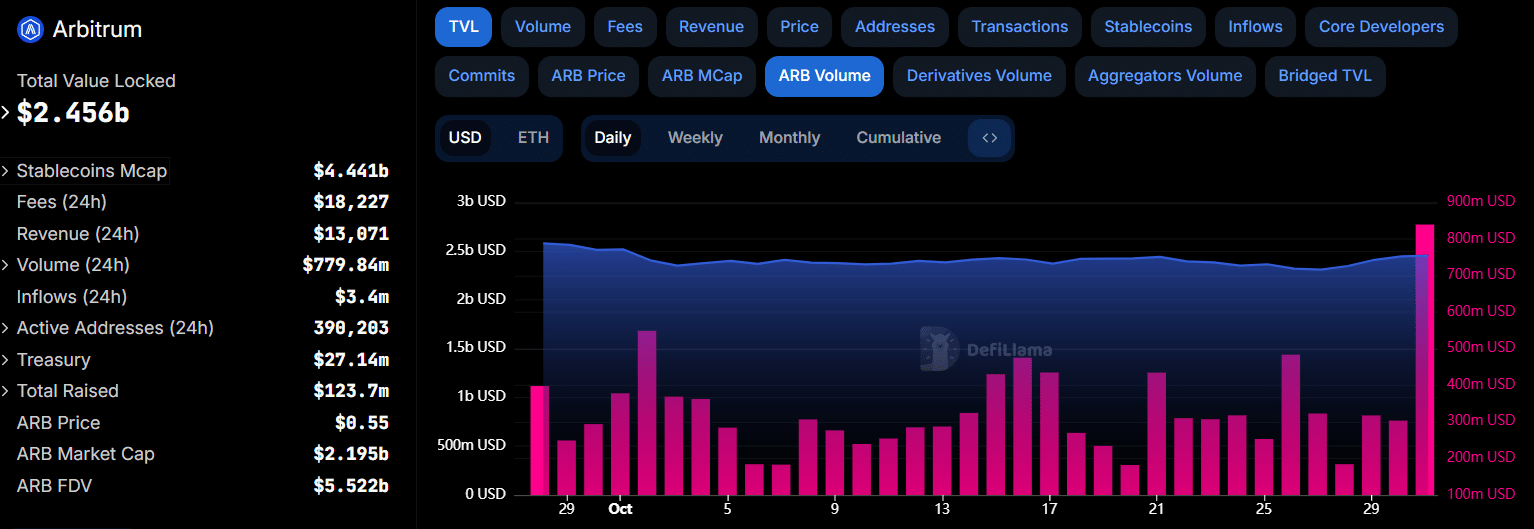

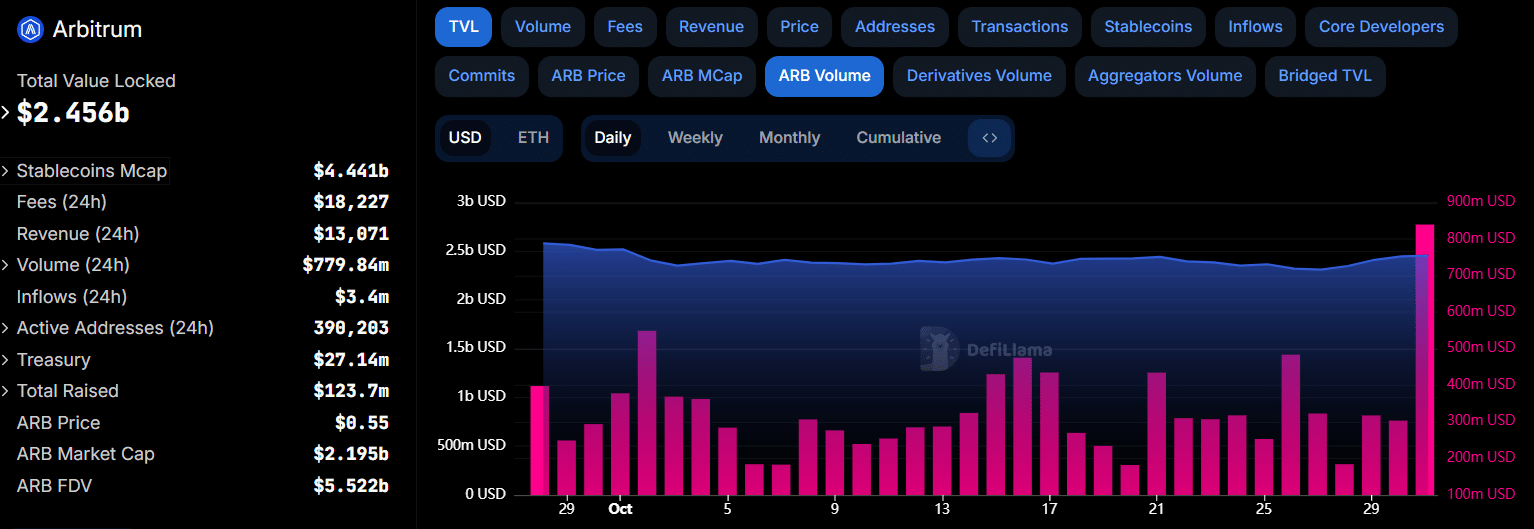

- Arbitrum’s DeFi TVL has been steadily growing, lately reaching a one-month excessive of $2.45 billion.

- Regardless of an increase in TVL and open curiosity, bearish alerts round ARB proceed to dampen market sentiment.

Arbitration [ARB] is caught in a bearish development as the worth has fallen 11% prior to now month. Nevertheless, the downtrend is exhibiting indicators of weak point because the ARB has risen from $0.49 to $0.56 in simply 4 days.

ARB had misplaced a few of these positive factors on the time of writing and was buying and selling at $0.551. On-chain knowledge reveals that ARB is effectively positioned to stage a restoration and probably regain its month-to-month highs.

Rising DeFi TVL may gasoline the ARB rally

Arbitrum was lately reversed Base by way of Whole Worth Locked (TVL) and is at the moment the second largest Layer 2 community by this metric.

Information from DeFiLlama reveals that decentralized finance (DeFi) exercise on the community is growing once more. On the time of writing, Arbitrum’s DeFi TVL stood at $2.456 billion, a single-month excessive.

Supply: DeFiLlama

Along with rising TVL, ARB volumes on centralized and decentralized exchanges have risen to their highest ranges since August.

The rising TVL and spike in volumes point out rising curiosity within the DeFi functions constructed on the Layer 2 community. This, in flip, may assist ARB’s value restoration.

