Altcoin

Bitcoin Bulls Positioning aggressively on Binance, Data shows

Credit : www.newsbtc.com

Knowledge exhibits that the Bitcoin community quantity has lately been very constructive on Binance, an indication that the bulls arrange aggressive bets.

Bitcoin Binance Web Taker Quantity is at present at a remarkably constructive degree

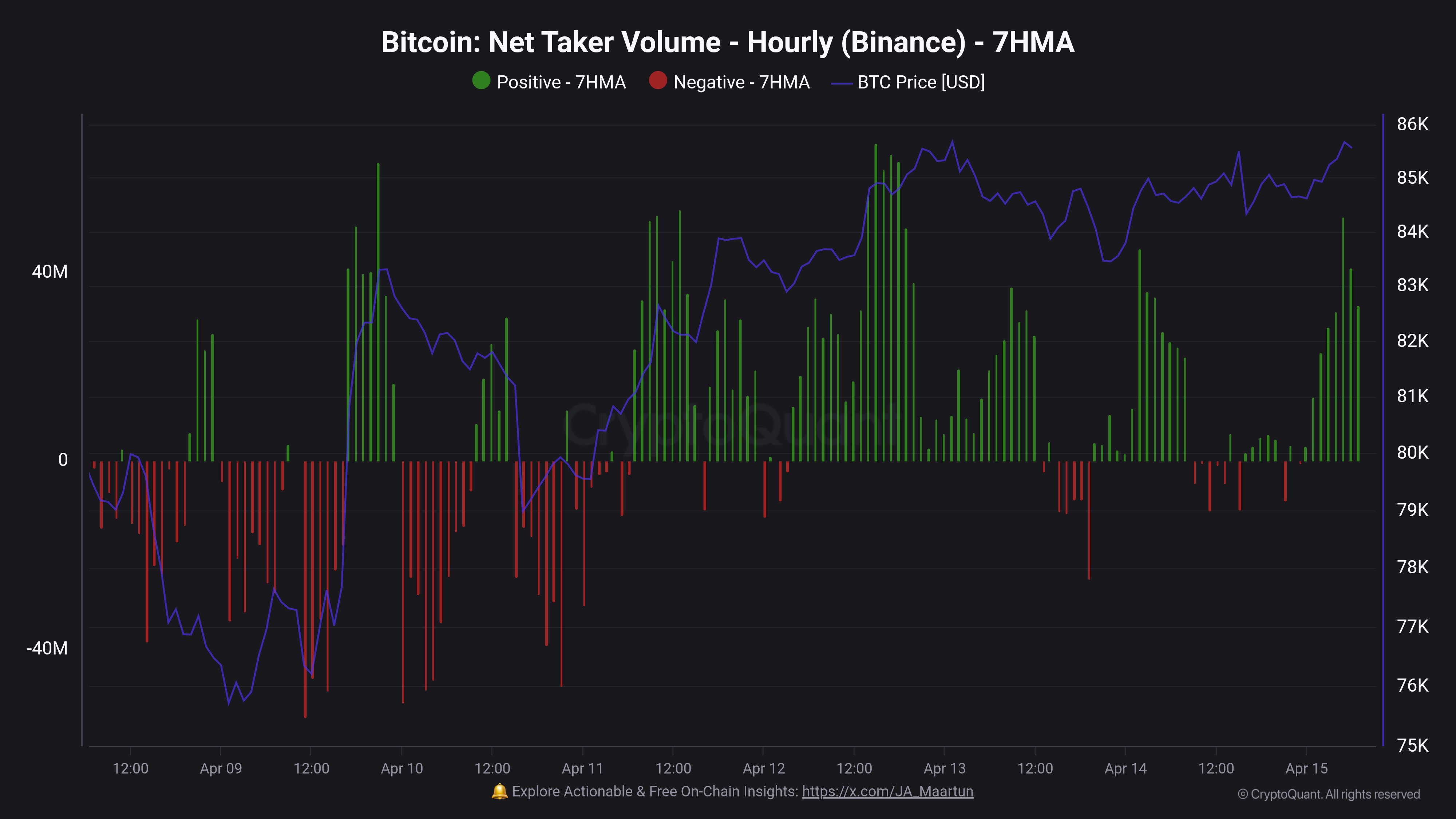

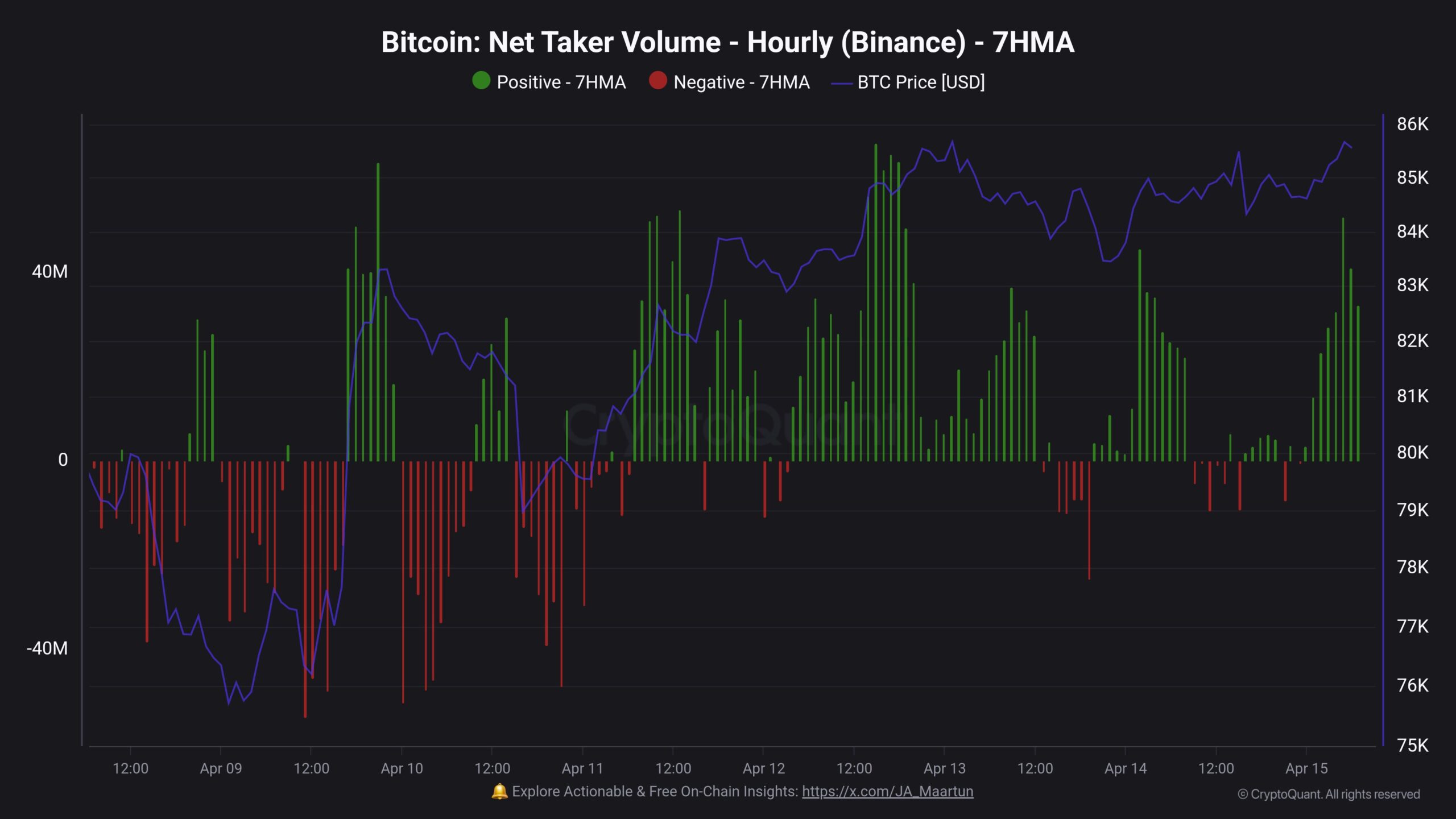

As defined by Cryptoquant Neighborhood Analyst Haarn after On X, Bitcoin Taker consumers have dominated the Binance platform in current days. The relevance indicator Right here is the “Takker Quantity”, which measures the distinction between the Taker Purchaser and Taker Vendor Quantity on a sure centralized alternate.

If the indicator has a constructive worth, it implies that the Taker consumers outweigh the Taker Sellers on the platform. One of these development implies that a bullish sentiment is shared by the vast majority of customers.

However, the metric suggests below the zero mark {that a} bearish mentality is dominant on the alternate, as a result of the quick quantity is bigger than the lengthy quantity.

Now under is the graph that’s shared by the analyst who exhibits the development within the 7-hour advancing common (MA) Bitcoin Web Taker quantity for the most important alternate within the cryptocurrency sector: Binance.

As proven within the graph above, the Bitcoin -net contractor quantity has often remained within the constructive territory since 11 April. The inexperienced values of the metric have additionally not been small, which means that the futures customers have positioned various aggressive bullish bets on the platform.

The shift to the constructive sentiment concerning the inventory alternate has come as a result of BTC recovers after the information of the 90-day break concerning the charges for many international locations.

Traditionally, Bitcoin tends to maneuver within the course that the group expects the least, so this bullish temper can truly be a foul signal for the restoration rally. Nonetheless, it is just to be seen whether or not a high can be hit whether or not the wager of those traders would bear fruit.

In a distinct information, the 30-day of the Bitcoin market worth and realized worth (MVRV) ratio has reached the bottom degree in six months, as an analyst has observed in a cryptoquant quicktake after.

The MVRV ratio is an indicator that really tells us concerning the revenue loss standing of the Bitcoin traders. It’s clear from the graph that the 30-day worth of this metric has lately fallen, which means that the profitability of holders has fallen.

The identical degree as now final 12 months was additionally reached on a number of factors and BTC fashioned a soil throughout each authorities. As such, it’s potential that this development can once more be bullish for the cryptocurrency.

BTC value

On the time of writing, Bitcoin floats round $ 85,800, a rise of greater than 8% within the final seven days.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now