Altcoin

Avalanche Has Resistance at $48, Expects $100 – But AVAX Faces Hurdles

Credit : ambcrypto.com

- $48 resistance holds the important thing for Avalanche’s subsequent massive transfer.

- Stochastic Oscillator warns of overbought ranges for AVAX.

Avalanche [AVAX] was priced at $45.28 on the time of writing, reflecting a rise of three.60% up to now 24 hours.

Its market capitalization was $18.53 billion, with a 24-hour buying and selling quantity of $827.93 million.

Over the previous day, AVAX has fluctuated between a low of $43.37 and a excessive of $45.95.

Whereas the token has made important progress these days, the all-time excessive of $146.22 reached on November 21, 2021 stays properly out of attain, marking a 68.89% decline from that peak.

The resistance at $48 stands in the way in which

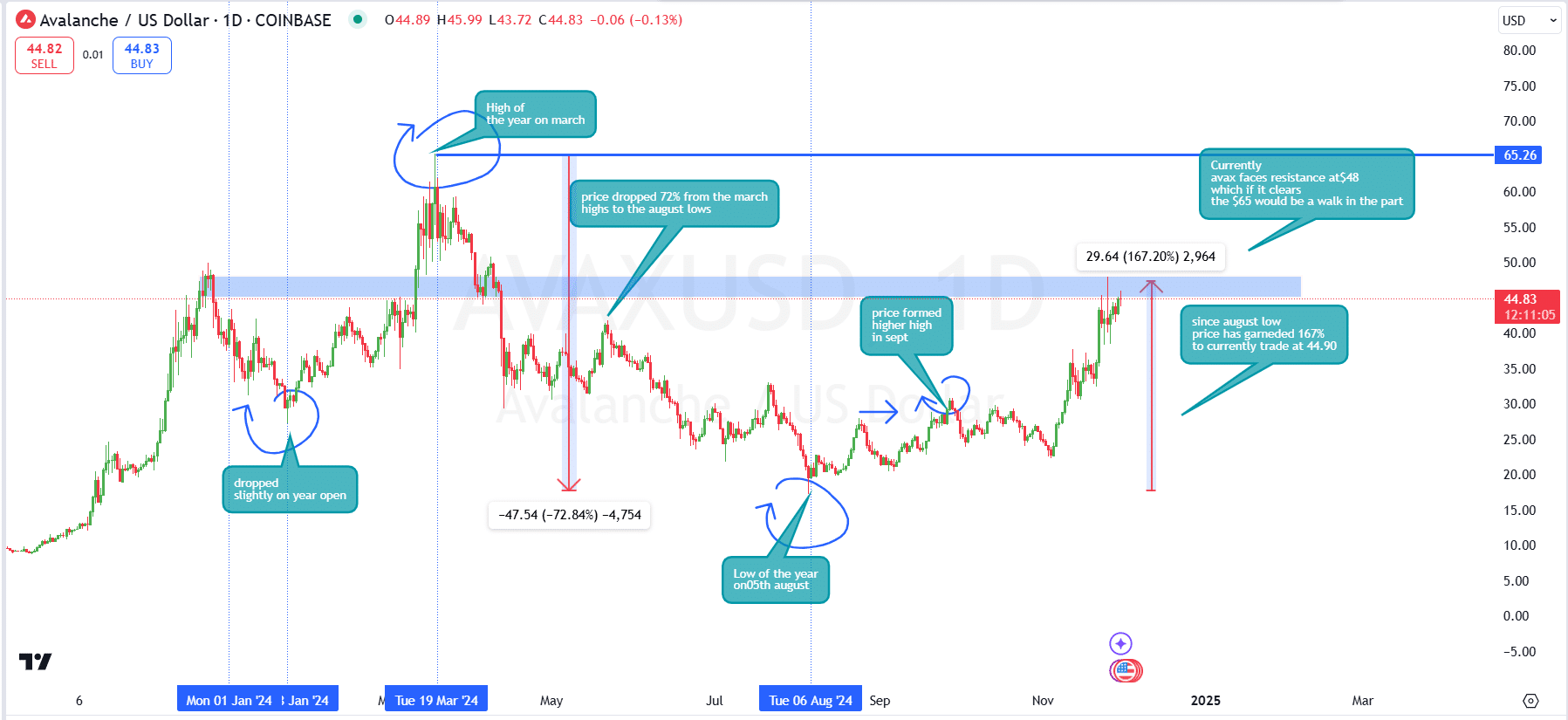

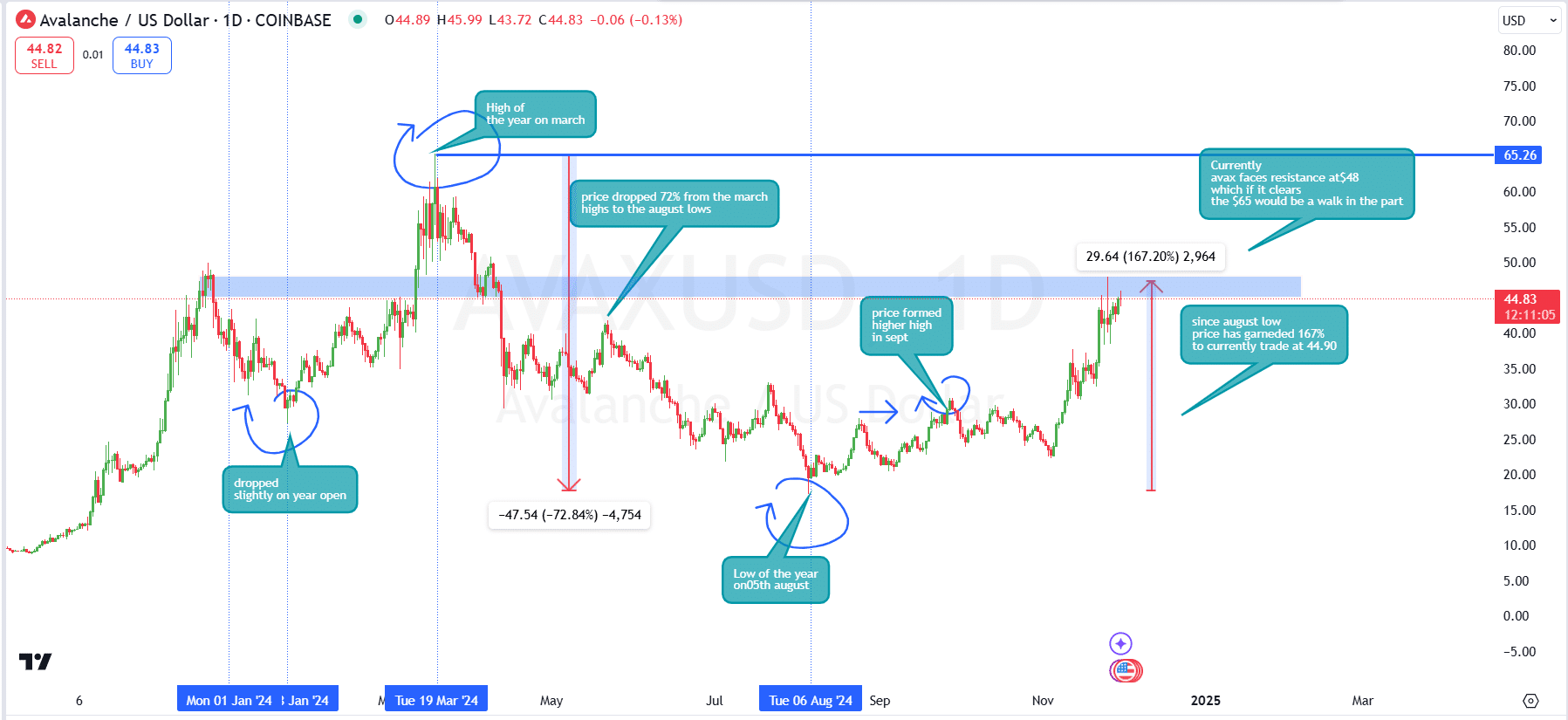

Avalanche confirmed a risky efficiency in 2024, beginning the yr with a slight decline earlier than reaching its yearly excessive at $65.26 in March.

