Altcoin

Avalanche -price breaks February low, $ 20.07 in danger as ETF delay

Credit : coinpedia.org

Essential takeaway eating places:

- Avax fell 13.49% to $ 20.07 this week and broke the Low van February and approached the crucial assist of March at $ 15.28.

- A lower of 6.82% in Defi TVL and $ 2.47 million internet outflow on 31 Might reveals a powerful risk-off habits.

- SEC’s delay from Grayscale’s Avax ETF choice till July 15 finds market confidence.

- Declining triangle breakdown confirmed as a value beneath $ 21 assist.

- Greater than 90% of the Avax holders stay in losses, indicating the fixed downward stress.

Avax value replace: Avalanche slips in February with

Avalanche (Avax) broke underneath the low level of February of $ 20.20 and pushed underneath $ 21 to behave at $ 20.07 – the weakest stage in three months. Regardless of a 24-hour quantity of greater than $ 568 million, sellers stay in management.

Makes an attempt to maintain the assist of $ 20.85 – $ 21.00 failed, failed, With the value that’s now approaching an important low level of March of $ 15.28. The value has now damaged its brief -term construction, which will increase the chance of fixed downward stress.

ETF delay and market voting resistance Avax and Ada

The SEC delayed the judgment of Avax ETF from Grayscale till July 15, shortly after Vaneck had launched a specifically constructed Institutional Fund for Avalanche. As an alternative of stimulating belief, this delay shook sentiment, cooling earlier optimism round institutional curiosity.

Cardano (ADA), confronted with the same delay, additionally witnessed Drawdowns, exhibiting that ETF decision-makinglessness continues to weigh on Layer-1 ecosystems.

