Bitcoin

Bitcoin ETF inflows surge to $22B – Are retail investors leading the charge?

Credit : ambcrypto.com

- Spot Bitcoin ETFs have gathered inflows of greater than $22 billion, reflecting robust market demand.

- Retail buyers now personal 80% of the whole belongings in Bitcoin ETFs, producing vital curiosity.

Uncover Bitcoin since their introduction [BTC] exchange-traded funds (ETFs) have seen a outstanding rise in recognition, amassing cumulative inflows which have eclipsed $22 billion.

Among the many leaders, BlackRock’s IBIT stands out with a formidable influx of $23 billion, whereas Grayscale’s GBTC has seen notable outflows totaling $20 billion.

As anticipated, current momentum is in BTC ETFs continued with internet inflows of almost $1 billion recorded final week, marking the best demand up to now six months.

Managers weigh in…

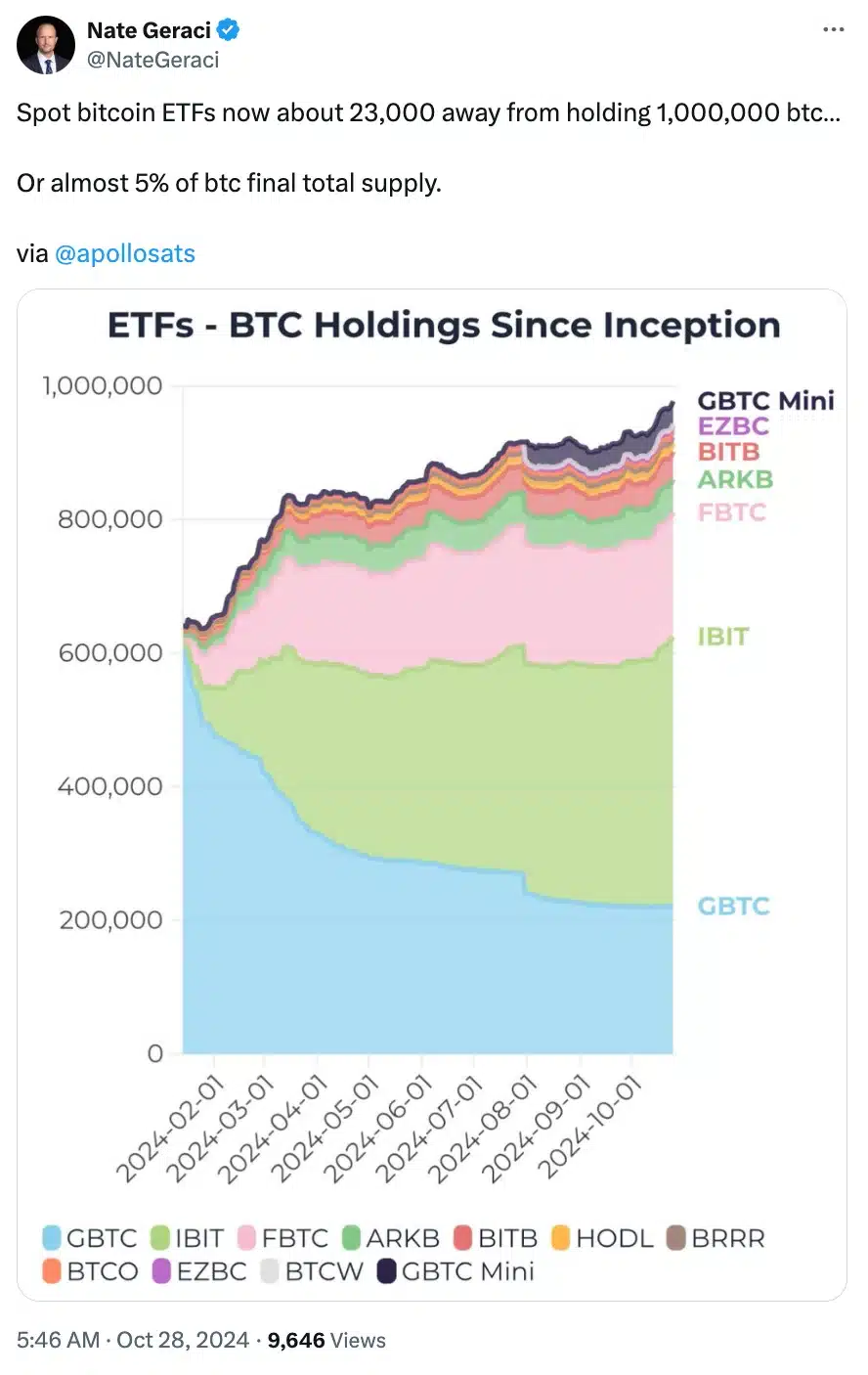

In gentle of the numerous success of spot Bitcoin ETFs, Nate Geraci, president of ETF Retailer, took to X to share his insights, stating:

