Altcoin

Bera wins 14% despite the outflow of $ 19.4 million, but OKX traders bet against the rally

Credit : ambcrypto.com

- Bera registered vital internet outbursts within the chain, however spot and derived merchants have gathered.

- OKX merchants stay resistant, the place the gross sales quantity continues to outweigh the shopping for of stress.

Berachain [BERA] has emerged as probably the greatest revenue, risen by 14% within the final 24 hours and his weekly revenue pushed over 30%, not like different tokens which have problem gaining a revenue.

Evaluation means that it nonetheless has a transparent path to additional revenue, as a result of the buying stress of spot and derived merchants is beginning to rise.

Spot merchants attempt to reverse

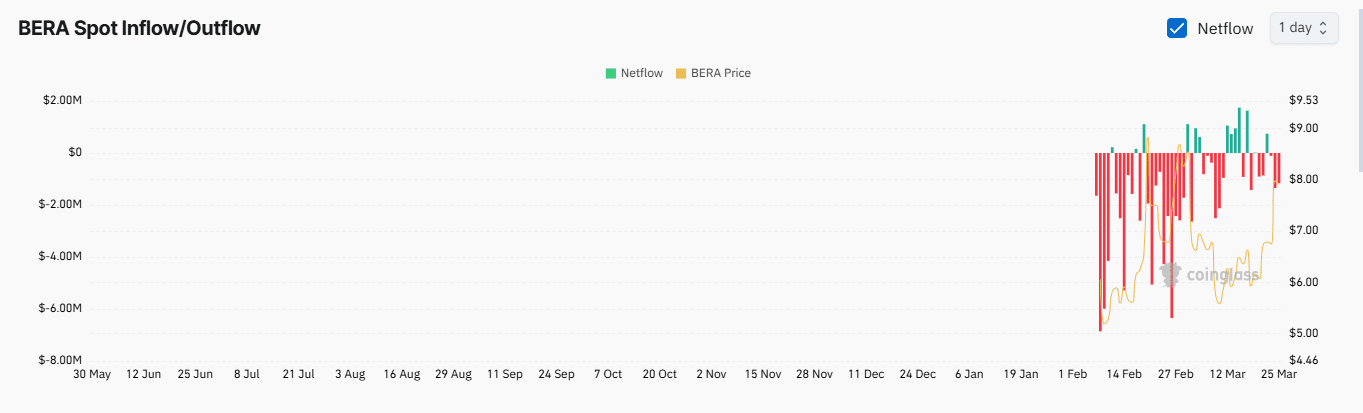

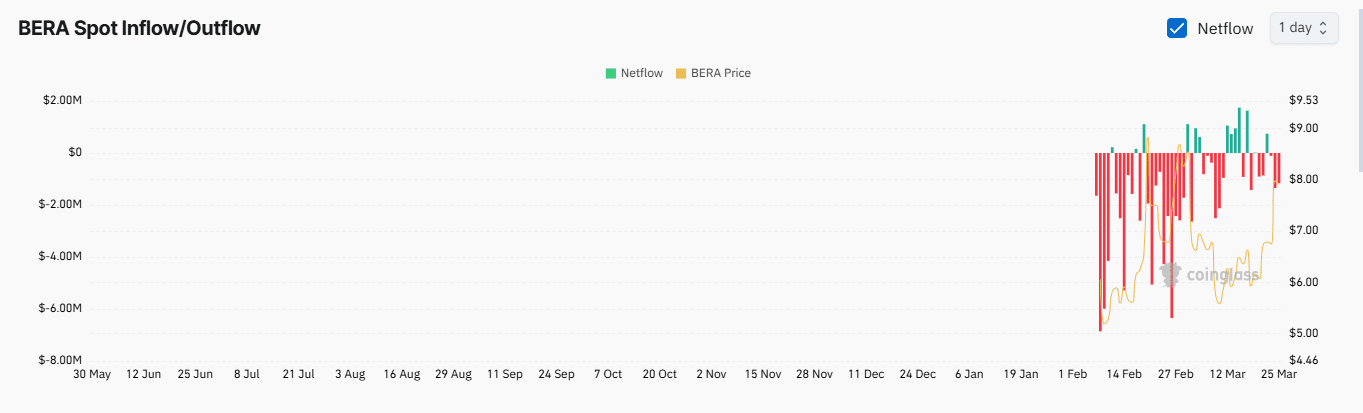

Previously week, Berachain noticed an enormous liquidity outflow, as indicated by Artemis, with $ 19.4 million faraway from the chain, which is often a bearish sign.

Nonetheless, the current improve in Bera’s value is opposite to this pattern.