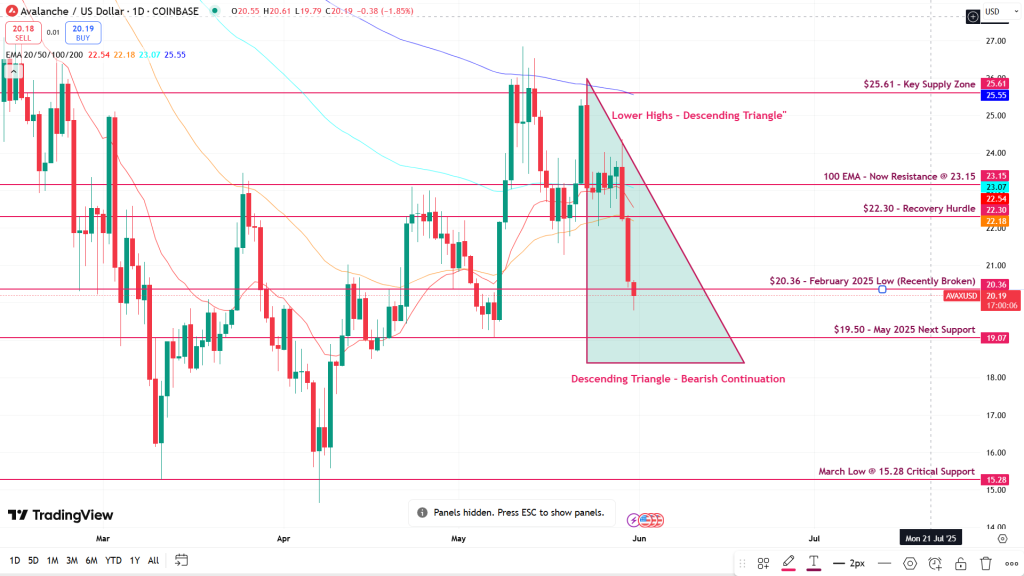

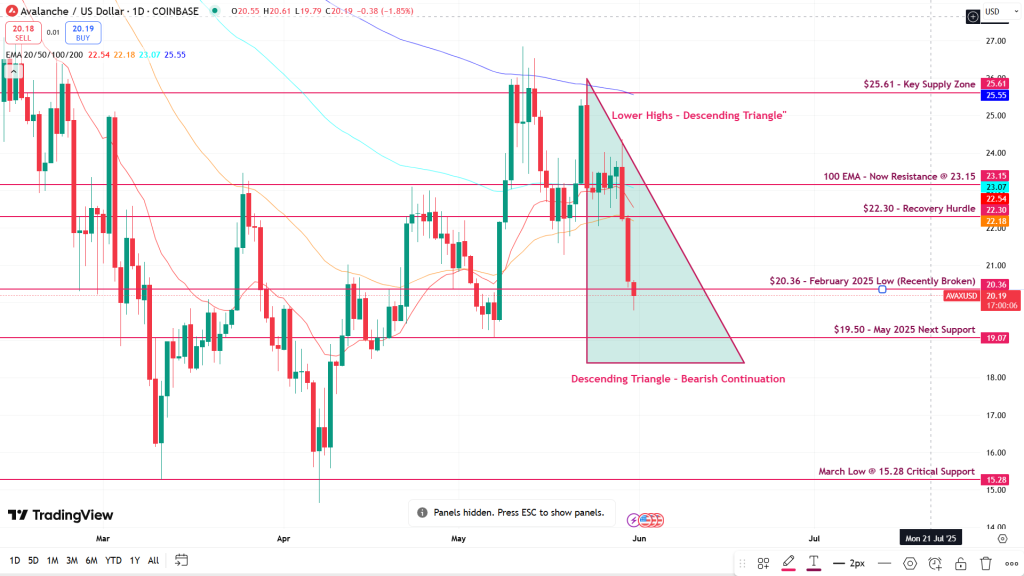

Technical prospects: Demolition of triangular breakdown in Avaxusd

The day by day Avaxusd graph reveals a breakdown of a falling triangular sample. Decrease highlights since April have been compressed within the path of the $ 21 assist base, which has now taken place.

The bearish continuation was confirmed by the rising gross sales quantity and never defending $ 20.50.

If $ 19.50 breaks, the extent of $ 15.28 turns into the following essential assist. The falling triangle attaches decrease highlights, and until $ 22.30 is recovered, each rally stays suspicious.

Furthermore, Avax stays amongst all the big EMAs – With the 20-day EMA at $ 22.55, 50 days on $ 22.18, 100 days on $ 23.15 and 200 days for $ 25.55 it types of an entire Bearish EMA stack that strengthens the slim stress.

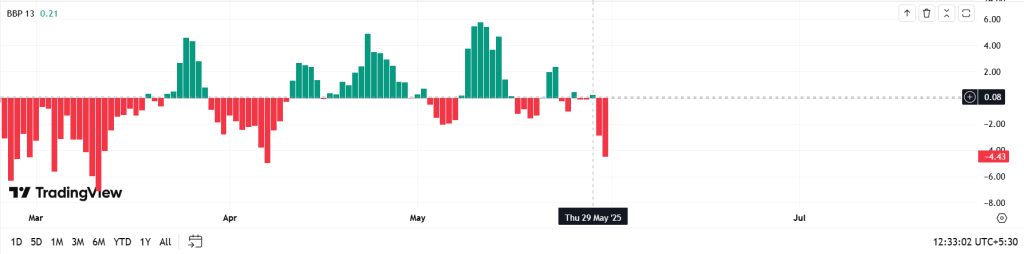

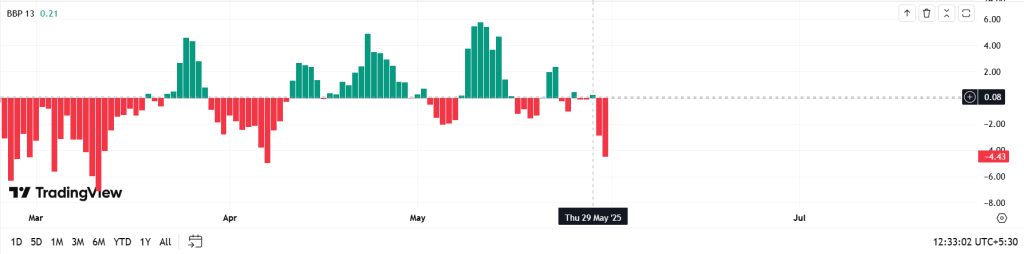

Momentum -indicators verify Beerarish bias

RSI is now at 39.79 and reveals a transparent bearish momentum. The MACD histogram is deepened in a pink space, the place each the MACD and the sign strains fall additional aside – the reinforcement of the downward affirmation.

The Bull-Bear Energy (GDP) Indicator has fallen -4.44The bottom stage since April. This sharp dip emphasizes that sellers have fully overwhelmed each bullish drive, in order that the present transfer is just not solely corrective, but in addition a part of a persistent bearish development.

Signaling tendencies on the chain persistent weak spot

Avalanche’s Defi TVL fell from $ 1,581b on 28 Might to $ 1,473b by 31 Might – an erosion of $ 108 million in three days, because of the capital flight and diminished protocol involvement.

Change exercise additionally helps the bearish case. On 30-31 Might the web outflows reached $ 4.34 million, with constant consumer outputs.

Greater than 90% of the Avax holders are actually underneath water, with solely 3.93% revenue. This emphasizes the risk-off sentiment and will increase the prospect of additional capitulation if the assist ranges break.

Conclusion: Demolition underneath $ 20.20 units on the redest check of March assist

Avax has now violated its low in February and goes to the extent of $ 15.28 of March. This confirms a bearish construction with potential continuation, until there’s a robust curiosity from the client.

The whole Bearish EMA strains and momentum indicators proceed to assist the everlasting voltage. If $ 19.50 doesn’t maintainAvax might check $ 15.28 within the brief time period.

Contemplating ETF retroses and lack of heavy holders, The Bearish development can live on till mid-June Except the market construction decides Bullish.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now