Analysis

Bitcoin ETFs see $2 billion inflow as institutional interest reignites

Credit : cryptoslate.com

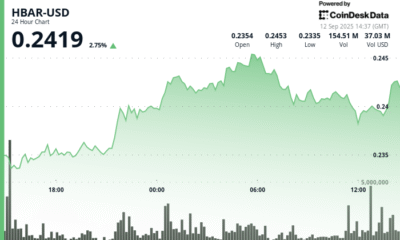

US-granted place Bitcoin-exchange-related funds (ETFs) see a pointy reversal in fortunes this month and draw almost $ 2 billion in contemporary consumption after a bruises of Augustus characterised by heavy repayments.

Facts Sosovalue exhibits that 12 Bitcoin ETF merchandise are recorded in six of the primary eight commerce periods in six of the primary eight commerce periods of September. Up to now 4 periods alone, they’ve drawn round $ 1.7 billion, indicating a transparent revival of the urge for food of traders.

The consistency of this inflow contrasts sharply with August, when the identical funds had $ 751 million in.

The development has additionally widened the hole with Ethereum, the second largest crypto via market capitalization.

Though Bitcoin merchandise have placed on significantly contemporary capital this month, Ethereum funding autos have registered greater than $ 550 million in the identical interval.

Nick Forster, founding father of the on-chain possibility platform, informed, informed CryptoSlate That this divergence emphasizes the shifting of the sentiment from Ethereum again to Bitcoin.

In accordance with him:

The registration will shut quickly …

Safe your house within the 5-day crypto-investor blue stress earlier than it disappears. Study the methods that divorce winners from pocket holders.

Introduced by cryptoSlate

“ETH influx is significantly delayed, whereas BTC noticed a significant peak yesterday in institutional purchase. The sensible cash appears to be reversing in BTC, probably taking a respiration break from ETH Beta after the latest run.”

Bitcoin ETFs at the moment are stimulating worth promotion

The most recent streams reinforce the rising function of ETFs in shaping the Bitcoin worth course of.

André Dragosch, head of analysis in Bitwise Europe, noted On X, day by day internet ETF streams have turn out to be the strongest figuring out issue of Bitcoin Marktricht, as a result of American supervisors have authorized the primary spot merchandise earlier this yr.

In accordance with him:

“Because the early 2024 and the American ETF inspections, day by day internet streams have demonstrated a significantly stronger correlation with subsequent returns, in order that the extent underlines to what extent the installationized query by way of ETPs now types the pricing.”

That is significantly clear within the latest worth efficiency of the highest crypto. This month’s latest wave coincided with the value of Bitcoin that consolidated almost $ 114,000 and reversed the few weeks of weak efficiency.

Given this, Dragosch emphasised that:

“Bitcoin ETPs have turn out to be rather more than a comfort of traders. They’re now an important figuring out issue for market liquidity, efficiency and evolution of Bitcoin’s broader ecosystem.”

State on this article

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024