Bitcoin

Bitcoin dominance hits 56%: Here’s what it means for your holdings

Credit : ambcrypto.com

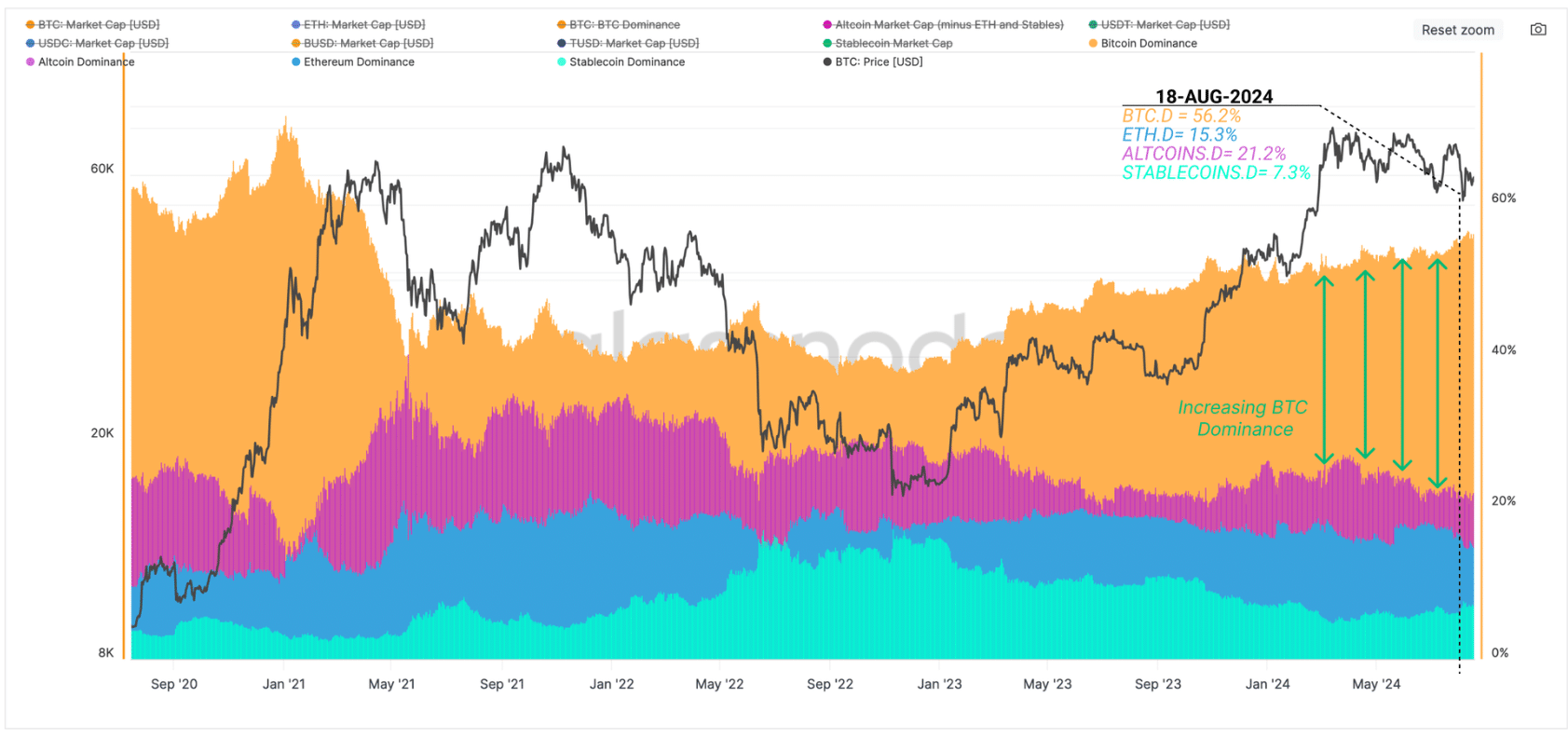

- Bitcoin’s dominance has elevated from 38% in 2022 to 56%, largely as a result of accumulation of long-term holders.

- Brief-term traders are left with unrealized losses, the place an overreaction will undoubtedly trigger additional declines.

Bitcoin [BTC] continues to dominate the cryptocurrency market, accounting for greater than half of the $2.1 trillion international crypto market capitalization.

In keeping with the on-chain analytics platform Glass junctionFor the reason that crypto market hit the underside of the cycle in November 2022, BTC’s dominance has grown from 38% to 56%.

Then again, Ethereum [ETH] Dominance has remained comparatively flat over the previous two years, whereas altcoins have additionally misplaced 6.5% of their market share.

