Altcoin

Avalanche TVL soars above $1 billion again as AVAX bulls face resistance

Credit : ambcrypto.com

- Bullish exercise breathes extra life into Avalanche TVL and stablecoin market cap.

- Can AVAX preserve its current features as promoting strain step by step will increase once more?

The avalanche [AVAX] ecosystem has skilled a resurgence in exercise because the market enters restoration mode. On-chain knowledge revealed important adjustments in some Avalanche metrics, most notably the overall worth locked (TVL).

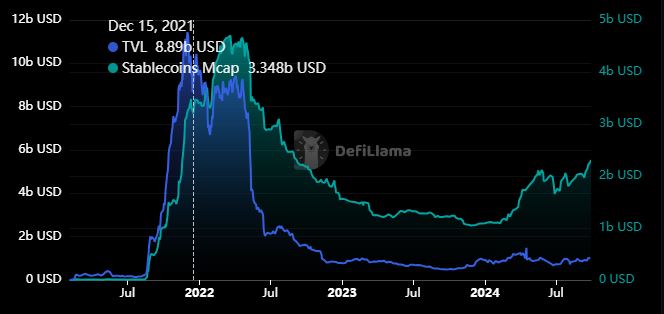

Avalanche’s TVL continues to be removed from its historic peak. It peaked at $11.49 billion in December 2021, however the community skilled heavy outflows in the course of the crypto winter.

The TVL fell beneath $500 million final September and solely managed to get again above $1 billion this week.

Supply: DeFillama

Avalanche had a TVL of $1.07 billion on the time of writing. Whereas it is a notable restoration, it nonetheless pales compared to historic highs. We additionally noticed a big restoration out there capitalization of the community’s stablecoins, to an area excessive of $2.31 billion.

The market cap of the community’s stablecoins hit a low of $536.96 million in October 2023, which means it’s now up greater than 300%. However just like the TVL, the Avalanche stablecoin market cap is presently a fraction of its 2022 peak of $4.67 billion.

Can TVL and stablecoin market cap restoration help AVAX upside?

Stablecoin development and TVL are important measures of a community’s development and liquidity. They facilitate the expansion of the DeFi ecosystem, so technically this might point out higher natural demand for AVAX.

AVAX has been in a macro-bearish pattern since March, which seems to have leveled off in August.

AVAX is up practically 50% yr thus far from its September low. The cryptocurrency just lately peaked at $30.85, however had a press-time worth of $29.33 after declining barely over the previous 24 hours.

