Bitcoin

Bitcoin above $90K – $5.42 billion in profits despite rising sell pressure means…

Credit : ambcrypto.com

- Bitcoin made $5.42 billion in income

- Rising web flows noticed BTC face near-term promoting strain close to $90,000

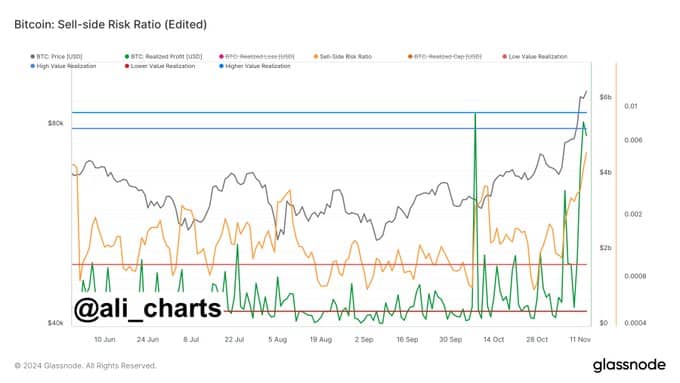

Bitcoin (BTC) has achieved a revenue of $5.42 billion, in line with the corporate market analyst Ali, whereas the sell-side threat ratio rose to 0.524%. This metric, which evaluates the steadiness between threat and reward for sellers, stays under historic highs, indicating that promoting strain will not be but at excessive ranges.

However, merchants are suggested to train warning as profit-taking will increase.

Supply: Glassnode

Realized income rose quicker than realized losses, with income rising in direction of $8 billion, whereas losses have been restricted to round $1 billion on the time of writing. Such an imbalance is an indication of market optimism, as extra buyers reap the benefits of good points as an alternative of promoting at a loss.

The Bitcoin market stays resilient regardless of the latest worth drop

Bitcoin traded above $91,000 on the time of writing, with a 24-hour buying and selling quantity of $84.43 billion. Though the cryptocurrency lately corrected on the charts, BTC rose just below 4% over the previous 24 hours.

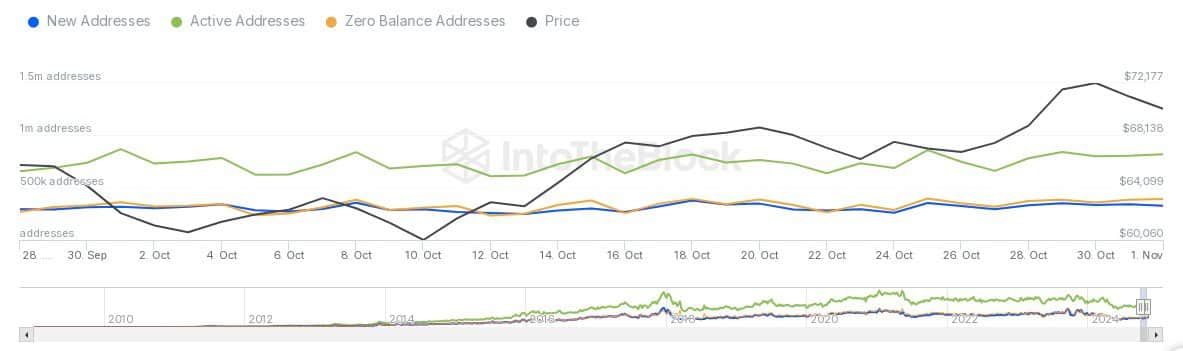

On the identical time knowledge from IntoTheBlock revealed that 307,000 addresses collected Bitcoin round a median worth of $89,200. This degree may act as a vital zone of help or resistance relying on the route of the market.

Supply: IntoTheBlock

Bitcoin’s skill to keep up its worth close to this degree will likely be intently watched as market contributors assess its subsequent transfer.

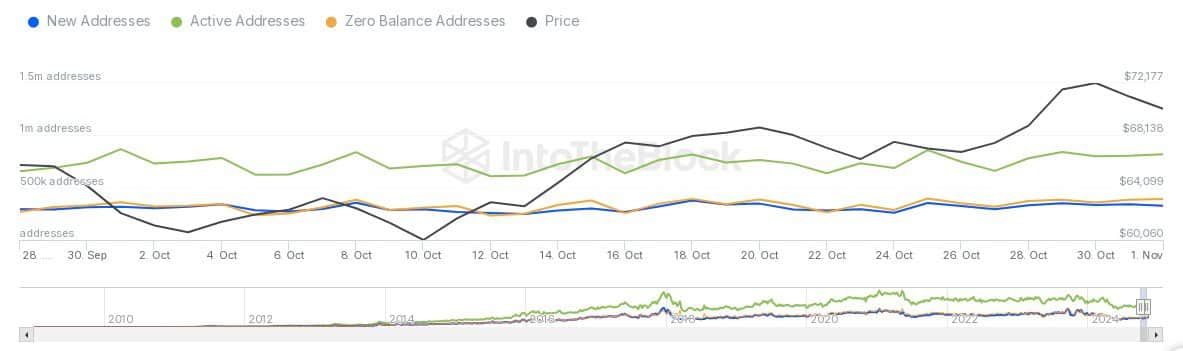

Community exercise displays rising adoption

The rise within the worth of Bitcoin correlated with a rise in community exercise. Actually, the information confirmed that there was a rise in each new and energetic addresses – an indication of elevated participation.