This peak marked a powerful begin to the yr, pushed by bullish sentiment and elevated exercise.

Nonetheless, beginning in March, AVAX suffered a steep decline, dropping 72% of its worth and reaching a yearly low of $17.72 on August 5.

Avalanche/ US greenback 1D | Supply: Tradingview

After the August low, AVAX began a powerful restoration part, gaining 167% from press time of $44.83. In September, the token reached the next excessive, signaling a shift in market sentiment.

At the moment, AVAX is testing the $48 resistance degree. Overcoming this barrier may pave the way in which for a rally in direction of the earlier excessive of $65 and presumably $100.

Brief-term cooling on the way in which?

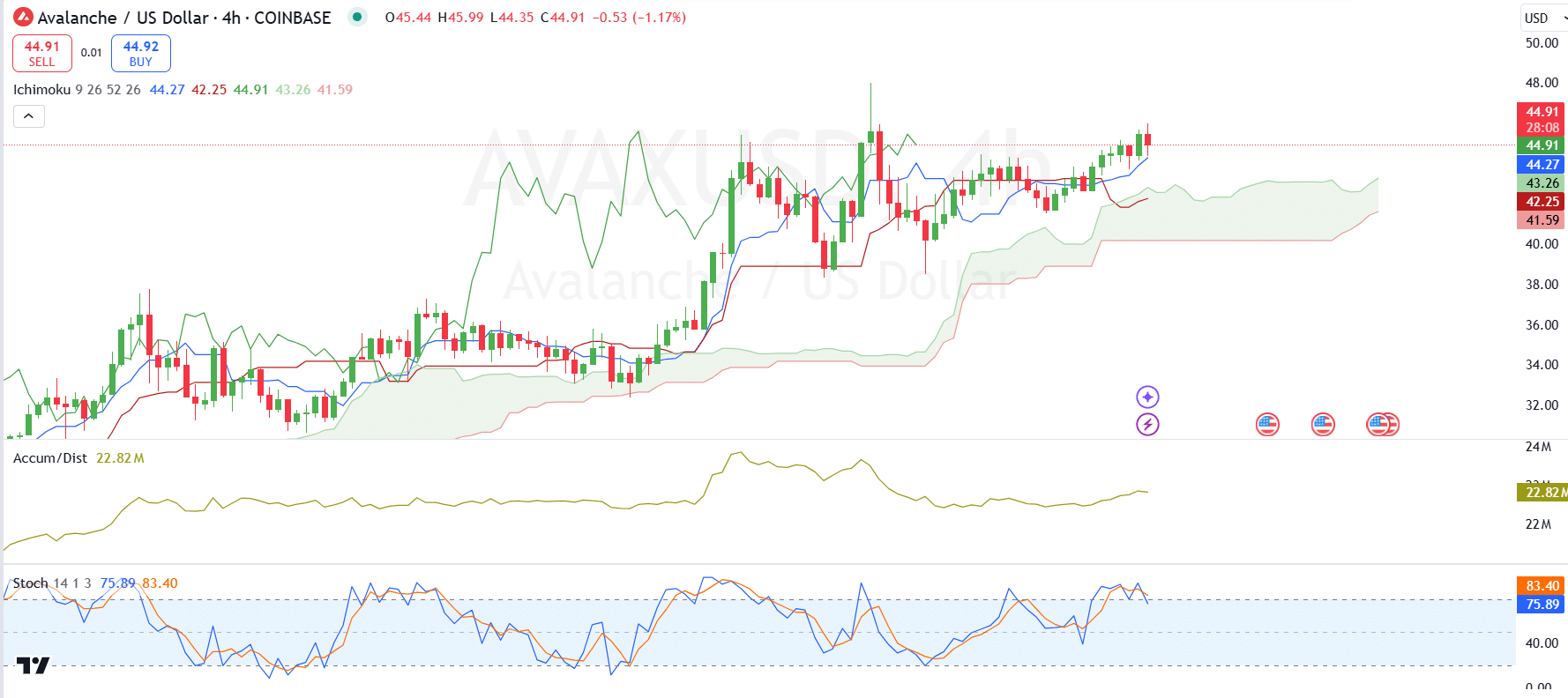

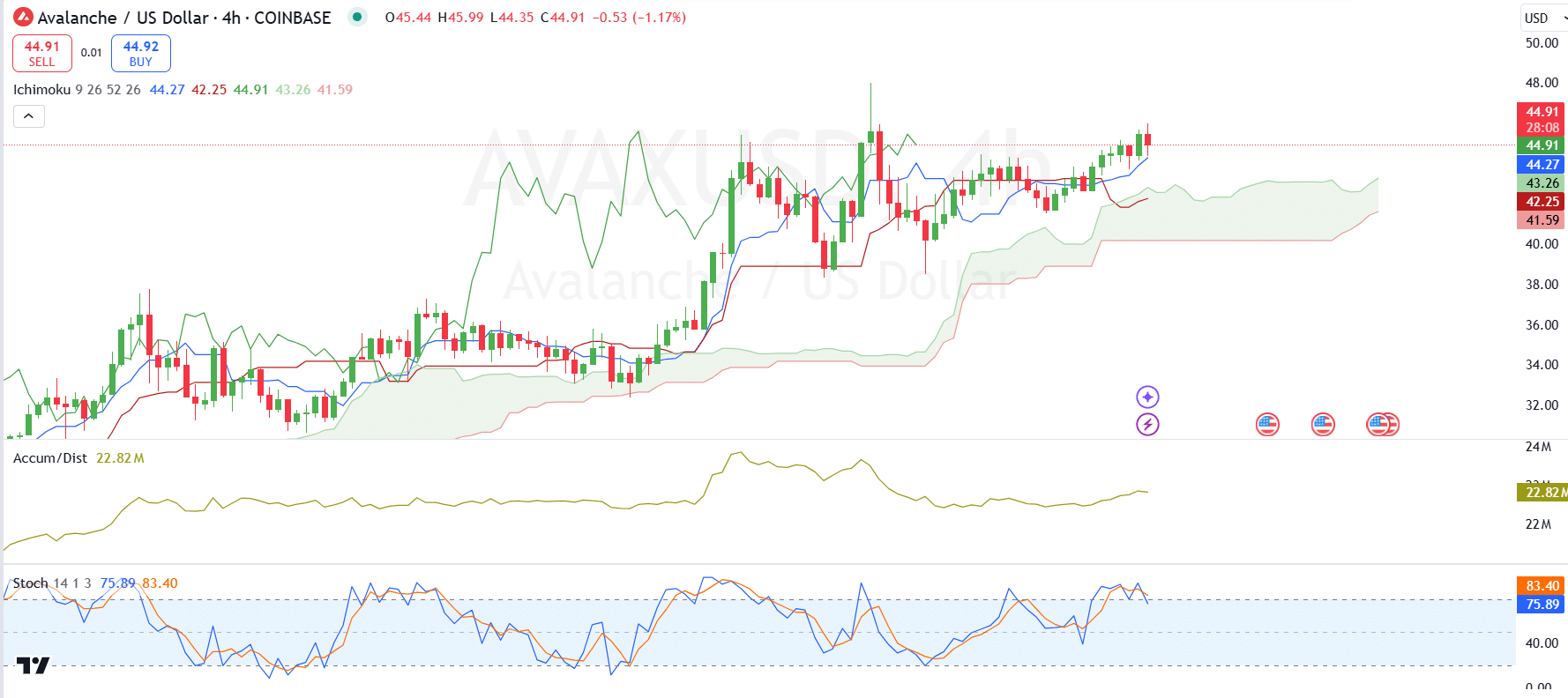

The Ichimoku Cloud indicated a bullish pattern on the time of writing, with the Tenkan-sen (blue line) and Kijun-sen (pink line) offering short-term assist at $44.27 and $42.25 respectively.

The upward momentum was supported by rising accumulation, because the Accumulation/Distribution indicator confirmed an upward pattern at 22.82 million.

The stochastic oscillator advised AVAX entered overbought territory, with the blue line crossing above the orange line at 75.89 at 83.40.

