Bitcoin

Bitcoin Crash Coming? $4.9 Trillion Options Expiry Sparks Warning

Credit : coinpedia.org

Bitcoin once more attracted consideration after breaking greater than $ 117,600 and has reached the very best level in a month. However behind the bullish rally, a giant warning flashes. The favored analyst Crypto Ted says that the market can get a storm if $ 4.9 trillion in inventory and ETF choices have been set as much as expire immediately.

For merchants, wild swings can convey within the coming days.

$ 4.9 trillion choice for decline risk

In his current tweet submit, Ted pointed From that $ 4.9 trillion in shares and ETF choices is lapsed immediately. For context, that quantity is sort of 1.2 occasions bigger than your entire cryptomarket that’s now $ 4 trillion.

He additional recalled that such a big expiration date has beforehand triggered sharp volatility in each shares and cryptocurrencies.

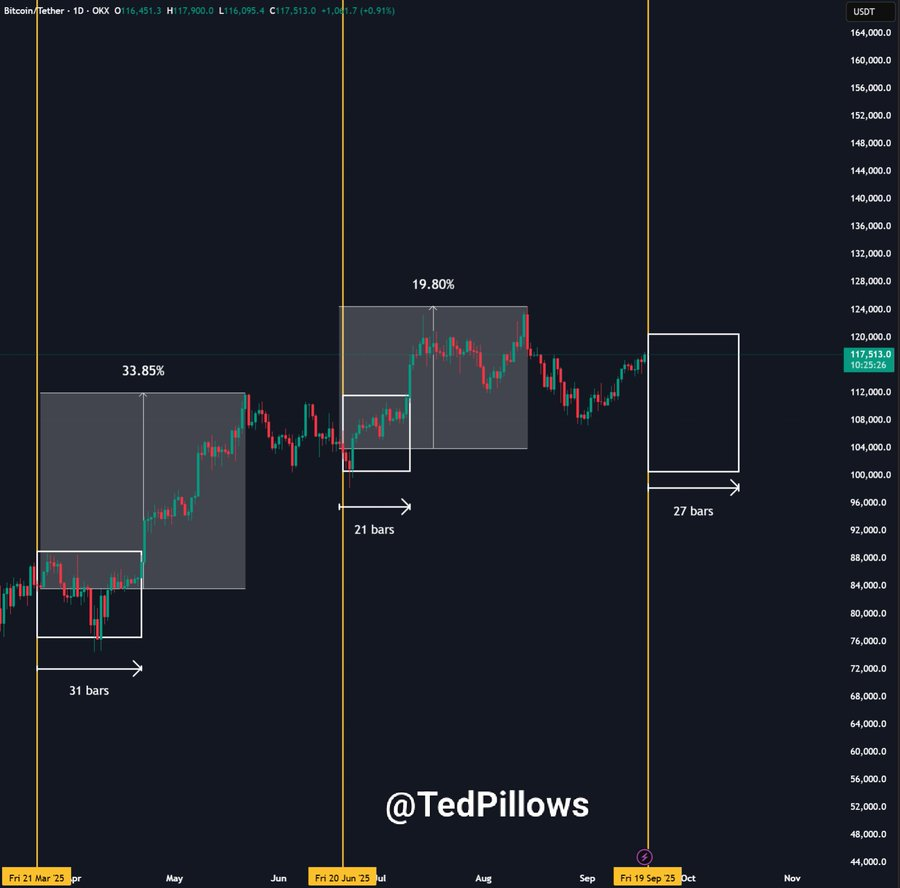

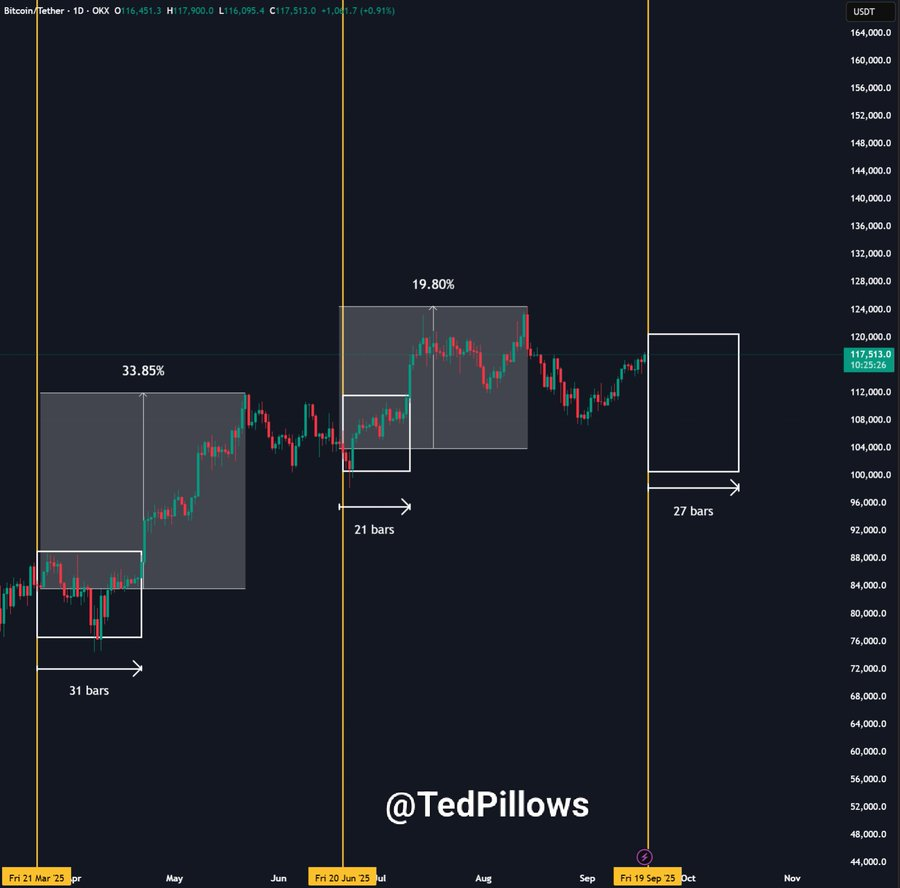

In March 2025, for instance, an identical expiry date was adopted by a crash inside two to a few weeks. In June 2025 Bitcoin went apart for some time after which slid below $ 100,000.

Now that merchants are once more loading a heavy leverage, Ted believes that the identical sample may play once more.

$ 4.3 billion Bitcoin & Ethereum choices that finish immediately

Within the subject of crypto, knowledge from Deribit reveals that greater than $ 4.3 billion in Bitcoin and Ethereum choices will expire immediately. For Bitcoin, the expiring choices have an concept value of $ 3.5 billionWith a put-to-call ratio of 1.23 and a most ache degree at $ 114,000.

Within the meantime, Ethereum Options Account For round $ 806 million, with a put-to-call ratio of 0.99 and a most ache degree at $ 4,500.

These faux ranges usually act as magnets for worth motion, which implies that merchants can see sharp swings within the quick time period.

