Bitcoin

Bitcoin and the risk of stablecoin liquidity shortage – Holders should know THIS!

Credit : ambcrypto.com

- Are stablecoin reserves holding again liquidity flows into Bitcoin?

- Bitcoin ETFs have grown considerably lately and should have additionally affected the value of the crypto

Stablecoins play a vital position throughout Bitcoin’s bull and bear markets. They’re the medium by way of which liquidity flows to BTC they usually additionally present a buffer to retain worth throughout bearish instances. Nonetheless, might stablecoin liquidity maintain Bitcoin again?

CryptoQuant founder Ki Younger Ju postulated in a current evaluation that stablecoins are unable to generate bullish momentum. The statement assumed essentially the most bullish state of affairs, taking into consideration each Bitcoin and stablecoin reserves. He stated,

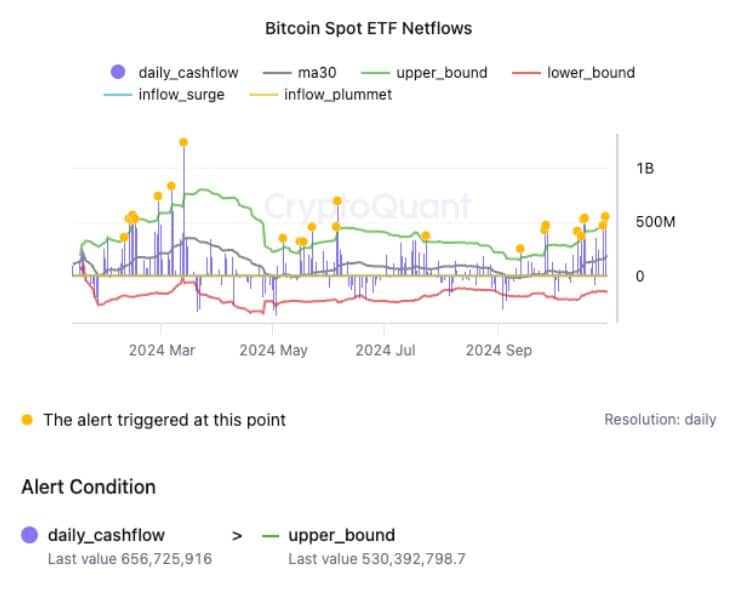

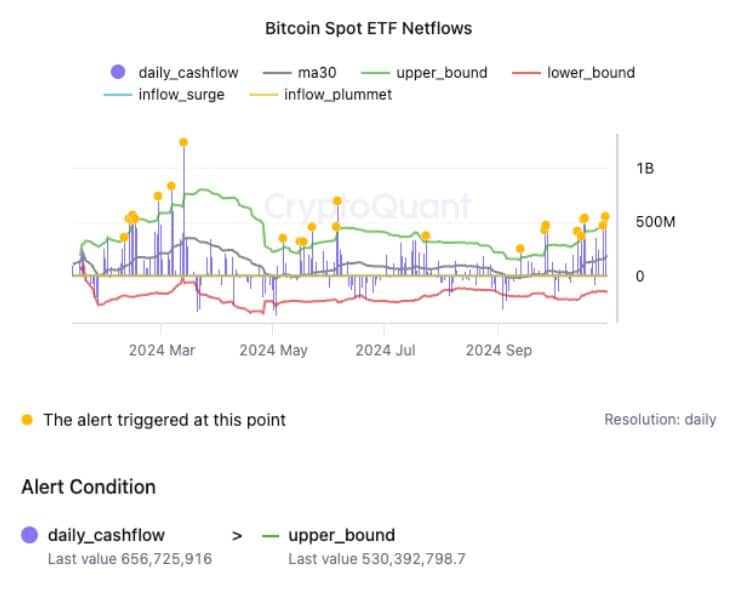

“Over the previous two weeks, now we have seen vital ETF inflows, led by BlackRock’s IBIT.

If spot ETF inflows might decelerate sooner or later, BTC/USD shopping for stress from brokerage corporations like Coinbase Prime might weaken, doubtlessly pushing the market again into stagnation.”

In response to the exec’s evaluation, Bitcoin reserves exceeded stablecoin reserves by greater than six instances. Which means that present stablecoin reserves might not be enough to fulfill peak demand for Bitcoin.

Bitcoin had a market cap of $1.38 trillion on the time of writing. Quite the opposite, the collective market cap for stablecoins was $172.887 billion on the time of writing.

Right here it’s value noting that the latter grew from simply $123.74 billion in September 2024 – the bottom degree up to now three years.

Supply: DeFiLlama

Bitcoin ETFs have pushed demand

The evaluation additionally examined the position of ETFs in Bitcoin’s value motion. It famous {that a} cooling in demand for Spot ETFs over the previous two weeks was adopted by weak demand.

The evaluation additionally performed with the concept that Bitcoin’s value motion threatened to trigger stagnation if demand for Spot EFT had been to say no to an excessive low.

Supply:

This remark coincided with the newest value motion and ETF flows. For instance, Bitcoin ETFs lately skilled a slowdown in demand on the final day of October, after beforehand reaching per week of optimistic flows.

The newest ETF information exhibits that Bitcoin ETFs ended the week with internet outflows. ETFs are included, for instance $54.9 million in outflows on Friday. In the meantime, BTC is struggling to get again above $70,000 – confirming a slowdown in demand.

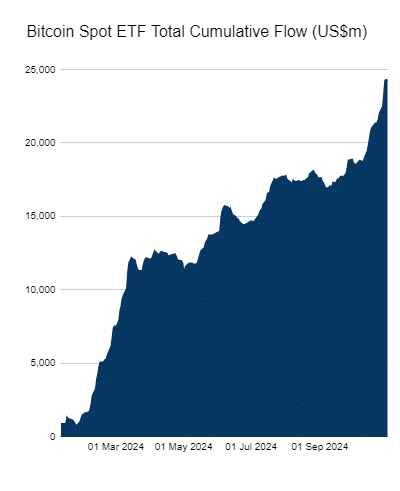

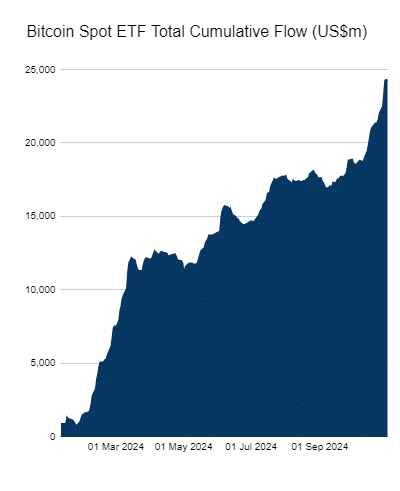

Anyway, Bitcoin ETFs Soared 62% from their approval date earlier this 12 months. Here is how the ETF flows have carried out thus far:

Supply: Farside.co.ke

On the time of writing, Bitcoin ETFs held over $24.4 billion. This spectacular progress is an indication of rising demand from the institutional class.

In the meantime, the newest outflows are possible associated to the uncertainty surrounding the election interval. It is going to be fascinating to see how issues will develop after the elections.

Institutional traders have additionally responded to the revival of worldwide liquidity, underscoring doubtlessly excellent news for the holder. It’s because decrease rates of interest have paved the best way for dangerous sentiment.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September