Altcoin

Assessing the market reaction after the sale of 1000 ETH by the Ethereum Foundation

Credit : ambcrypto.com

- The Ethereum Basis has offered greater than 1,000 ETH once more

- The earlier gross sales wave was broadly criticized by the group

Over the previous 24 hours, the Ethereum Basis has performed two transactions, promoting extra of its ETH holdings in trade for DAI. This transfer comes regardless of important criticism throughout their earlier large-scale sale of ETH property.

The Basis’s resolution to transform ETH into stablecoins like DAI might be a step towards managing their property. Nevertheless, it may additionally elevate issues in regards to the potential affect on market sentiment and worth stability of ETH.

Ethereum Basis on the street once more!

In accordance with knowledge from Spot on chainOn September 5, the Ethereum Basis offered 100 ETH for over 241,000 DAI.

Whereas this primary transaction didn’t generate any important reactions, the newest transaction did entice some consideration. On September 6, the Basis transferred 1,000 ETH, value roughly $2.38 million, to a multi-signature pockets. Primarily based on earlier transaction patterns, this ETH is anticipated to be transferred to a different pockets and sure exchanged for DAI.

Regardless of the scrutiny surrounding these transactions, the Ethereum Basis nonetheless owns a big quantity of ETH – over 274,000 ETH, value over $652 million. Whereas the sale of 1,000 ETH has raised some issues, one other notable transaction from 13 days in the past got here into the highlight. That transaction confirmed the Basis shifting greater than 35,000 ETH to Kraken, elevating questions from observers in regards to the motives behind these gross sales.

On the time, Ethereum’s Vitalik Buterin responded to allegations that the Basis had offered off property. But neither he nor the Basis has made a public assertion about these newest transactions.

