Ethereum

Bitcoin and Ethereum Funds Lost $876 Million Despite Trump’s Strategic Crypto Reserve Announcement

Credit : coinpedia.org

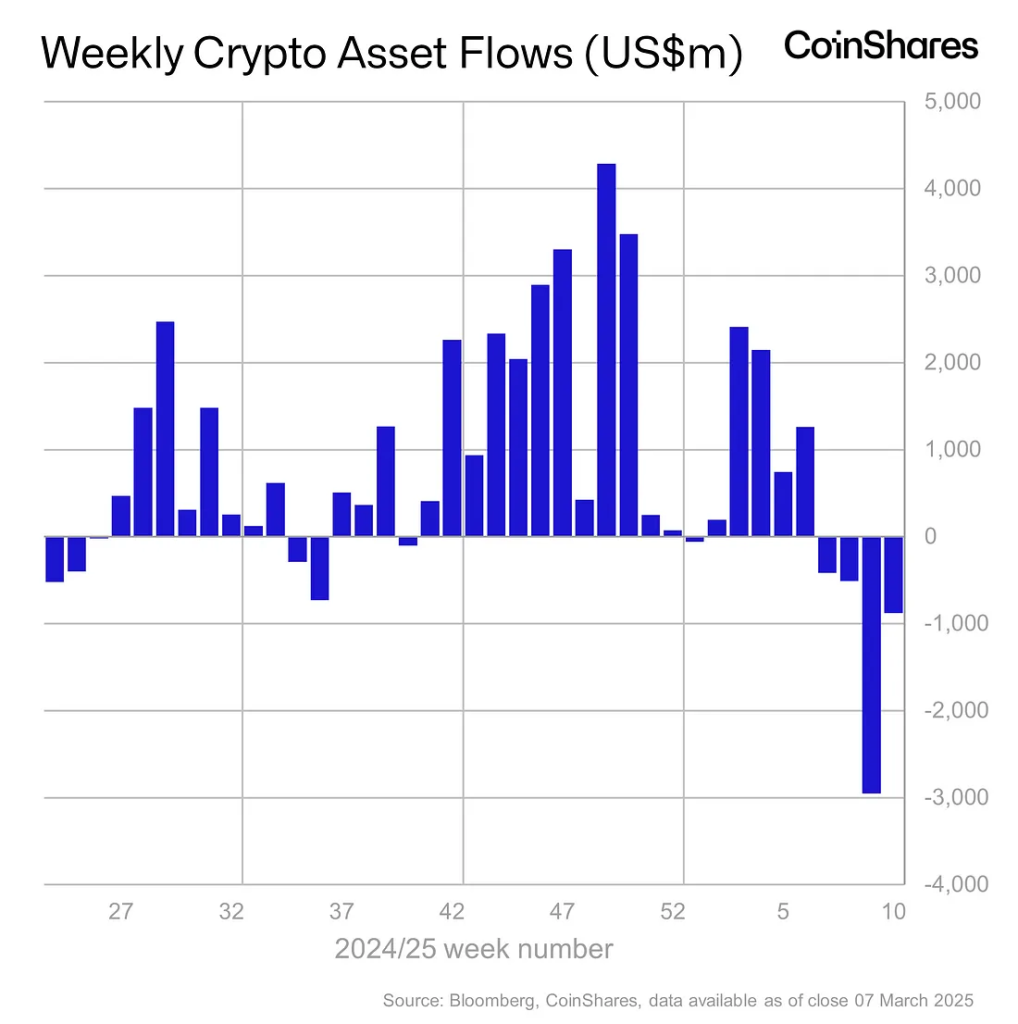

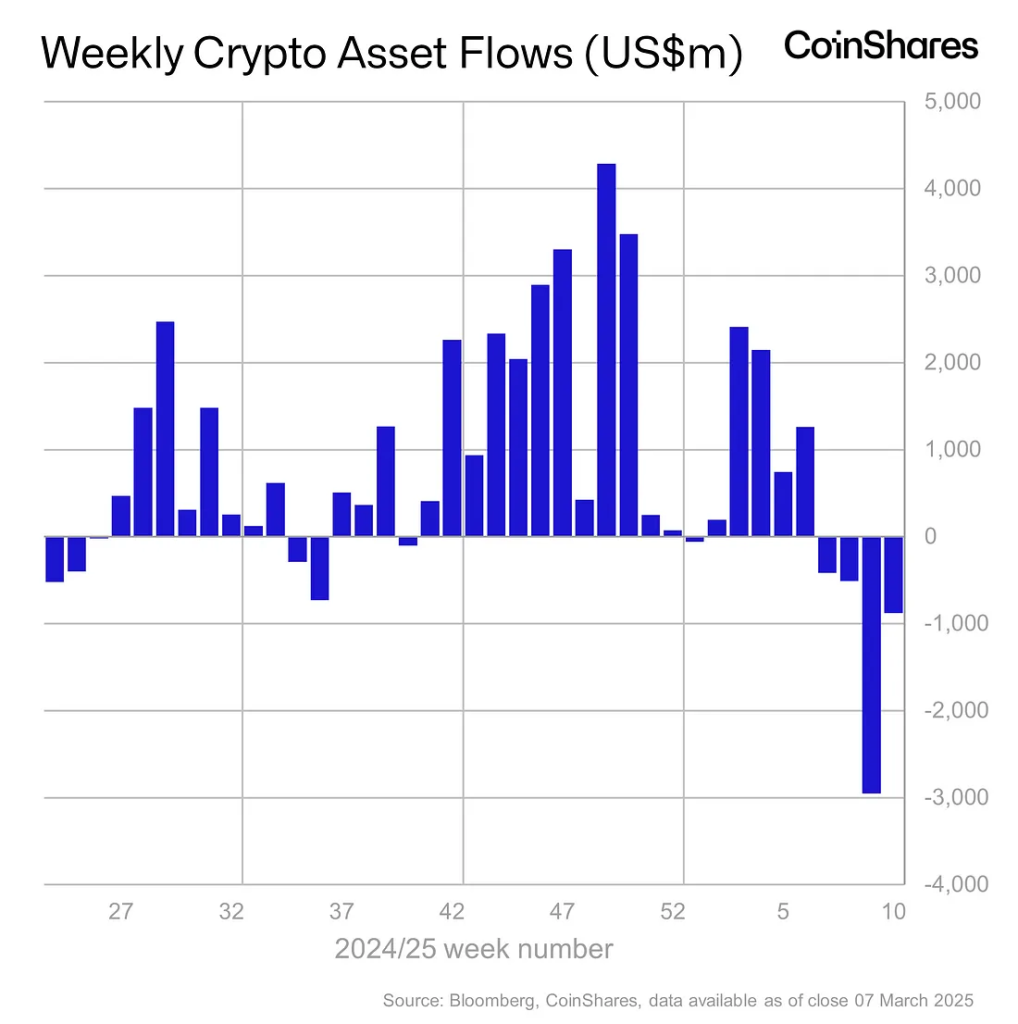

Although President Trump carried out numerous crypto-friendly measures, comparable to making a strategic crypto reserve, the market didn’t see any enhance in buy demand. Final week the cryptomarkt skilled a lower, with giant losses in Bitcoin, Ethereum and different merchandise traded by crypto festivals. Based on a coinshares report, crypto ETPs have collectively misplaced $ 4.75 billion prior to now 4 weeks. Final week solely $ 876 million was admitted from these funds.

Market battle regardless of strategic crypto reserve

After the chief command of President Donald Trump to arrange a strategic Bitcoin reserve for the US, the cryptomarkt has seen a pointy decline. Previously week there was an essential exodus of crypto-related funds.

Funding merchandise within the world crypto market, managed by giant asset managers comparable to BlackRock, Bitwise, Constancy, Graysscale, Proshares and 21Shares, skilled web outflows of $ 876 million final week. This decline was activated by Trump’s choice to impose extra charges.

This marks the fourth consecutive week, with a complete lack of $ 4.75 billion throughout this era, which reduces the influx of the 12 months thus far to $ 2.6 billion. James Butterfill, Coinshares head of analysis, famous in current report“Though this means a delay within the tempo of the outflows, investor sentiment bearish stays.”

It’s most likely not shocking to listen to that American buyers have withdrawn $ 922 million from crypto funds, as acknowledged within the report. This occurs on the similar time President Donald Trump will increase a commerce conflict with giant buying and selling companions comparable to Canada, Mexico and China.

