Bitcoin

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

Credit : dailyhodl.com

An analyst who precisely referred to as the Bitcoin correction originally of 2024 believes that BTC will stay on a bullmarkt after bouncing a low level of 2025 of $ 76,000.

Pseudonymous analyst stretches Capital tells His 542.00 followers on the social media platform X that the present Bullmarkt cycle of Bitcoin nonetheless has to succeed in a peak.

“BTC Bull Market Progress: 82.5%(the progress will pace up parabolic progress and decelerate on deeper edges).”

The analyst too tells His 107,000 YouTube subscribers that the most recent correction from Bitcoin to $ 76,000 shouldn’t be the signal of a beginning Bear market based mostly on historic precedence.

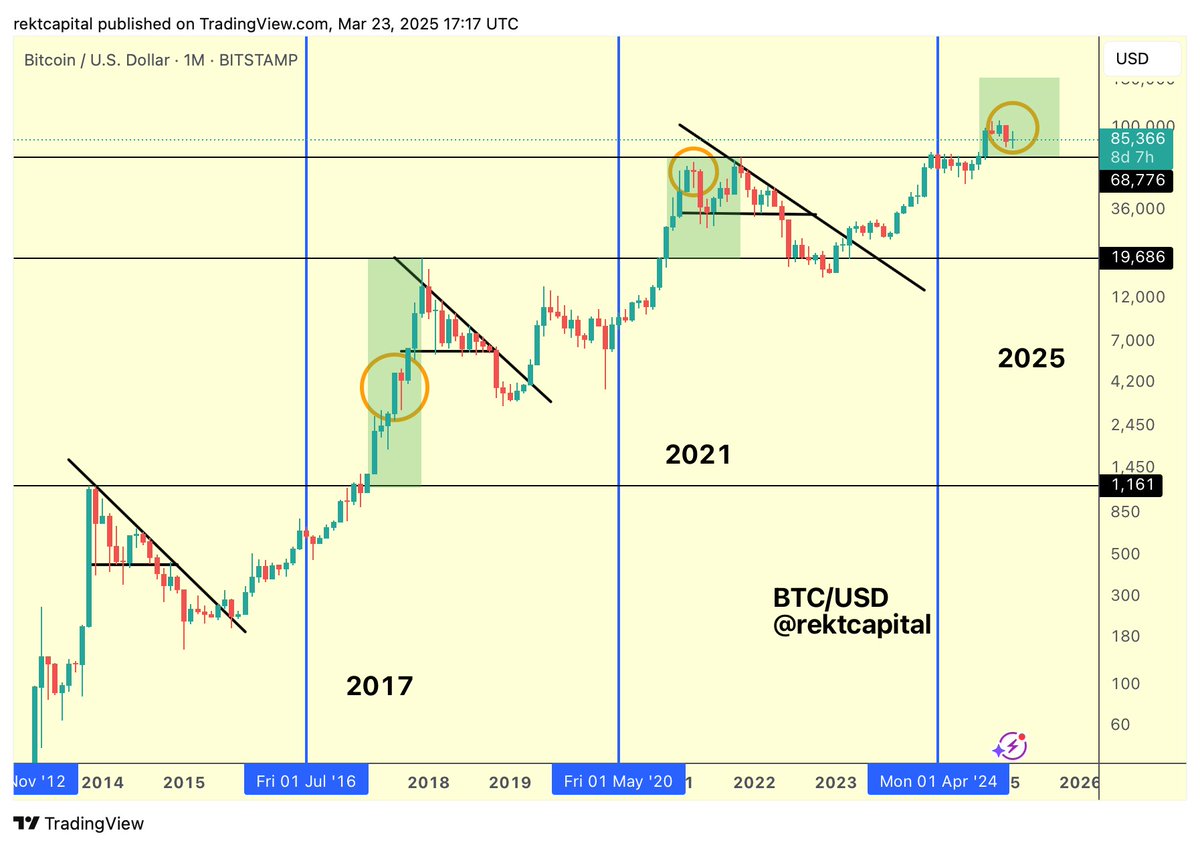

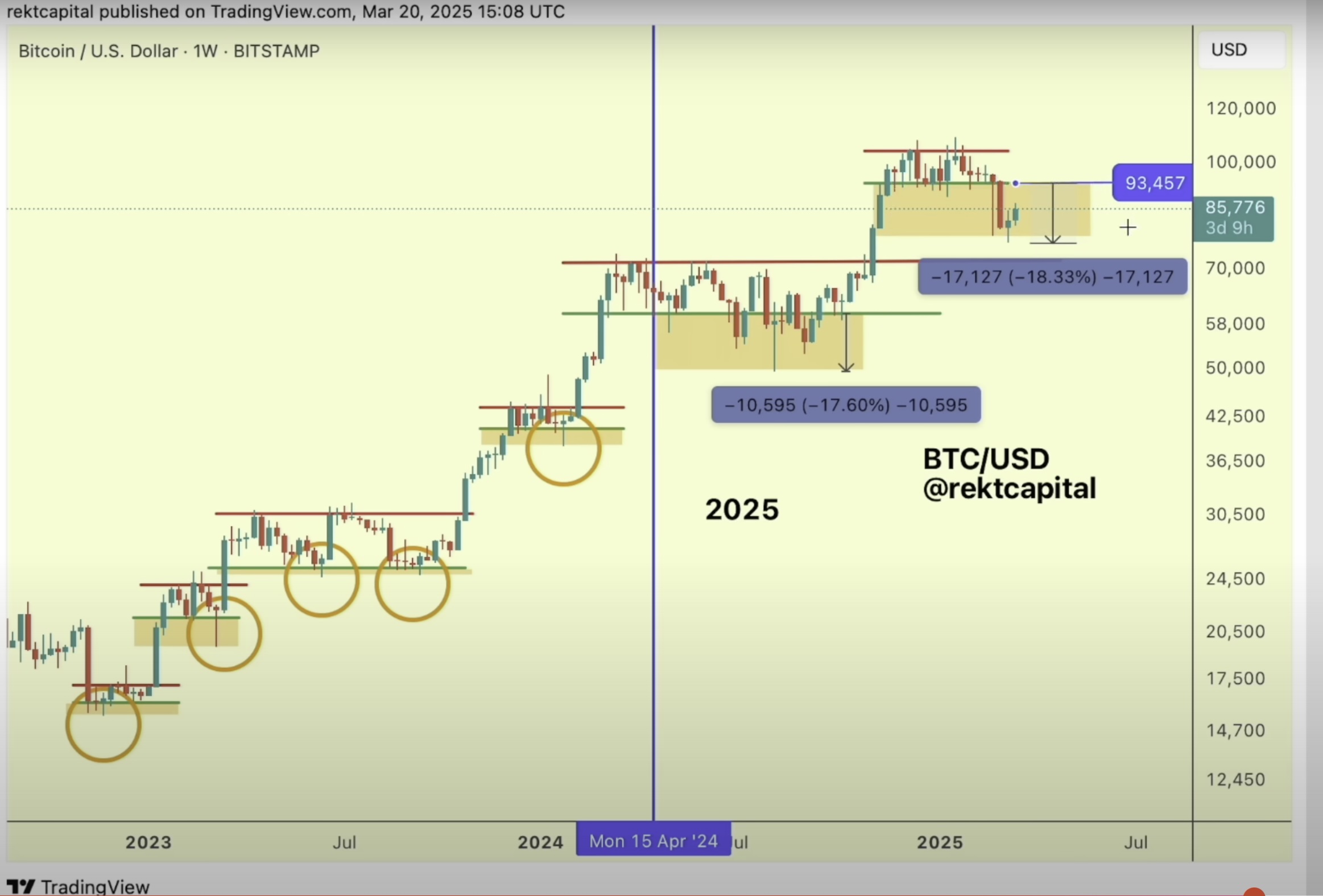

“Many individuals have talked about this that could be a bear market, however plainly it’s a downward deviation interval that’s similar to what we now have seen up to now. After all, these downward deviation durations change over time, however it’s actually essential to take a look at the map in a sober approach and attempt to view it in an unbidered approach and to not see right here. [in 2024].

This was a pullback of 32% [in 2024]. This can be a pullback of 30% [when Bitcoin corrected to the $76,000 range this month]So very related in that respect, however actually essential to remain sober and have a look at the information, have a look at the graph and zoom out when they’re questioned. “

Within the technical evaluation, a downward deviation is an set -up by which an lively help breaks by to print a false breakdown earlier than he loses a restoration and turns to new highlights.

Bitcoin acts for $ 88,028 on the time of writing, a rise of three.4% within the final 24 hours.

https://www.youtube.com/watch?v=XXERSG_PBCY

Observe us on X” Facebook And Telegram

Do not miss a beat – Subscribe to get e -mail notifications on to your inbox

Examine value promotion

Surf the Each day Hodl -Combine

Generated picture: midjourney

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024