Bitcoin

Bitcoin ETF inflows soar as price nears $90K – Is $100K next?

Credit : ambcrypto.com

- Bitcoin’s worth soared after Donald Trump’s presidential victory, approaching the $90,000 mark.

- BlackRock’s Bitcoin ETF and crypto shares hit report buying and selling volumes throughout Bitcoin’s rally.

Bitcoin [BTC] has entered a bullish section following the victory of Donald Trump because the forty seventh President of america.

Curiously, market hypothesis was already buzzing with predictions that Trump’s victory may push BTC to the long-awaited $100,000 mark.

As Bitcoin approaches $90,000, that milestone seems inside attain – though market analysts stay cautious, stressing that future worth actions stay unsure amid continued volatility.

Along with BTC’s spectacular worth rise, the broader crypto market can also be witnessing outstanding efficiency.

Influence of Bitcoin approaching $90,000

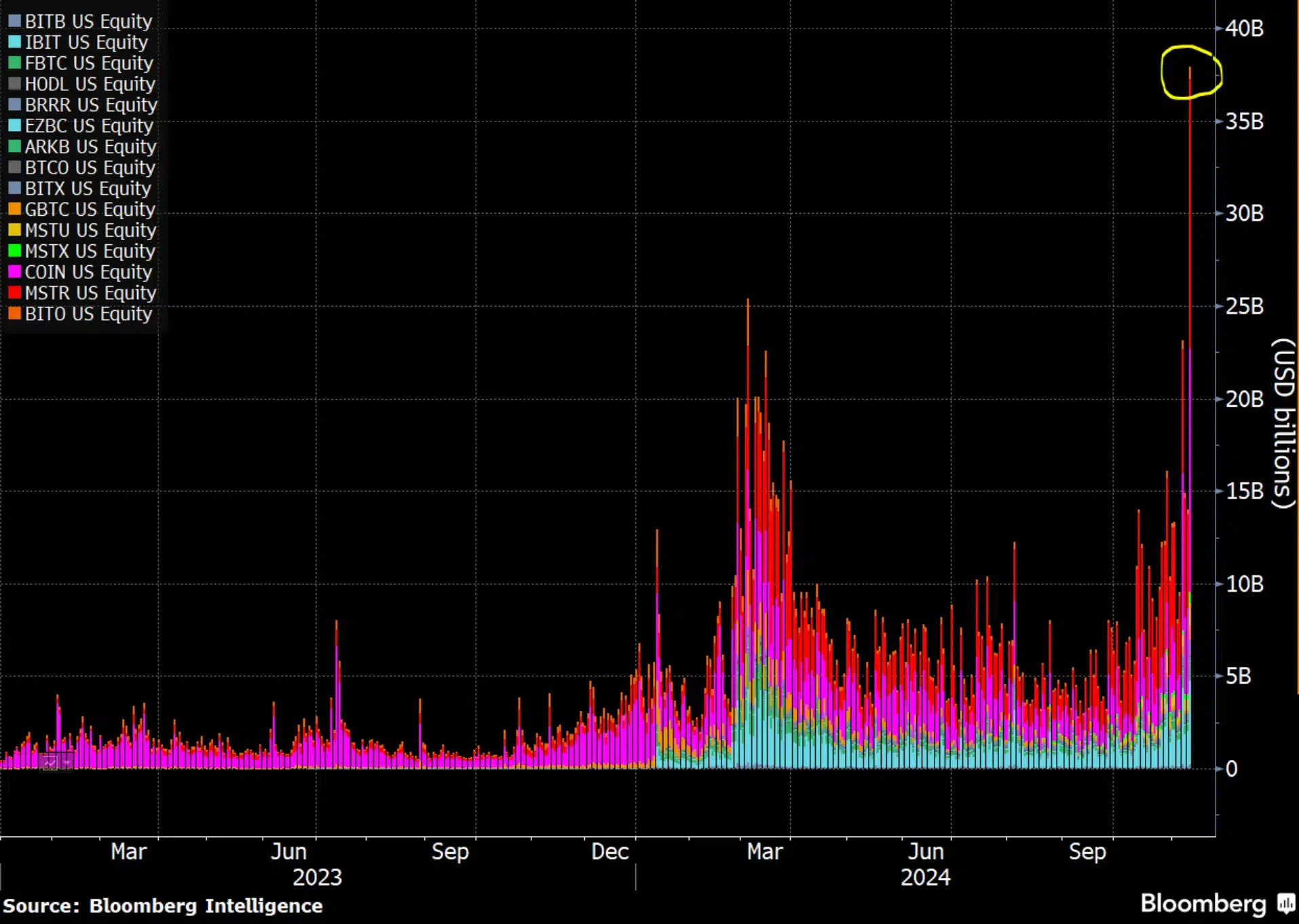

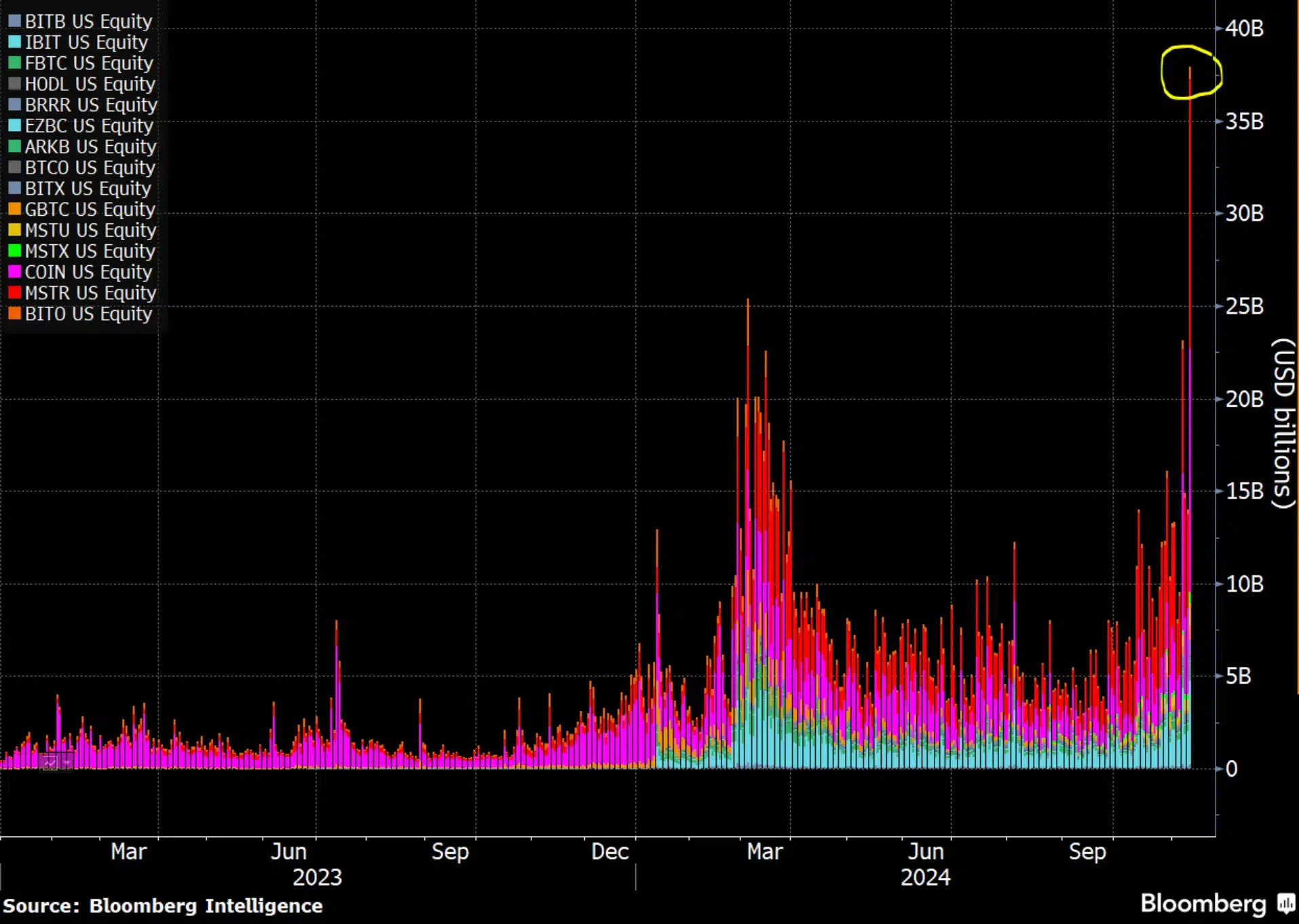

Bitcoins recent rally of 11% in 24 hours, pushing it to $89,700 on November 12, has led to a surge in buying and selling volumes for US Bitcoin Change-Traded Funds (ETFs), together with crypto companies like MicroStrategy Inc. (MSTR) and Coinbase International Inc. MINT).

Mixed every day buying and selling volumes for these belongings reached a report $38 billion, a big improve from the earlier report of round $25 million in March.

Bloomberg Intelligence and ETF analyst says about the identical Eric Balchunas mentioned,

“The Bitcoin Industrial Complicated (ETFs + MSTR, COIN) noticed $38 billion in buying and selling quantity at present, setting lifetime data in all places, together with $IBIT bringing in $4.5 billion, indicating a sturdy week of inflows. Simply an incredible day, it actually deserves a reputation a la Volmageddon.

