Bitcoin

Bitcoin – Analyzing IF there’s a red flag ahead for BTC’s price

Credit : ambcrypto.com

- Rising change fee and stroll in put choices instructed that Bitcoin can quickly be confronted with gross sales strain

- Bitcoin’s Choices Market revealed an elevated demand for downward safety

Bitcoin [BTC] May be on the best way to turbulent waters. A pointy enhance in whale exercise and the rising warning on the choice market blink early warning alerts.

Because the change fee ratio climbs to the best stage in additional than a yr and Choices Outpace calls in each volumes and premium locations, merchants appear to be scraped for potential drawback.

The shift in sentiment means that a few of the largest gamers out there could also be getting ready to promote, which will increase the potential of extra volatility within the coming days.

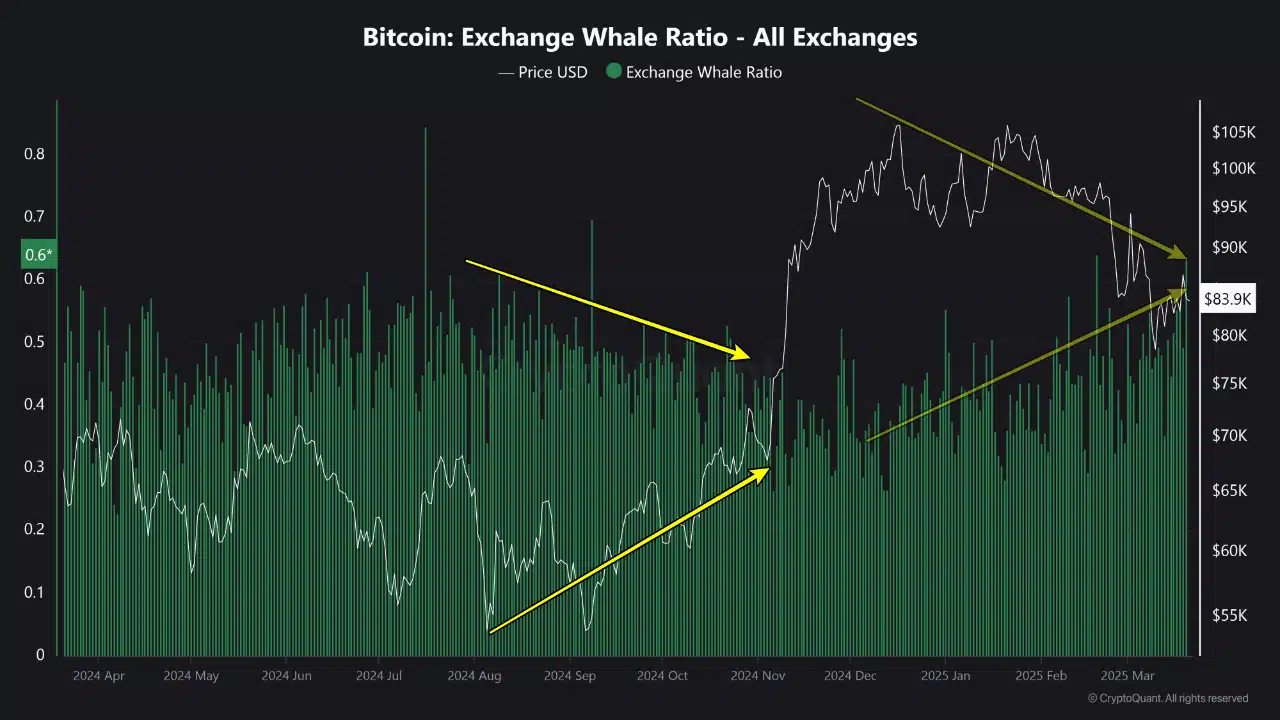

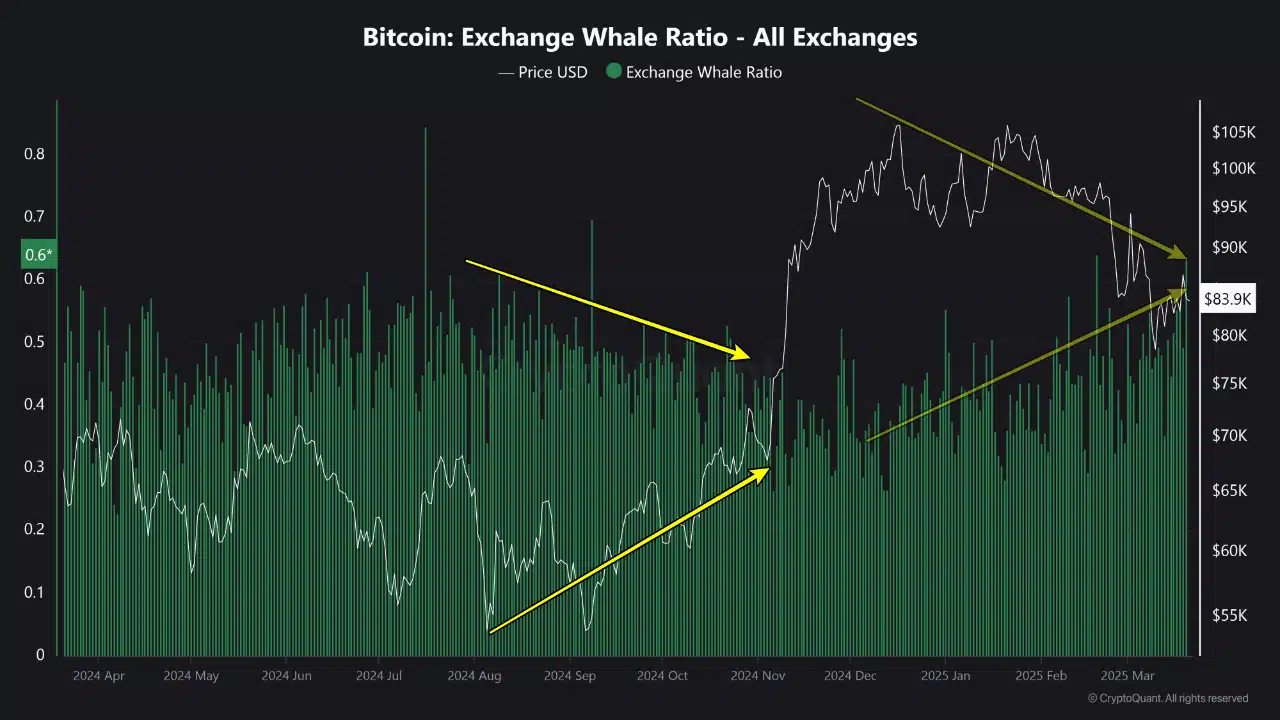

Change whale ratio – A sign of potential gross sales strain

The exchange rate ratio Climbed to 0.6 – the best studying in additional than a yr.

This peak indicated that enormous holders, or whales, at the moment are answerable for a major a part of Bitcoin who introduce exchanges. Traditionally, such conduct precedes the tendency to precede massive market actions, which frequently point out a stroll in gross sales actions.

Supply: Cryptuquant

As is clear from the graph, comparable peaks have been adopted by exceptional value decreases in mid -2024.