- Additionally learn:

- Crypto Market Right now (Reside) Updates: Aster Worth, Myx Worth, Pump.Enjoyable, Bitcoin Worth and extra

- “

BTC to drop earlier than you hit Ath

In accordance with Ted, the construction of leverage virtually at all times ends in the identical method, a speedy flush. Which means quick dips can come as a result of weak positions are deleted. However this additionally units up the following rally.

In March Bitcoin jumped with 33% earlier than he withdrew. In June the turnout was smaller with 20percentand the drop got here sooner. Now in September Bitcoin is sort of $ 117,000 with merchants who take main dangers once more.

If historical past repeats itself, this volatility will be the push that brings BTC to new highlights, helped by the current charge discount of the FED and extra cuts this yr.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, knowledgeable evaluation and actual -time updates on the most recent tendencies in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The market is confronted with potential volatility on account of huge choices of $ 4.9 trillion, which traditionally prompts the worth fluctuations within the quick time period and liquidates over-delivery positions.

The quick focus is on the aftermath of the large choices. Additional reductions of the fed this yr are the next main occasions that may affect the lengthy -term momentum.

Analysts warn of a possible short-term dip to rinse the leverage, however stay bullish in the long run, whereby every lower is taken into account an association for a rally to new all-time highlights.

Primarily based on historic post-drifting cycles, analysts challenge Bitcoin can attain a peak between $ 140,000 and $ 150,000 on the finish of September or October 2025.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024