Altcoin

Bitcoin and S&P are falling together, but data predicting a change

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the trade and punctiliously assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Bitcoin is just not the one one who suffered. Traders are fearful as a result of the flagship Cryptocurrency has adopted the latest lower within the S&P 500. But when the efficiency of the previous is a sign, Bitcoin Can expertise a revival.

Associated lecture

President Donald Trump of the USA recorded an workplace in November for a second time period, however since then the US inventory market has fallen by round 10%. For the reason that worldwide recession got here onerous within the markets in 2009, that is the worst begin of an American presidency. Though there are numerous causes for this decline, uncertainty about financial technique and issues about inflation.

Prior to now it has typically indicated with a threatening volatility when the S&P 500 and Bitcoin fall on the identical time. The Berenmarkt from 2022, which noticed lengthy -term losses, was the final time that each markets fell rapidly on the identical time. Nonetheless, not all dips result in lengthy -term decline. Some have led to a outstanding rebound, particularly because the Cycli of the Cryptocurrency cease.

How does the market react to Trump’s second time period?

Since its return, the S&P 500 has fallen by 9%, which marks the worst begin of a presidency since 2009.

On the time, a recession drove the drop. This time the uncertainty is within the driver’s seat.

Let’s dive into the information 🧵👇 pic.twitter.com/A10F0Qtweb

– Cryptoquant.com (@Cryptoquant_Com) March 12, 2025

Bitcoin and shares that transfer collectively – for now

Bitcoin has lengthy been often known as ‘digital gold’, nevertheless it now features extra as a technical inventory. By one Cryptuquant researchThe value of Bitcoin has adopted conventional markets, specifically the S&P 500. This sample is just not new. Through the COVID-19 Pandemie in March 2020, the crypto and shares coincided earlier than they recovered later that 12 months.

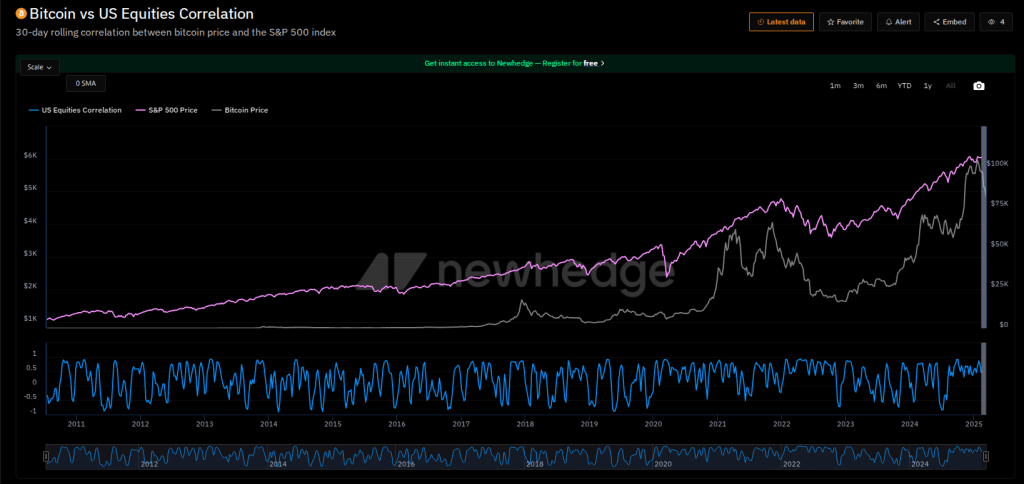

However analysts from Intotheblock found that Bitcoin’s relation In essence, zero has fallen to the S&P 500. This might counsel that BTC, in accordance with the sample of the lengthy -term holders, begins emigrate exterior of standard financing.

If this decoupling continues, the motion within the value of Bitcoin could also be much less depending on modifications within the inventory market.

Historic developments counsel a restoration

In response to Cryptoquant, earlier knowledge reveals that Bitcoin has typically returned after sturdy corrections. In 2018, for instance, Bitcoin misplaced round 80% of the worth of its worth earlier than he recovered in 2019. Likewise, after the 2020 crash, Bitcoin reached contemporary all-time highlights in 2021.

One other statistics to keep watch over is the Coinbase Premium Index, which measures the distinction in Bitcoin costs between Coinbase and Binance. When this indicator turns into unfavorable after which returns to a optimistic space, it has normally indicated an imminent value rebound.

Associated lecture

Warning and optimism with analysts

Within the meantime, market analysts stay divided. Some warn that Bitcoin’s decline may point out that the whole enhance within the inventory market is untenable. Tyler Richey, co-editor of Sevens Report Analysis, said that Bitcoin’s underperformance may very well be a warning sign for shares in comparison with the January peak.

Featured picture of Gemini Imagen, Graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024