Ethereum

Bitcoin & Ethereum brace for a bleak Q1 – Massive rally unlikely?

Credit : ambcrypto.com

- Bitcoin and Ethereum noticed a outstanding lower in retail adoption, as mirrored by shrinking community exercise.

- Will Q2 sign the beginning of a deeper corrective cycle?

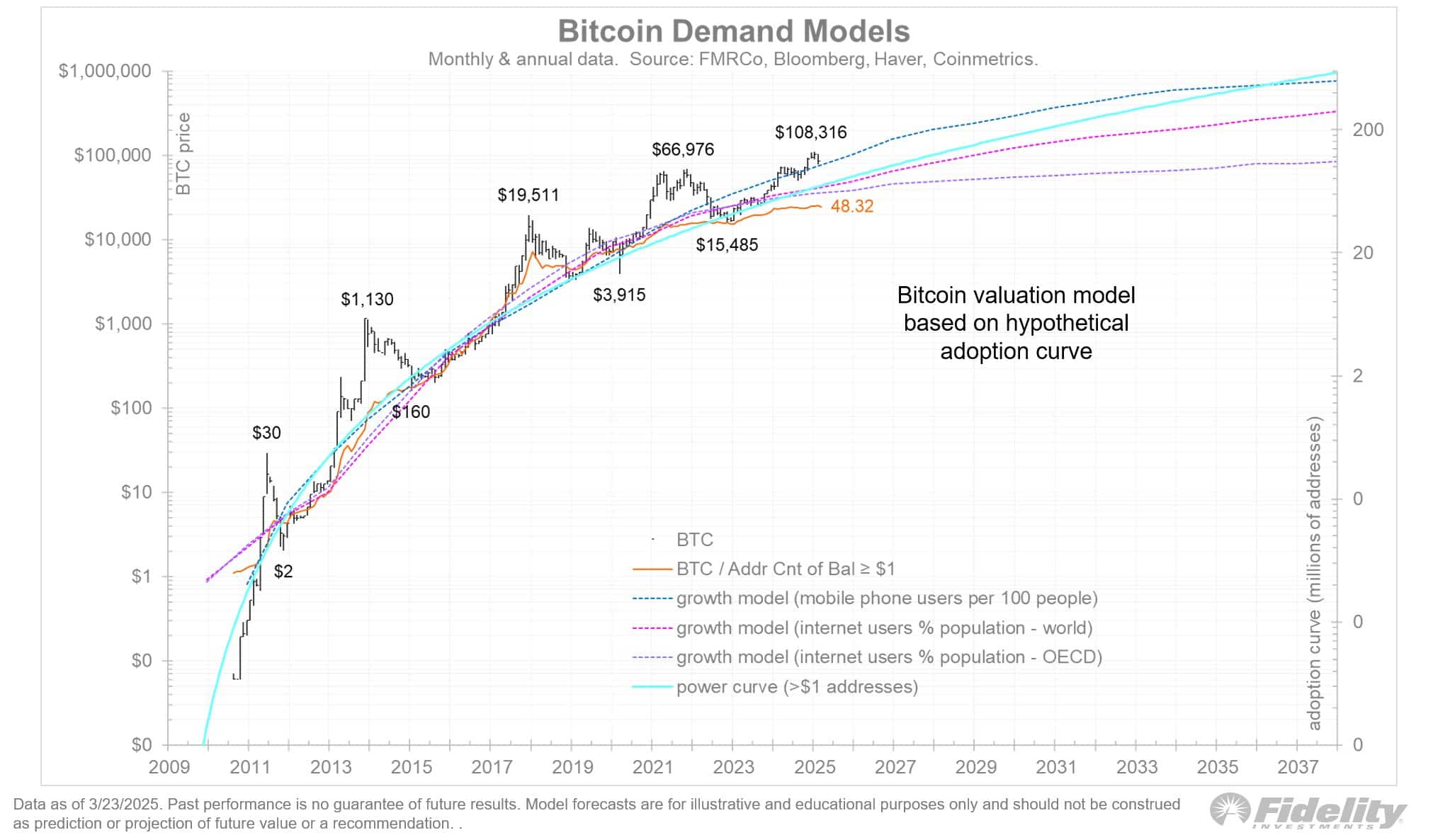

Based on the graph beneath, since that of Bitcoin [BTC] After the 2020 bull cycle, the enlargement of distinctive portfolios and energetic addresses is delayed, particularly amongst portfolios that hold greater than $ 1.

This stagnation corresponds to the Adoption curve modelWhich means that institutional accumulation BTC has consolidated in much less excessive -quality portfolios.

Supply: Constancy Investments

In easy phrases, large-scale entities, akin to micro technique (MSTR), have concentrated corporations, lowering the necessity for a broad pockets distribution. Consequently, a broader distribution amongst non-public members has decreased.

Ethereum [ETH] has proven this development and registered the bottom adoption share in 2025. As institutional dominance grows, on-chain statistics can turn into much less dependable for assessing the adoption of the retail commerce sooner or later.

The market influence of this structural shift may be in -depth. Institutional portfolios are more and more dictating liquidity cycles. For instance, the sharp Retracement from Bitcoin to $ 77k in February correlated with persistent BTC ETF outflows.

On 25 February, BTC ETFs registered a internet movement of $ 1.4 billion, which catalys a value drop of 5.11% inside 24 hours. Ethereum ETFs have remained in the identical means in a persistent section on the gross sales aspect and is struggling to draw new influx.

Extra important, this one Institutional outsource have collided with Trump’s aggressive charge coverage and added a macro -economic layer to the volatility of the crypto market.

Whereas Q2 unfolds, the administration appears to be in full “reset” mode. Whereas market reactions stay insecure, Bitcoin and Ethereum don’t reply to their Q1 rally the query:

Will Q2 convey a depressing Bearish cycle?

Meals to assume: is the Q2 cycle of Bitcoin and Ethereum at risk?

Bitcoin recovered $ 88k inside two weeks as a result of BTC ETFs returned to the web consumption. MSTREN made use of the momentum and gathered 6,911 BTC for $ 584 million at a median acquisition value of $ 86k.

Ethereum adopted the instance and retest quick $ 2k. Nonetheless, the lengthy -term consolidation, together with lowering community acceptance and modest institutional influx, suggests underlying structural weak point.

If BTC resists and recovers, the value motion of ETH may be weak for a deeper corrective section.

Supply: TradingView (ETH/USDT)

Weak fundamental rules and selective accumulation by portfolios of high-quality and a headwind for each Bitcoin and the Q2 rally from Ethereum.

Traditionally, the Q1 drive of BTC has activated an Altcoin -increase, however the value motion of this cycle is various. Crucial distinctive issue? Elevated macro -economic volatility.

If institutional capital flows don’t compensate for this volatility within the coming quarter, each Bitcoin and Ethereum may be confronted with distribution stress and postpone a full development forecast.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024