Avalanche / US Greenback 4H | Supply: TradingView

This means a doable slowdown or small setback within the quick time period.

AVAX is in a bullish part with sturdy assist ranges, however overbought situations may result in short-term corrections earlier than resuming upward momentum.

Merchants ought to keep watch over the USD 44 and USD 42 ranges for assist throughout any retracements.

Rising quantity fuels AVAX’s comeback

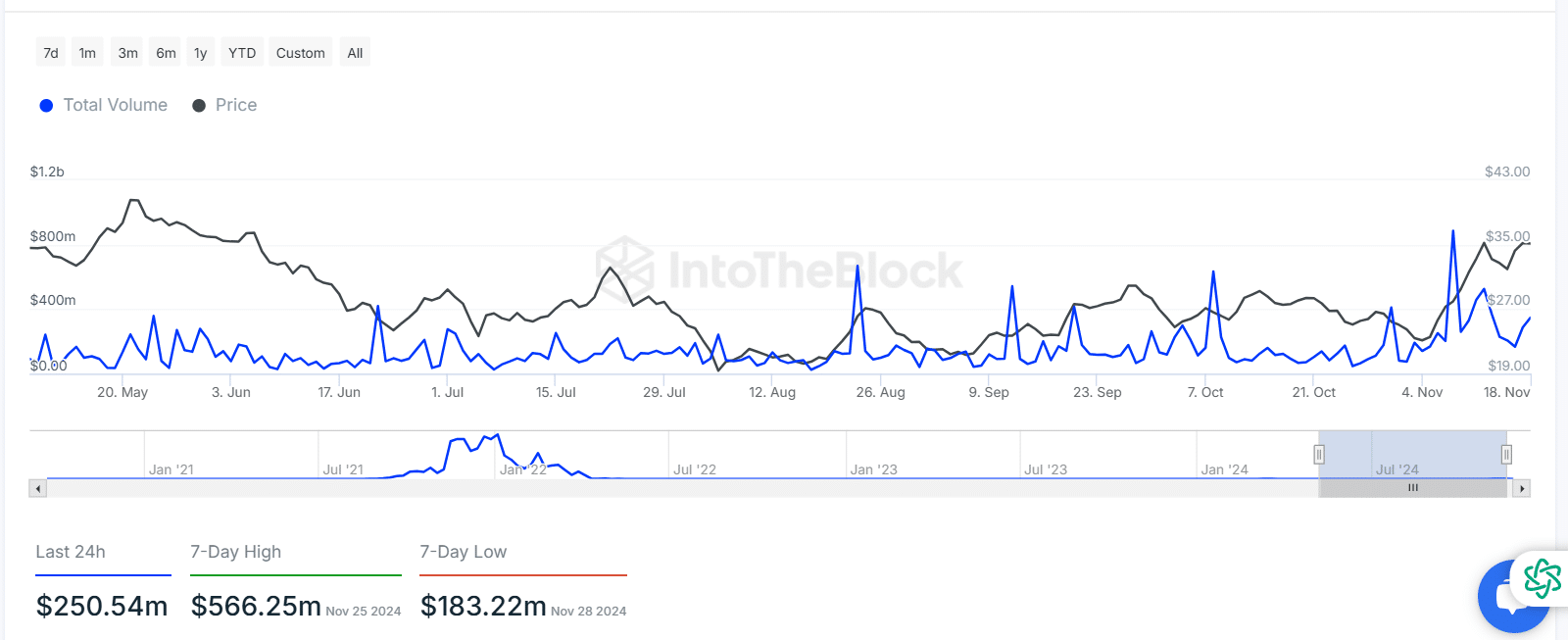

Information from IntoTheBlock confirmed that AVAX’s transaction quantity peaked at $800 million in Could and June, pushing its value to $43.

In July, each transaction quantity and value fell sharply, with AVAX falling to the $19-$27 vary.

From August to September, periodic spikes in transaction quantity briefly supported a small value restoration, though the general pattern remained flat.

Supply: IntoTheBlock

In November, transaction quantity rose to a seven-day excessive of $566 million, pushing AVAX’s value to $35.