Supply: Nate Geraci/X

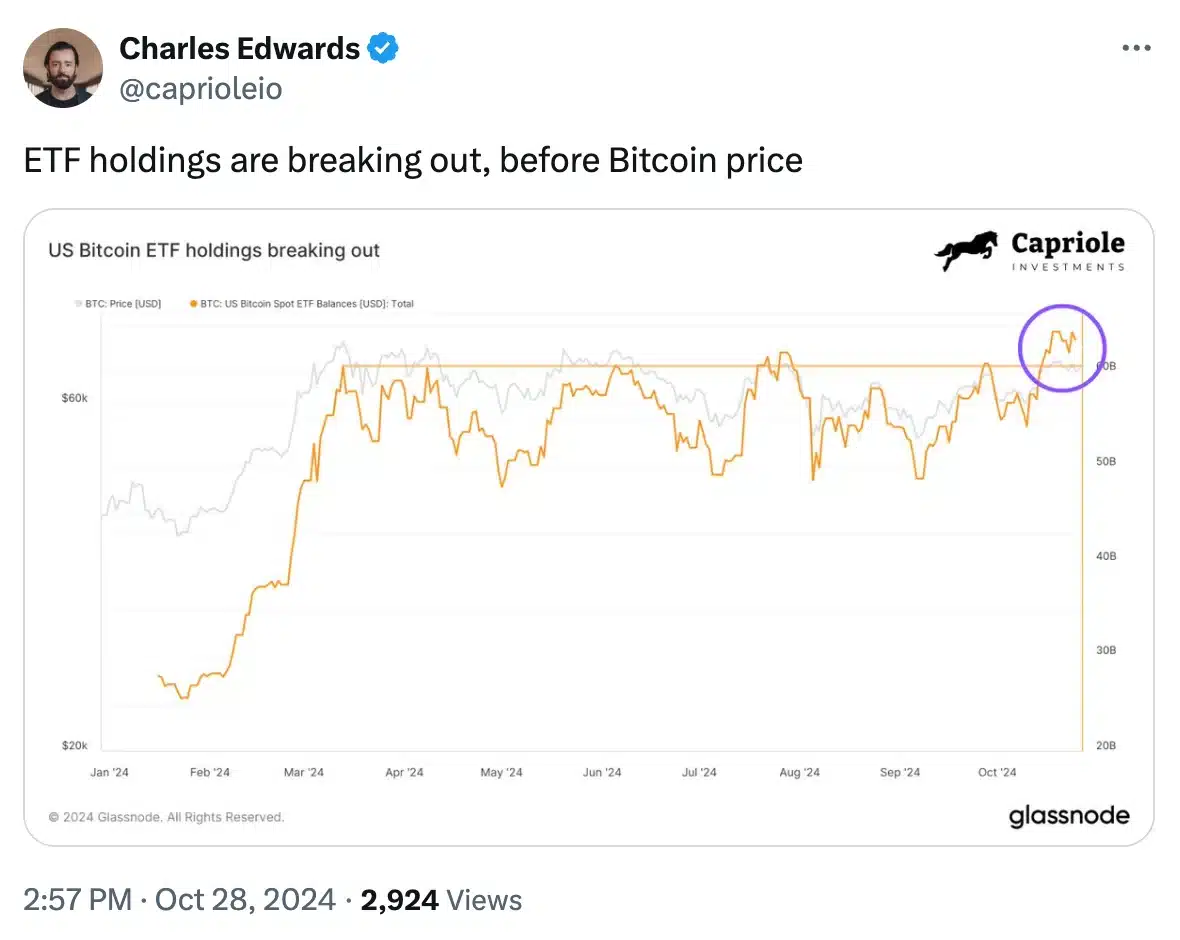

Charles Edwards, founding father of Capriole Investments and The Ref, joined the dialog and commented:

Supply: Charles Edwards/X

Are retail buyers driving the Bitcoin ETF market?

Though spot BTC ETFs supply alternatives for institutional buyers, current insights from crypto change Binance present that retail buyers are considerably driving the rising demand.

In keeping with them reportretail contributors now personal as a lot as 80% of the whole belongings in these ETFs, underscoring their essential function out there’s upward momentum.

This pattern highlights a notable shift in funding dynamics, with particular person buyers not solely being lively but additionally producing vital curiosity in Bitcoin by way of these monetary devices.

The report famous:

“Spot Bitcoin (“BTC”) change traded funds (“ETFs”) have gathered over 938.7K BTC (~US$63.3 billion), and when together with different related funds, this determine contains 5.2% of the whole provide of Bitcoin.”

What else is occurring?

The report additional highlighted a big improve in exercise inside crypto ETFs, with internet inflows exceeding 312,500 BTC (roughly $18.9 billion) and optimistic inflows recorded in 24 of the previous 40 weeks. On common, these ETFs take away roughly 1,100 BTC from circulation day-after-day, reflecting a proactive shopping for method.

This lower in provide, mixed with rising demand, may push Bitcoin costs greater, signaling rising adoption of Bitcoin investing by way of ETFs and a notable shift in market dynamics.

Bitcoin ETFs vs Gold, Ethereum ETFs

That stated, the report additionally exhibits that spot BTC ETFs have considerably outperformed early gold ETFs, with internet inflows of roughly $18.9 billion inside a yr, in comparison with simply $1.5 billion for gold ETFs. This surge has attracted greater than 1,200 institutional buyers to Bitcoin ETFs, a notable improve from the 95 establishments in Gold’s first yr.

Ethereum, however [ETH] ETFs have been struggling, experiencing outflows of roughly 43,700 ETH (roughly $103.1 million) and unfavourable outflows in eight of the previous eleven weeks.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Subsequently, Bitcoin ETFs have a extra substantial influence on market dynamics when adjusted for spot buying and selling quantity, reflecting stronger demand from establishments.

These developments correspond to a rise within the worth of BTC to $68,266.17, following a 1.87% improve up to now 24 hours and a month-to-month achieve of 4.38%. CoinMarketCap.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now