Supply: Glassnode

Lengthy-term holders guarantee Bitcoin’s dominance

In keeping with Glassnode, Bitcoin’s development comes amid a rise in capital inflows into the asset as long-term holders present diamond fingers.

The availability of Bitcoin amongst these merchants has elevated considerably. The report famous that almost all of those merchants turned long-term holders after buying BTC close to its all-time excessive in March.

“Regardless of the uneven and uneven worth motion, the resolve of long-term holders stays agency, with a transparent choice for HODL and buying cash,” Glassnode stated.

These holders have a revenue of roughly $138 million per day. This will increase the gross sales danger, however the profit-taking actions have cooled down.

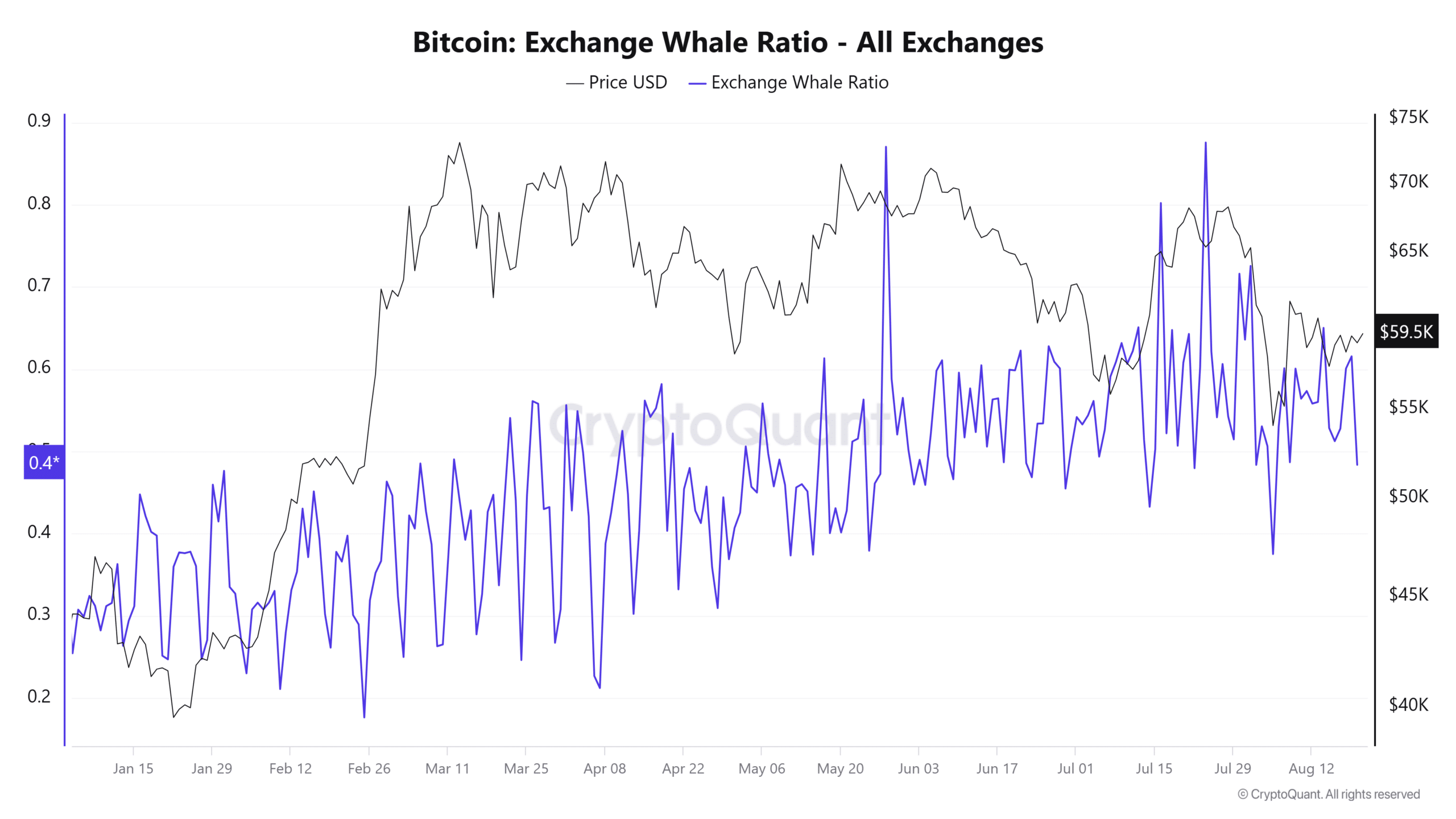

This commentary is additional bolstered by information from CryptoQuant displaying that after intense profit-taking by whales in Might and July, the Trade Whale Ratio is now declining.

(Supply: CryptoQuant)

Moreover, consumers seem like absorbing the cash bought, which explains why Bitcoin’s worth has remained range-bound in latest months since its ATH worth dropped.