Additionally learn: Why crypto -market crashes? Trump’s charge conflict falls $ 800 billion

Final week President Trump additionally adopted his promise to arrange a Nationwide Bitcoin reserve and a inventory of different cryptocurrencies. Nevertheless, the way in which it was finished appears to have disenchanted many merchants.

The property within the administration of those funds have shrunk by $ 39 billion from their peak, making the entire $ 142 billion. That is the bottom degree that’s being noticed since simply after the US presidential election in November.

Excessive inflation will increase the autumn available in the market

Previously month, ETFs have led to a lower of 10% within the complete cumulative influx. This exhibits itself on rising buyers and means that many buyers have already stuffed their supposed cryptocurrency assignments.

Along with charges, rising American inflation performs a key position within the current crypto market crash. Given the American job report that was launched on Friday, the sentiment modified to a difficult weekend within the cryptom markets. The report confirmed a rise in unemployment to 4.1%, which introduced the Federal Reserve to a troublesome place to decide on between concentrate on financial development or the management of inflation, in response to the assertion.

The open market committee of the Federal Reserve is deliberate to announce its choice on inflation on March 19. Any longer, buyers imagine primarily based on the CME Fedwatch instrument that there’s about 3% likelihood that the FOMC will resolve to decrease the rates of interest.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024