Bitcoin

Bitcoin analysis: Will rising high-yield credit rates boost BTC above $60K?

Credit : ambcrypto.com

- Excessive-yield credit score charges flip bullish after the outbreak.

- Bitcoin Worth Motion at Essential Assist.

Bitcoin [BTC] has turn out to be a focus in discussions, particularly after the recession yesterday, August 28.

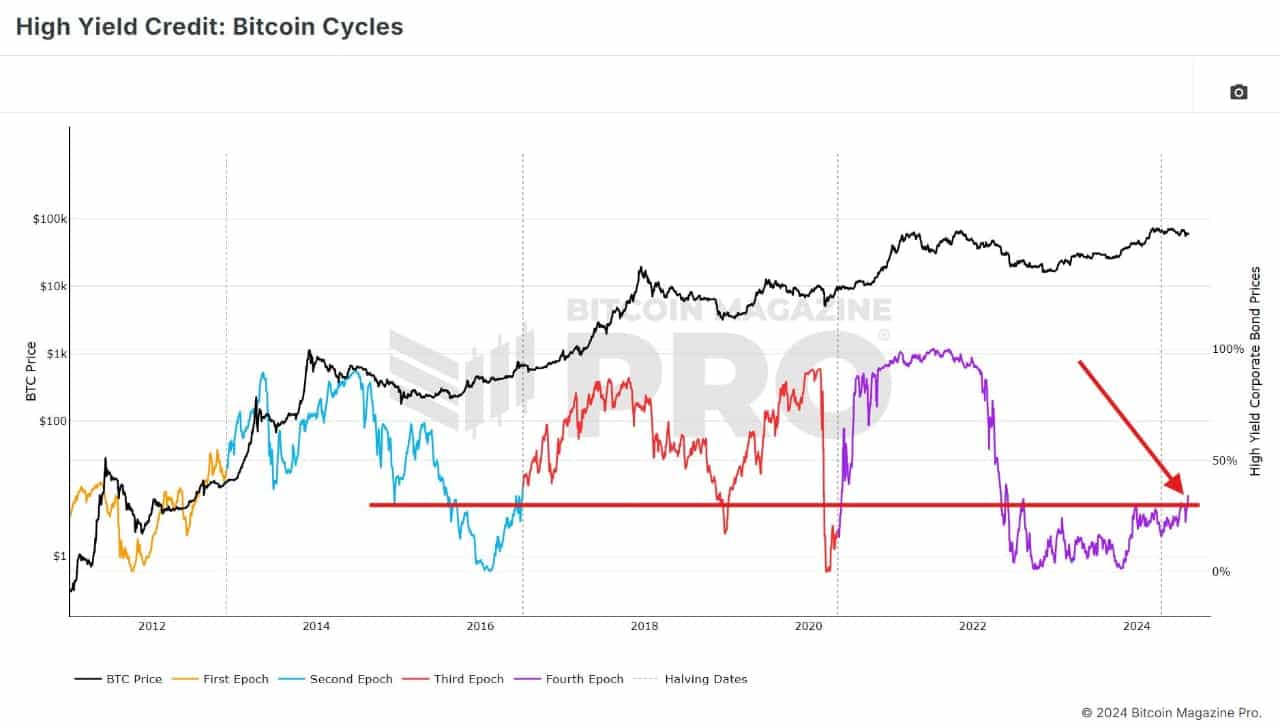

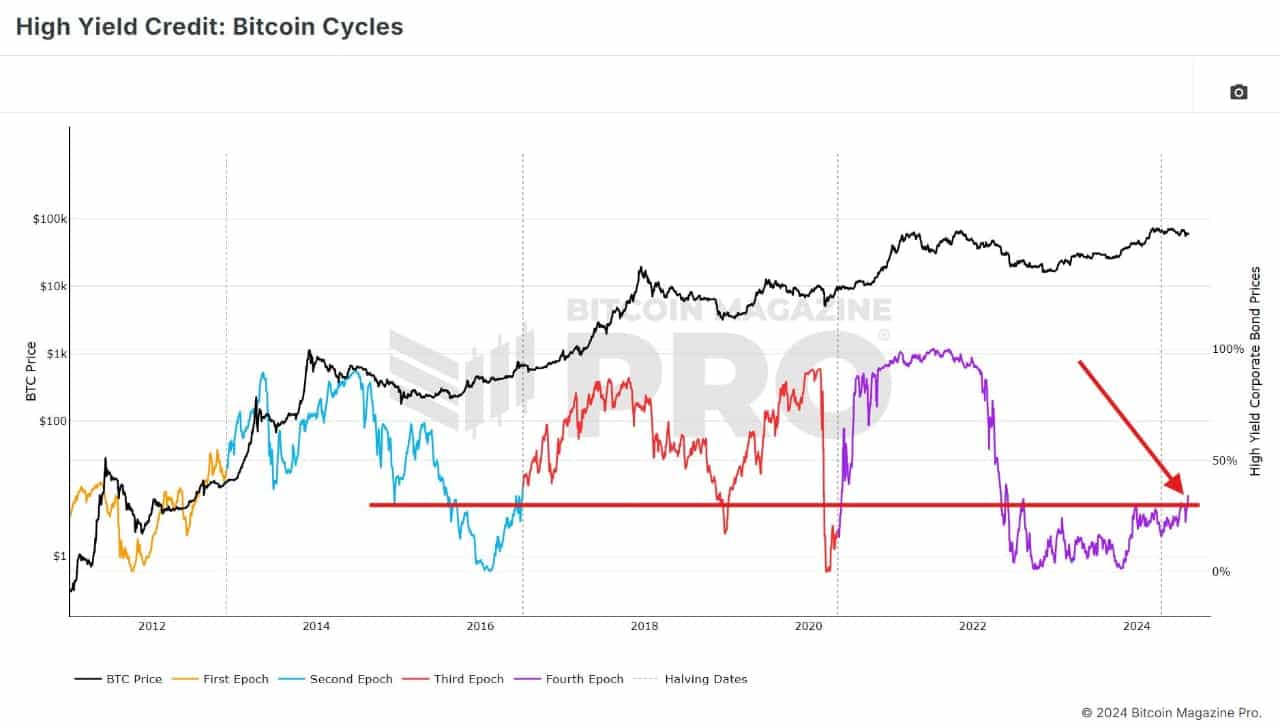

An evaluation of high-yield credit score charges reveals a bullish breakout from the trough, indicating elevated investor optimism in regards to the international financial system.

This shift in sentiment is contributing to a rising danger urge for food for dangerous belongings, together with Bitcoin. This pattern is predicted to positively affect the Bitcoin worth, probably pushing it greater.

Supply: Bitcoin Journal PRO

The actions in high-yield lending charges may play a major function in shaping market dynamics, making it important to observe how these developments affect Bitcoin and different belongings.

With BTC presently at a vital four-hour help, the query turns into: will this newfound danger urge for food assist Bitcoin recuperate from its current losses?

Essential help

The BTC/USDT pair focuses on Bitcoin worth motion and is presently consolidating throughout the $59,000 – $60,000 vary over a 4-hour timeframe.

9 consecutive 4-hour candles have failed to interrupt under this essential help degree, resulting in hypothesis that BTC might have gathered the required liquidity round this vary. Nevertheless, the weekly candle nonetheless presents a worrying outlook.

Supply: TradingView

Given rising danger urge for food and the potential for upcoming charge cuts, intently monitoring Bitcoin efficiency in September can be essential because it may decide the course for BTC within the coming months.

Bitcoin RSI is approaching extraordinarily oversold ranges

Furthermore, BTC’s Relative Power Index (RSI) is approaching extraordinarily oversold ranges. Whereas there is probably not an instantaneous restoration, traditionally such RSI ranges have typically preceded important worth reversals.

Because the indicator approaches the reversal zone, growing danger urge for food may assist BTC reverse its current losses and presumably goal for the $70,000 worth degree.

