Bitcoin

Bitcoin dips 26% in Q1: How low can it go? – Experts predict…

Credit : ambcrypto.com

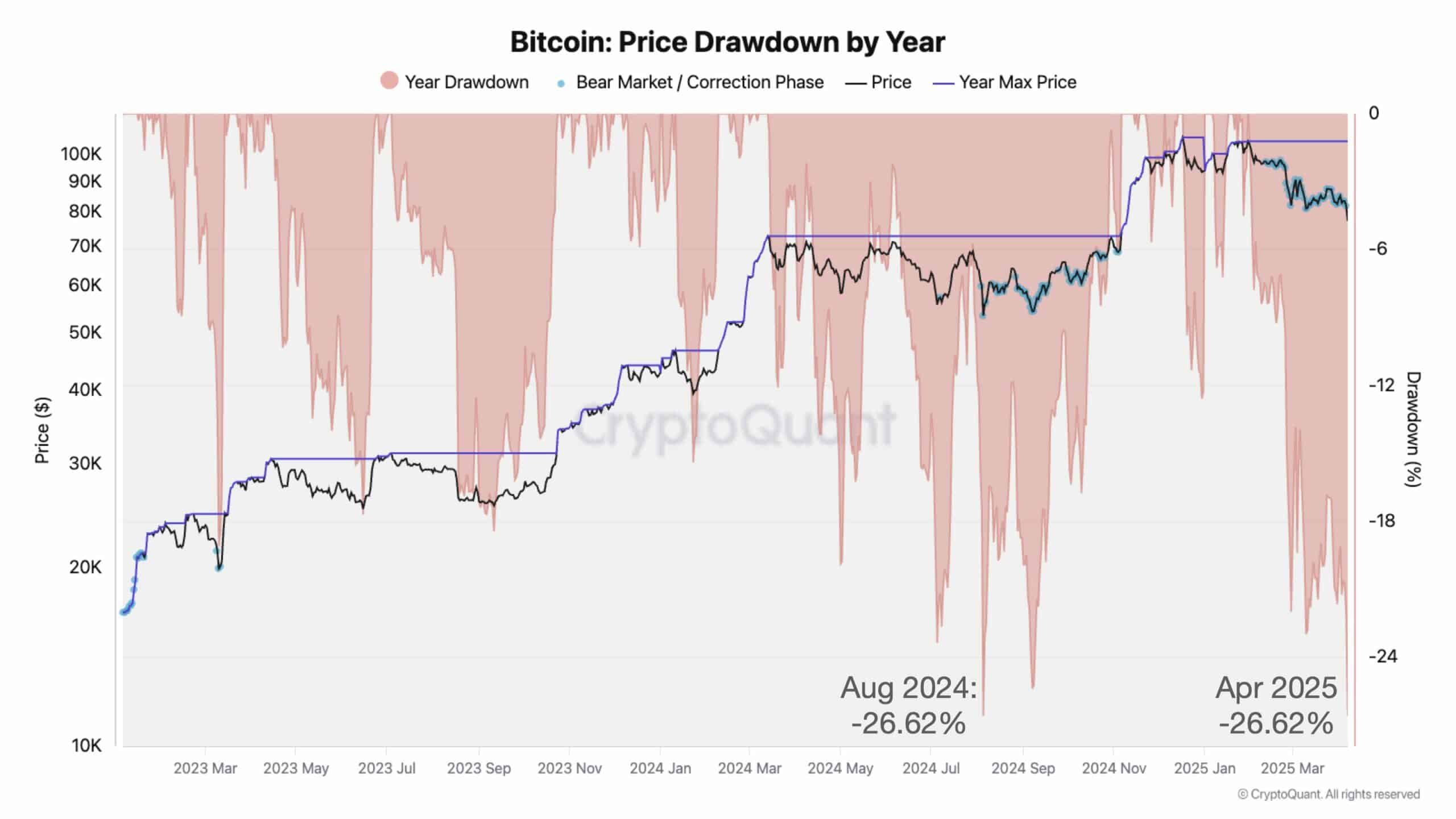

- BTCs 26% deviation could be a mid-bull correction or the beginning of a bigger correction.

- Glassnode projected {that a} probably soil above $ 70k may very well be affected.

Bitcoin’s [BTC] 26% DrawDown In 2025, the most important on this present cycle can develop into if the lower extends.

