Bitcoin

Big bets on Bitcoin: Options traders gear up for potential post-election surge

Credit : ambcrypto.com

- Main funds anticipated wild worth swings however had been optimistic about BTC’s potential.

- Nonetheless, analysts anticipated that BTC would fall decrease earlier than a doable restoration.

The end result of the US elections is predicted this week, as is the market positioning of hedge funds Bitcoin [BTC] stays demonstrably bullish regardless of common warning.

Final week, BTC teased an all-time excessive (ATH) after surging above $73,000 on robust demand for BTC ETFs and growing possibilities of Trump profitable.

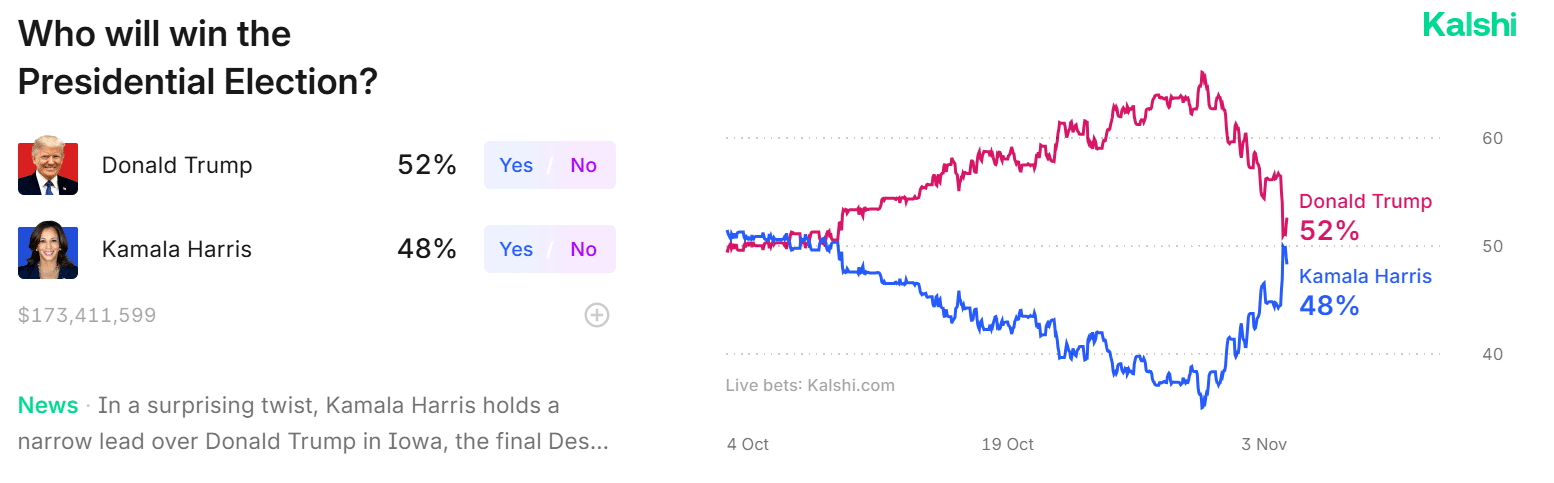

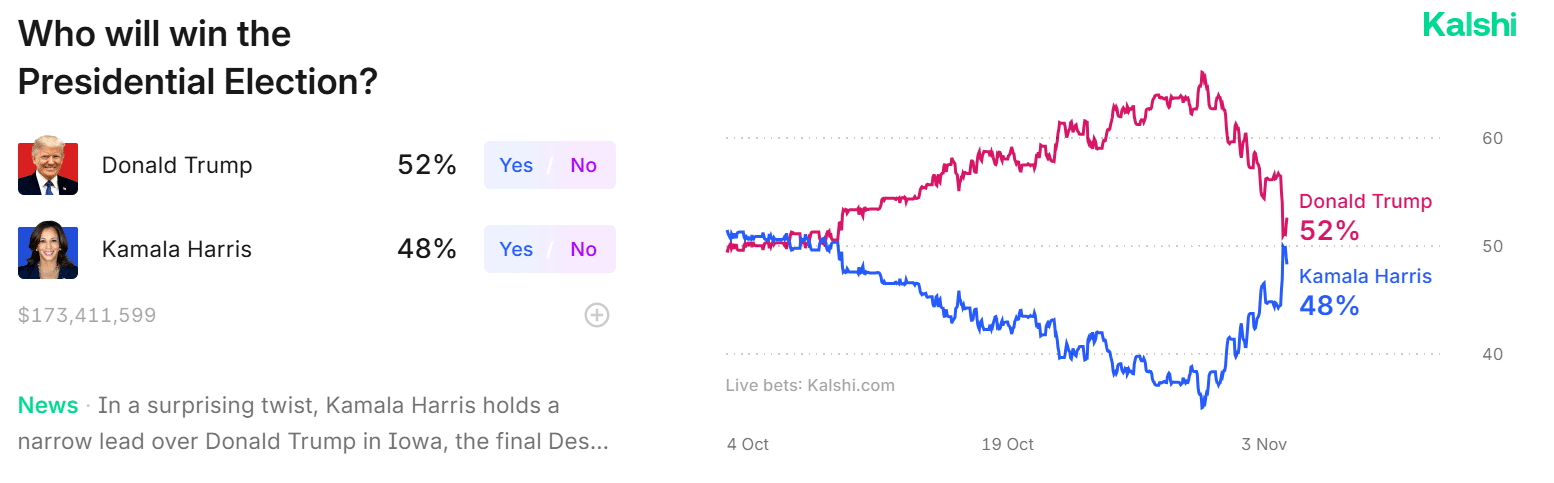

Issues had been totally different throughout election week. As of November 3, Kamala Harris had approached Trump’s odds on Polymarket and was near 50/50 on Kalshi, one other prediction website. In brief, it was an in depth race and any candidate might win.

Supply: Kalshi

Main funds are $70,000-$85,000 for BTC

Regardless of the tight race, hedge funds had been overwhelmingly optimistic, however each side of the market had been hedged as a precaution.

In response to the most recent information from Deribit, the choices market noticed huge name shopping for (bets on worth rises) in November for targets between $70,000 and $85,000. A part of the corporate replace read,

“Overwhelming possibility purchases within the run-up to the elections. Massive fund buy displays (covers?) CME 70+80+85k Nov Name buy with 74-85k Nov Calls + 70k Nov Straddles.”

Moreover, the large bids on straddles (big worth swings) point out the anticipated wild volatility round Election Day. Massive funds purchased each name choices (upside safety) and places (draw back safety) to soak up potential worth swings in both course.

Delay prone to lead to election outcomes?

Maybe a very powerful a part of the Deribit information, nevertheless, was that merchants shifted their focus from possibility expirations on November 8 to November 29. This indicated an anticipated extended delay in election outcomes, seemingly because of controversies or manipulation claims.

“November 8 nonetheless has the bump, however bigger flows on November 29, maybe because of much less theta decay in a long-term consequence, have dominated the previous week.”

This cautious angle within the quick time period might have been the reason for the latest derisking on the spot market on the finish of final week.

