Bitcoin

Bitcoin closes above a key level: Is now the time to grab BTC?

Credit : ambcrypto.com

- Bitcoin value motion turns bullish.

- Bitcoin is attracting establishments on account of its annual features.

Bitcoin [BTC] has closed above the Bull Market Assist band, an important degree on the upper time-frame, after remaining beneath it for 3 consecutive weeks.

This restoration signifies a possible improve within the value of BTC. Regardless of transient deviations, the value motion now signifies a bullish pattern, with the present degree round $67,000 appearing as a key liquidity zone.

Bitcoin breaking by way of the liquidity zone on sturdy quantity and staying above it offers merchants and buyers the boldness to go lengthy, whereas others might improve their positions.

Supply: TradingView

Bitcoin’s attraction is unstoppable

Institutional curiosity in Bitcoin continues to develop, reinforcing its upward momentum. Semler Scientific just lately bought 83 extra Bitcoin, price $5 million, bringing their whole holdings to 1,012 BTC.

This acquisition positions them because the fourth largest Bitcoin holding firm within the US, excluding miners.

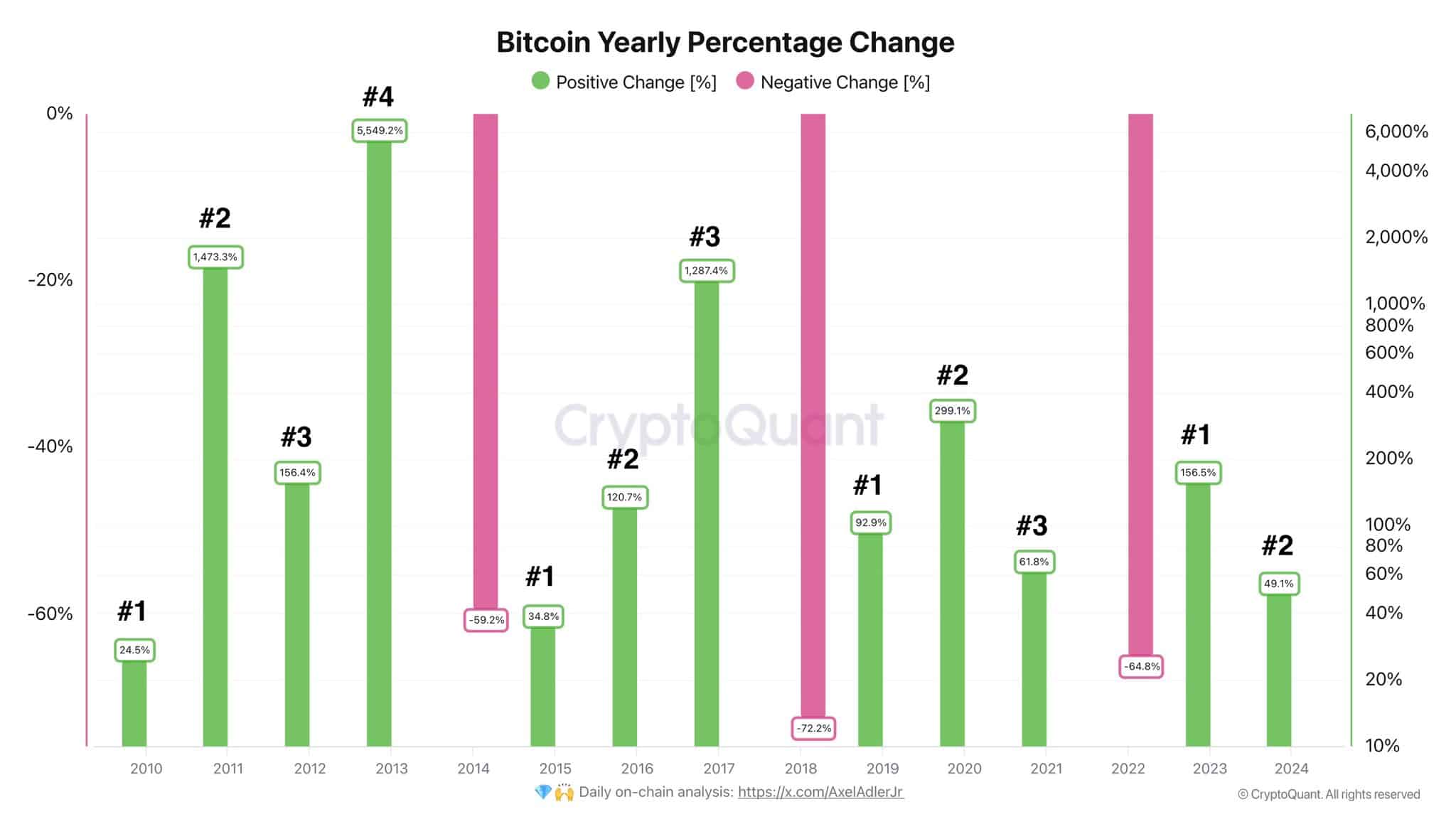

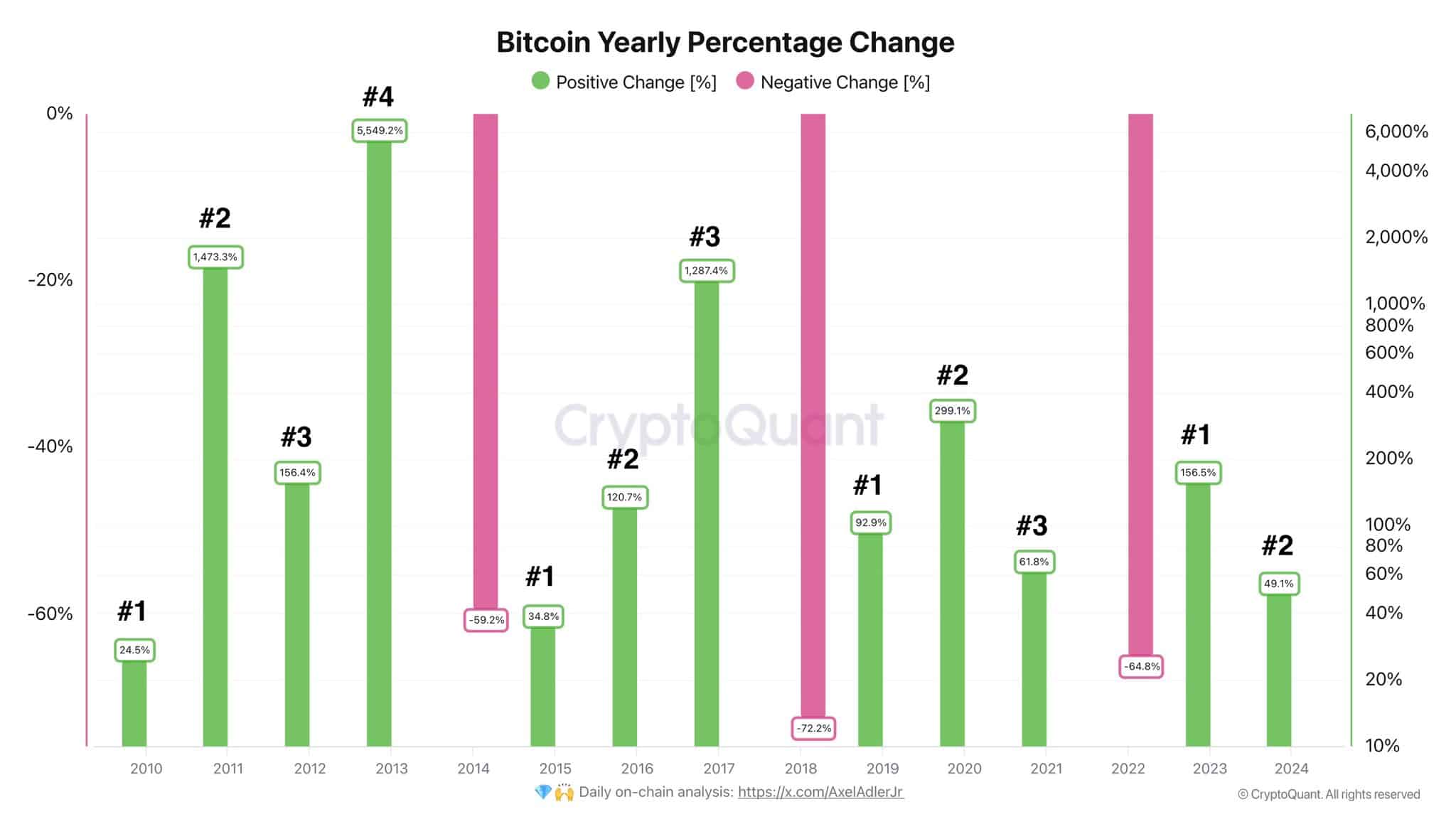

Traditionally, BTC has proven resilience, with solely three years of adverse share change since inception, whereas the remaining twelve years have been constructive.