Quantity remained at $250 million on the time of writing, supporting stability within the mid-Nineteen Thirties. The rising exercise alerts renewed curiosity, pointing to the potential for additional value appreciation.

AVAX is seeing rising adoption

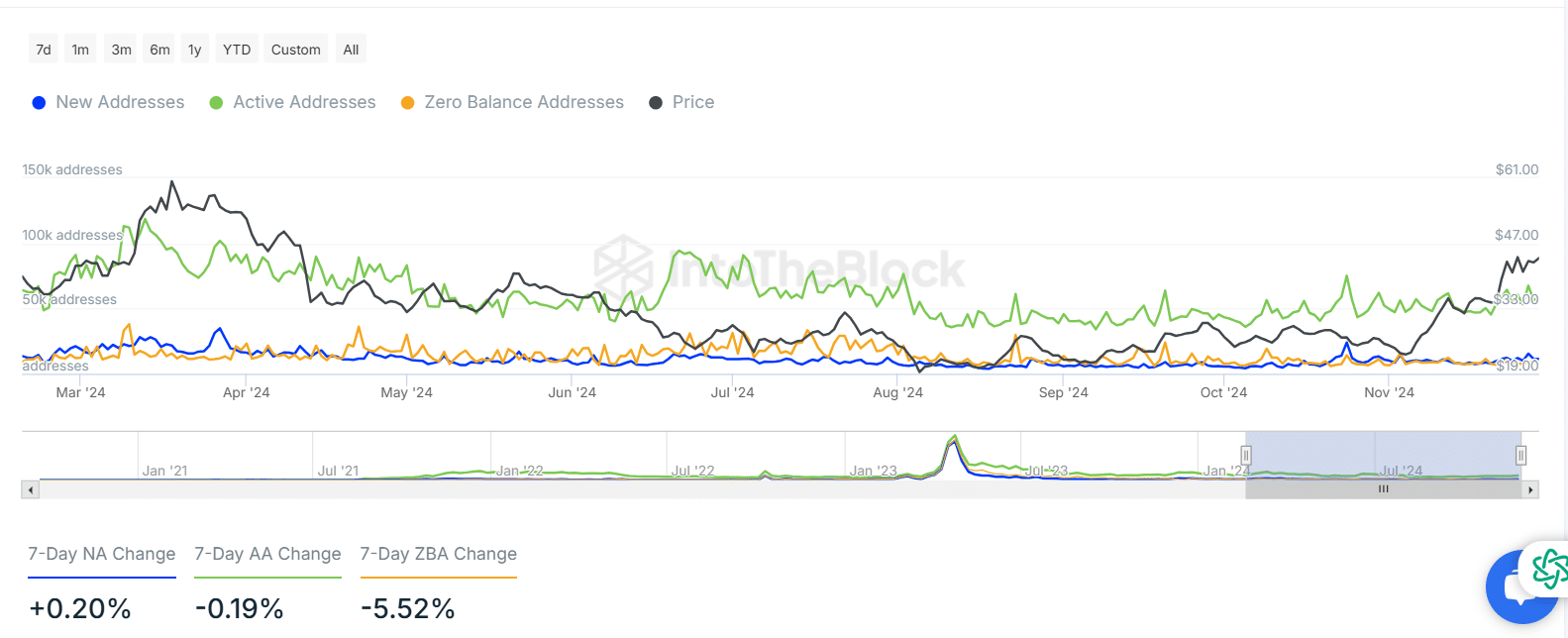

From March to June, energetic addresses peaked at practically 150,000, alongside a value improve to $61. Nonetheless, each energetic addresses and costs declined steadily in August, reflecting lowered community exercise and market curiosity.

Within the second half of 2024, energetic addresses stabilized whereas new addresses grew modestly, supporting a gradual value restoration.

Supply: Intotheblock

Learn Avalanche [AVAX] Worth forecast 2024–2025

In November, the value reached $47, whereas addresses with zero balances fell 5.52% in seven days, indicating that cash is again in circulation.

This renewed exercise alerts rising market confidence and higher utility for AVAX.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now