Bitcoin

Binance stablecoin outflows soar – Why this affects Bitcoin

Credit : ambcrypto.com

- The latest weak sentiment has been marked by prolonged outflows of Binance stablecoins.

- USDT’s dominance additionally elevated as buyers selected to protect capital when markets plummeted.

This week’s risk-off sentiment has unnerved some crypto buyers, forcing most to lock of their income or choose out altogether to protect capital.

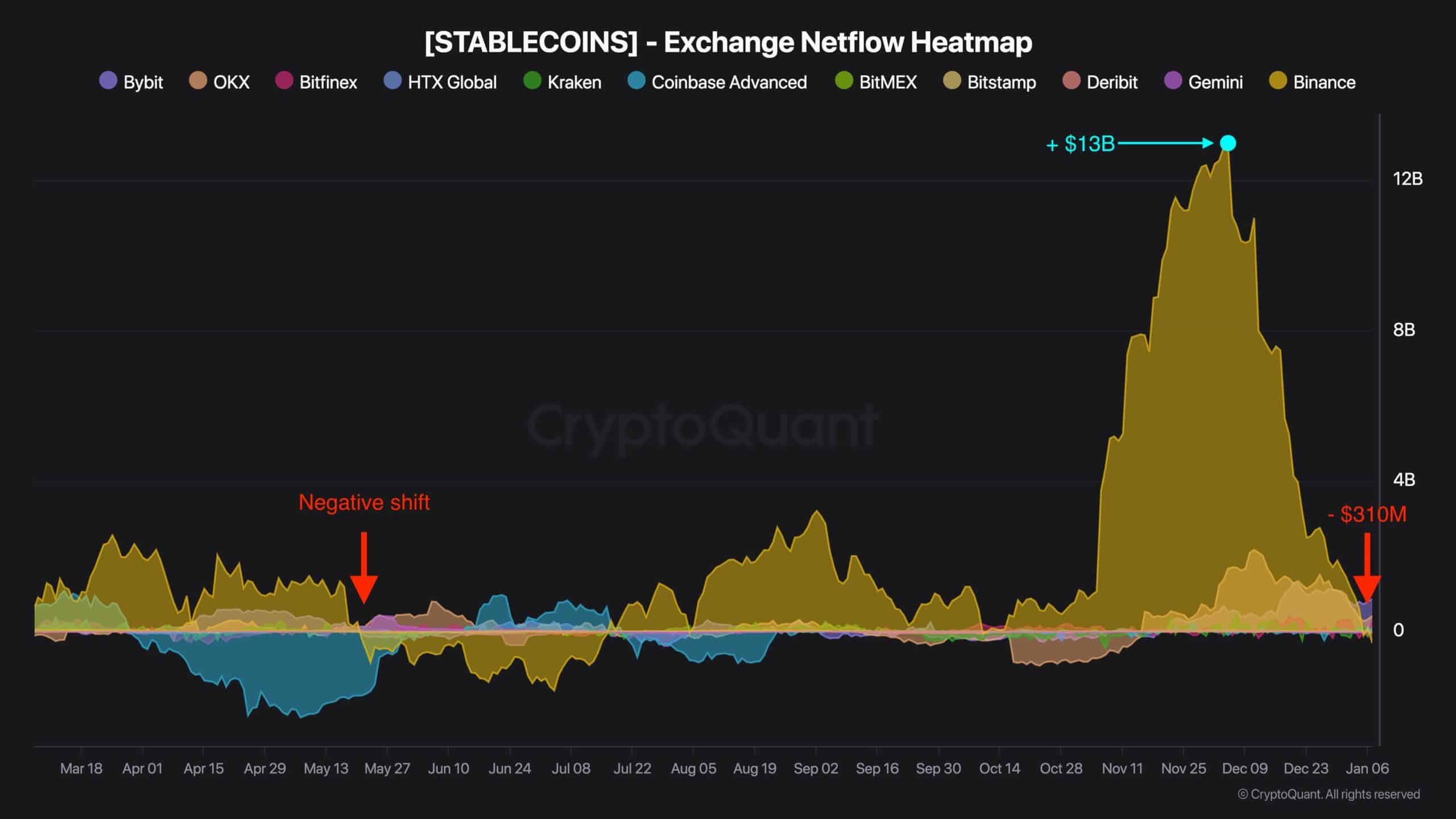

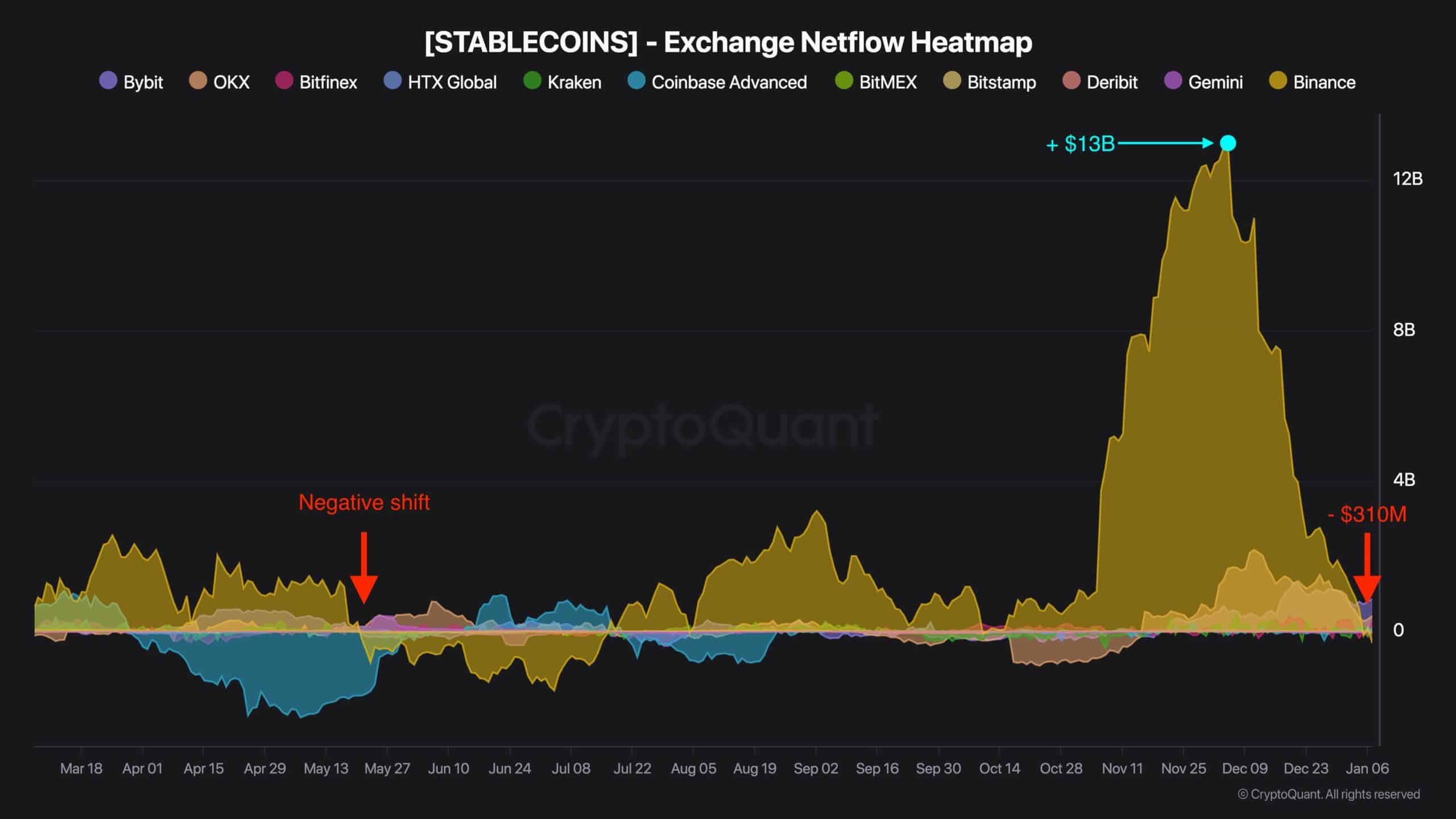

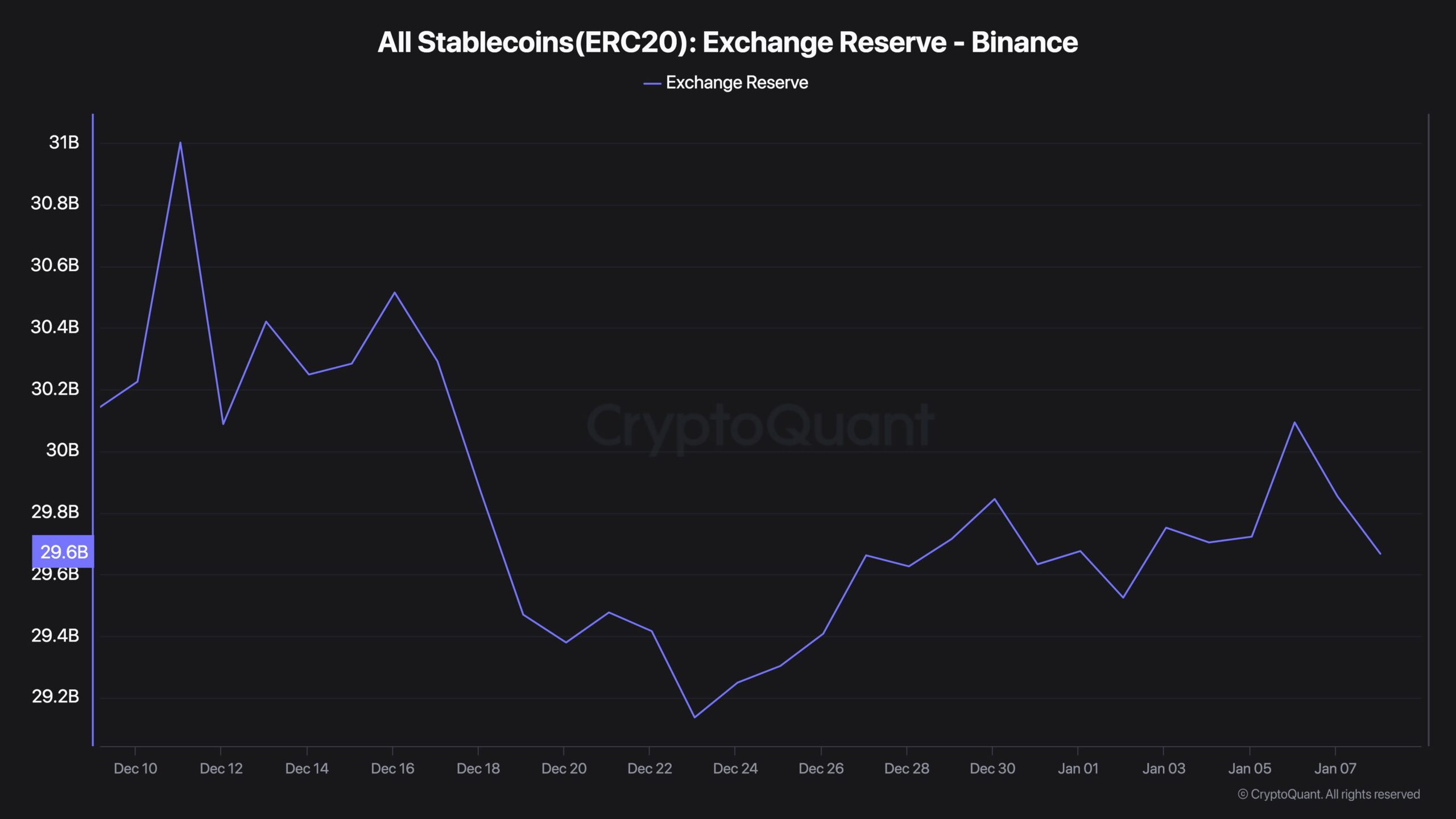

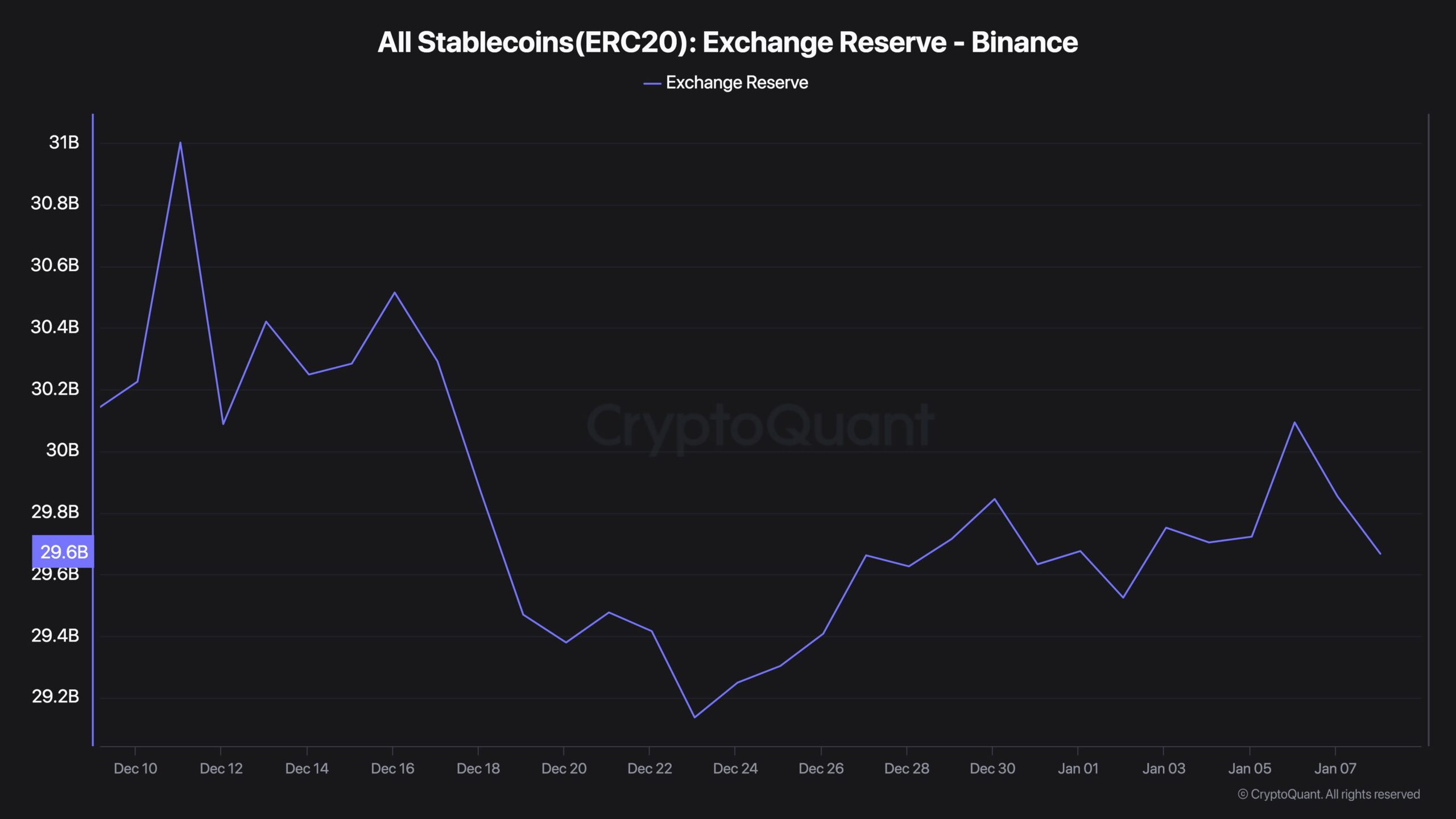

Based on pseudonymous CryptoQuant analyst Darkish Fost, Binance stablecoins’ reversal from an influx of +$13 billion in November to an outflow of $310 million in early January mirrored final summer season’s BTC market stoop.

He declared,

“We’re at present witnessing a reversal within the dynamics of stablecoin move on Binance. The sort of pattern reversal was final noticed in Could 2024, simply earlier than Bitcoin’s sharp value drop over the summer season.”

Supply: CryptoQuant

Bitcoin market on edge

Fost added that tepid stablecoin inflows usually point out weak buying energy.

Nonetheless, he warned that continued outflows seen since mid-December underlined market warning and will hit the economic system. Bitcoin [BTC] prospects.

“Whereas a discount in stablecoin inflows alerts weakening shopping for strain, outright stablecoin outflows point out a bigger market shift, with buyers leaning towards warning.”

Supply: CryptoQuant

The weak market sentiment was attributable to persistent US inflationThis reinforces the Fed’s sluggish rate-cutting path, which might stagnate asset dangers.

