Bitcoin

Bitcoin drops to $104K: Can $3.3B in inflows spark BTC’s reversal?

Credit : ambcrypto.com

- Whale gross sales contrasts with $ 3.3 billion influx and lengthy -term holders who add 881K BTC.

- N / a peaks, new tackle progress slows down and liquidation zones threaten elevated volatility.

On June 11, Bitcoin [BTC] Accumulation portfolios noticed the most important influx of sooner or later of 2025 and absorbed 30,784 BTC price $ 3.3 billion.

This pockets, usually sure to lengthy -term holders and never linked to exchanges, now collectively have 2.91 million BTC.

This occurred particularly whereas Bitcoin traded round $ 104,719, which mirrored a day by day lower of two.41%. Regardless of the brief -term volatility, the scale and conviction of this influx recommend an extended -term bullish bias.

This conduct implies that enormous holders place a possible profit, even when the retail sentiment appears cautious.

Whales versus LTHS

A distinguished Walvispallet lately deposited 1,000 BTC price $ 106 million to Binance and continued a gross sales line that began in April 2024.

Up to now, this pockets has discharged 6,500 BTC, which signifies a robust intention to attain revenue as the value approaches crucial resistance.

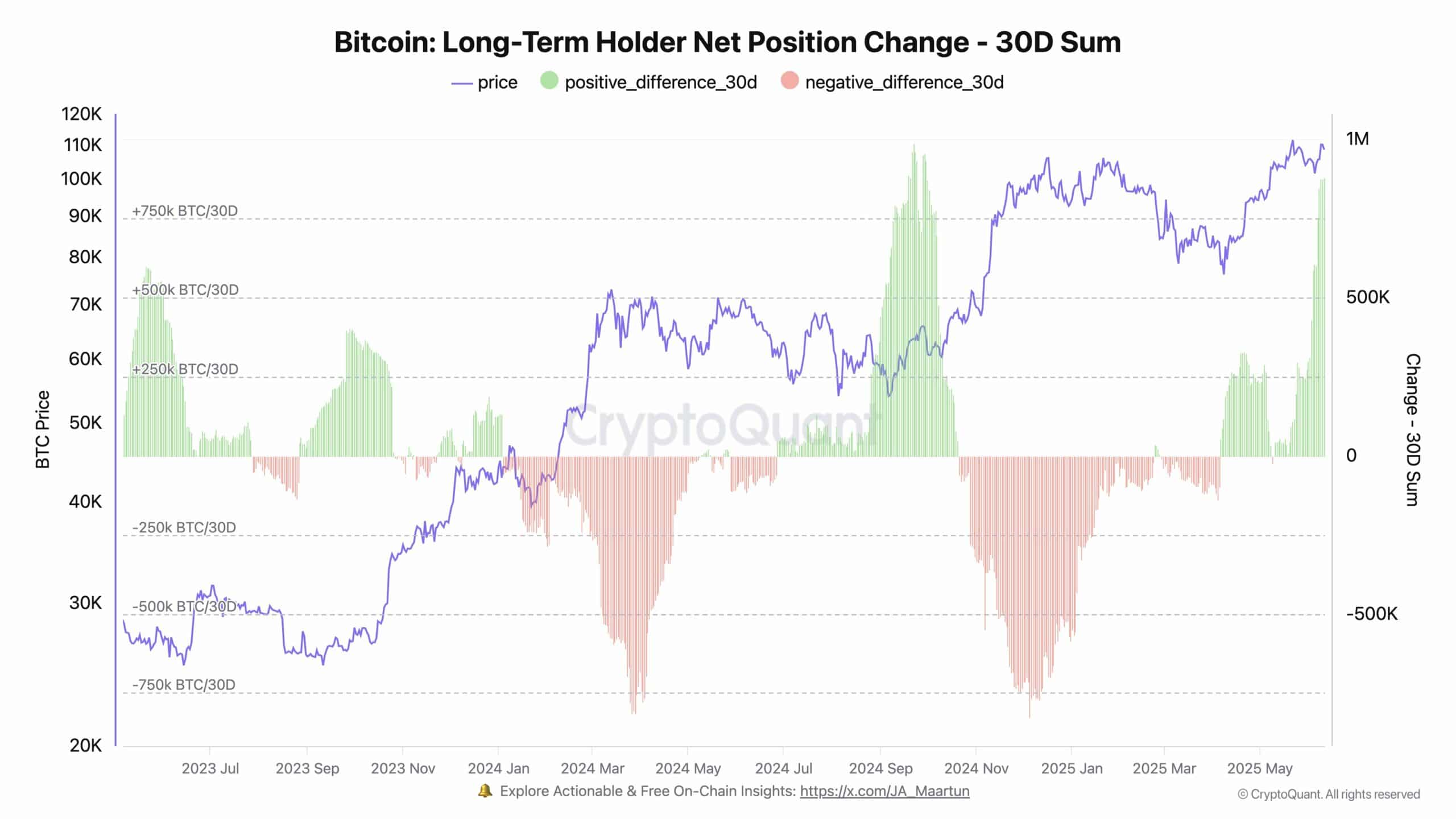

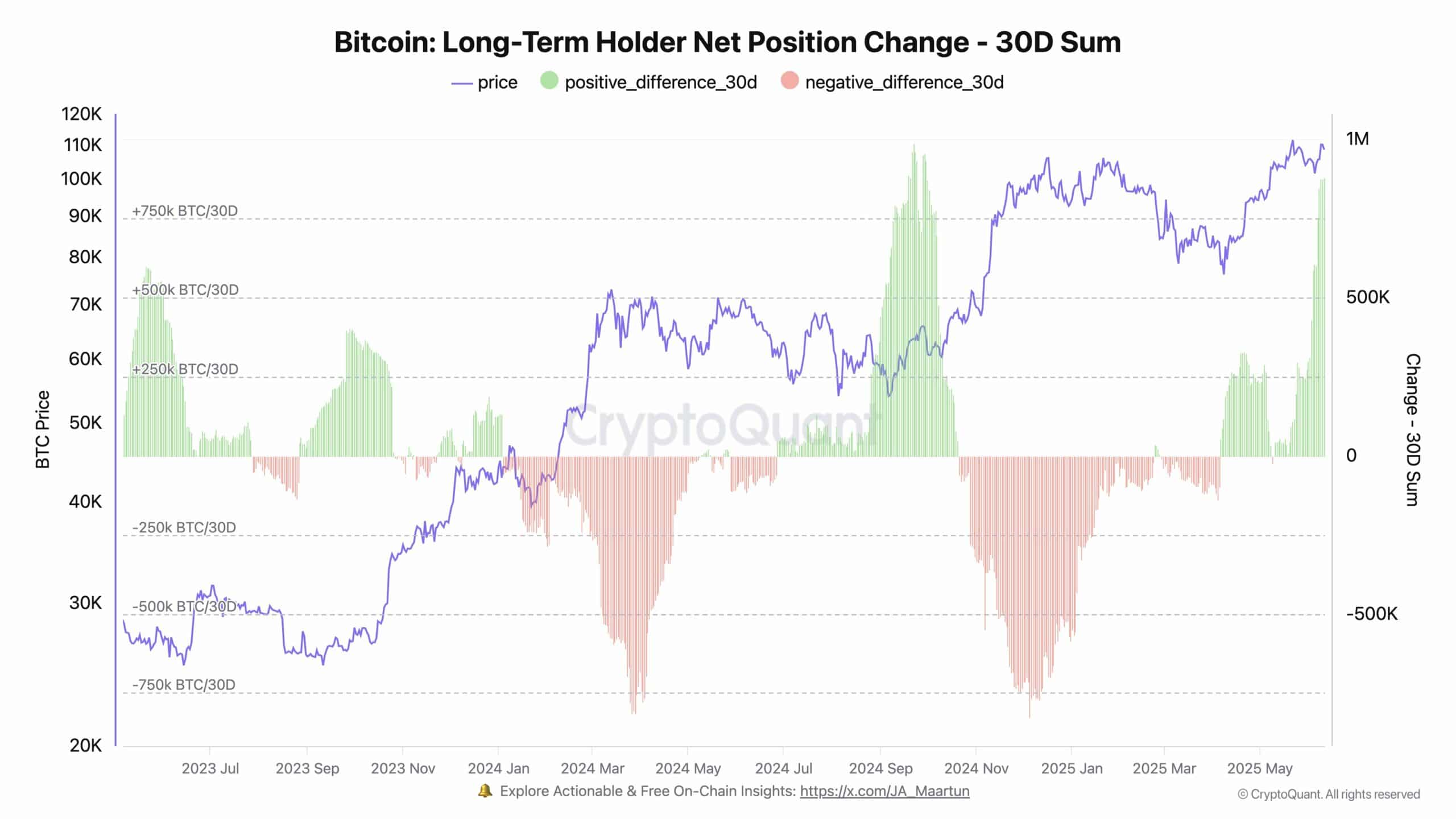

Nevertheless, the whale nonetheless accommodates 3,500 BTC, indicating that it’s not a whole output however a tactical distribution. Lengthy -term holders, however, have added a shocking 881,578 BTC within the final 30 days, in line with cryptoquant.

This aggressive accumulation reveals non-reversing convictions within the upward upward for Bitcoin uphill in the long run, regardless of short-term volatility and whale exits.

