Altcoin

Bitcoin ETF Inflows Hit $20 Billion, Outpacing Gold ETFs by 10x: What Now?

Credit : ambcrypto.com

- Bitcoin ETFs surpassed $20 billion in inflows of their debut yr, outpacing gold ETFs by an element of 10.

- BTC change inflows drop 95.93% in 48 hours, whereas social quantity rises steadily.

American Bitcoin [BTC] ETFs have surpassed a powerful $20 billion inflows of their first yr, as just lately reported tweet from MartyParty.

That is in stark distinction to gold ETFs, which attracted a lot decrease inflows of their first yr.

The speedy adoption of BTC ETFs underlines the rising curiosity in digital belongings, additional strengthening Bitcoin’s place as a serious participant within the funding universe.

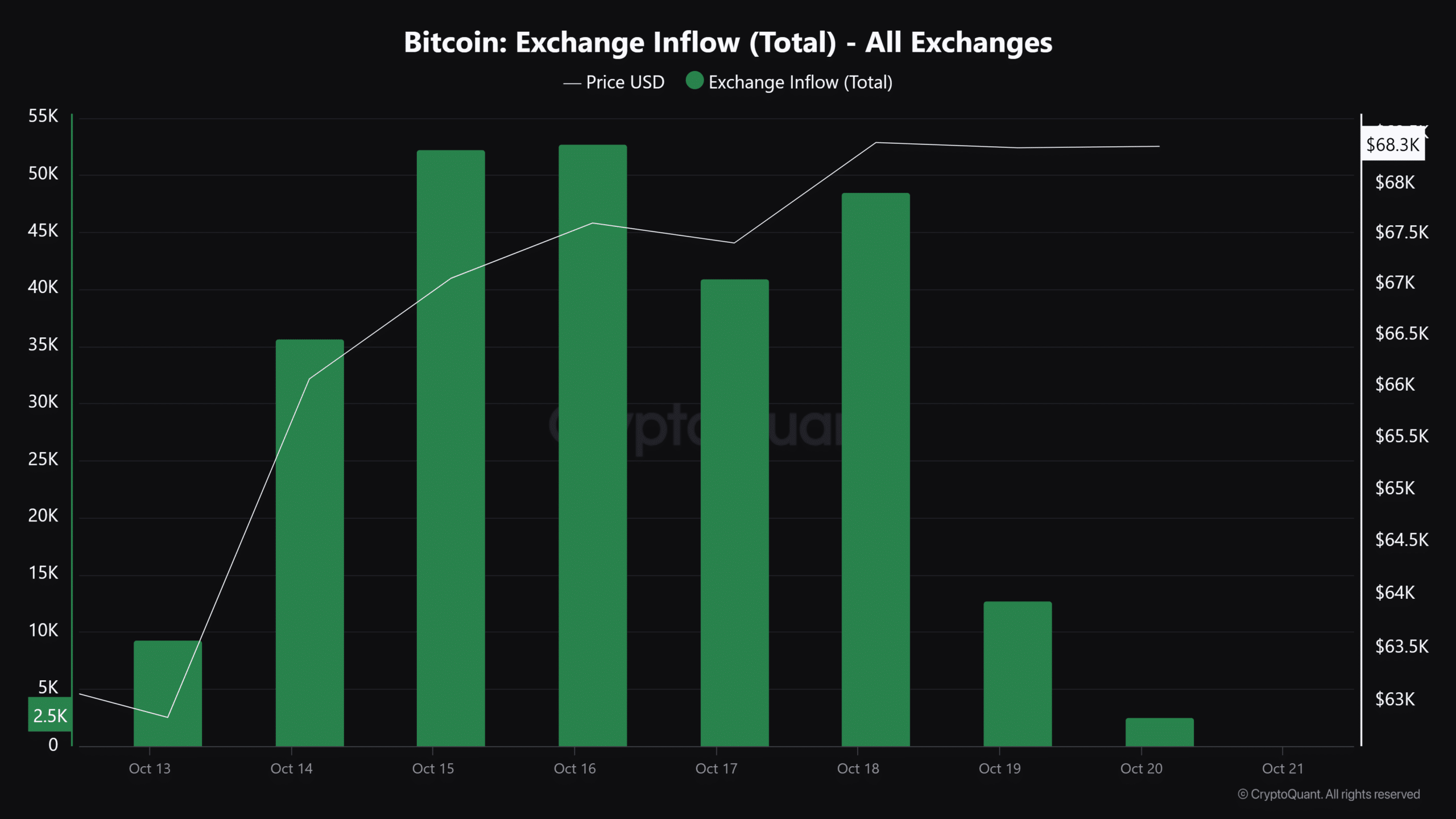

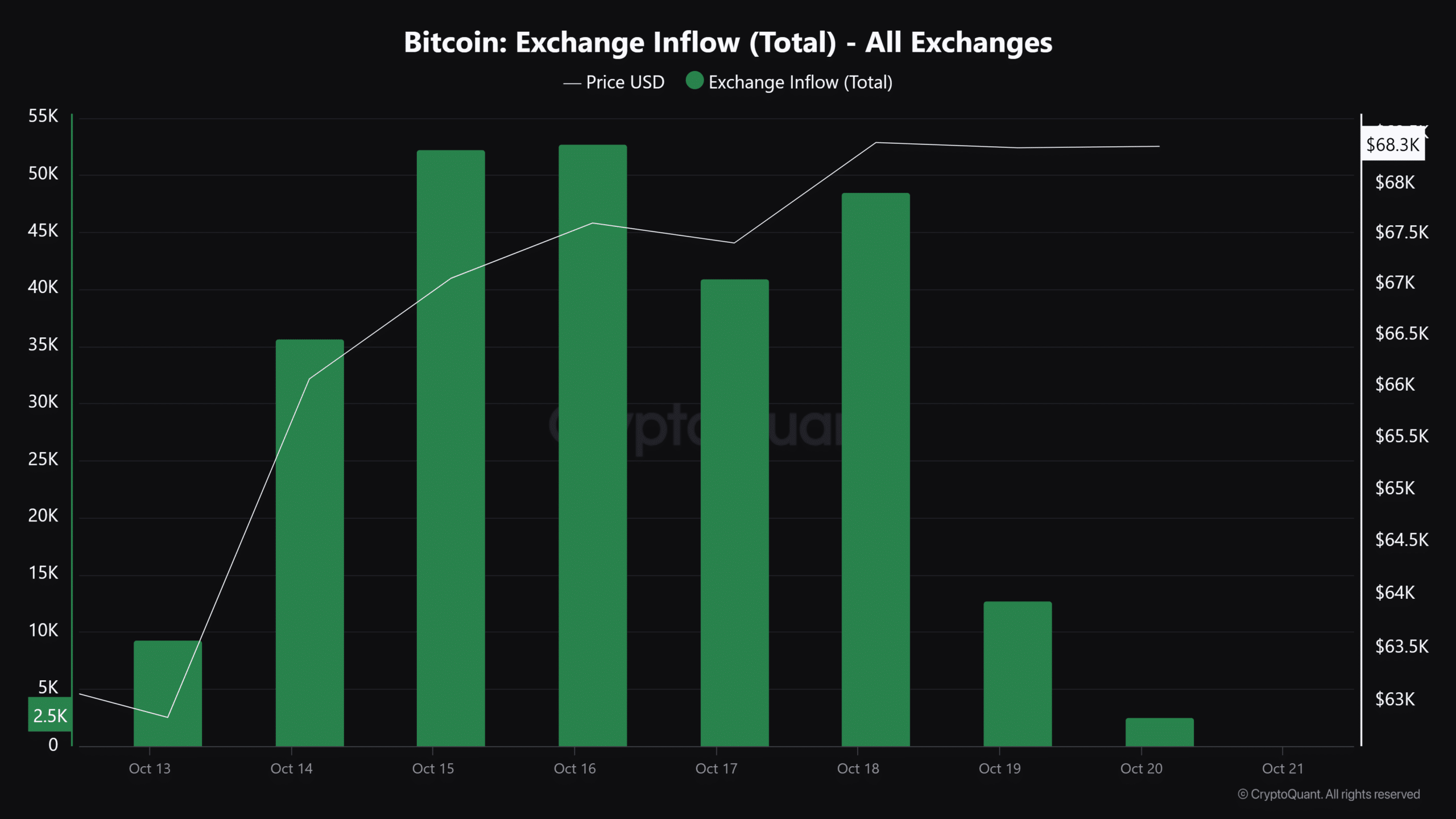

Bitcoin change inflows are declining

Whereas ETFs are seeing heavy inflows, Bitcoin inflows on the exchanges have fallen considerably over the previous 48 hours, by over 95.93%.