Supply: Dealer Tardigrade/Buying and selling View

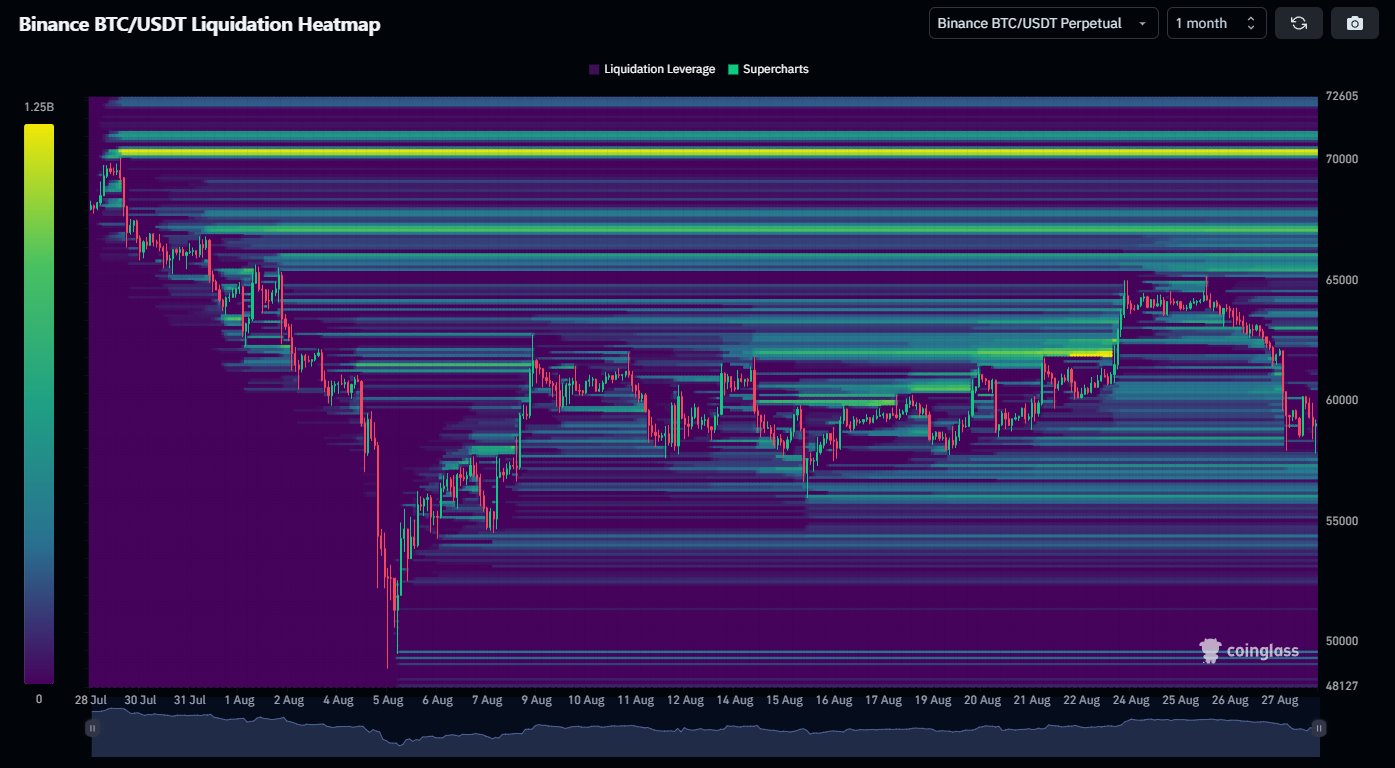

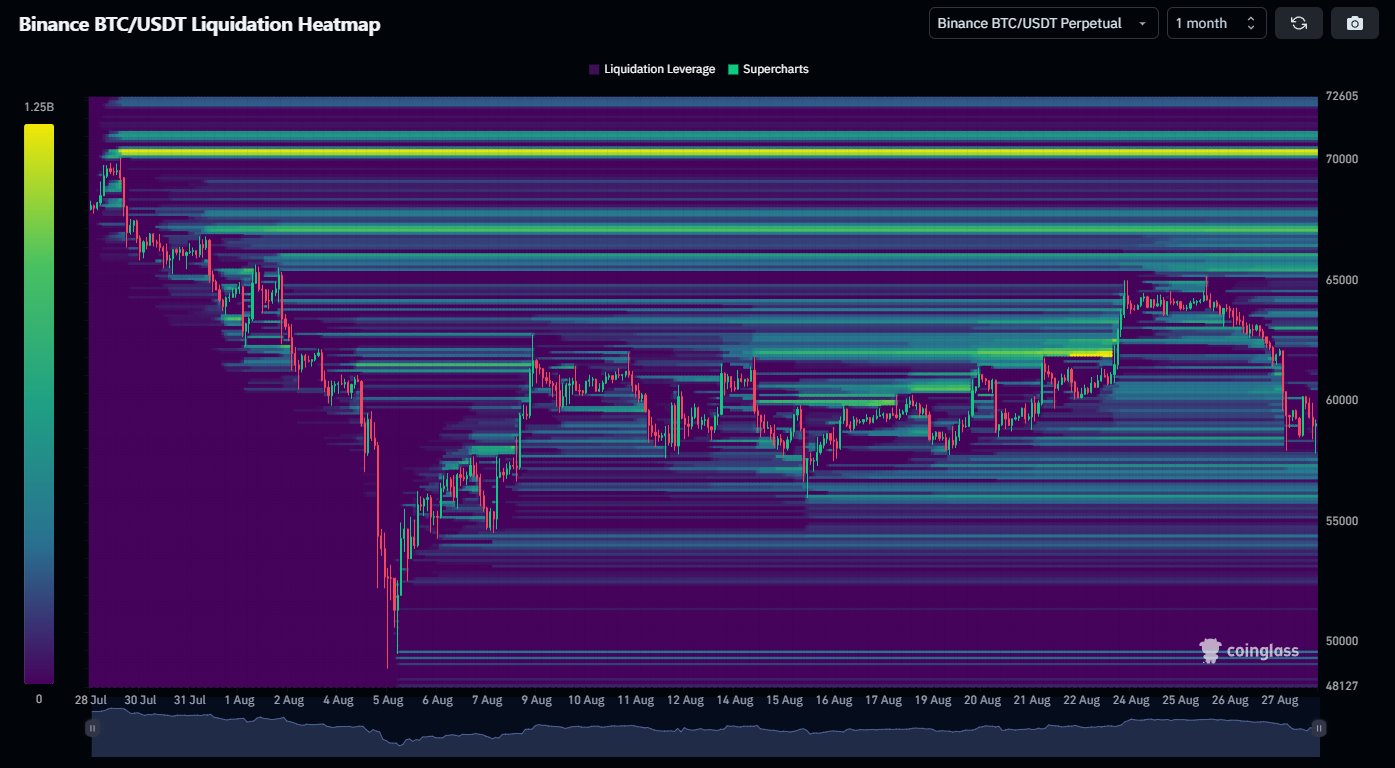

Liquidity evaluation

Liquidity evaluation additionally reveals that Bitcoin has lately absorbed important liquidity under $60,000, with costs briefly falling under $58,000.

Nevertheless, a major liquidity zone awaits above $70,000. If BTC fails to interrupt under the present help degree, there’s a sturdy expectation that the value will attain this greater zone once more.

Whereas it’s nonetheless too early to fixate on this goal, if the Bitcoin worth begins buying and selling inside a number of % of this degree, it turns into extra seemingly that liquidity can be taken away.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth forecast 2024-25

For now, BTC stays on the decrease finish of this vary, so vigilance is suggested. Bitcoin’s worth motion, pushed by rising urge for food for danger, may mark a restoration from current losses, particularly if essential help ranges maintain.

The potential for BTC to maneuver greater is evident, however requires cautious remark of key indicators and market dynamics.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now