On the time of writing, spot merchants began to board and purchases $ 2.8 million from Bera within the final three days, as in line with change internet stream information.

Supply: Coinglass

If shopping for exercise extends to the week, this could point out an elevated optimism of the dealer, in order that Bera might drove to additional income.

Derivaten merchants can feed the Rally of Bera

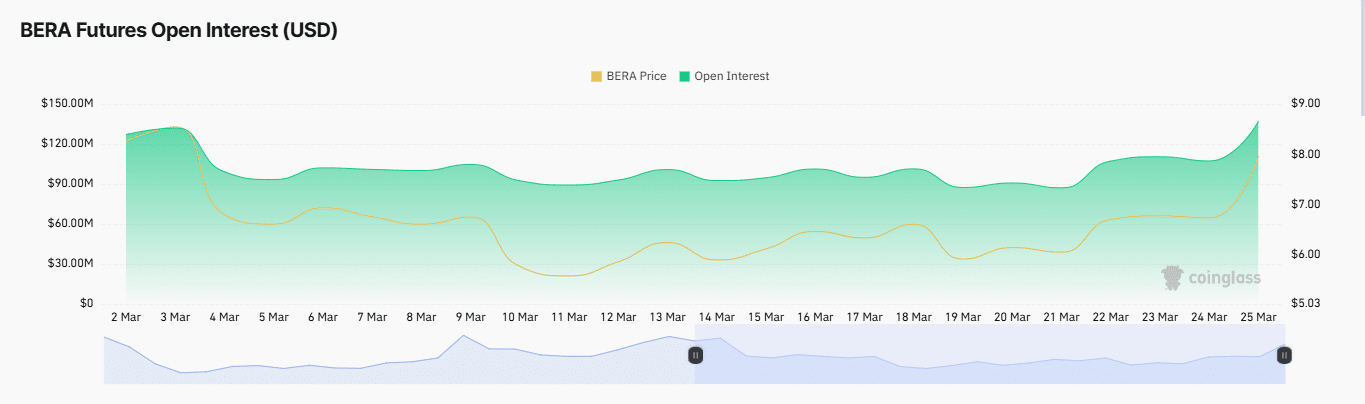

Derivators merchants can act as a catalyst for a possible Bera rally. Presently, vital indicators recommend a shift in Momentum.

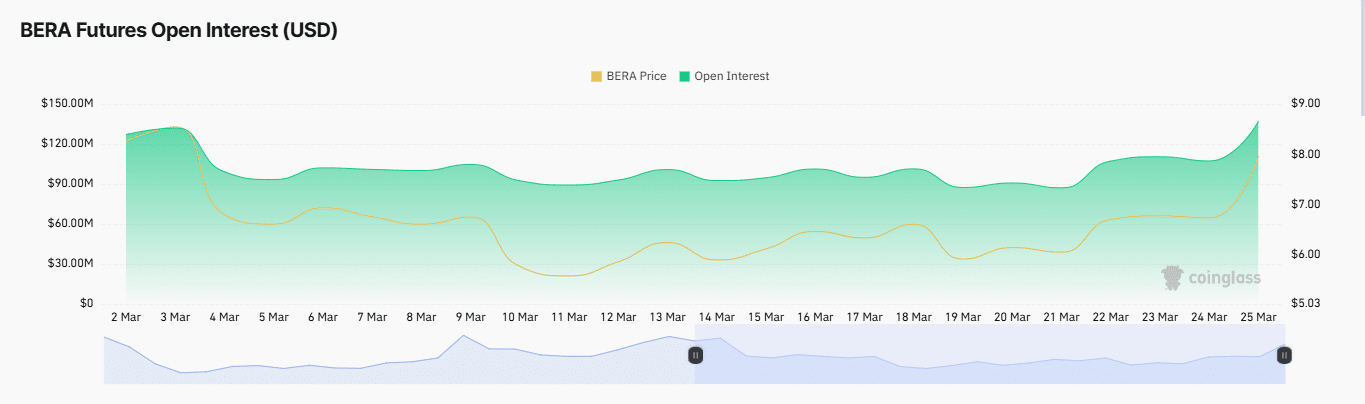

Within the final 24 hours, Bera’s open curiosity rose by 202.2% has risen to $ 136.79 million, indicating a exceptional improve in stressed spinoff contracts.