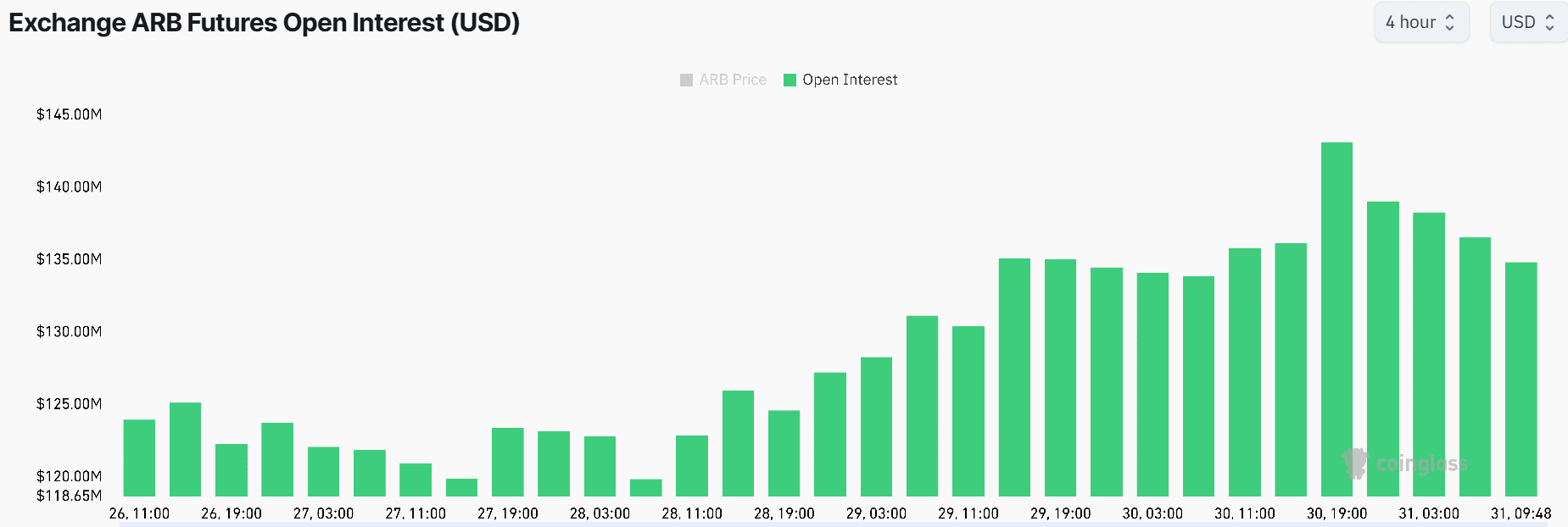

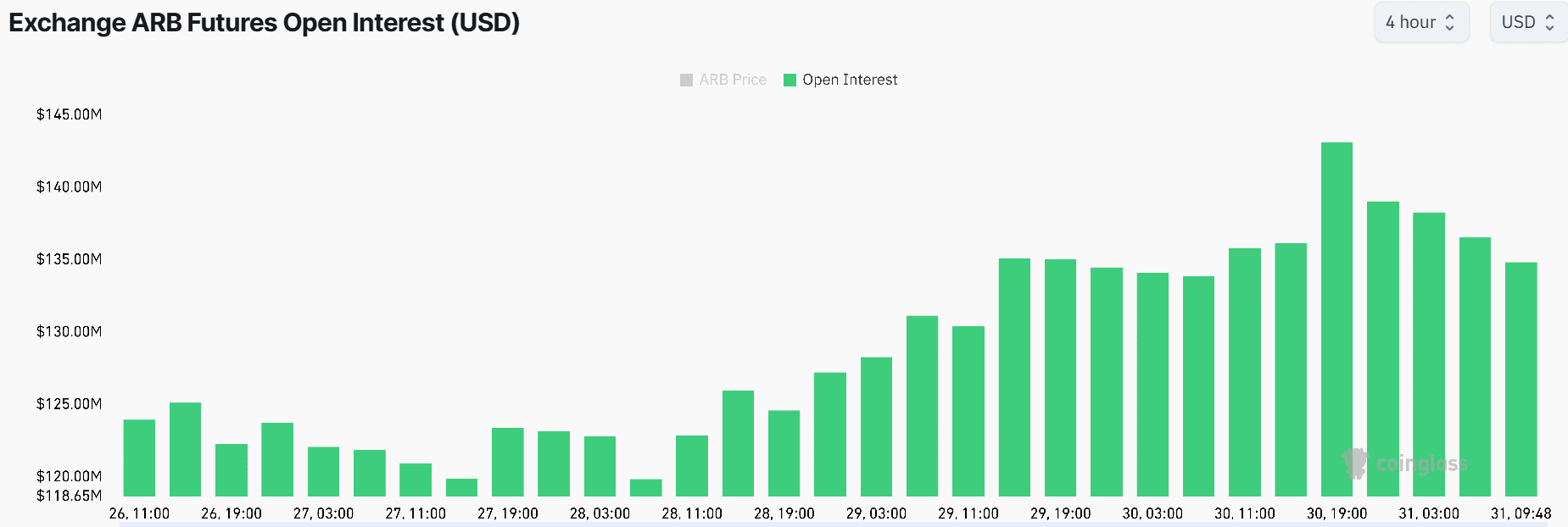

Arbitrum’s open curiosity is rising

There may be additionally a flurry of speculative exercise surrounding Arbitrum. That is mirrored within the improve in open curiosity, which stood at $135 million on the time of writing.

In simply three days, ARB’s OI has risen greater than 10%, indicating derivatives merchants are opening new positions on the token.

Supply: Coinglass

A spike in OI accompanied by a value improve often signifies bullish sentiment. Moreover, Arbitrum’s funding charges have been largely optimistic since September, reinforcing the bullish thesis.

Is ARB prepared for a breakout?

