Bitcoin

Bitcoin, Ethereum and XRP Price Prediction For October 2025

Credit : coinpedia.org

Whereas September 2025 closes within the Inexperienced, cryptocurrency markets begin in October with cautious optimism. Traditionally, October was one of many strongest months for Bitcoin (BTC) and Ethereum (ETH), whereas XRP is confronted with doubtlessly remodeling ETF selections that may reform its future. With macro -economic uncertainties, institutional influx and the heating of traders, heating traders can transform an important month for the digital belongings market.

Bitcoin (BTC) Value forecast October 2025

Bitcoin merchants look carefully in October after BTC September September completed revenue, traditionally a powerful sign for additional the other way up. An evaluation of the final 15 Bitcoin Octobers reveals a 73% likelihood of a constructive month-to-month closure, with 11 of these 15 years ending within the Inexperienced.

The final six consecutive Octobers are all positively closed and yield a median return of +27% and a median return of +28.3%. Some octobers have seen even higher power, with conferences above 30% and a 12 months surpassed 40%.

Unfavorable octobers have been uncommon, with the final place in 2018 when Bitcoin dropped 3.3% throughout the closure of the US authorities. Traditionally, nevertheless, the shedding of Octobers tends to ship sharper indicators of a median of round 30%. If such a sample repeated at present, Bitcoin may see a correction till the vary of $ 80,000.

Present indicators additionally level to potential early weak point. The 4-day advancing common cross suggests a corrective goal close to $ 105,000, whereas a Bearish 5-day sign that would lengthen to $ 102,500. But, if Bitcoin follows his historic efficiency within the fourth quarter, a renewed enhance in new all-time highlights stays a powerful alternative.

