Analysis

Bitcoin Didn’t Crash From Selling—It Crashed Because Buyers Disappeared. Can BTC Price Recover?

Credit : coinpedia.org

Bitcoin remained inside a bandwidth-bound consolidation and closed the month-to-month commerce above $90,000, elevating hopes for a bullish annual shut. Nonetheless, the BTC worth crashed laborious under $86,000, inflicting a ripple impact on the markets. The worldwide crypto market cap fell under $3 trillion, wiping out almost $140 billion, whereas ETF accumulation additionally stays nominal regardless of the lowered worth.

It’s stated that the primary purpose behind the present collapse is liquidations and excessive volatility, however deep down it was as a result of a liquidity vacuum created by the consumers. This raises critical issues as as to whether consumers lack confidence in BTC’s worth restoration as a standard decline became a pointy downward cascade.

Liquidity disappears earlier than the Bitcoin worth crash

Within the run-up to the early Monday session, the depth of the order e book on a number of prime exchanges had already decreased considerably. Market makers sometimes scale back stock on weekends, however this time the drawdown was deeper. Bid-side liquidity – the amount of purchase orders inside 2% of the present worth – fell by an estimated 30-50% for Bitcoin and Ethereum, creating the right circumstances for volatility.

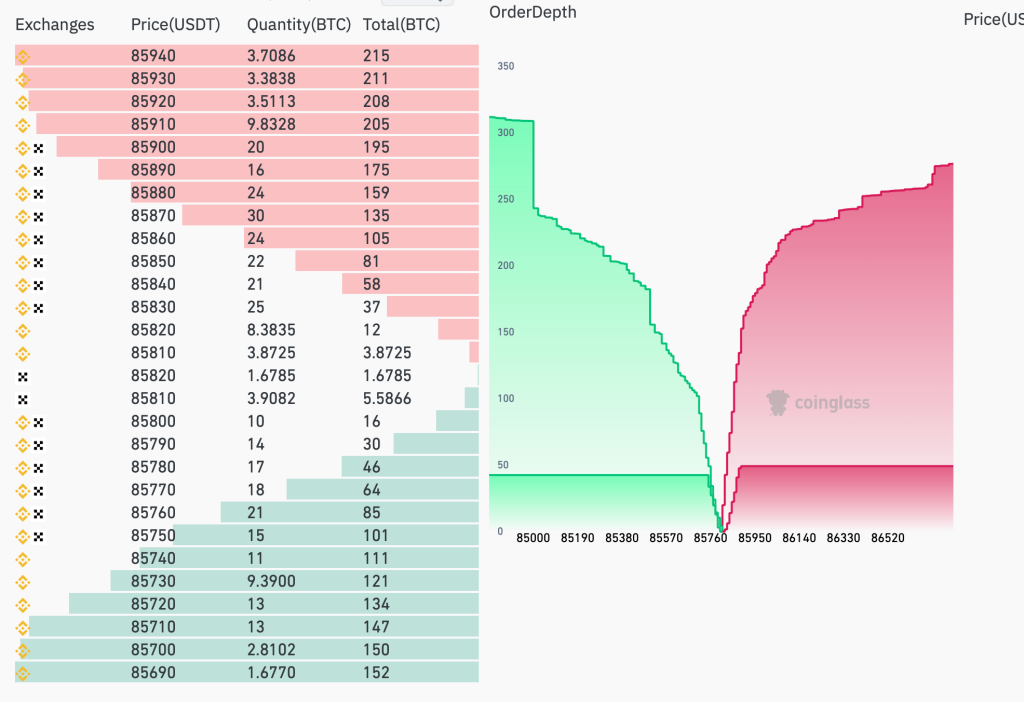

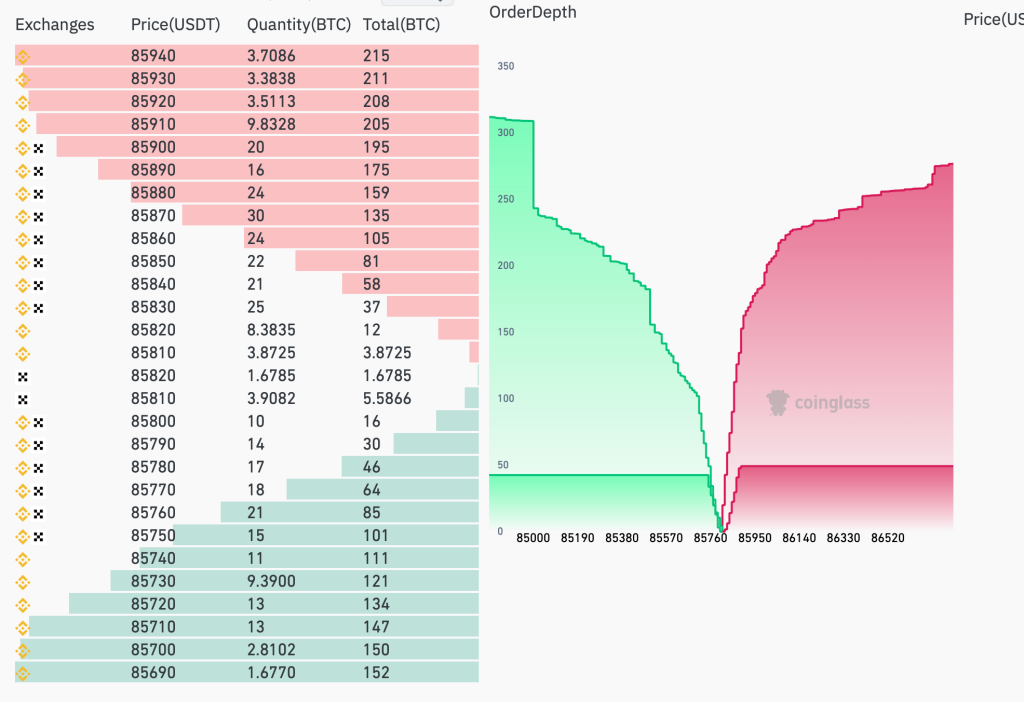

The order e book information – taken as BTC slid under the $86,000-$85,700 zone – exhibits a big imbalance:

- Gross sales orders stacked deep within the e book

- Purchase orders are virtually flat on the draw back

- Complete bid liquidity close to the important thing $85,760 stage virtually disappeared

Within the depth chart, the inexperienced facet (consumers) drops sharply earlier than leveling off – a visible affirmation that there was merely no extra demand out there. In the meantime, the pink facet (sellers) thickened round $85,900-$86,500, overwhelming the skinny bid facet.

That is exactly the structural sample that turns a routine relapse right into a speedy cascade.

