Policy & Regulation

‘Avoidable errors’ wiped a year’s worth of Gary Gensler’s texts… oops

Credit : cryptonews.net

An investigation into Securities and Trade Fee into lacking SMS messages from the phone of former chairman Gary Genler concluded between October 2022 and September 2023 that “avoidable errors” led to their loss.

The SEC Workplace of Inspector Common (OIG) investigated how nearly a 12 months of SMS messages from Gary Genler was completely misplaced between October 2022 and September 2023, throughout the spotlight of the Crypto Enforcement Motion marketing campaign of the company.

In a report that was launched on Wednesday, the OIG revealed that the IT division of the ‘a poorly understood and automatic coverage applied {that a} enterprise abnormality of the cell gadget of Gensler induced’, which eliminated saved textual content messages and logbooks from the working system.

The loss was exacerbated by poor change administration, lack of excellent again -ups, ignored system warnings and non -addressed provider software program errors.

The IT division didn’t acquire or recorded the required log information, which is why the Fee couldn’t decide why the GENLER smartphone now not communicated with the Cell System Administration System of the SEC.

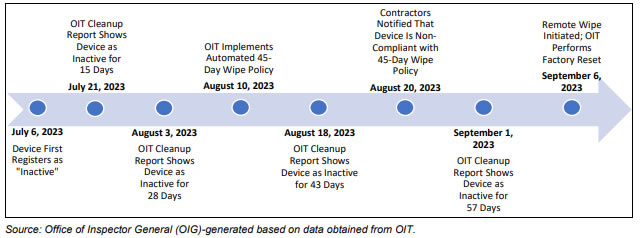

Timeline of occasions that result in the lack of the SMS messages of Gensler. Supply: SEC

Vital communication about crypto enforcement actions have been misplaced

The OIG found that a few of the eliminated texts from Gensler SEC Herveling promotions towards crypto corporations and their founders involved, which signifies that essential communication about how and when the SECs could by no means be utterly identified, even for courts, the congress or the general public.

Researchers assessed round 1500 messages that have been recovered from colleagues and different data. They stipulated that almost all have been federal information, with roughly 38% of the recovered textual content interviews “mission -related” with regard to issues that on the time concern SEC workers, reminiscent of:

“A dialog of Might 2023 with regard to Gensler, his workers and the director of the enforcement division about when the SEC would submit an motion towards sure crypto -activa -trading platforms and their founder.”

🇺🇸 Final: The Inspector Common of the SEC has launched a report on the lack of SMS messages from former chairman Gary Gslerer as a consequence of avoidable errors by the IT workplace of the workplace between October 2022 and September 2023. Pic.twitter.com/3iwixftgkrr

– Cointelegraph (@Cointelegraph) 5 September 2025

Sec -performance when holding

Across the similar time that Gensler’s messages had disappeared in a black gap, the SEC burst on the usage of messages apps. Numerous international funding banking and monetary establishments have been charged with violating the archiving and e-book and data legal guidelines underneath the Securities and Trade Act of 1934.

“Finance finally is dependent upon belief. By honoring their registers and e-book and data, the market contributors we’ve sued at the moment can not retain that belief,” Genner stated on the time.

Ondermining transparency in crypto choices

The SEC has since disabled SMS messages on most units, knowledgeable the Nationwide Archives and Information Administration of Misplaced Information, launched Capstone-specific Information coaching for prime officers and began enhancing backup practices for prime officers units.

“The lack of the SMS messages from Gensler can affect the SEC response to sure Freedom of Info Act requests,” stated it.

Genler, who resumed in January, was infamous within the crypto neighborhood for his AAS and swap providing to “are available and be registered”, who had a number of sec actions towards corporations who claimed they have been attempting to do precisely. Enforcement actions towards crypto corporations reached a spotlight of 10 years in 2023.

“Consider all the things that occurred in Crypto presently. In precept, FTX is collapsing by means of the Grayscale Spot BTC ETF proper case,” famous Novadius Administration President Nate Geraci, who added “makes you suppose.”

“So the SMS messages of Gary Genler of his time period of workplace as SEC chairman are eternally misplaced in a mysterious ‘boot accident’ ???,” the founding father of Custodia Financial institution Caitlin Lengthy.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024