Supply: Cryptuquant

Can Bulls conquer the $ 112k wall?

The value of Bitcoin has failed a number of occasions to interrupt the $ 112k resistance. The market construction nonetheless leans bullish due to the rising trendline help.

Nevertheless, the relative energy index (RSI) fell under 50 and emphasised the declining momentum. Subsequently, until patrons reclaim the $ 106k zone quickly, will increase the chance of a brand new withdrawal to $ 101K.

Nonetheless, Bulls can catch late shorters in the event that they achieve pushing the costs above this congestonone. Market resolution round this stage will most likely outline the subsequent step of BTC.

Supply: TradingView

Did BTC’s admire its usefulness?

The ratio of the community worth / transaction (NVT) elevated by 15.21% to 36.49, which displays the rising divergence between market capitalization and switch quantity on the chain.

Such peaks have indicated traditionally speculative overvaluation. That’s the reason this statistics now recommend that the value of Bitcoin can rise quicker than the precise demand for transactional use.

If this development persists, it might precede an area prime. Nevertheless, excessive NVTs may happen in early phases of the excessive -time uptrends, particularly when holders want accumulation over expenditure.

Supply: Cryptuquant

What does BTC preserve lively?

Up to now week, lively addresses rose by 1.69%, whereas new addresses fell by 2.36%. This means that the present customers stay concerned, even when the brand new person’s influx is gradual.

That’s the reason the market might be working on the inside momentum as a substitute of attracting recent capital.

