Policy & Regulation

Australian fintech Finder wins court battle over crypto yield product

Credit : cryptonews.net

The Australian Federal Court docket dominated in favor of Fintech Firm Finder.com, on account of which the and its effectivity producing product, Finder Earn, in a authorized battle with the Australian Securities and Investments Fee (ASIC) that lasted nearly three years.

In a Thursday determination, Justices Stewart, Cheeseman and Meagher confirmed an earlier assertion that Finder Pockets and Earn have met the monetary legal guidelines of the buyer.

The federal courtroom “confirmed the primary discovering that Finder was not a monetary product,” Finder mentioned in a weblog submit on Thursday.

The choice got here three months after ASIC appealed towards a courtroom determination of March on the Earn product of the Australian Fintech agency, through which it was in accordance with the monetary legal guidelines of Australia.

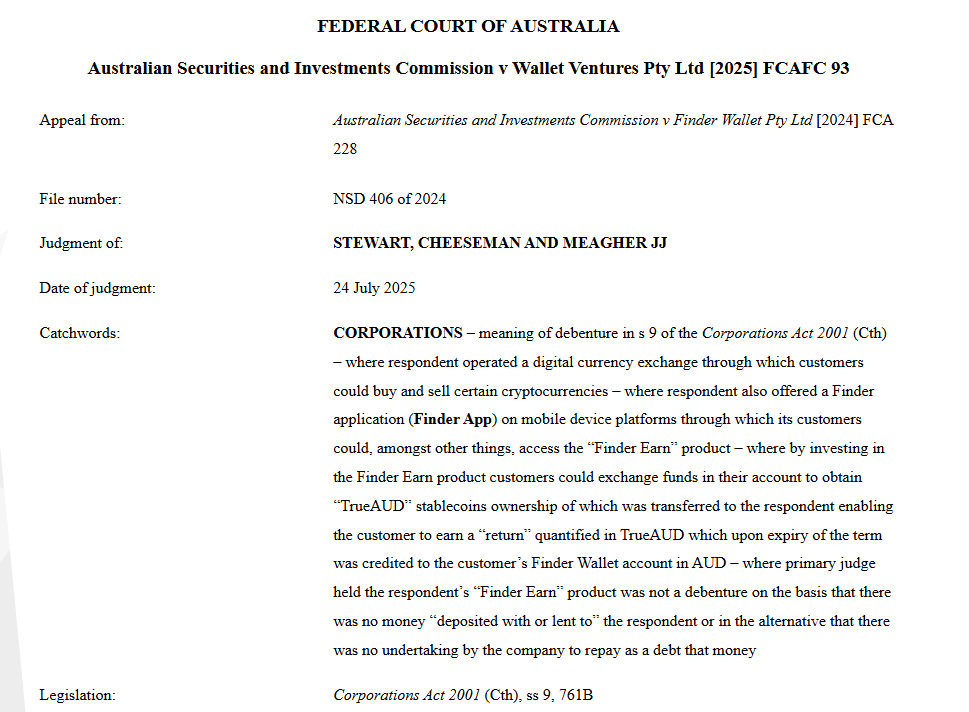

Finder Court docket pronunciation. Supply: Federal Court docket of Australia

The case marked the primary time that the authorized definition of bond had been examined in an Australian courtroom with regard to cryptocurrency, in keeping with Finder.

Associated: Colorado Pastor and Girl charged in $ 3.4 million crypto -wambling

Finder Earn, which labored between February and November 2022, enabled customers to transform Australian {dollars} in Stablecoins on the platform and switch them to Finder Pockets in alternate for an annual yield of 4% to six%.

The corporate mentioned it had returned all buyer funds, a complete of greater than 500,000 Treaud (Taud) or round $ 336,000.

Associated: Technique launches Bitcoin shares linked to $ 100 to extend the treasury

Finder Case Marks “Win” for the Australian Fintech trade

Finder welcomed the choice and referred to as it a milestone for the fintech trade in Australia.

“It is a victory, not just for Finder, however for Fintech in Australia,” mentioned Fred Schebesta, the founding father of Finder.com. “We should give Australians conform to the following era of funding choices, from deploying and admitting to NFTs and past, as a result of these rising crypto providers are acquainted, well-regulated paths, identical to another asset class,” he mentioned Cintelegraph.

“We’ve constructed Finder Earn with transparency and integrity from the primary day, consulting ASIC in every single place,” he mentioned, including that the authorized case “was about innovation that pushed for the laws.”

When requested what the following step is after the authorized victory, he hinted on a brand new undertaking. “I’ve one thing big that I’ve labored on that may construct on this victory,” he mentioned.

Journal: Crypto -Airdrops from actual customers steal in a 30,000 phone bot farm

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now