This alerts a shift in investor habits as fewer individuals transfer their BTC to exchanges.

Consequently, the decline in inflows may be an indicator of the bullish perspective of the holders as they select to carry the belongings somewhat than promote them.

Supply: CryptoQuant

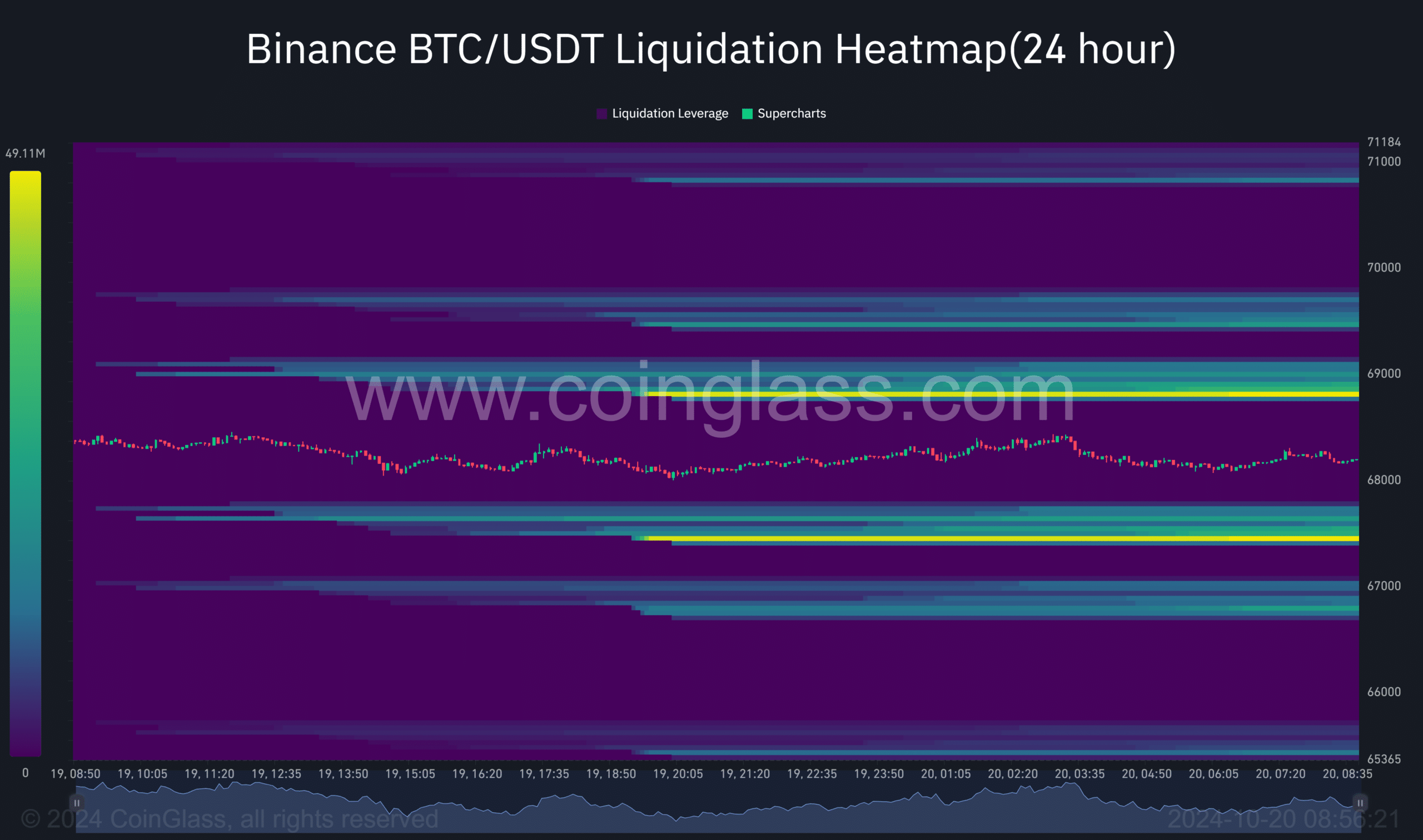

The liquidity heatmap reaches equilibrium

AMBCrypto evaluation of the liquidity heatmap knowledge revealed an equilibrium in Bitcoin’s liquidity ranges.