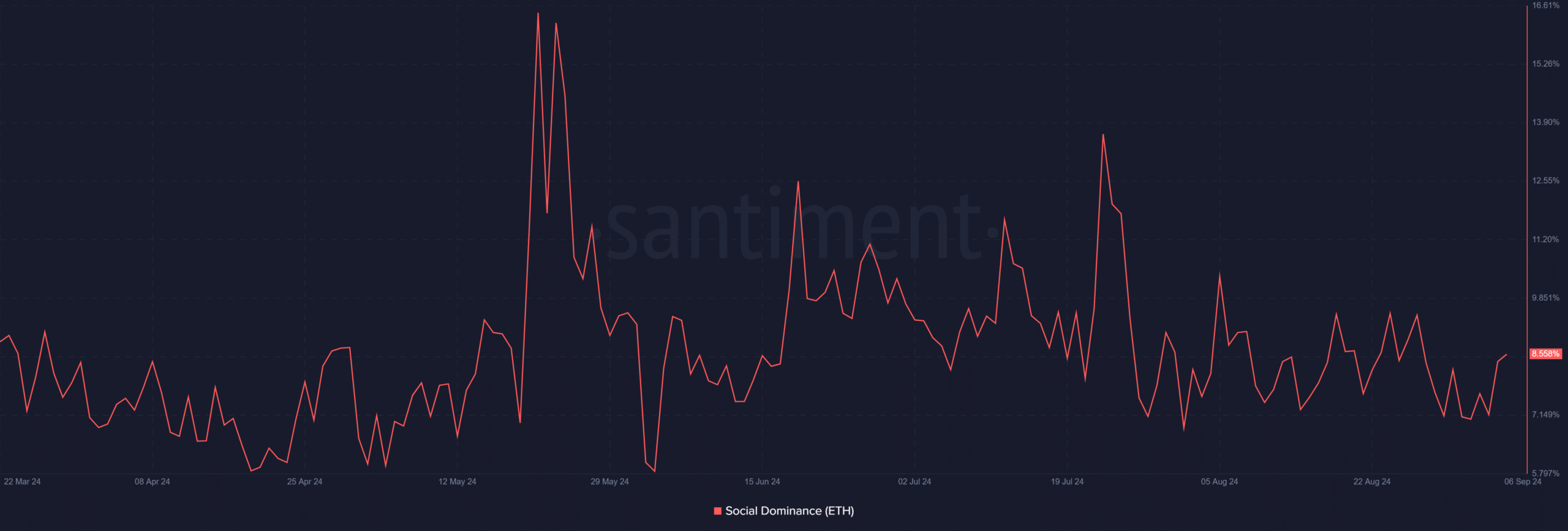

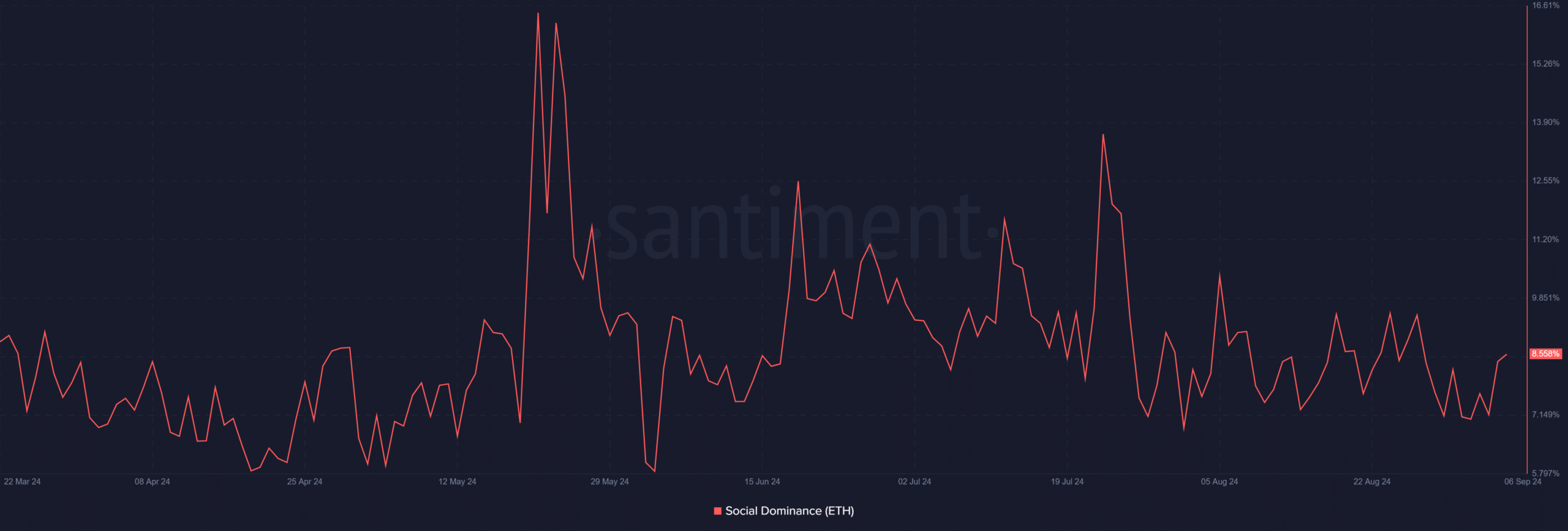

Ethereum’s social metrics present an absence of affect

A latest evaluation of Ethereum’s social dominance confirmed a slight improve, with Ethereum accounting for over 8% of whole crypto discussions.

Nevertheless, a better take a look at the social context Santiment revealed that the latest sale by the Ethereum Basis has but to develop into a trending subject. Regardless of the Basis’s sale of ETH, this occasion has not considerably affected the broader dialogue throughout the crypto group.

Supply: Santiment

As a result of the sale didn’t obtain widespread consideration, which means the transaction didn’t meaningfully affect market sentiment.

Because of this the sale is unlikely to harm Ethereum’s worth for now. Whereas it’s nonetheless early, the dearth of group response factors to a comparatively impartial market response. One with no instant expectations of serious worth declines on account of the Basis’s actions.

