Altcoin

Bitcoin could see a price jump of 14% if this level is recovered

Credit : www.newsbtc.com

Purpose to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

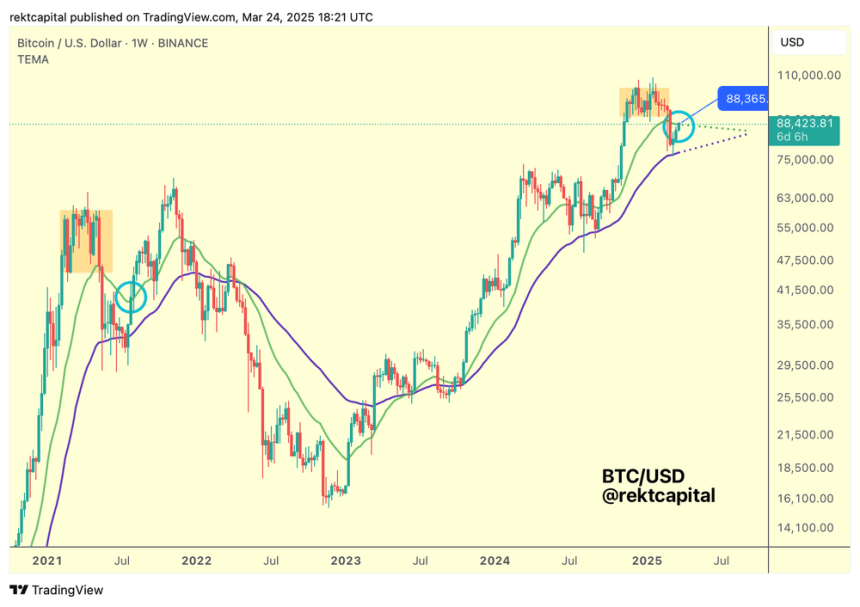

Bitcoin (BTC) climbed practically 5% up to now week and has returned vital help ranges for the previous three days. The current Bullish Momentum has despatched BTC to the $ 88,000, with some analysts recommend {that a} recovering from his earlier value vary can nearly be.

Associated lecture

Bitcoin Restoration may cause a rise of 14%

After he had been rejected a number of occasions from the $ 84,000-$ 85,000 zone a number of occasions within the final two weeks, Bitcoin recovered this attain throughout the weekend. The Crypto flagship has risen 4.7% in comparison with final week’s ranges and closes the week above $ 86,000.

Through the starting of the week Pump, BTC seemed on the resistance of $ 89,000 and reached a biweekly spotlight of $ 88,765, however failed to check the following essential zone whereas Bullish Momentum delayed. However, the cryptocurrency has stored its present attain, and floating between the $ 86-000-$ 88,000 help zone for the final 24 hours.

Analyst Alex Clary confirmed that Bitcoin’s Momentum seems to be nice for a break above the $ 88,000-$ 90,000 help zone, as a result of the cryptocurrency reveals a relative energy index (RSI) bullish divergence, a V-shaped restoration is damaged.

In response to the submit, an outbreak and restoration of the essential resistance degree of $ 90,000 might propel BTC to rise between 8 to 14% from present costs to the extent of $ 95,000- $ 100,000 misplaced in February.

Within the meantime, Daan acts crypto noted That Bitcoin “has not moved a lot in current weeks in comparison with SPX.” In response to the dealer, the value of BTC was correlated with the S&P 500 (SPX) and “normally moved hand in hand collectively”, which might clarify the current dump and strout of the flagship crypto.

He confirmed That Bitcoin nonetheless trades ‘in a stable place Premium throughout this bounce’, which suggests {that a} transfer to new native highlights is feasible if BTC maintains the present ranges and the Breakout vary after the US is above $ 90,000.

BTC has to maintain this degree by the tip of the week

Within the midst of Monday’s market restoration, Analyst warned that Bitcoin wants weekly above $ 88,400 and $ 93,500 to finish the downward deviation interval.

The analyst defined that previously 5 weeks BTC has consolidated the 2 exponential advancing averages (EMAs), the EMAs of 21 weeks and 50 weeks.

The value promotion has just lately come nearer to the EMA of 21 weeks, about $ 88,400, prepared “for a big development choice”. In response to the analyst, Bitcoin wants a weekly near this degree and a retest in help to concentrate on his macro vary.

“This was the precise affirmation that Bitcoin wanted again in mid -2010 when the value -55percentcrashed,” famous Capital, which means that “issues may very well be unstable each on the entrance (FOMO patrons of the higher Wick) and the downward time (with panic distributors bought in a downwarts)”, “,”, “

A weekly closure above it “might kick an upward continuation of the re -accumulation oak of $ 93,500.” As well as, after reclaiming the 21-week EMA, Bitcoin wants a weekly closure above the RE-accumulation vary low to “once more synchronize with the vary.”

Associated lecture

However, he warned that “the post-reduction vary of Herncumulation has proven that straightforward weekly closure above $ 93,500 is probably not adequate” as a result of it ought to “a profitable redemption of the re-representation of the re-accumulation hole to substantiate resynchronization with the vary.

He concluded that it doesn’t efficiently re -test and ensure that the brand new help might lose the value of BTC to lose this important degree and to present strategy to the drawback.

Featured picture of unsplash.com, graph of TradingView.com

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International