Supply: Eric Balchunas/X

Bitcoin ETF can also be experiencing a robust improve

Effectively, it wasn’t simply the same old gamers like Bitcoin ETFs, MSTR and COIN that witnessed a surge; BlackRock’s spot BTC ETF additionally shattered earlier buying and selling quantity data.

Days after Trump’s victory, BlackRock’s Bitcoin ETF recorded inflows of greater than $1.1 billion in a single day, setting a brand new benchmark.

MicroStrategy emerged as one of many largest gainers on November 11, with its inventory rising greater than 25% to $340. Coinbase additionally rose almost 20% to achieve $324.20 – its first time above $300 since 2021.

Notably, MSTR and COIN have been among the many high 5 most traded shares in early buying and selling, even surpassing giants like Apple and Microsoft, as famous by ETF analyst Eric Balchunas.

Neighborhood response and extra

Contemplating the outstanding impression following Trump’s victory, Sam McDonald replied to Balchunas’ tweet saying:

“@EricBanchunas is simply attempting to gauge the temper on Wall Avenue. Are these figures that entice consideration? It appears (from a distance) just like the Trump impact is taking every part to the subsequent degree.”

So, whereas BTC’s latest worth surge has created pleasure, it’s unsure whether or not this rally is pushed solely by Trump’s victory or if different components are additionally at play.

Subsequently, because the market adjusts within the coming days, will probably be intriguing to see whether or not Bitcoin’s momentum will proceed or if a pullback is in retailer.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now