Altcoin

Assessing Bitcoin’s October fortunes after a bearish September

Credit : ambcrypto.com

- BTC has managed to remain near its psychological resistance degree.

- Indicators pointed to the potential for a value breakout.

Traditionally, September has been a turbulent month for Bitcoin [BTC]typically characterised by vital unfavorable developments.

Regardless of this, the king coin has maintained a comparatively secure value, near the present psychological resistance degree. If this development continues, we may see a extra constructive transfer in October.

Bitcoin is dealing with consecutive declines

Over the previous three days, Bitcoin has seen consecutive declines, buying and selling round $58,650 on the time of writing.

This downtrend began on September 14, after Bitcoin broke above its psychological barrier in the course of the earlier buying and selling session. BTC rose greater than 4% in that session, reaching round $60,543.

This uptrend briefly pushed BTC right into a bullish part, with the Relative Energy Index (RSI) rising to round 50. Nonetheless, the RSI rested on the impartial line on the time of writing, indicating a weakening of the bull development.

Bitcoin: October rally in prospect?

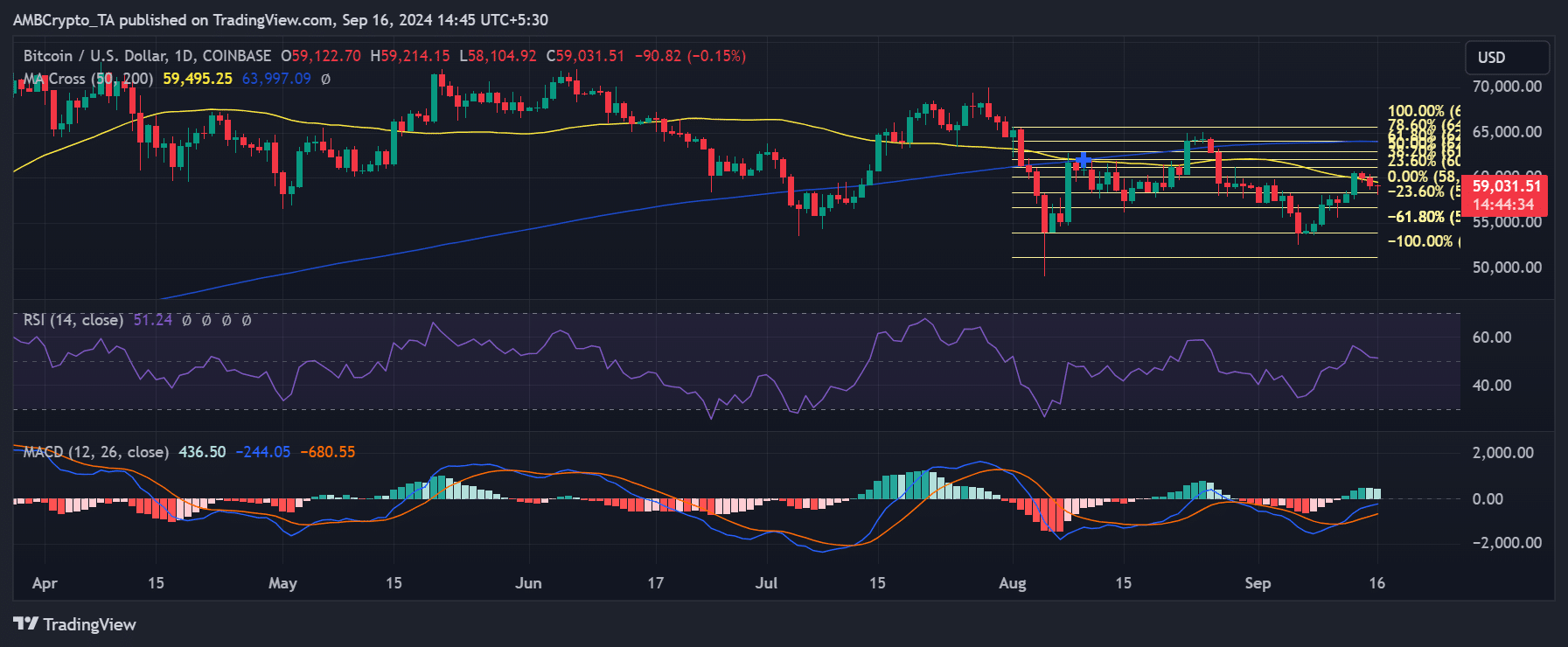

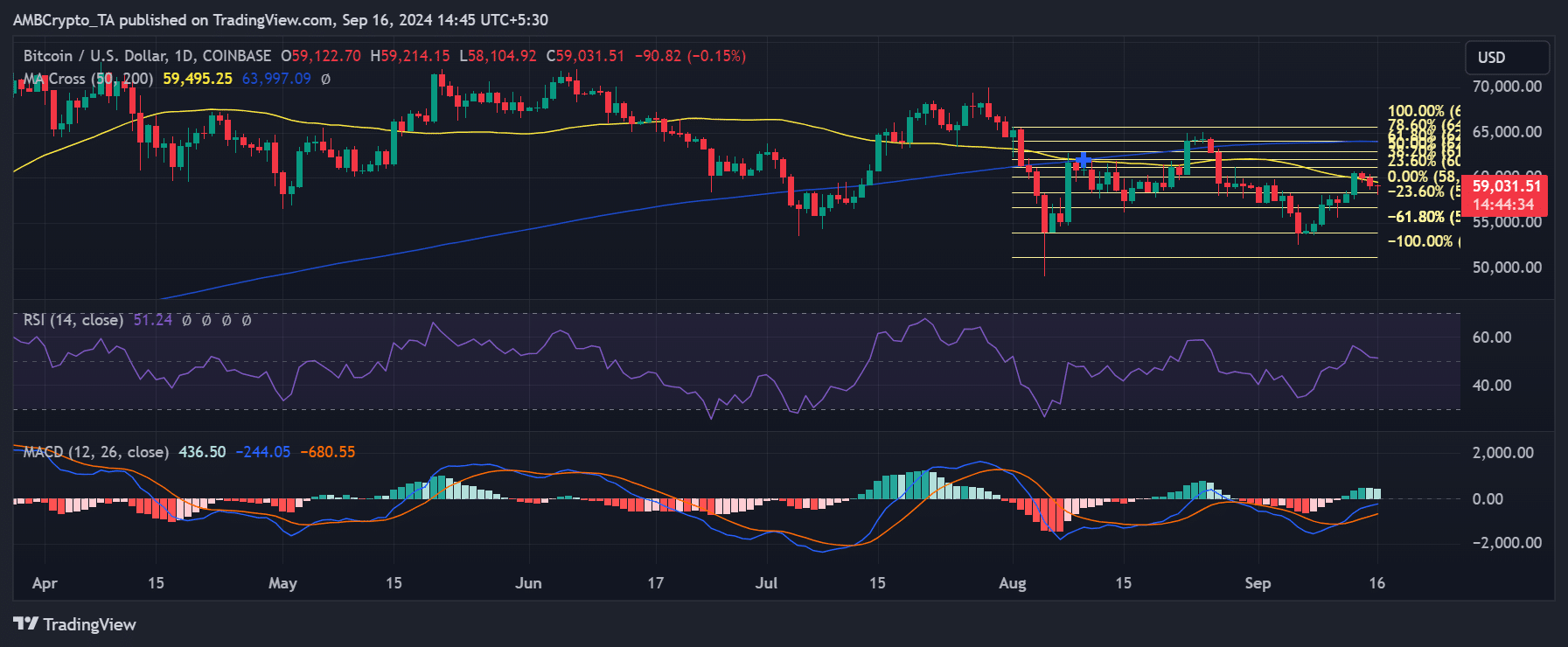

In early October, Bitcoin’s value hovered round key technical ranges. The yellow line represented the 50-day transferring common, at $59,495.25, whereas the blue line marked the 200-day transferring common, at $63,997.09.

Bitcoin was buying and selling close to the 23.6% Fibonacci retracement degree, round $58,104.92, indicating potential resistance. On the draw back, the $55,000 degree emerged as the following main help primarily based on Fibonacci extensions.

Supply: TradingView

Suppose BTC can break above the 50-day transferring common round $59,500 and preserve momentum. In that case, it may attain the 200-day transferring common at $63,997, a key resistance degree.

Constructive indicators from the MACD and a impartial Relative Energy Index (RSI) pointed to a potential upside transfer in October, particularly if the bulls regain management.

An increase in direction of the $63,000 vary may set off FOMO (concern of lacking out), doubtlessly pushing BTC to retest its all-time excessive.

The provision on the inventory exchanges reveals a slight upward development

Current evaluation on Santiment indicated a slight upward development in Bitcoin provide on exchanges. Regardless of this enhance, buying and selling quantity has remained comparatively secure and inside the similar threshold.

Learn Bitcoin’s [BTC] Value forecast 2024-25

On the time of writing, the full BTC provide on the exchanges was roughly 1.8 million.

Given the latest market declines, this upward development in provide may point out a better likelihood of a big upward transfer in October as Bitcoin may very well be primed for a possible rally.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024