In line with Julio Moreno, head of analysis at Cryptoquant, the 2025 was at present dive equivalent To the Pullback of August 2024.

Supply: Cryptuquant

After a peak at $ 109k in January, BTC withdrew this week to $ 74k in the midst of macro uncertainty – that’s greater than 30% correction. Since then it has been discovered to $ 79k. Final 12 months it fell from $ 73k to $ 49k, which marked a lower of 33%.

However in comparison with historic drawings, is BTC out of the forest, or is the worst to come back?

BTC – A rebound or extra ache?

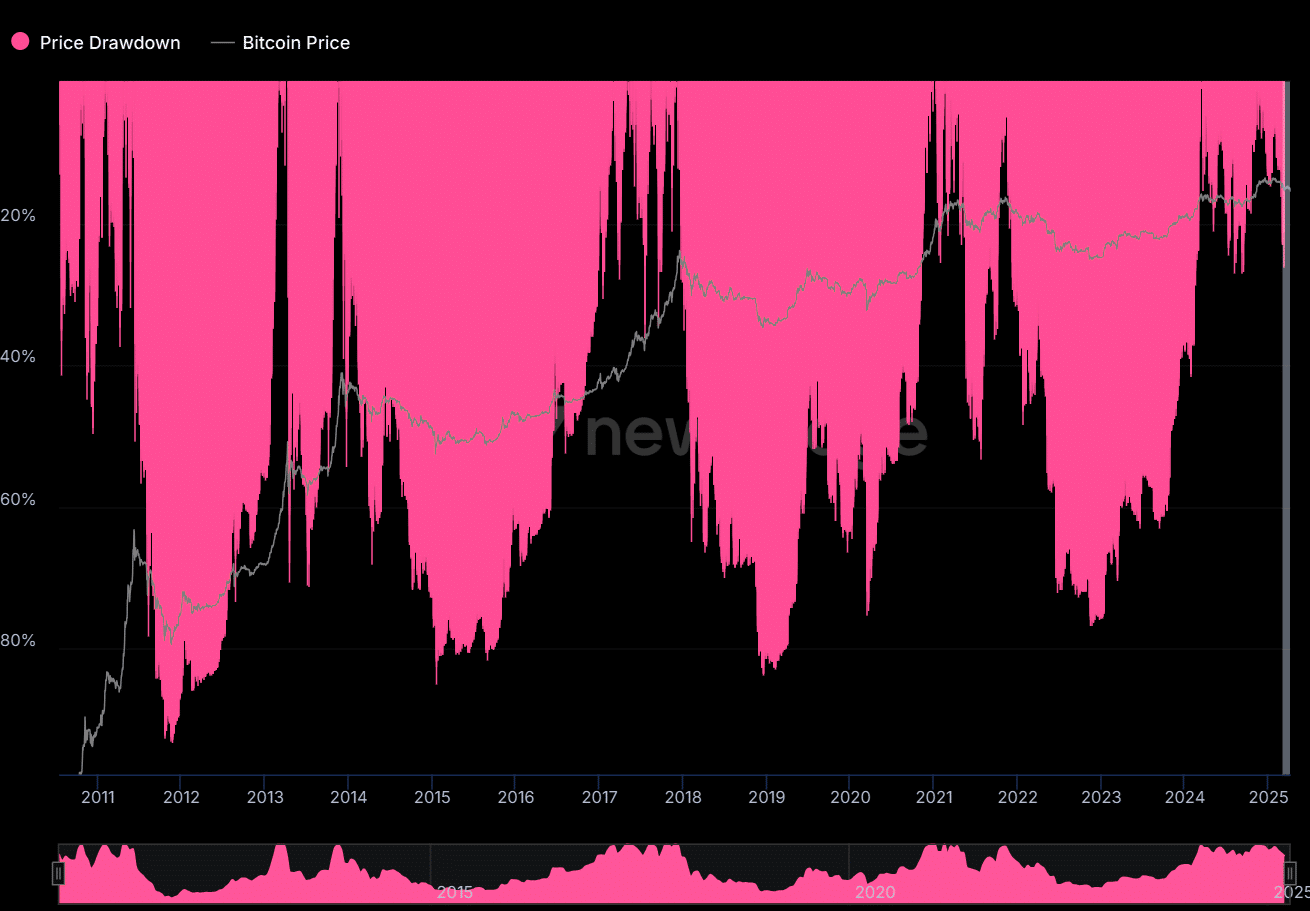

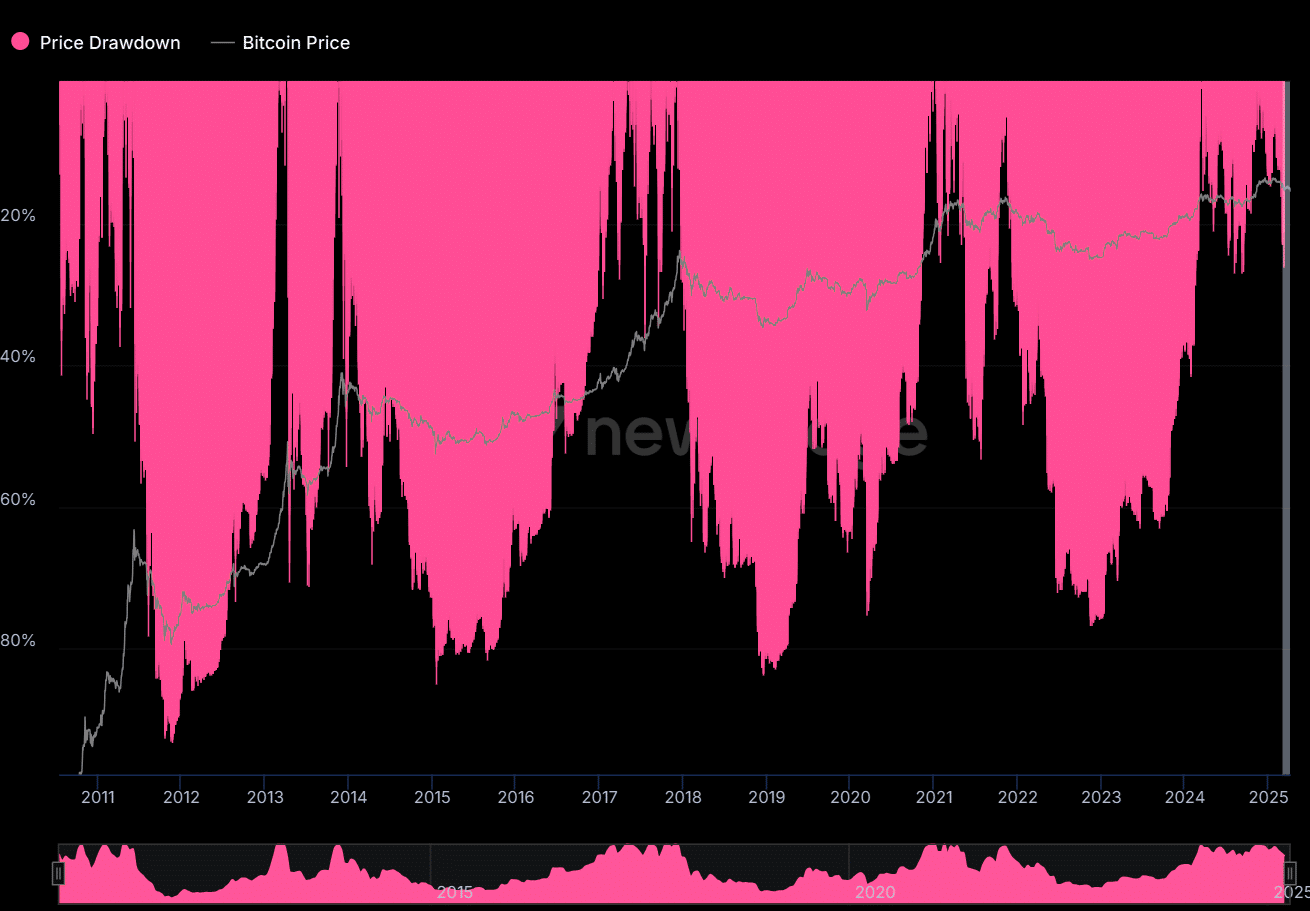

Supply: Newhedge

Earlier BTC -DrawDowns, particularly throughout the Bears market part, had been comparatively extra critical than the present lower of 36% -30%. In 2012, 2025 and 2019, for instance, BTC fell greater than 80% and lasted 6-12 months after it reached a value peak.