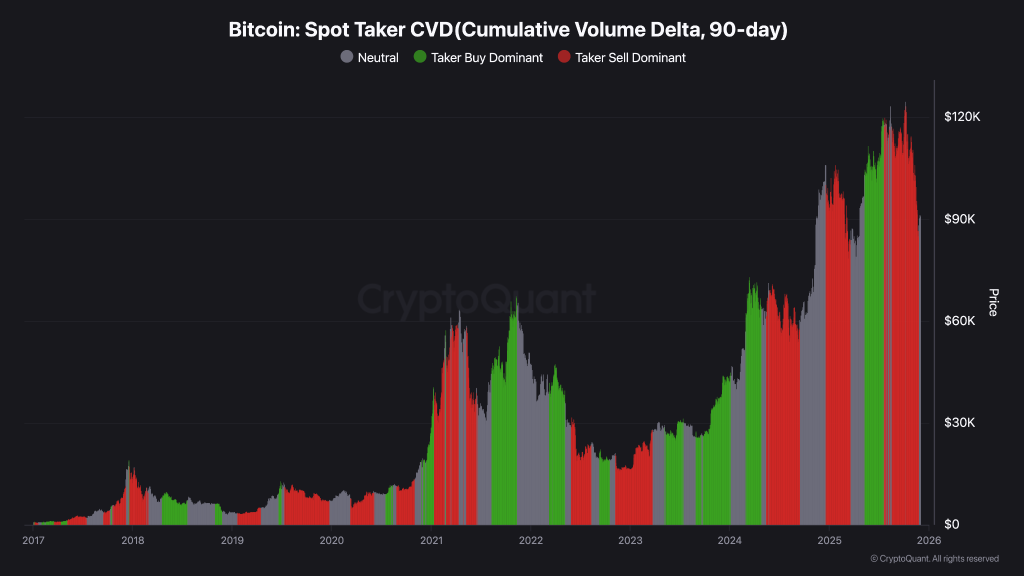

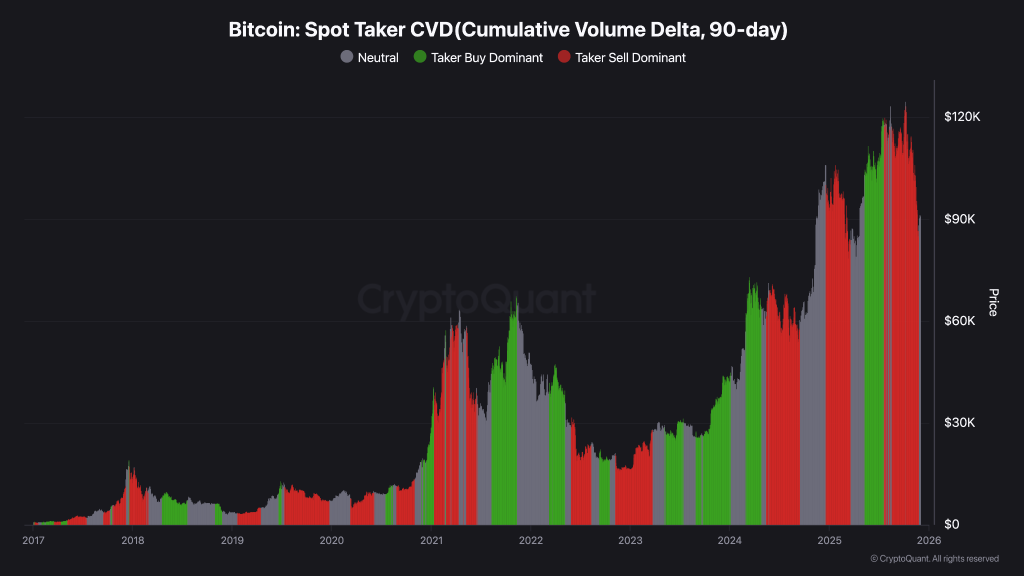

Spot CVD confirms that consumers are stepping again, not sellers attacking

To validate whether or not the promoting strain was actually overwhelming, we study the Spot Taker Cumulative Quantity Delta (CVD), a dependable device that tracks whether or not consumers or sellers are in management. This indicator measures the cumulative distinction between the shopping for and promoting quantity out there over a sure time frame.

The chart clearly exhibits a pointy reversal in buy-side aggressiveness, with taker-buy quantity drying up across the time of the decline. Importantly, there is no such thing as a spike in taker-sell dominance, strengthening the argument that Bitcoin’s decline was brought on by a sudden lack of consumers and never panic promoting.

This completely matches what the order books point out: the value didn’t fall as a result of merchants dumped, however fell as a result of nobody took the step to purchase.

Is restoration from right here doable?

Right this moment’s crash was not a typical danger occasion or liquidation cascade. Traditionally, comparable liquidity-driven declines are likely to get better shortly as soon as market makers restore depth and spot consumers step again. Crucial ranges to regulate are:

- $85,800 – rapid resistance

- $86,500–87,000 – Quick-term restoration zone

- $83,500 – the subsequent large demand zone if liquidity stays tight

If new bids come again into the e book and CVD turns optimistic once more, a fast restoration is probably going. But when buy-side liquidity stays weak, the value of Bitcoin (BTC) could proceed to say no till stronger demand emerges.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict editorial tips based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to supply well timed updates on every part crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared symbolize the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts accountability on your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our website. Adverts are clearly marked and our editorial content material stays fully impartial from our promoting companions.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International