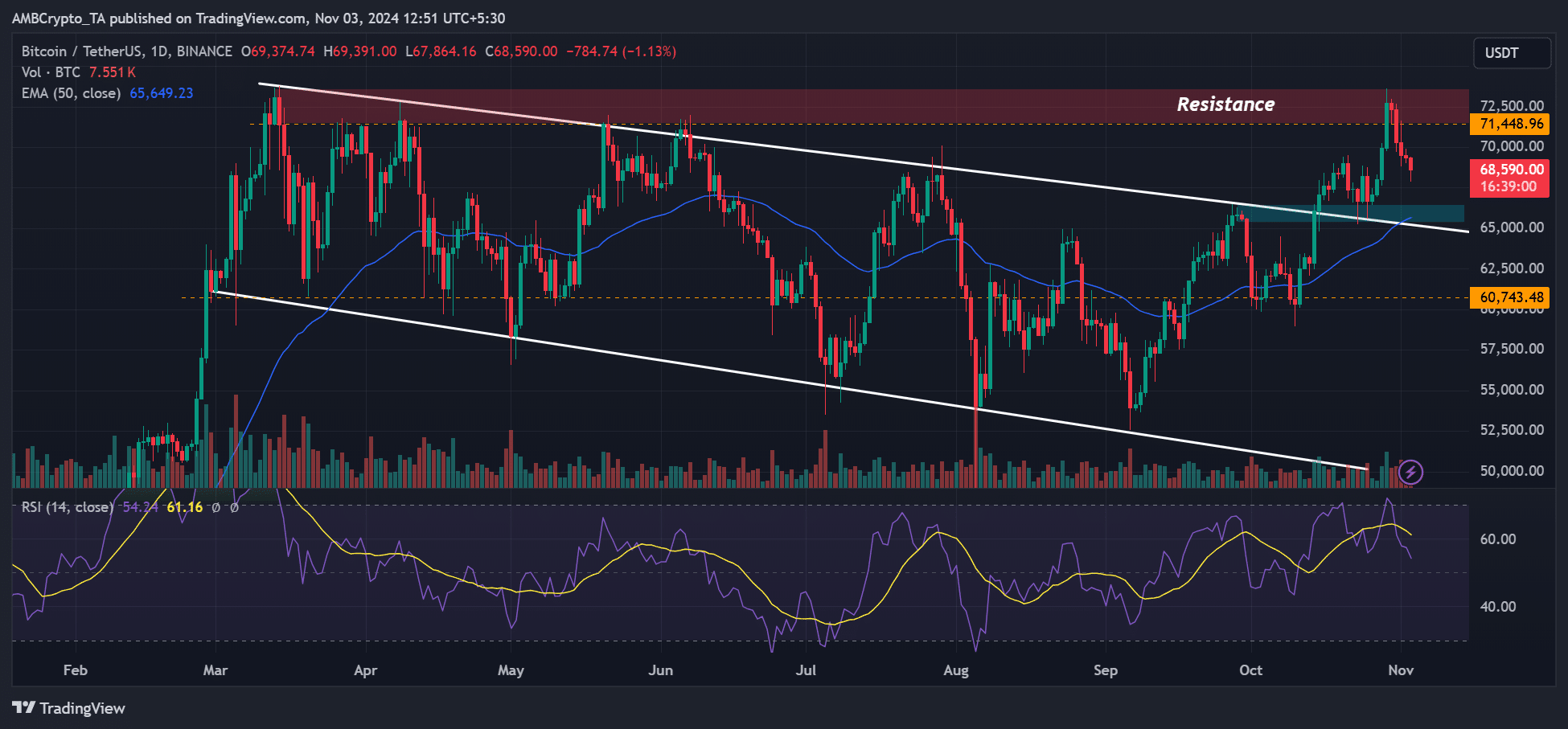

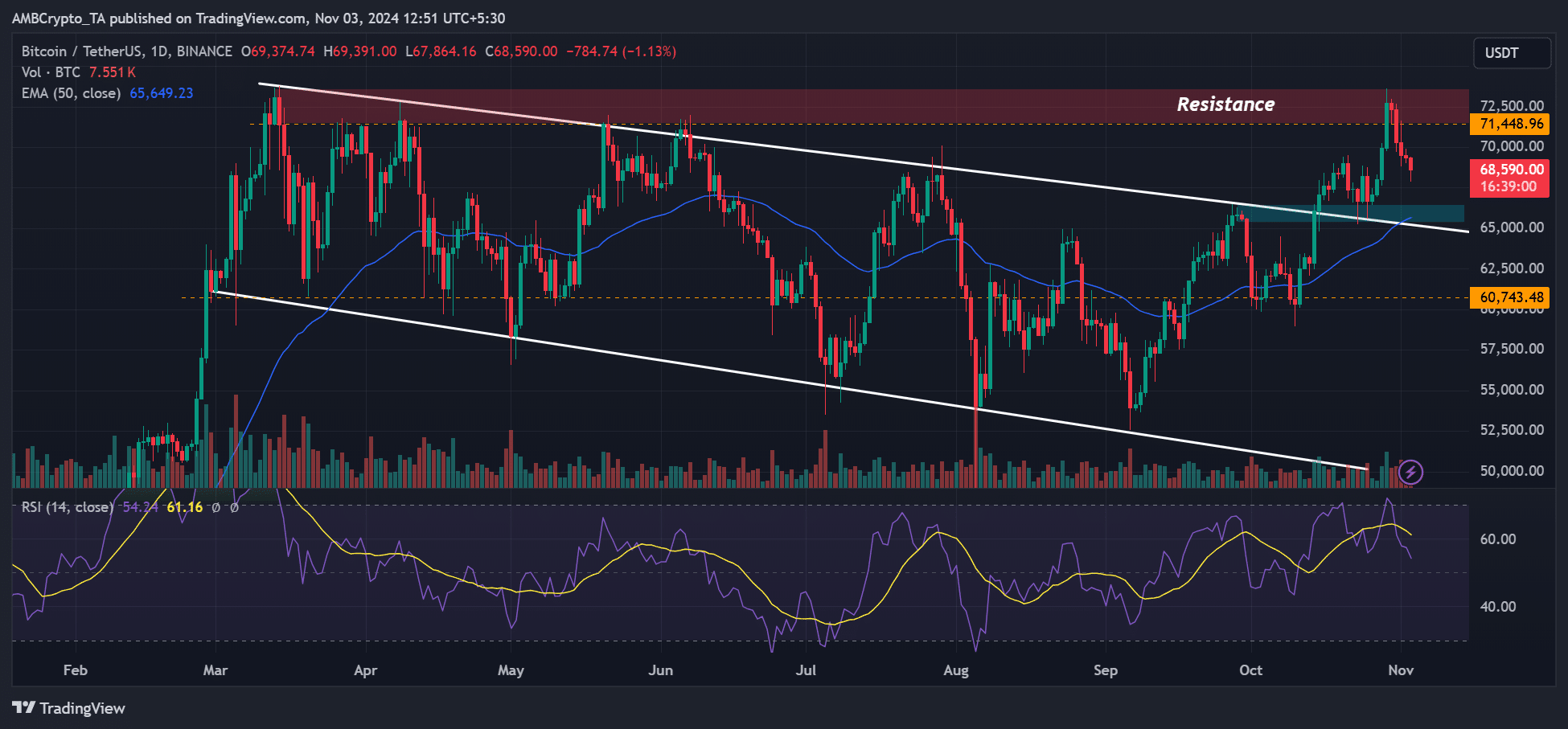

BTC fell from final week’s excessive of $73.6K to under $68K, and a few analysts anticipated it to fall even decrease, citing historic patterns round Election Day.

One of many analysts, Eugene Ng Ah Sio, a crypto dealer, said,

“Seeing constructive threat discount occur at precisely the fitting time. The plot thickens…’

Eugene added that he would keep away from the markets till the election outcomes are identified.

The cautious strategy was echoed by crypto buying and selling agency QCP Capital, warning that the election consequence may very well be a sell-the-news occasion. It stated:

“Whatever the consequence, we consider the election might be one other sell-the-news transfer that may replicate the Bitcoin convention in Nashville.”

One other market observer and investor, Mike Alfred, shared an analogous sentiment, however identified that this may very well be the final week to purchase BTC below $70,000.

“Each earlier cycle, Bitcoin has made a low worth the week of the US election that has NEVER been revisited… This week would be the final time you may ever purchase Bitcoin below $70,000.”

Supply: BTCUSDT, TradingView

On the worth charts, $65,000 remained a key stage (confluence space) ought to the pullback be decrease.

Nonetheless, the positioning of main funds was a telltale signal of doable restoration for BTC regardless of the uncertainty surrounding the election consequence.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024