BTC has at present fallen round 30% within the final 3 months. As such, if tendencies from the previous happen, this could solely be the beginning of a bigger correction for the following 3-9 months.

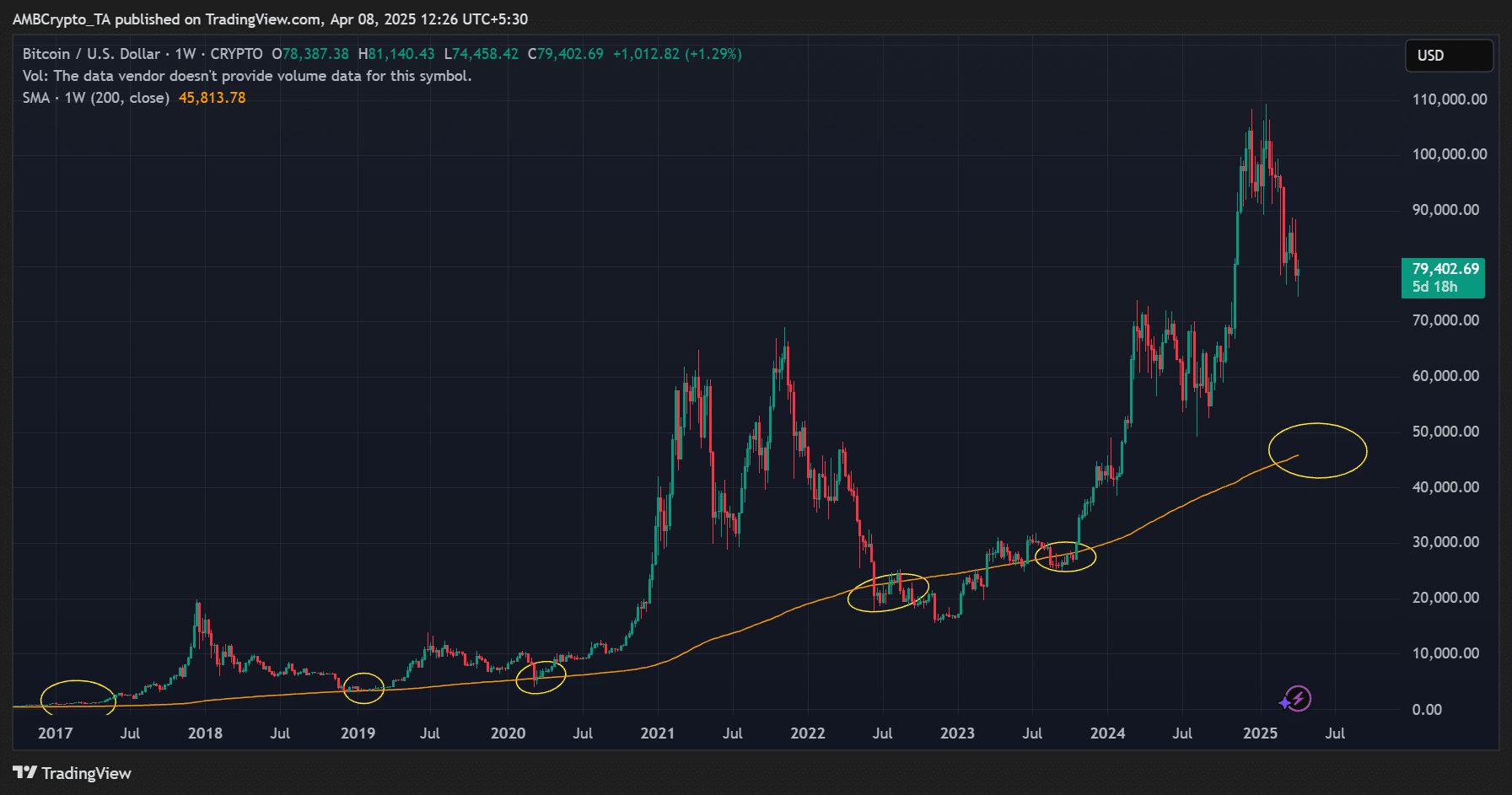

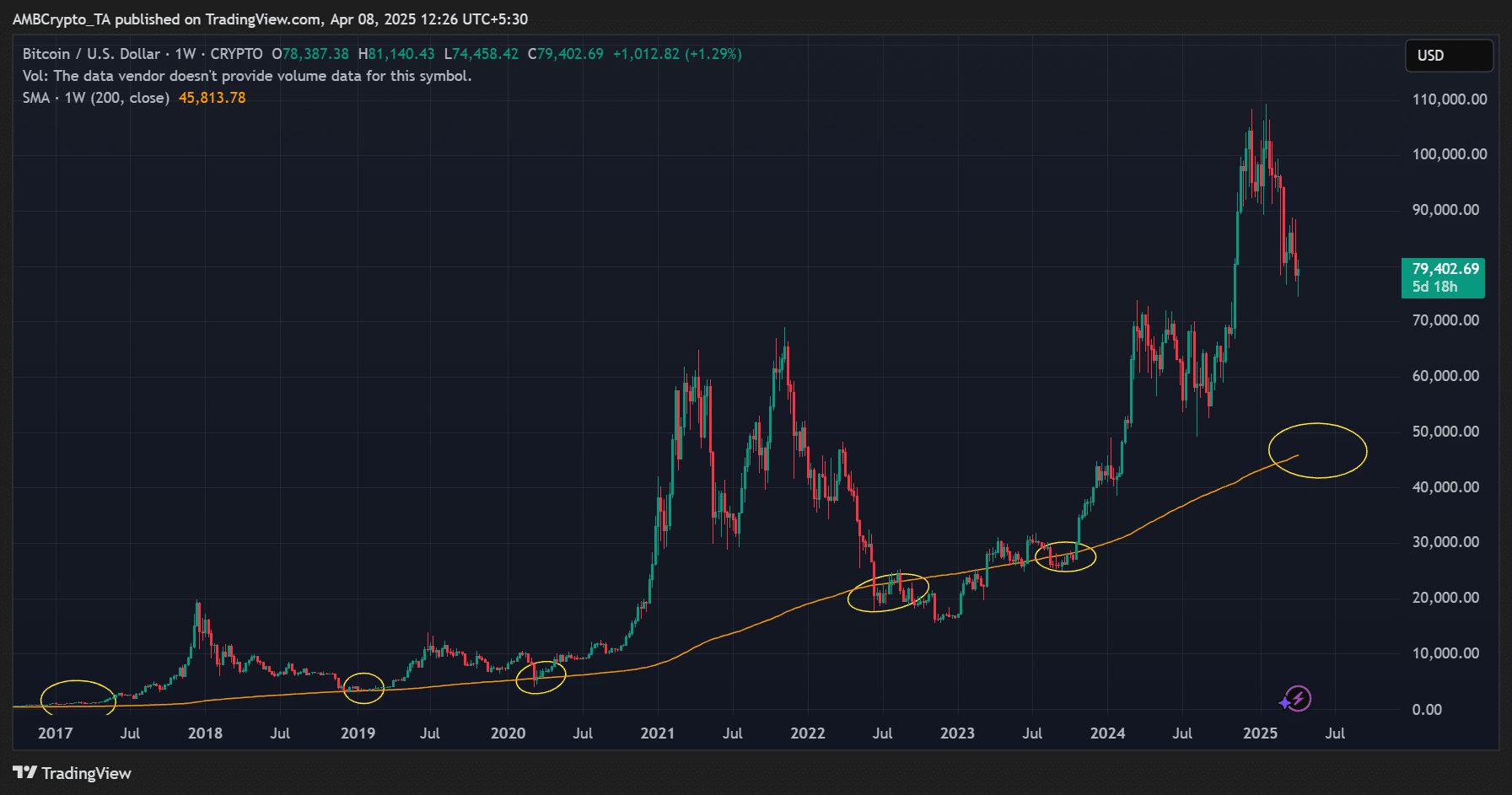

Nevertheless, a lower of 80% (as much as $ 21k) might be unlikely, since a very powerful bull-market assist, the 200-weekly advancing common, has risen to $ 45k.

Supply: BTC/USD, TradingView

In its place, some analysts imagine that present cycle assortment might be much less critical resulting from market maturation. Glassnode expected A possible soil across the $ 74k $ 70k space.

“The drawback can decelerate a bit from right here – between $ 74k and $ 70k, there’s a whole of ~ 175k $ BTC in price -based price -base clusters. The most important stage inside this attain is $ 71.6k, with ~ 41k $ btc.”