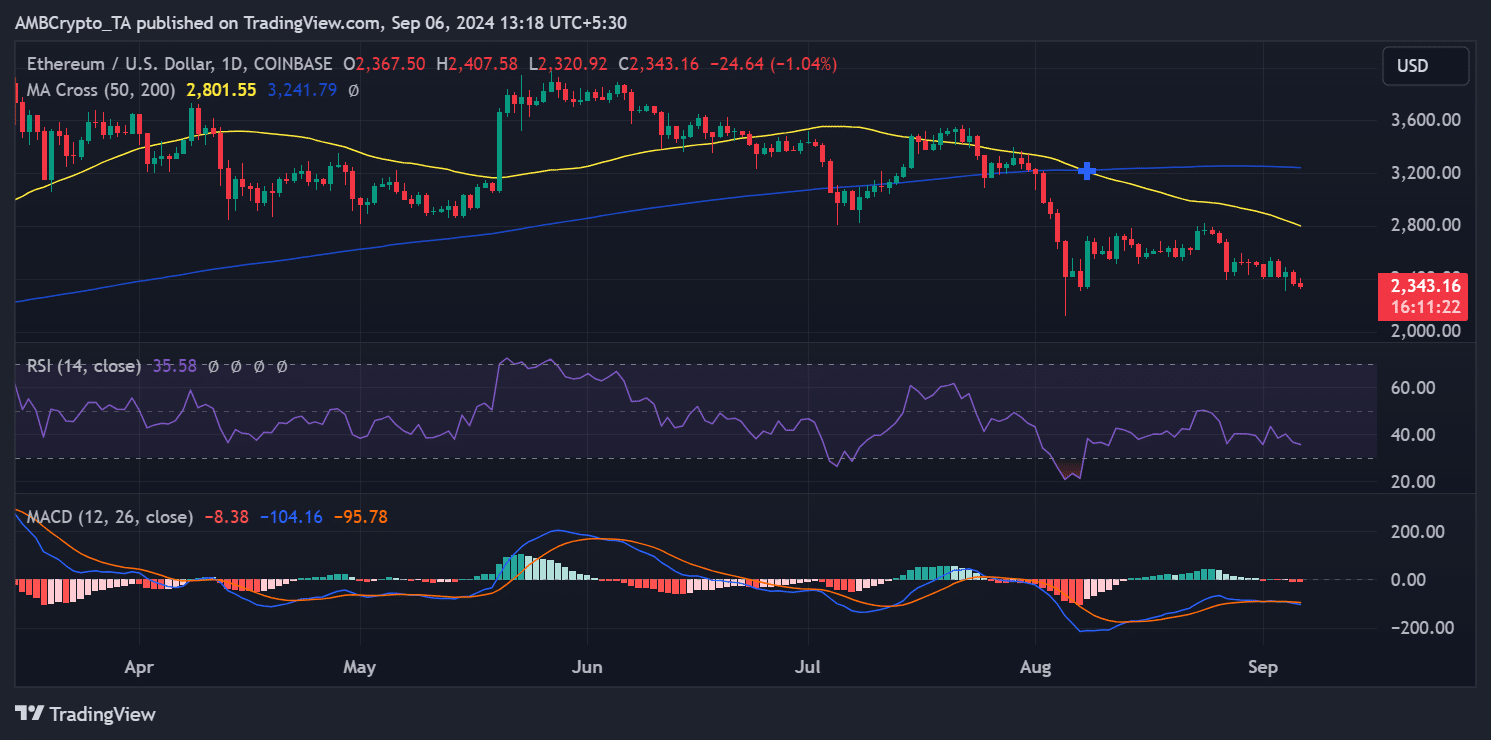

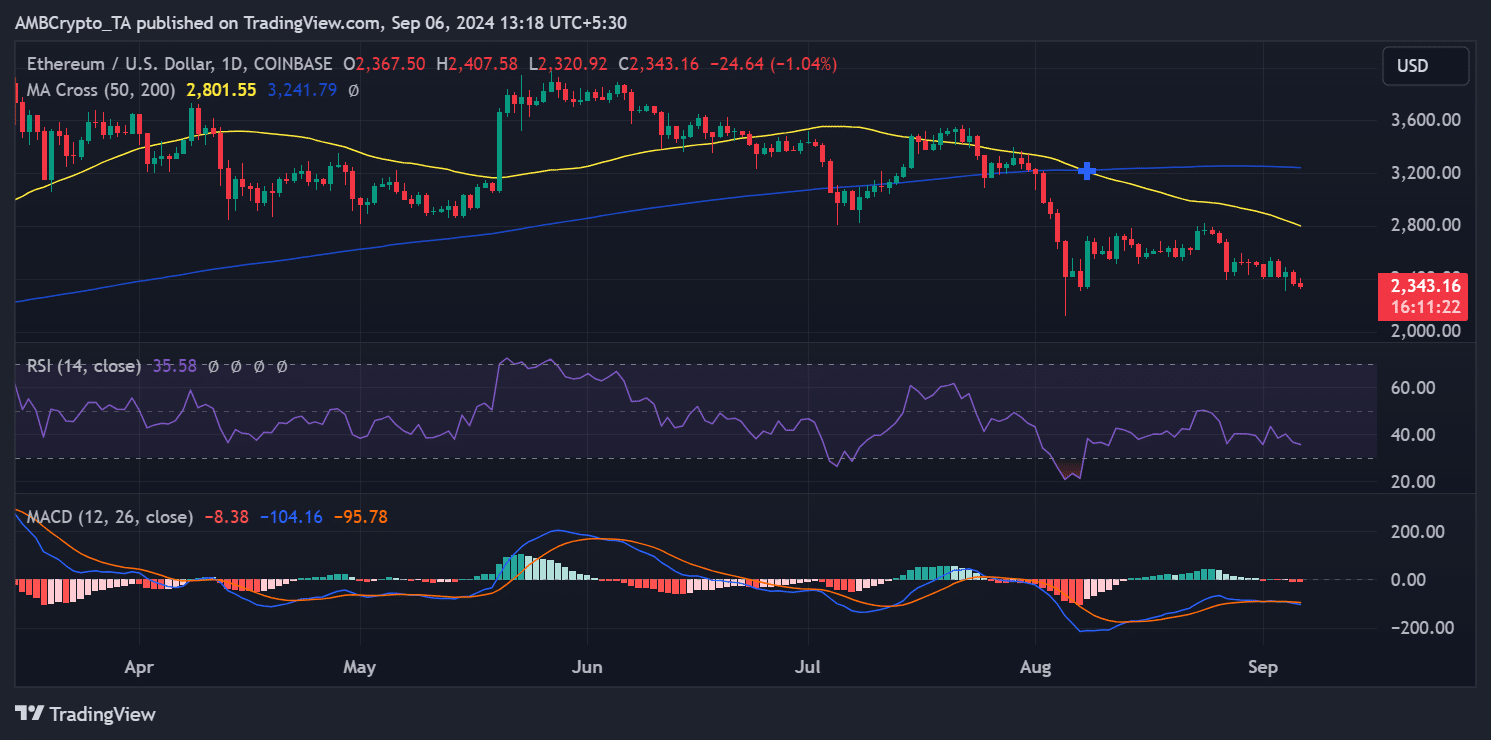

ETH continues its downward trajectory

By the tip of buying and selling on September 5, ETH was buying and selling round $2,367, after dropping greater than 3% on the charts. This bearish momentum continued all through the final buying and selling session, with the altcoin buying and selling at round $2,343 quickly after.

Supply: TradingView

Whereas the value of ETH may proceed to say no, the latest sell-off by the Ethereum Basis isn’t serving to. In reality, the prevailing worth motion seems to be extra consistent with broader market situations, because the sell-off has not but produced a big shift in sentiment.

– Learn Ethereum (ETH) worth forecast 2024-25

Moreover, Ethereum remained firmly in a bear pattern on the time of writing, as evidenced by the Relative Energy Index (RSI). Till the RSI indicators a momentum shift or different technical indicators enhance, ETH will proceed to wrestle within the brief time period.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now