New addresses have additionally been steadily added, reflecting the brand new inflow of customers into the ecosystem. Energetic addresses, which characterize contributors in every day transactions, additionally elevated to ~1.1 million, demonstrating sustained community engagement.

Supply: IntoTheBlock

In the meantime, the variety of zero steadiness addresses has remained comparatively flat, indicating no noticeable enhance in dormant or deserted wallets.

This pattern might be interpreted as an indication of sustained belief and neighborhood involvement, whilst Bitcoin’s worth fluctuates on the charts.

Brief-term promoting strain?

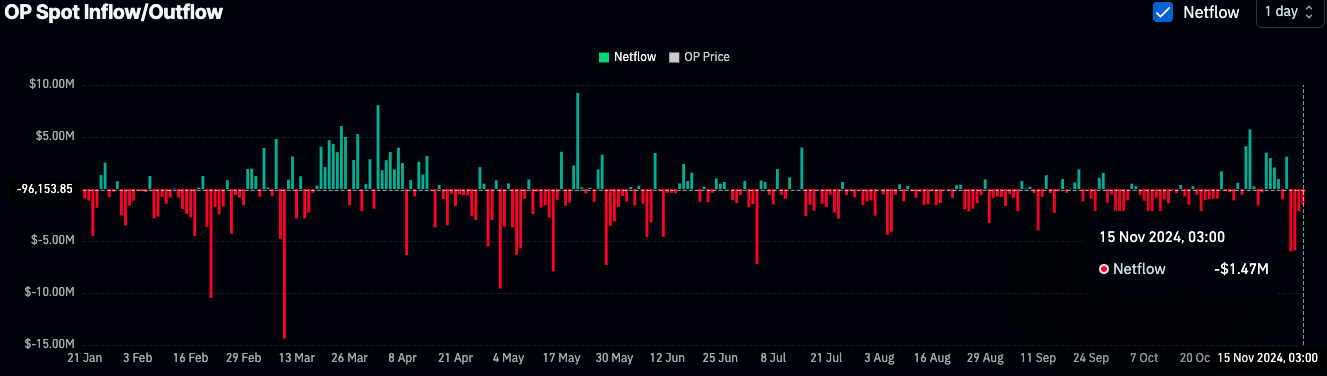

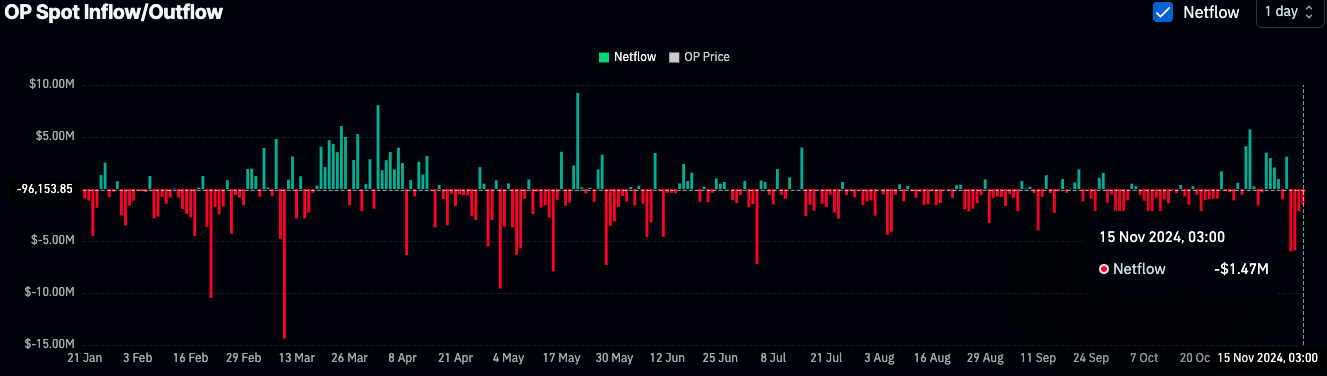

Internet inflows of $128.46 million have been recorded on November 15, indicating a attainable enhance in promoting strain.

Traditionally, increased inflows into inventory markets have been related to short-term corrections as merchants look to capitalize on latest good points.

Supply: Coinglass

And but Bitcoin’s efficiency has remained robust, supported by intervals of accumulation earlier this 12 months. Between Could and August, constant detrimental web flows indicated large-scale withdrawals from inventory markets, typically linked to institutional or long-term buyers.

This accumulation section doubtless fueled Bitcoin’s latest rally, which noticed its worth rise from $25,000 to over $90,000.

Broader financial components may decide Bitcoin’s future

Based on a latest AMBCrypto reportThe uncertainty surrounding regulatory insurance policies and sovereign debt ranges may affect Bitcoin’s worth trajectory.

The brand new authorities may introduce fiscal measures to deal with the debt downside, which may enhance inflation dangers.

Moreover, with the Bitcoin/Gold ratio having peaked at 35, Bitcoin is now valued at 35 instances the worth of gold, which is an annual excessive. It is a signal of Bitcoin’s continued outperformance towards conventional belongings, even in instances of macroeconomic uncertainty.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now