Over the previous 24 hours, Aster value rose a formidable 12.14%, recovering from a pointy weekly decline of 21.92%. This revival is not only about an upturn, however is brought on by three compelling components. First, anticipating Section 2 airdrop claims, which is able to unlock 4% of ASTER’s $570 million providing. Lively accumulation of whales throughout final week’s dip, and a technical restoration offering new momentum.

As a dealer watching these developments, this appears like a pivotal second. The quantity and volatility recommend one thing huge is coming. With Aster priced at $1.51 and a market cap of $3.05 billion, the state of affairs is quickly altering.

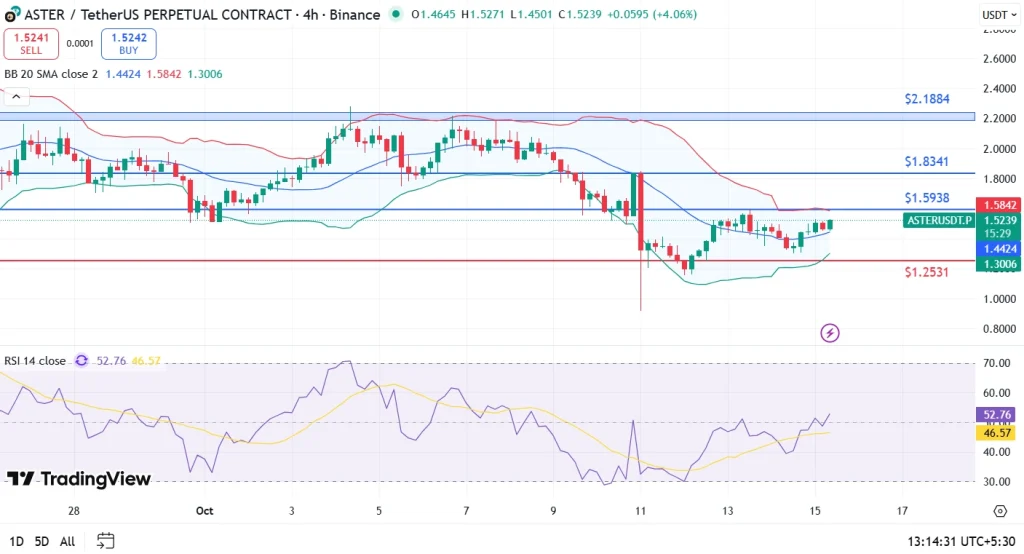

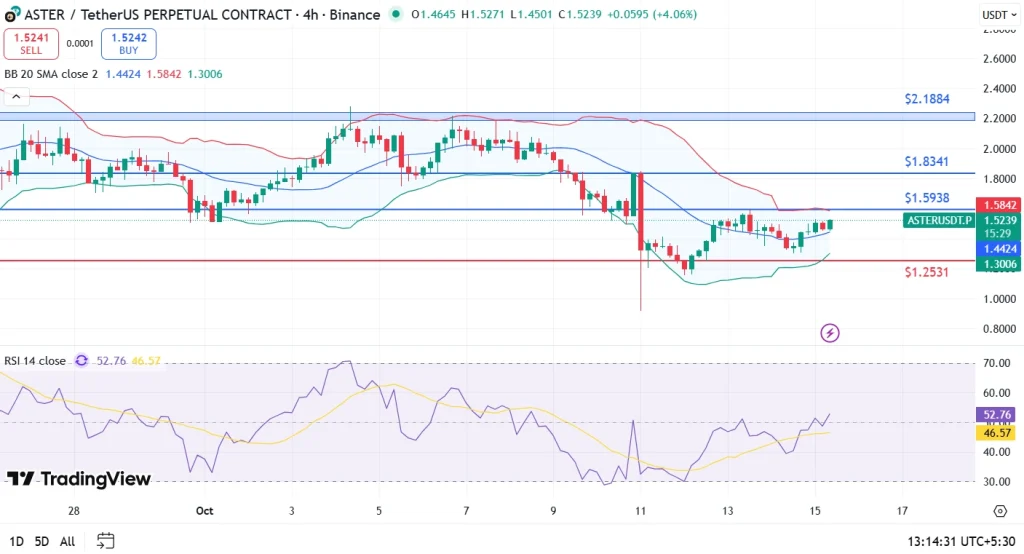

Aster Value Evaluation:

Right this moment’s rebound pushed ASTER’s value to a excessive of $1.53, resetting key transferring averages. On the 4-hour chart, the RSI-14 rose from a low of 45 to round 55.77, signaling a transfer out of oversold territory. This restoration coincided with a wholesome leap in buying and selling quantity, up 45% to $1.31 billion.

Crucially, the value closed above the 7-day SMA at $1.51, a technical zone intently watched by short-term merchants. Many have interpreted this SMA crossover and RSI rebound as a sign that the promoting fatigue could also be over, at the least for now.

Nonetheless, resistance is seen at $1.65, close to the September swing excessive. If ASTER breaks this stage decisively, the following goal could possibly be $1.80. Conversely, if momentum stalls, assist is close to the low of $1.31 from earlier in the present day.

Regularly requested questions

Aster’s leap was pushed by the excitement of Section 2 airdrops, the buildup of whales over $12 million, and a technical momentum restoration.

The principle resistance is at $1.65, with a break at $1.80. Help is anchored at $1.31, in the present day’s 24-hour low.

The rally combines robust quantity, a rising RSI and demand for airdrops. Additional positive aspects rely upon breaking resistance and continued curiosity in whales.