Brief-term holders precipitated a $50,000 dip

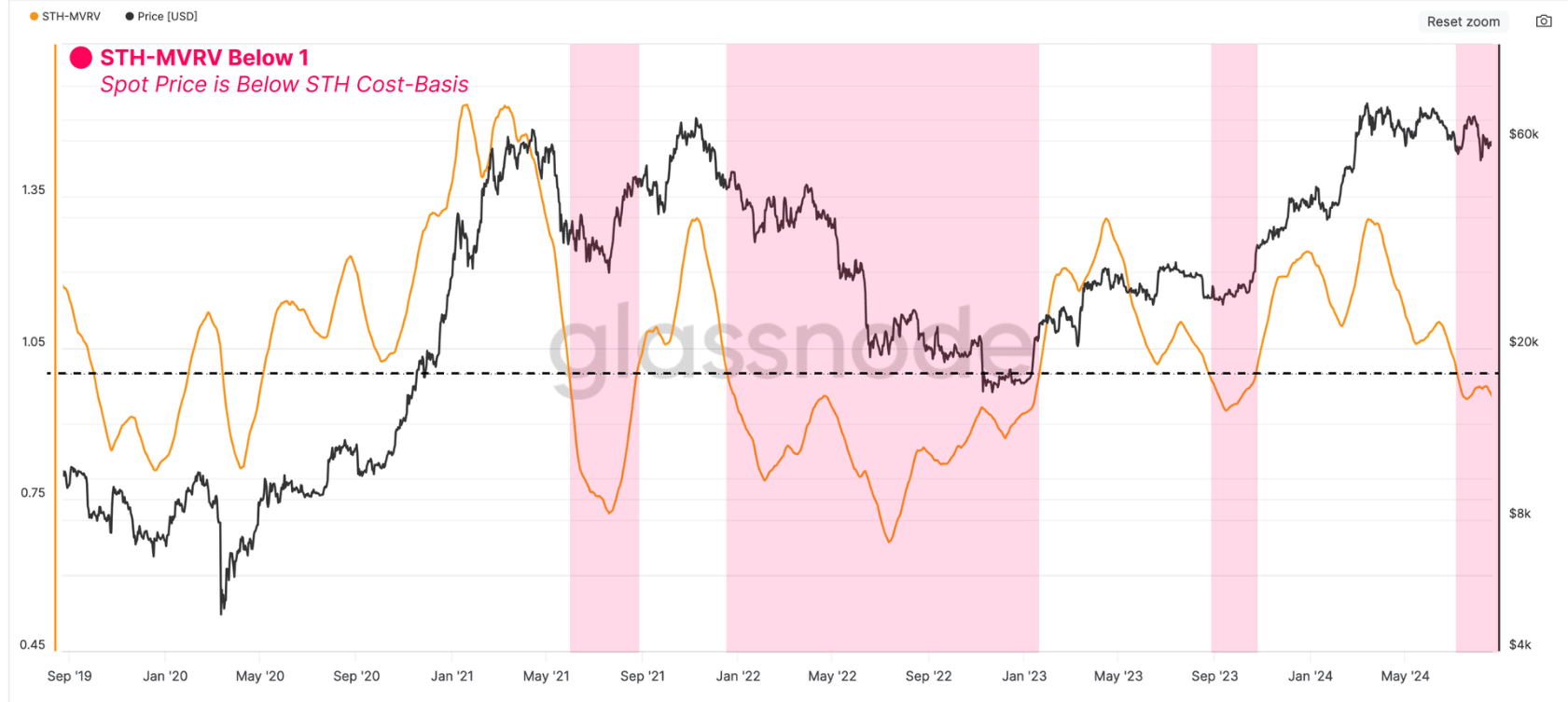

Glassnode additionally argued that an “overreaction” from short-term holders precipitated Bitcoin’s drop beneath $50,000 earlier this month.

The market worth to realized worth ratio (MVRV) for the short-term holder is beneath 1, indicating that these traders are struggling unrealized losses. This ratio has been beneath the equilibrium level for the previous 30 days.

Supply: Glassnode

In contrast to long-term holders, short-term Bitcoin holders are way more reactive to cost actions, with their responses lagging behind native tops or bottoms, in keeping with Glassnode. That is what occurred on August 5 when BTC crashed to a multi-month low at $49,000.

If these traders proceed to maintain losses beneath $59,000 for prolonged durations, the analysts say it’s going to enhance the chance of market panic and critical bearish momentum.

A take a look at leveraged buying and selling signifies a slight shift to the bullish aspect. The lengthy/quick ratio is on Mint glass confirmed a gradual enhance in lengthy positions since August 18.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now