Moreover, the hawkish FOMC minutes and information that the US authorities would reportedly be allowed to promote Silk Street’s seized BTC dampened market optimism.

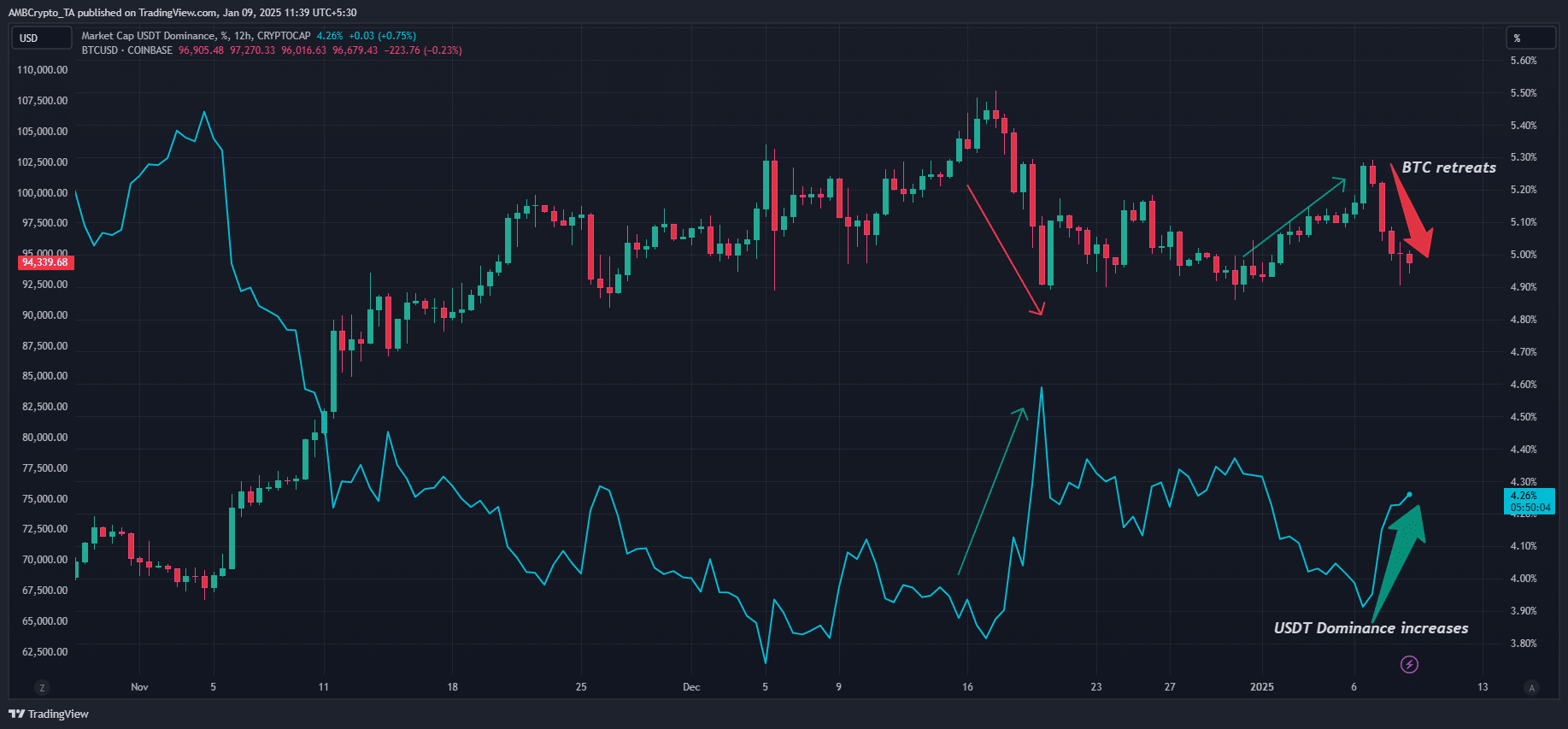

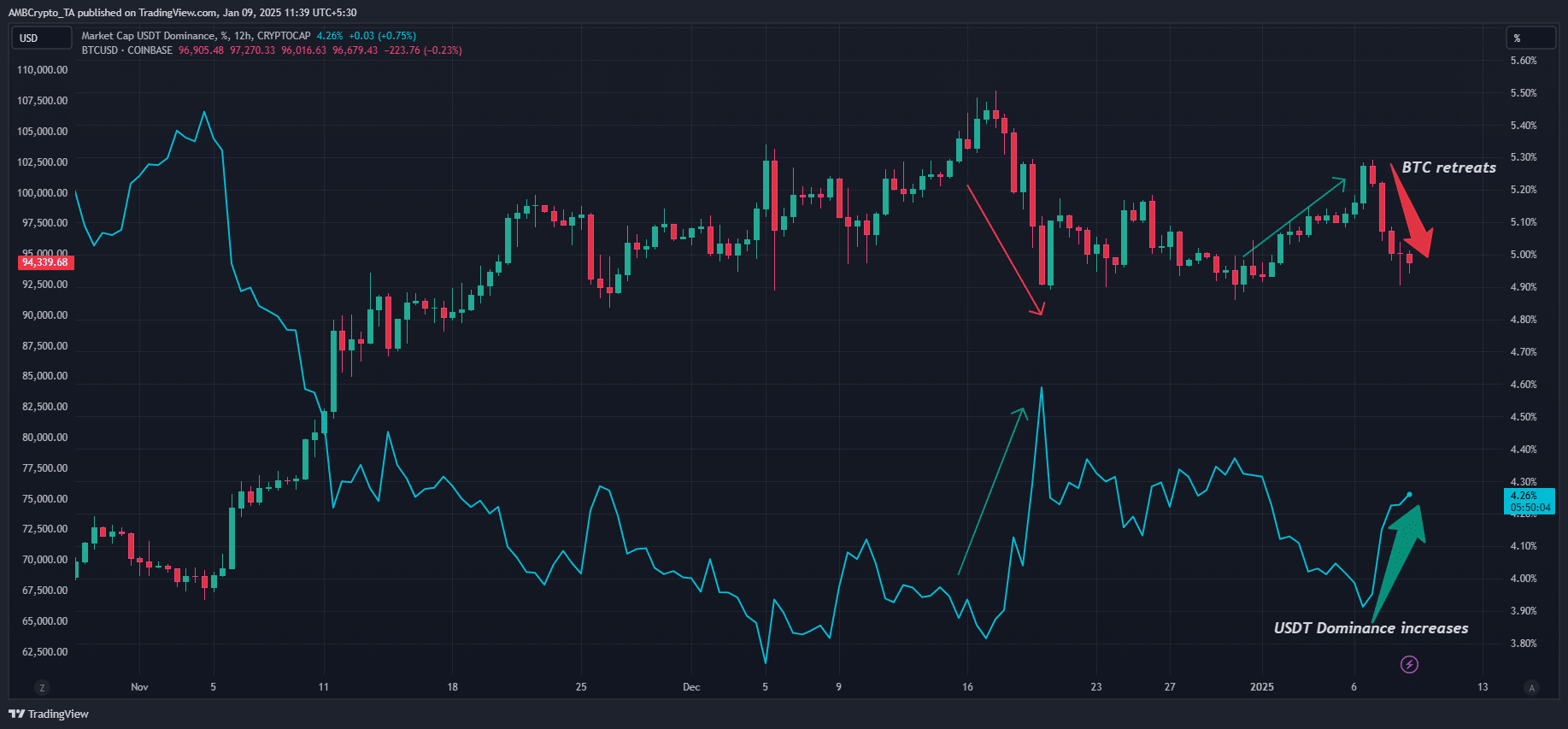

The rising dominance of Tether (USDT) additionally confirmed Darkish Fost’s issues. The indicator is inversely correlated with the BTC value, and the latest highs marked the native prime at $108,000 and $102,000.

Some analysts, reminiscent of Peter Brandt, beforehand warned that BTC’s inverse head-and-shoulders sample might drag the value to the $75,000 stage if it breaks under $90,000.

Supply: TradingView (USDT Dominance vs BTC Efficiency)

Whether or not USDT dominance will rise above 4% once more and permit BTC to get better stays unsure.

Nonetheless, Benjamin Cowen and CoinDesk’s senior analyst James Van Straten downplayed the latest drop in BTC as a typical January pullback in the course of the 12 months after the halving.

On the time of writing, the asset was attempting to stabilize above $94,000.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024