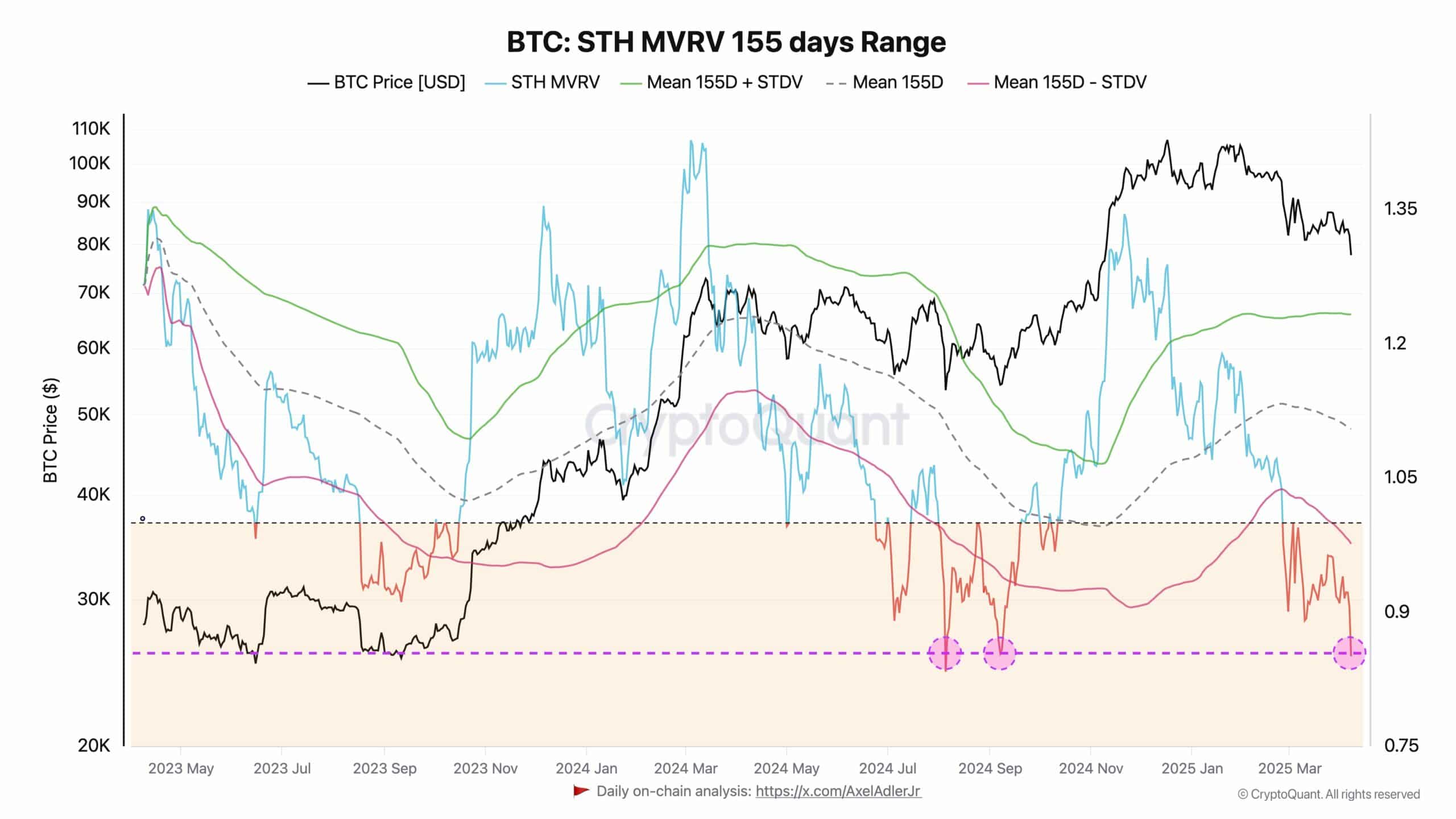

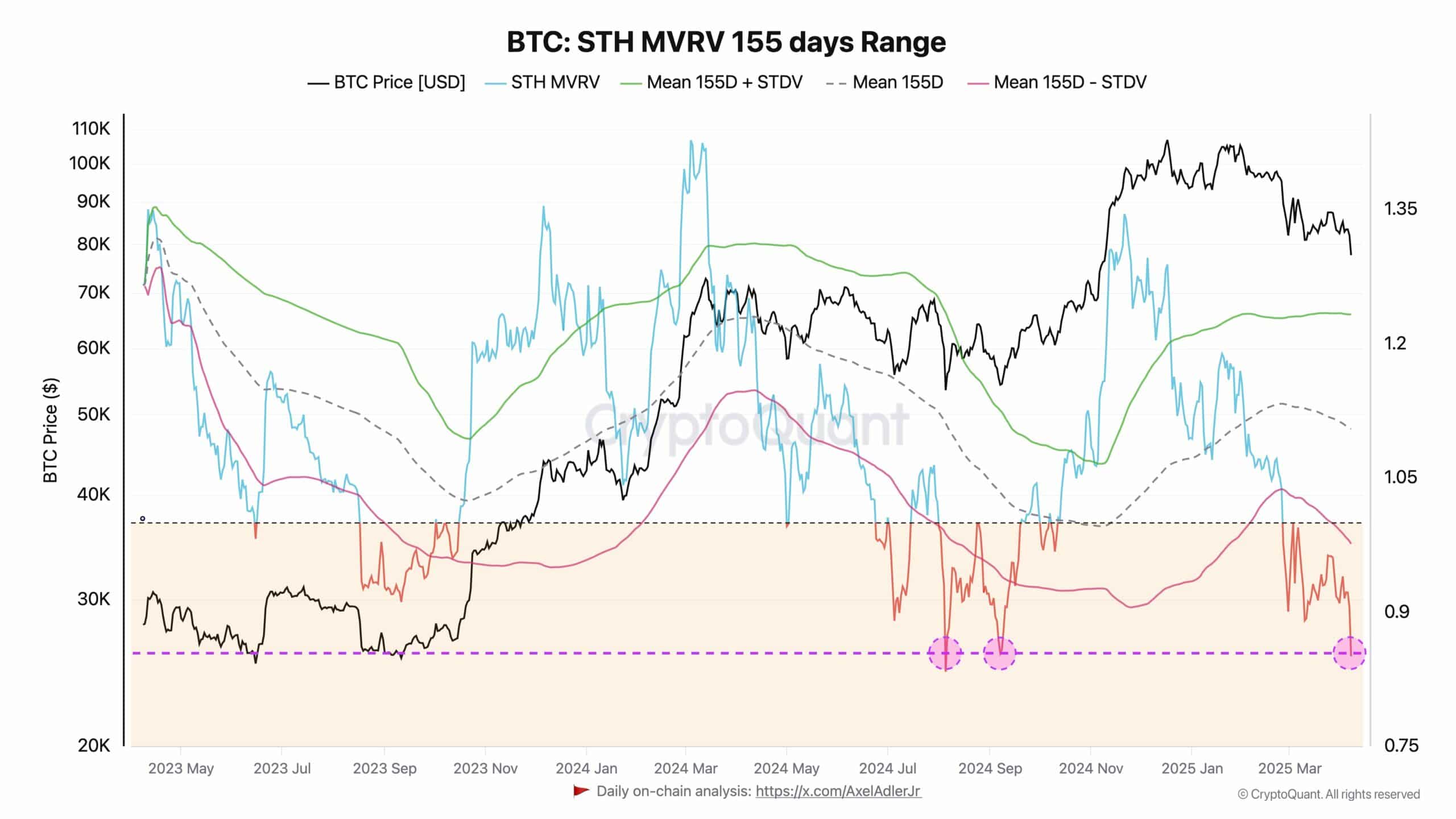

Analyst Axel Adler on chains, reflect The same angle, famous that BTC was dropped at the underside and was in an accumulation part, referring to the MVRV indicator of the STH (short-term holder), which mirrored the native soil that was seen final August.

“In essence, these situations often level on the finish of a correction part and the start of the buildup.”

Supply: Cryptuquant

Certainly, different good buyers, reminiscent of Philip Swift and StockMoney hace echoes had been filled with confidence bidding At these ranges.

Moreno warned That the soil was not absolutely marked as a result of numerous bullish indicators nonetheless needed to present for BTC.

In conclusion, the present drawing of 30% was nothing in comparison with the bear phases of the earlier cycle, which was on common a value lower of 80%. That’s the reason the present pullback could be a mid-bull correction for one more leg up.

Nevertheless, observe that it can be the beginning of a bigger correction if bullish circumstances don’t enhance.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024