Within the final 24 hours alone, liquidity on the $68.8k and $67.5k worth ranges has reached equilibrium, with 49.12 million at each factors.

Maybe this might point out that BTC is consolidating and gathering vitality to push costs larger.

Supply: Coinglass

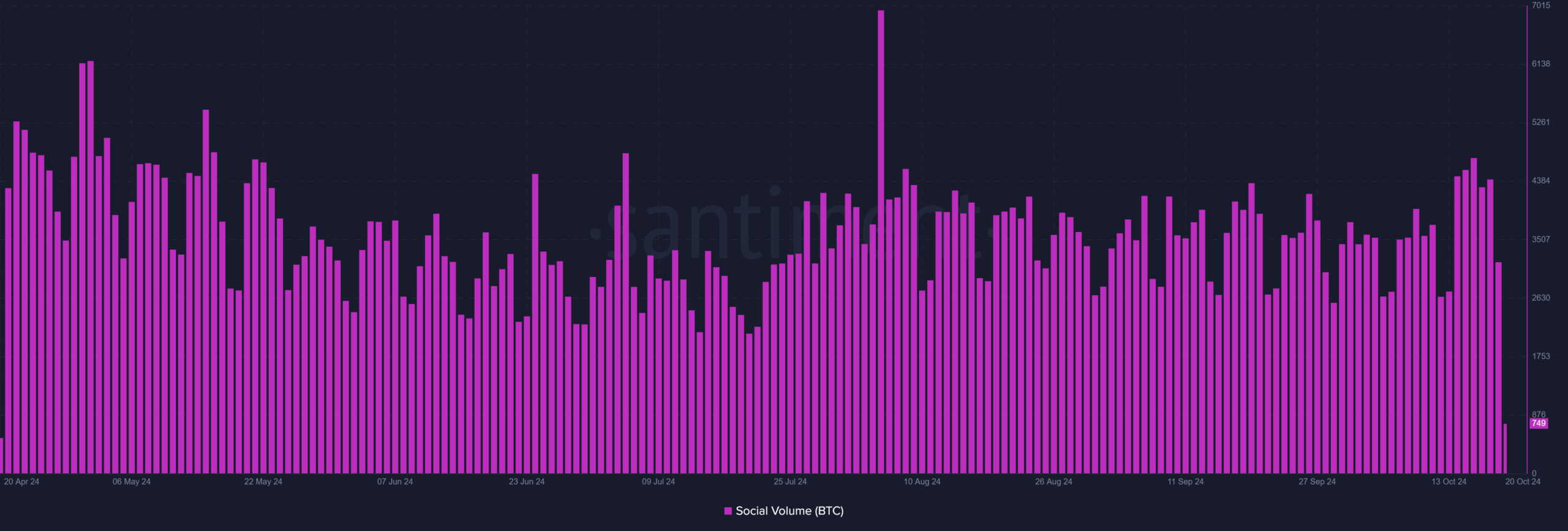

Bitcoin’s social quantity is growing

Complementing the inflows into the ETF and the steadiness of the market is the step by step growing social quantity of BTC.

Since October 12, Bitcoin social quantity has elevated, indicating larger engagement and curiosity inside communities.

This flurry of social exercise means that Bitcoin is as soon as once more a scorching subject, with extra individuals than analysts and buyers speaking about its worth, expertise and future potential.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Traditionally, as social quantity will increase, so does market curiosity and exercise.

Supply: Santiment

The success of BTC ETFs, declining foreign money inflows, balanced liquidity, and growing social engagement all level to a bullish market outlook for Bitcoin.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024