The most recent stroll coincided with Bitcoin’s current value racement of his all time-one signal that whales might once more be a red-raised belongings pending the weak spot of the market. If the traits from the previous retain, elevated whale ratio ranges can violate volatility.

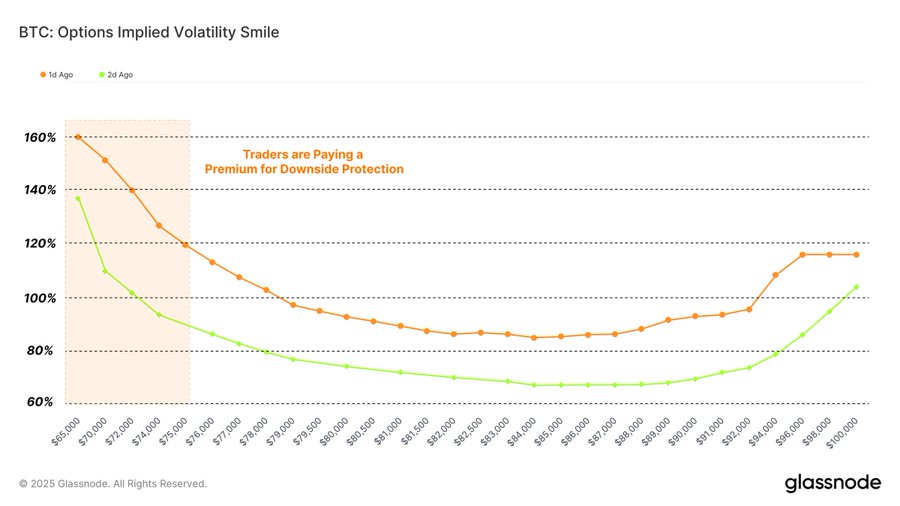

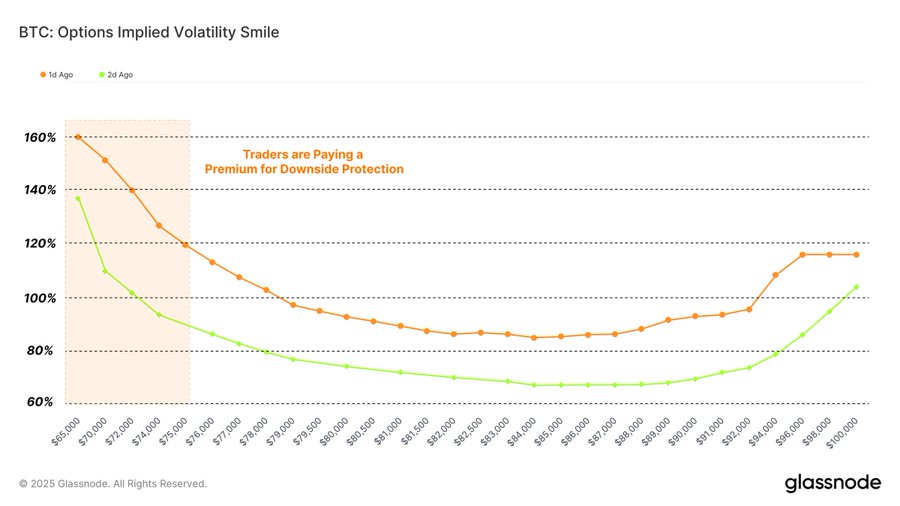

Bitcoin Choices Market – Rising demand for downward safety

The choice market of Bitcoin can also be cautiously indicators of warning.

Choices allow traders to cowl themselves at value adjustments and the time positioning of the press revealed a transparent tilt in response to threat aversion. The implicit Volatility Smile Chart emphasised that merchants pay a premium for put choices, in comparison with calls, particularly for train costs under $ 80,000.

Supply: Glassnode

This pattern May be interpreted to check with the rising demand for downward safety, whereas traders are braced for potential decreases.

The steep left distance on the graph hinted with an elevated worry of brief -term volatility and appeared to strengthen the shift from the broader market to defensive methods. This enhance in premiums can also be an indication of investor sentiment that’s cautious, in accordance with whale exercise within the chain, whereas she factors to a extra cautious prospect for Bitcoin within the brief time period.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024