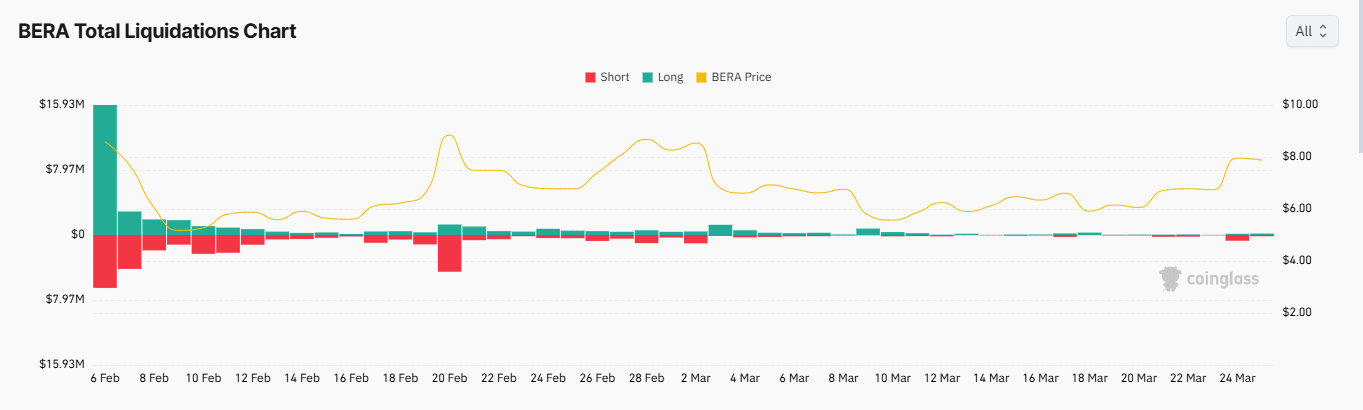

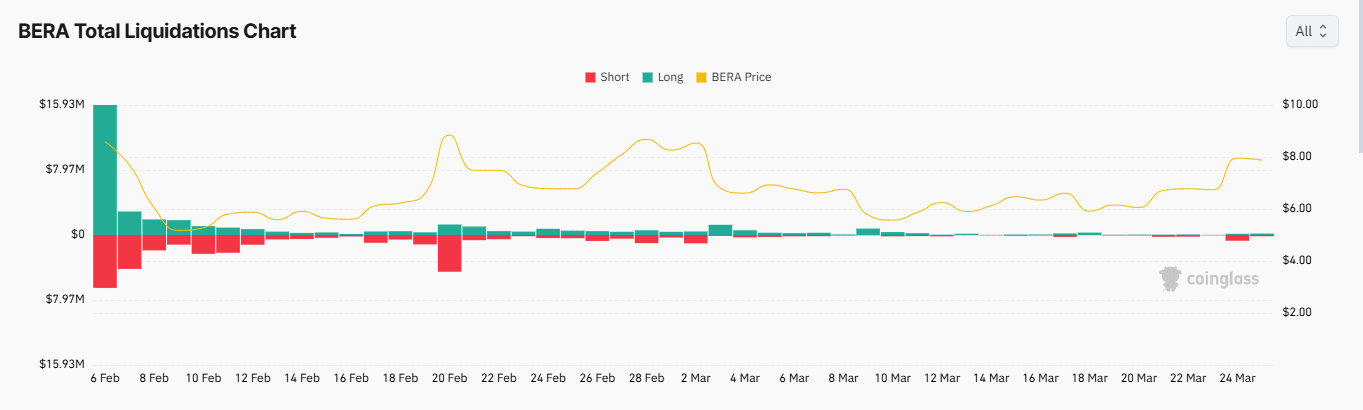

These contracts can favor bulls or bears, however the rising quantity and quick liquidations affirm a bullish pattern.

Supply: Coinglass

Bera’s commerce quantity has additionally risen to $ 595 million within the final 24 hours, which is a illustration of elevated market exercise that has positively influenced its value.

Within the meantime, quick liquidations have elevated, the place merchants wager that Bera misplaced $ 769,000 whereas the market was transferring in opposition to them.

When quick liquidations surpass lengthy liquidations, this means a powerful bullish sentiment, permitting merchants to depart their positions at Cease-Loss ranges.

Supply: Coinglass

Regardless of the general bullish prospects, Ambcrypto found that not all market segments correspond to Bera’s potential for additional revenue.

OKX merchants oppose shopping for, hold promoting Bera

The gross sales stress of derivatives merchants on OKX has been intensified up to now day.

Based on Coinglass information, the long-to-Korter ratio, a metric that signifies that purchasing versus gross sales actions, is at the moment 0.76 on OKX.

A ratio below 1 means that the gross sales stress dominates, and the additional it’s from 1, the stronger the bearish momentum.

With OKX merchants Heavy Bearish, sustainable gross sales can hinder Bera’s possibilities of a direct rally.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International