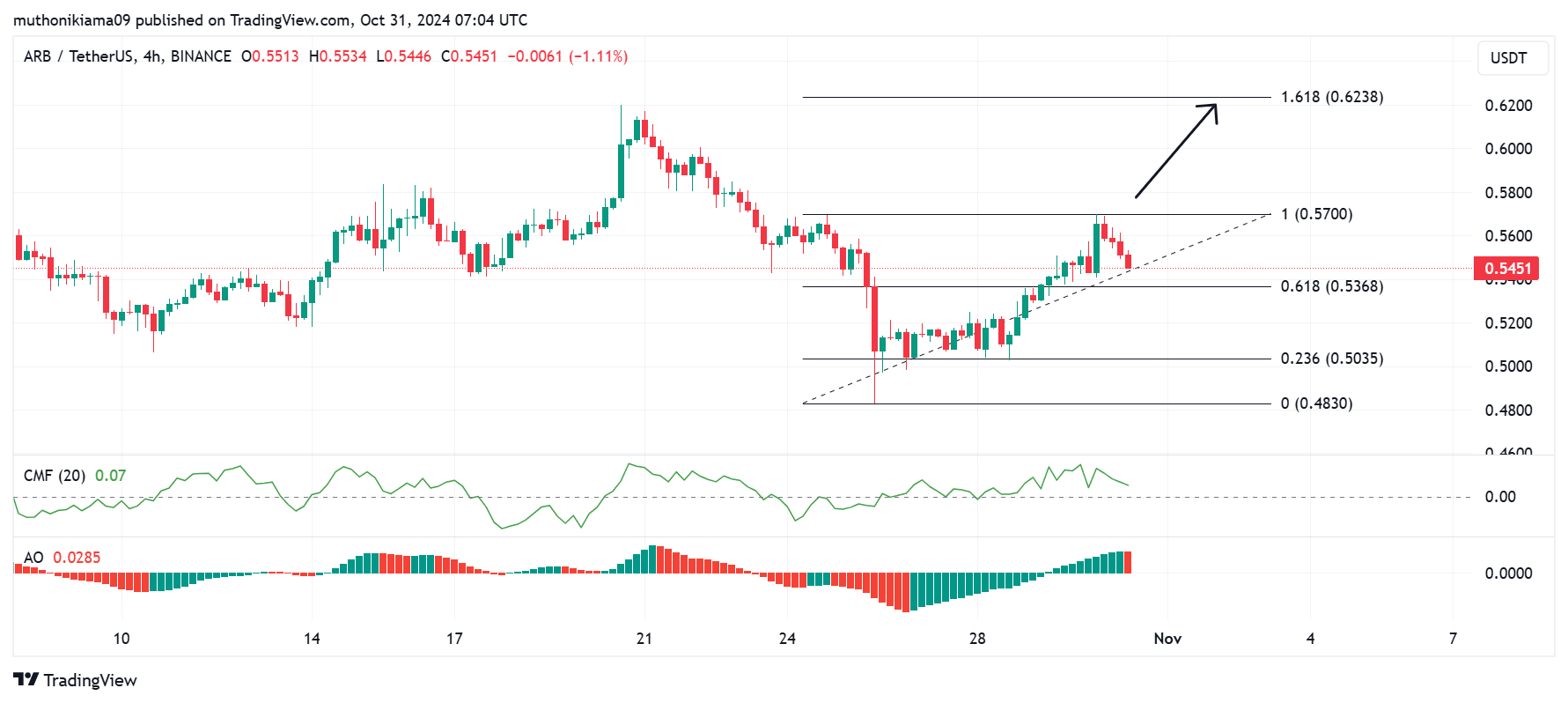

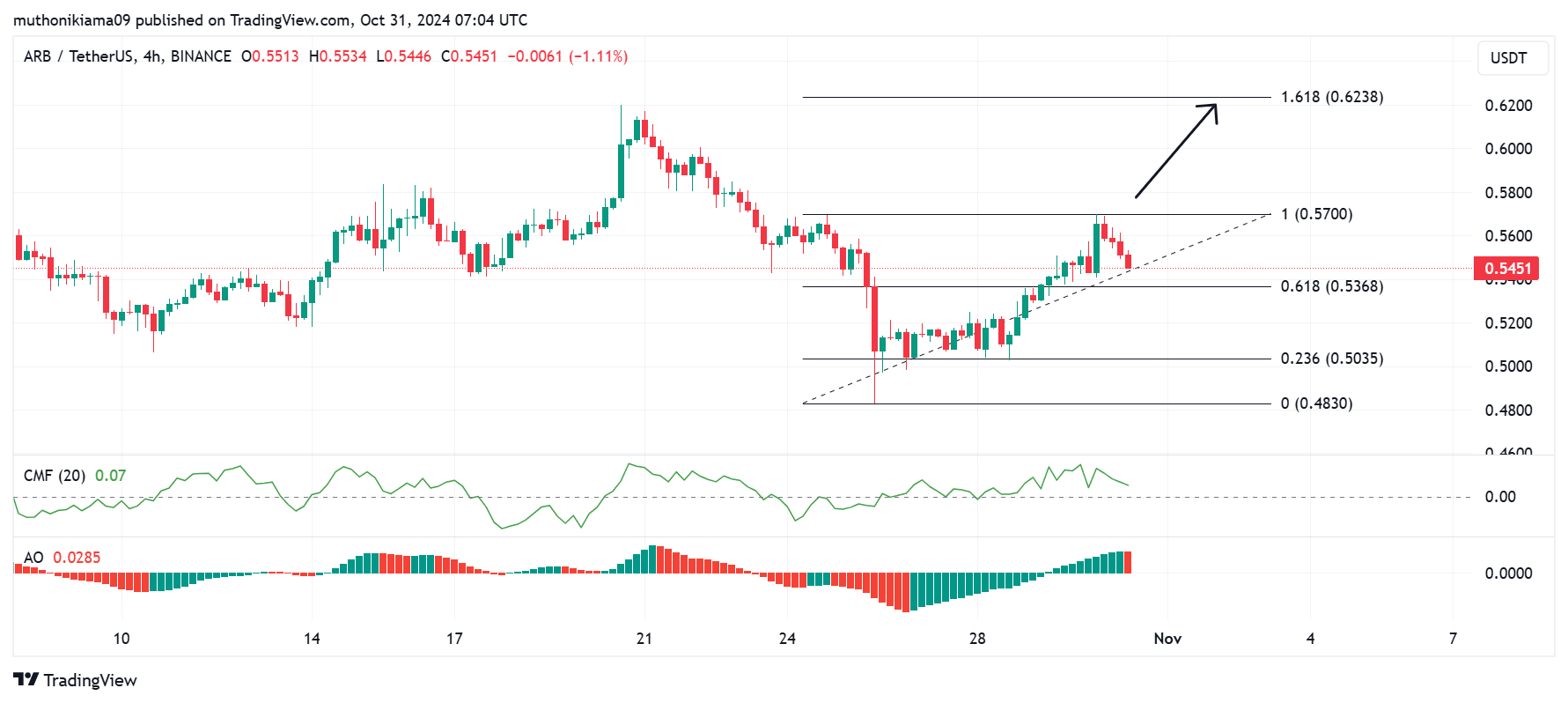

Arbitrum’s four-hour chart reveals that short-term momentum has turned bullish. The Chaikin Cash Stream (CMF) indicator has a optimistic worth of 0.07, indicating greater shopping for stress than promoting stress.

The Superior Oscillator additionally reveals bulls taking management of ARB’s value motion, with the AO bars turning optimistic.

Nevertheless, the motion of those indicators additionally requires warning. The CMF is tilting south, indicating that purchasing stress is easing. Moreover, the purple AO bar reveals bears competing for management.

Supply: Tradingview

If new consumers are available at present costs and Arbitrum breaks the resistance at $0.57, the following goal would be the Fibonacci degree of 1.618 ($0.62).

Real looking or not, right here is ARB’s market cap in BTC phrases

Alternatively, if ARB succumbs to the bearish traits and falls beneath the assist on the 0.618 Fib degree ($0.53), the worth may fall to assemble liquidity at $0.48.