Supply: CryptoQuant

Semler’s dedication to purchase extra BTC, backed by a $150 million fundraising, displays Bitcoin’s rising institutional adoption, which is driving the market larger.

Regardless of challenges, Bitcoin persistently demonstrates its potential to succeed in new highs. With this 12 months already displaying constructive progress, expectations are for a powerful end, reinforcing bullish sentiment.

Distinction between BTC and S&P 500

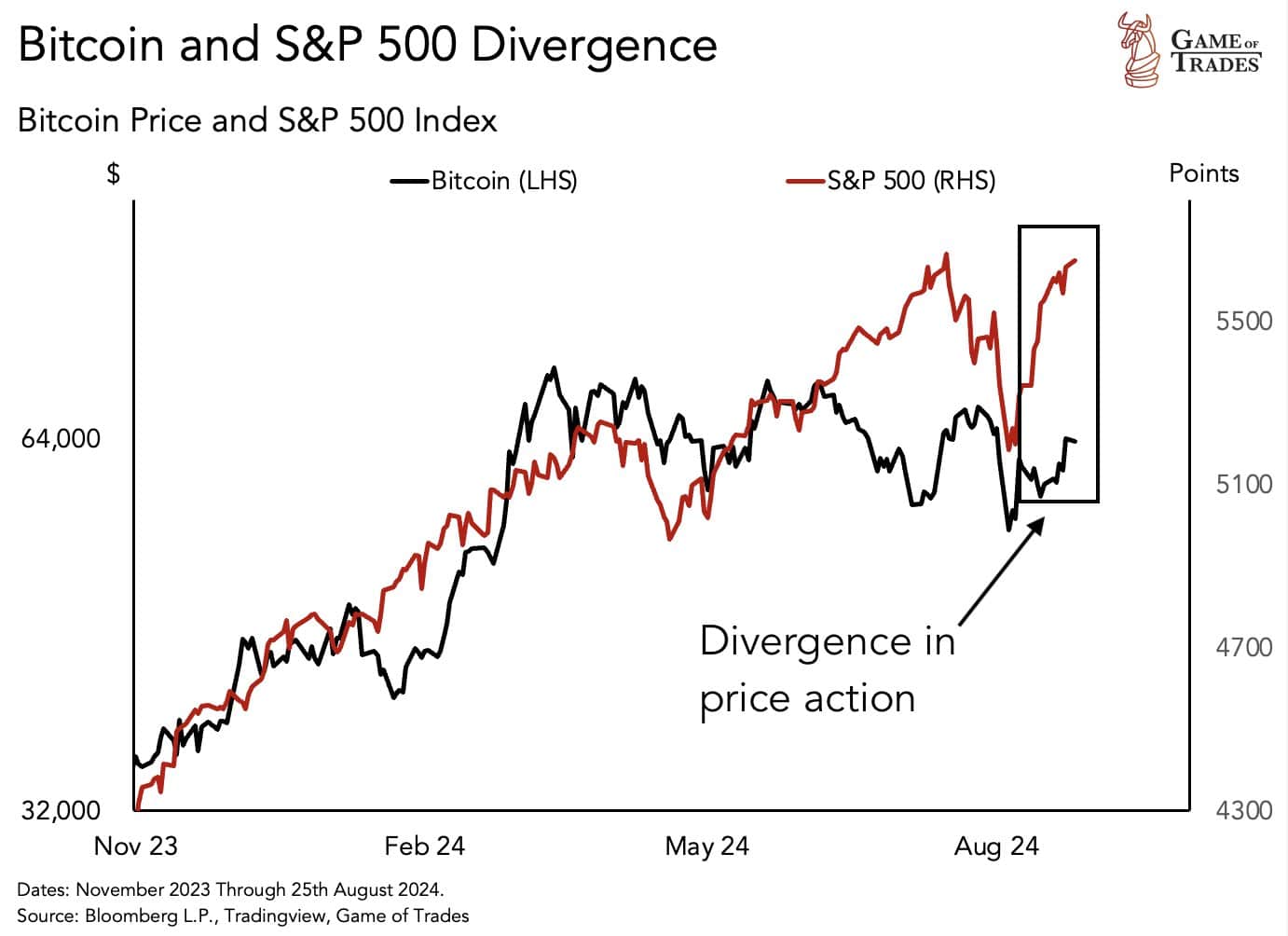

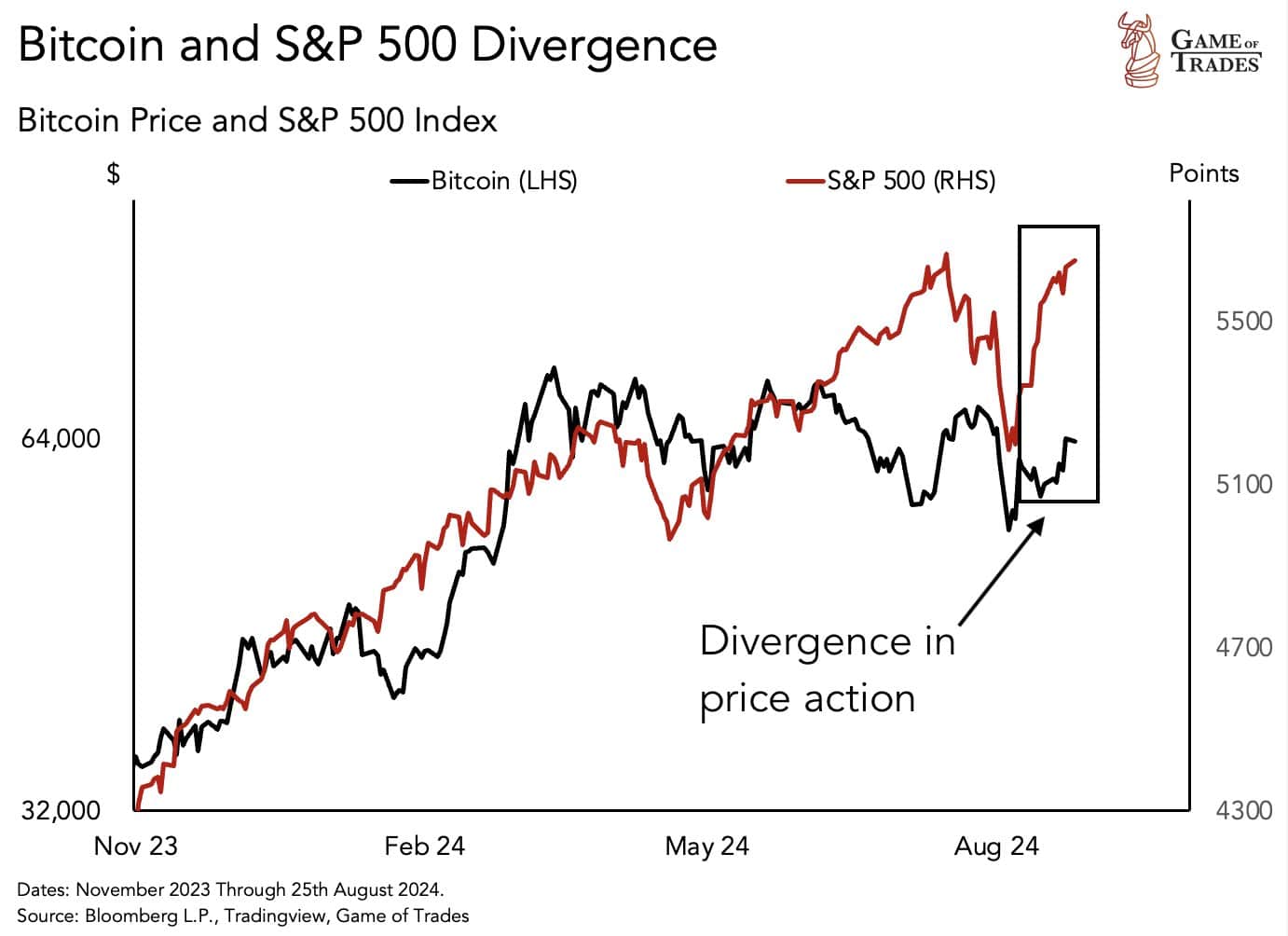

Bitcoin’s value actions typically mirror that of the US inventory market, particularly that of the S&P 500. When the S&P 500 rises, BTC tends to comply with, and vice versa.