Though this dynamic can help brief -term rallies, lengthy -term sustainability normally requires the enlargement of the person base.

Nonetheless, the rise in lively portfolios indicators nonetheless embrace that set holders are nonetheless collaborating, which stabilizes the community throughout unsure circumstances.

Supply: Intotheblock

Liquidation clusters centered on volatility

The 24-hour Binance Liquidation HeatMap emphasizes dense lengthy liquidations of round $ 105k and $ 102k. That’s the reason worth actions in these zones can activate cease loss.

This setup will increase the volatility threat as bears pushing below these thresholds. Nevertheless, if BTC holds above $ 104k, this will catch brief positions and provoke a reduction bouncing.

These clustered zones usually work as bending factors and reinforce which aspect additionally positive factors energy. Consequently, merchants should test these ranges for sharp actions in each instructions.

Supply: Coinglass

Will holders in the long run feed the subsequent outbreak?

Regardless of the value rejection within the neighborhood of $ 112k and bought within the brief time period, long-term accumulation and file present in HODL portfolios are a robust conviction.

Community fundamentals appear to be blended, with weakening person progress however regular exercise of present individuals.

Elevated valuation statistics recommend warning, however the conduct of patrons implies belief in lengthy -term advantages.

Subsequently, if Bitcoin can reclaim $ 106k and defend essential help, the subsequent leg to new highlights could possibly be underway.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now