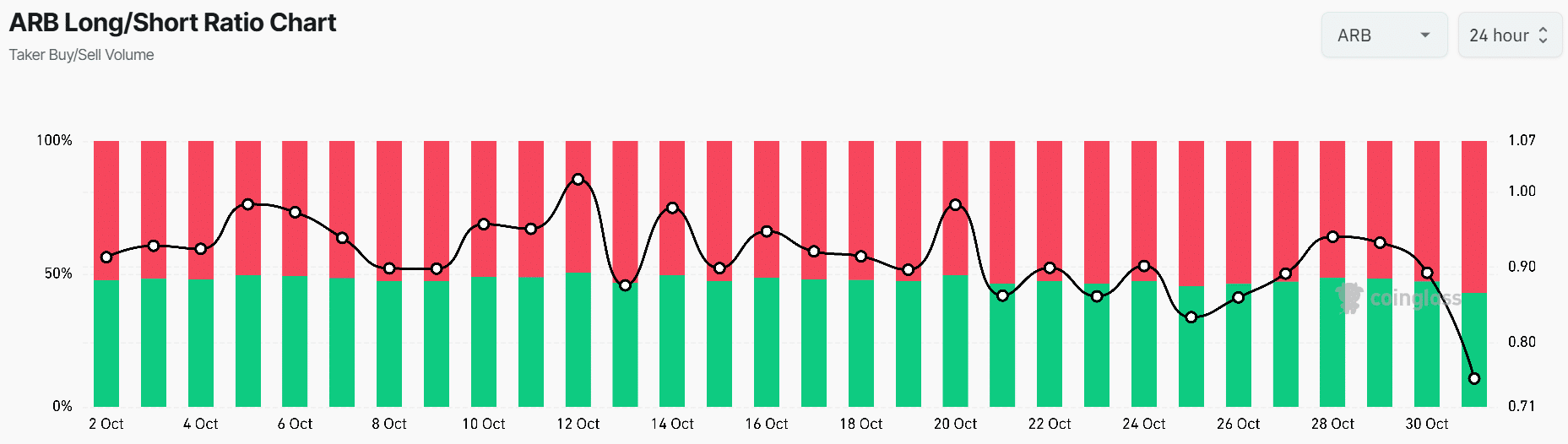

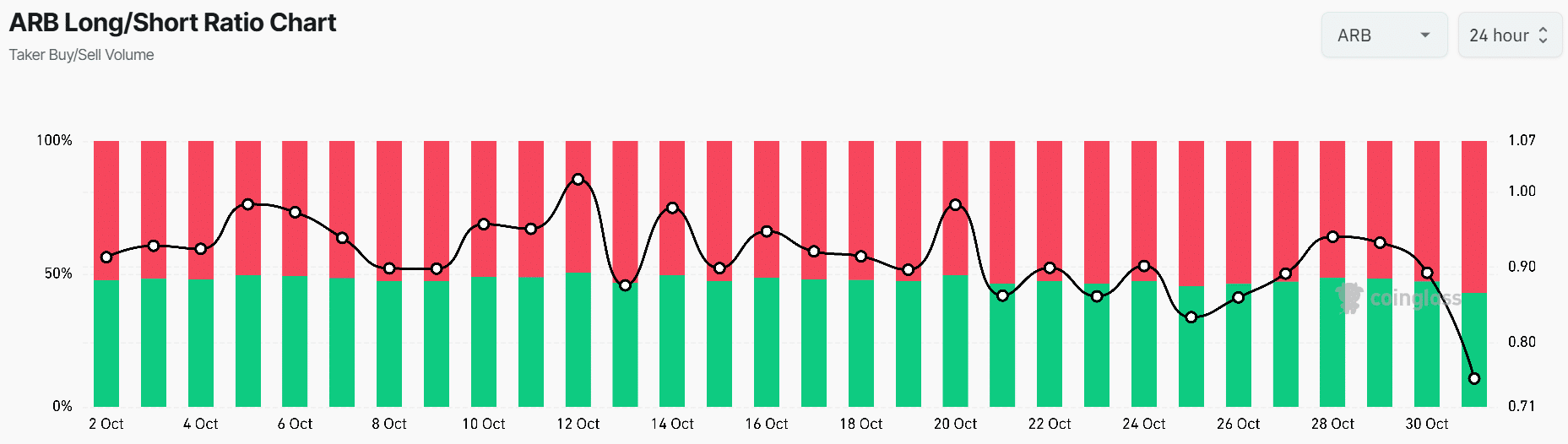

The Arbitrum’s lengthy/brief ratio suggests merchants are strongly leaning in the direction of one other decline. This ratio has fallen to 0.75, with 57% of merchants opening brief positions. This implies that merchants are much less optimistic that the bullish alerts round ARB will proceed.

Supply: Coinglass

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024