In August, when the market fell 6% on account of fears of a recession, the Bitcoin value additionally noticed a pointy decline of 30%.

However because the market has since recovered and neared an all-time excessive, BTC stays 20% beneath its July degree and 30% beneath its March 2024 degree.

Supply: Bloomberg

This distinction presents a sexy alternative to purchase BTC, anticipating it to meet up with the inventory market’s restoration.

Learn Bitcoin’s [BTC] Value forecast 2024-25

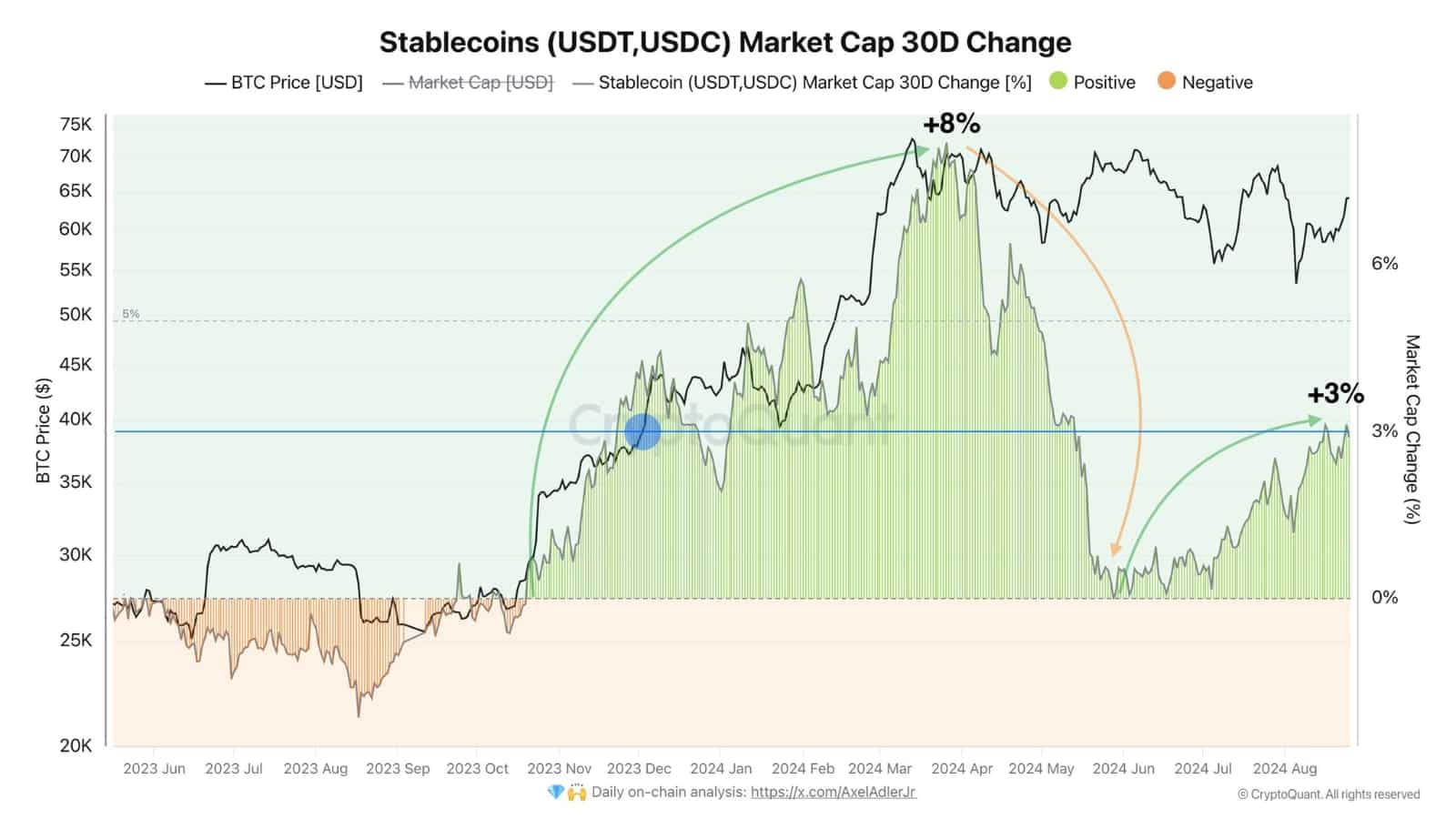