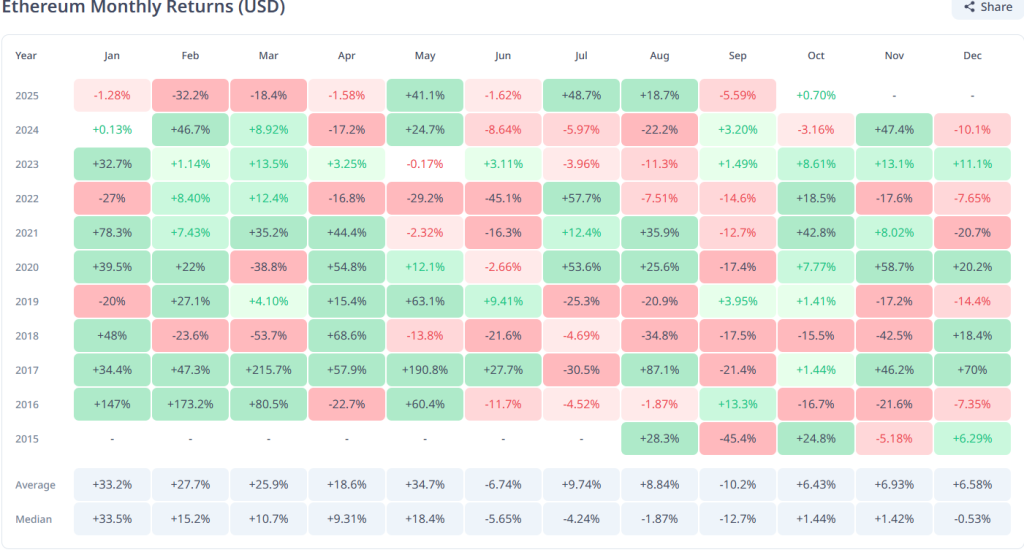

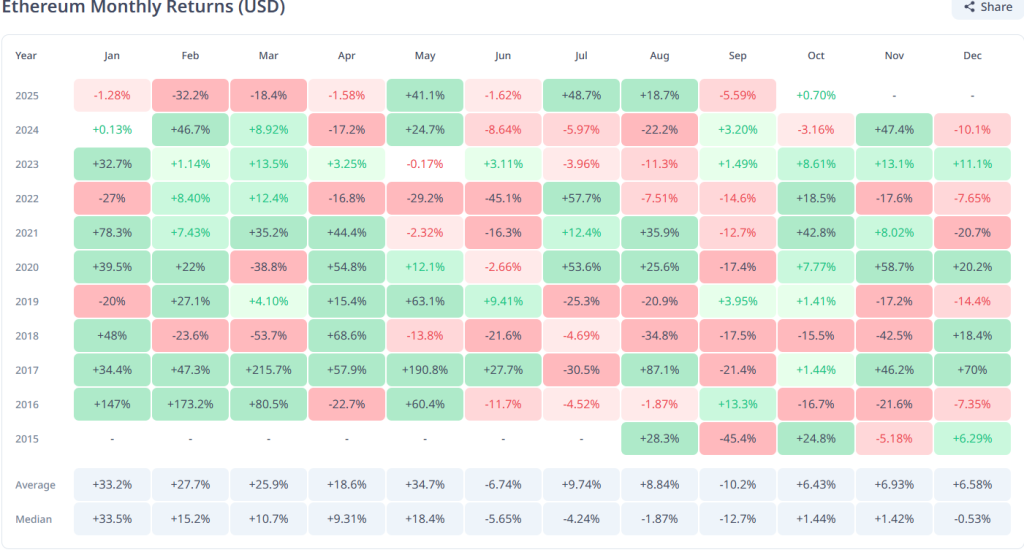

Ethereum (ETH) Value forecast October 2025

Ethereum enters October after a risky September, which has fallen under $ 4,000 to succeed in a low of $ 3,825 earlier than bouncing and holding over the important help zone of $ 3,900. Market members are actually aimed toward whether or not Ethereum can break a very powerful resistance ranges. Essentially the most direct barrier is round $ 4,260.

A robust outbreak above this degree can enable ETH to check $ 4,670, and if that vary is surpassed with conviction, the milestone of $ 5,000 would be the following goal. In a cautious state of affairs, Ethereum can consolidate between $ 4,000 and $ 4,600 earlier than he’s determined within the subsequent route.

From a technical perspective, the RSI of Ethereum is probably the most offered -over studying since April 2025, a uncommon situation that has been preceded traditionally upfront of highly effective rallies. The final time ETH was offered over, it organized a rally of 134% inside simply two months. This provides the load to the argument for a potential rebound within the coming weeks.

Historic knowledge of the fourth quarter additional help these outlooks, with Ethereum lately making robust earnings: +104% in This autumn 2020, +142% in This autumn 2017, +36% in This autumn 2023 and +28% in This autumn 2024. On common, Ethereum has nearly +24% in This autumn, traditionally a powerful restoration part. If ETH can reclaim and maintain $ 4,000 on weekly closures, analysts imagine {that a} rally to $ 7,000 – $ 8,000 stays within the sport, which can be arrange a strong bull in early 2026.

XRP value forecast October 2025

XRP is probably the largest story of October 2025, with definitive SEC selections that owe eight XRP ETF requests from massive asset managers akin to Grayscale, Wisdomtree and Franklin Templeton between October 18 and 25. These corporations supervise greater than $ 8 trillion in belongings within the administration of expectations that even protecting institutional directions have a delegate impression on XRP.

Analysts estimate that $ 3-5 billion in influx within the first 12 months might be ample to double the market capitalization of XRP, which pushes token to the $ 5 marking. Persistent influx might probably propel the XRP value for the primary time in historical past within the historical past of double digits, creating a remodeling second for the cryptocurrency.

Technically, XRP consolidated across the $ 3 degree after he had withdrawn from his $ 3.66 all time in July. The worth of $ 3 has turn out to be a important battlefield for bulls and bears. Holding above may trigger an outbreak, first to $ 3.65 after which doubtlessly $ 4.50, which might open the door for brand spanking new value discovery.

Nonetheless, if XRP doesn’t maintain a momentum and weakens the quantity, the token dangers again to $ 2.75, an essential degree of help that has held for months. Analysts additionally level out that XRP shows graph patterns which can be akin to the Bull Run 2017, which means that it might be actively making ready for a parabolic motion.

The mix of potential ETF inspections, simplified SEC processes and institutional significance may tune into one of the essential moments within the historical past of XRP.

Conclusion

Bitcoin begins October with a bullish historic monitor document, though dangers akin to an US authorities closure may cause volatility within the quick time period. Ethereum appears over offered and prepared for a possible This autumn rebound, with robust historic earnings that help a restoration rally. XRP may very well be the largest mover, as a result of upcoming ETF selections may cause massive institutional influx.

Basically, This autumn 2025 may decide the scene for a remodeling crypto rally that’s on its strategy to 2026.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024