Supply: TradingView

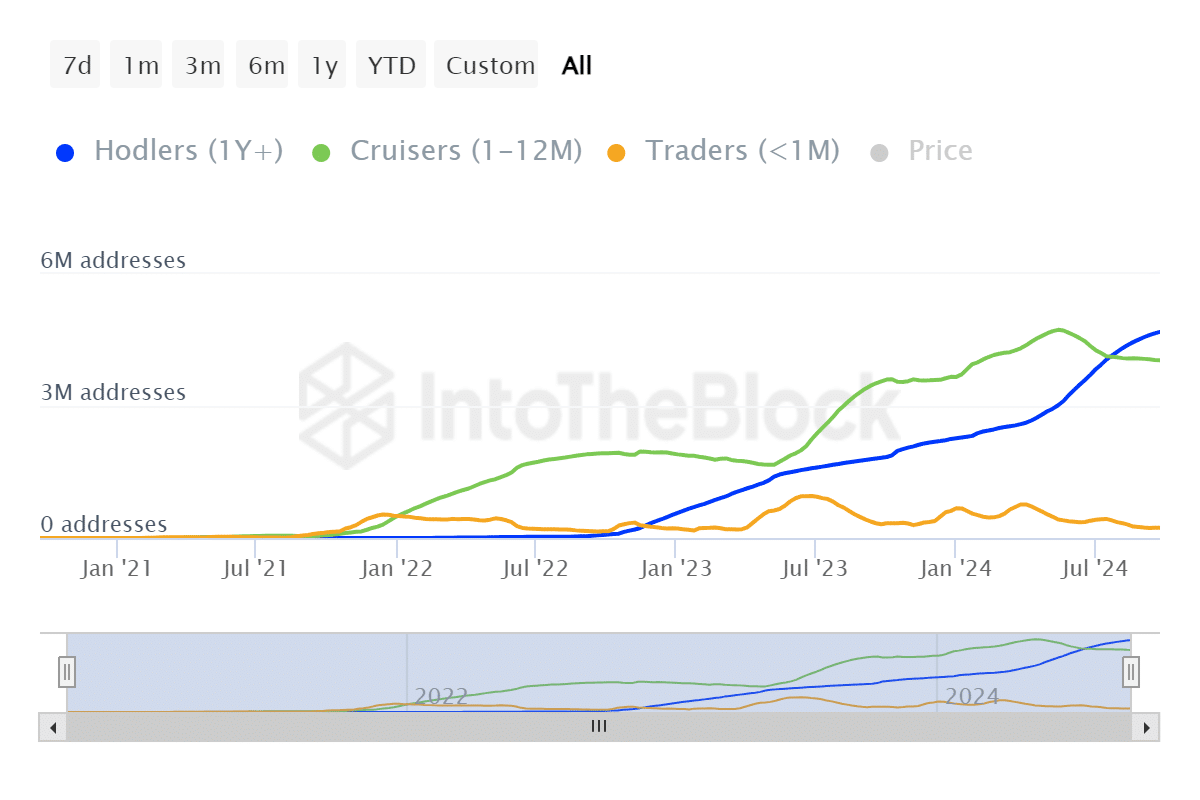

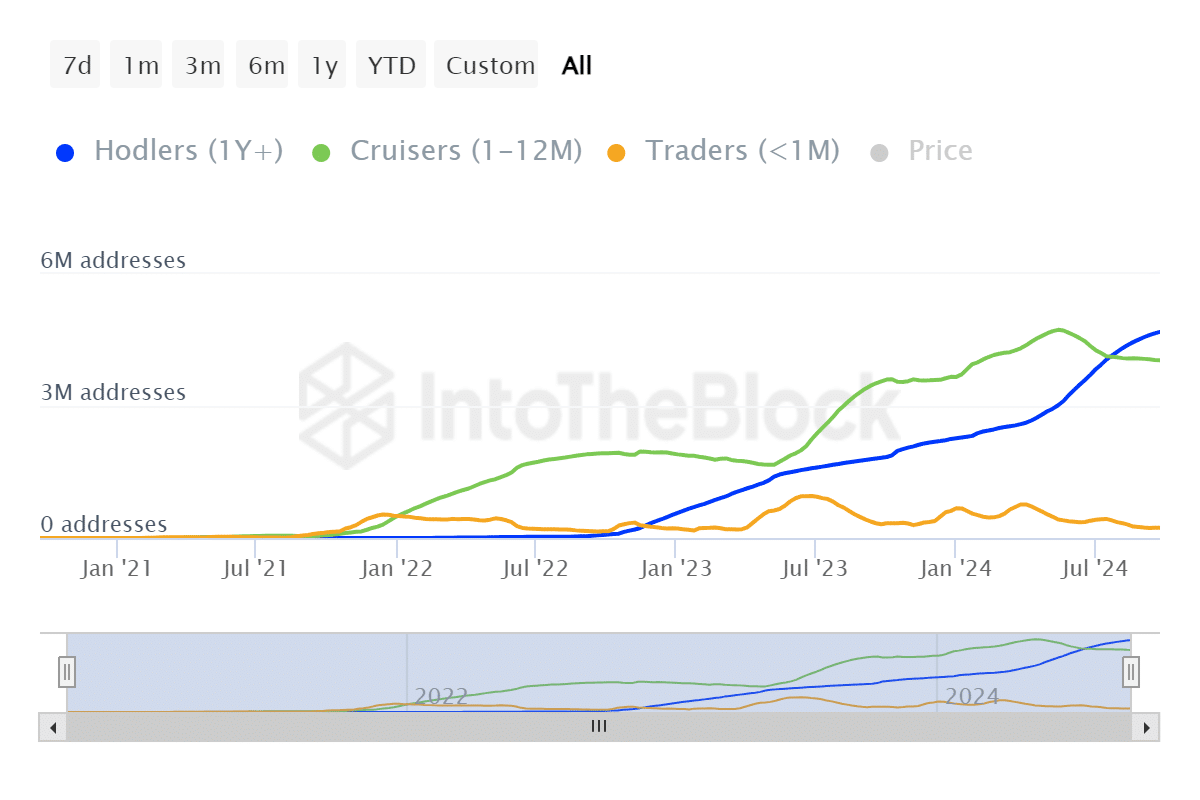

AVAX bulls are beginning to encounter resistance, suggesting promoting strain may improve after the most recent rally. Will there be one other retracement? Knowledge from IntoTheBlock confirmed that AVAX cruisers maintain nearly as many cash as HODLers.

Cruisers are equal to short-term holders whose possession interval is lower than twelve months. On the time of commentary there have been 4.04 million cruiser addresses, 4.69 million HODLers and 234,000 merchants.

Supply: IntoTheBlock

Learn Avalanche [AVAX] Worth forecast 2024–2025

The above commentary means that AVAX is susceptible to draw back if cruisers resolve to take income. However, promoting strain will not be as robust, particularly now that the market is just simply exhibiting indicators of restoration.

This implies there could also be some incentive for AVAX holders to attend or there could also be extra potential upside.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024