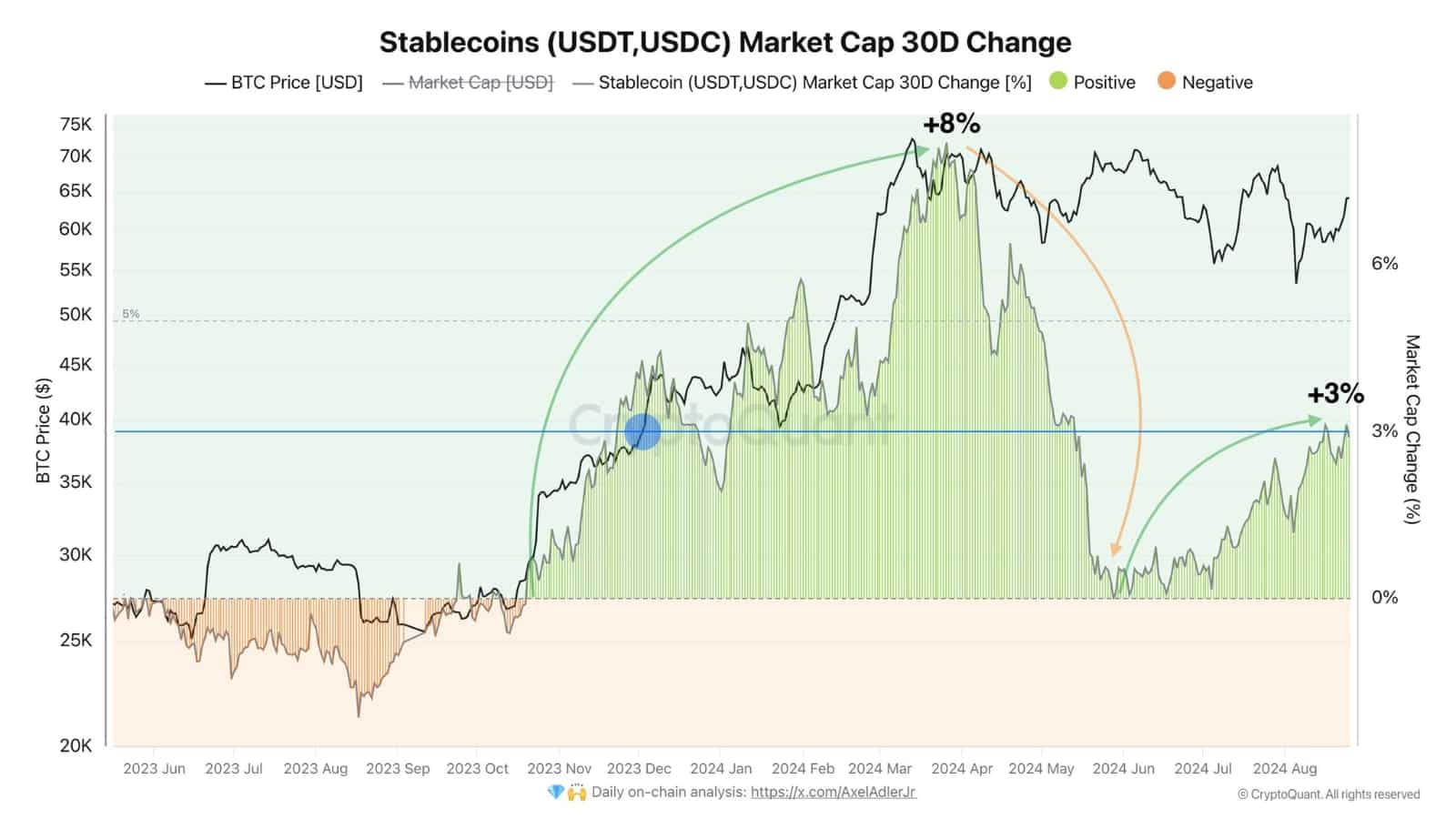

The provision of stablecoins is rising

Lastly, the rising provide of stablecoins corresponding to USDT and USDC additionally helps a better BTC value. Over the previous three months, their market capitalization has grown by 3%, indicating rising demand.

With BTC provide progress slowing after the halving, this rising demand signifies that the value is prone to proceed climbing larger.

Supply: CryptoQuant

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now